Arkansas Agreement to Partition Real Property among Surviving Spouse and Children of Decedent

Description

How to fill out Agreement To Partition Real Property Among Surviving Spouse And Children Of Decedent?

Finding the right lawful record design can be quite a struggle. Needless to say, there are a lot of themes available online, but how can you get the lawful kind you want? Utilize the US Legal Forms site. The support delivers a huge number of themes, for example the Arkansas Agreement to Partition Real Property among Surviving Spouse and Children of Decedent, that you can use for business and private requirements. All of the types are examined by professionals and meet up with state and federal requirements.

When you are currently registered, log in for your profile and click on the Download button to obtain the Arkansas Agreement to Partition Real Property among Surviving Spouse and Children of Decedent. Utilize your profile to check through the lawful types you have purchased previously. Visit the My Forms tab of your own profile and obtain yet another version from the record you want.

When you are a whole new consumer of US Legal Forms, here are basic directions so that you can comply with:

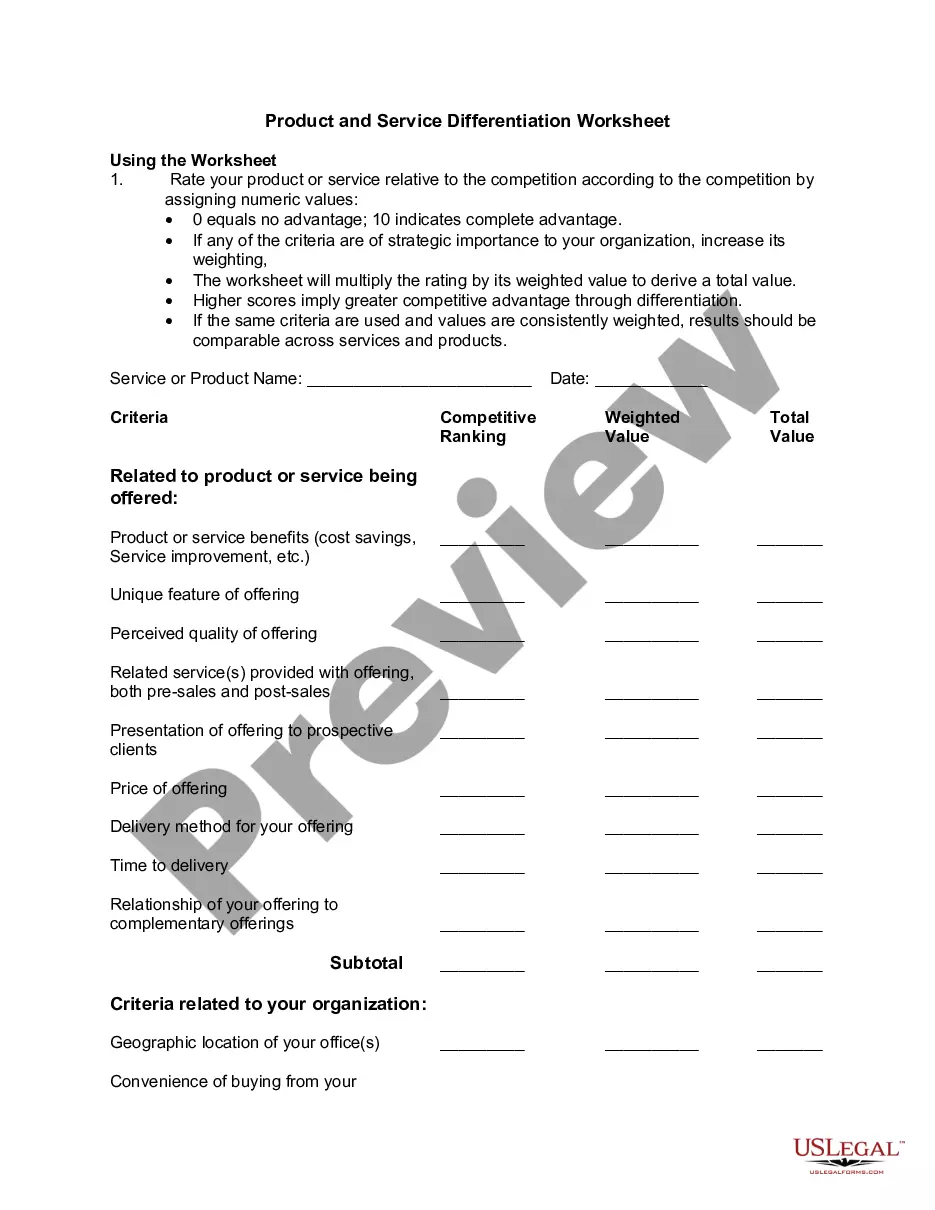

- First, be sure you have selected the proper kind for the city/state. You can check out the form using the Preview button and look at the form information to ensure it is the best for you.

- If the kind will not meet up with your requirements, use the Seach area to get the correct kind.

- Once you are certain the form is suitable, click on the Purchase now button to obtain the kind.

- Select the pricing prepare you would like and type in the needed information and facts. Create your profile and pay money for an order using your PayPal profile or Visa or Mastercard.

- Pick the document formatting and obtain the lawful record design for your system.

- Complete, change and printing and indicator the obtained Arkansas Agreement to Partition Real Property among Surviving Spouse and Children of Decedent.

US Legal Forms will be the greatest collection of lawful types in which you can see different record themes. Utilize the service to obtain appropriately-produced paperwork that comply with state requirements.

Form popularity

FAQ

Spouses in Arkansas Inheritance Law Whether or not you have a will when you die, your spouse will inherit your property through a doctrine known as ?dower and curtesy.? If you have no children or descendants, your spouse automatically inherits half of your real estate and half of your personal property.

The Uniform Partition of Heirs Property Act (UPHPA) helps preserve family wealth passed to the next generation in the form of real property. If a landowner dies intestate, the real estate passes to the landowner's heirs as tenants-in-common under state law.

What happens if no beneficiary is named on bank account? If there is no listed beneficiary on a bank account, then ownership of the funds usually defaults to the surviving spouse or registered domestic partner per applicable state laws.

What if All Owners Don't Agree to Sell in Arkansas? In such cases, the majority of inheritors can go ahead with the sale. You can start by filing a lawsuit known as a partition action in the Arkansas probate court.

Spouses do not automatically inherit all of the property and assets unless there are no other relatives. In most cases, spouses receive half or less of community property and assets.

The Heir Property Act balances the rights of family members who want to retain their land with the rights of family members who want to sell. This became Arkansas law in February of 2015 and took effect January 1, 2016.

In Arkansas, whether or not you have a will when you die, your spouse will inherit property from you under a doctrine called "dower and curtesy." Briefly, this is how it works: If you have children or other descendants. Your spouse has the right to use, for life, 1/3 of your real estate.

If you don't have a Will, the default order of descent goes like this: (1) full blood and adopted children of the decedent, subject to any dower, curtesy, and homestead interest of a spouse; (2) if no full blood or adopted children, then everything to a spouse of greater than three years or half of everything plus ...