Arkansas Monthly Retirement Planning

Description

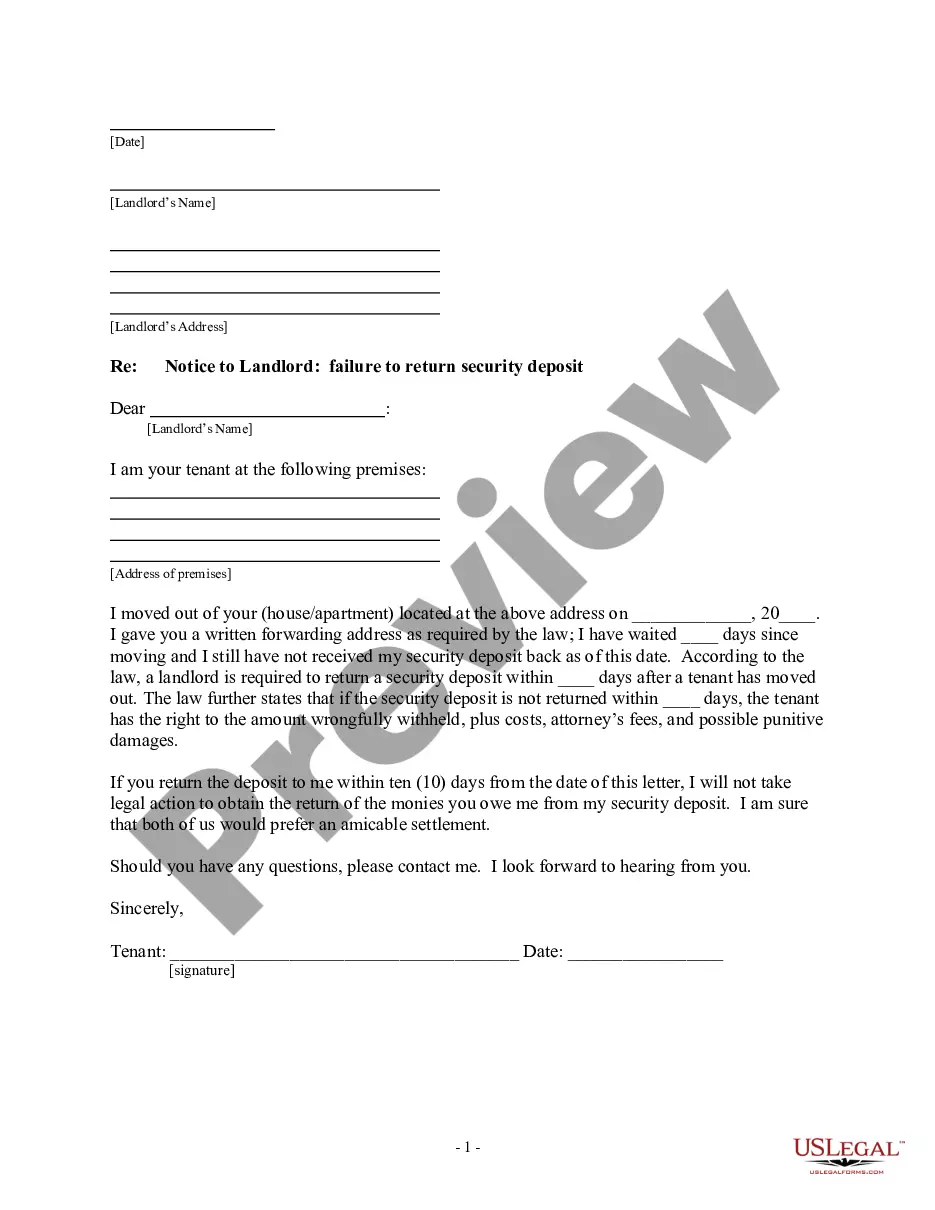

How to fill out Monthly Retirement Planning?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a comprehensive selection of legal form templates that you can obtain or print.

By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can locate the latest forms such as the Arkansas Monthly Retirement Planning in just a few minutes.

If you have a membership, Log In to download the Arkansas Monthly Retirement Planning from the US Legal Forms repository. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the payment. Use a credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill, edit, print, and sign the downloaded Arkansas Monthly Retirement Planning. Each form you add to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Arkansas Monthly Retirement Planning with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- Ensure you have chosen the correct form for your city/county.

- Click the Preview button to review the form's content.

- Check the form description to confirm you have selected the correct form.

- If the form does not meet your needs, use the Search bar at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose the payment plan you prefer and provide your credentials to sign up for an account.

Form popularity

FAQ

The average monthly Social Security benefit fluctuates based on various factors, including work history and earnings. For those retiring around $1,925, it is vital to understand how this income fits into your overall retirement plan. Utilizing Arkansas Monthly Retirement Planning can help you create a financial strategy that works alongside your Social Security benefits.

To determine the amount of reduction an active or deferred member will have, APERS looks at the amount of actual service that person has at the time of retirement. If the member has less than 25 years of actual service the reduction is 1/2 of 1% for each month before age 65.

ABOUT APERS APERS' mission is to provide income to retired members, to survivors and to disabled members of the system. To this end, the system prudently invests all contributions received, monitors reporting by participating employers, maintains records and disburses monthly benefit checks to all those entitled.

With APERS, you have no individual retirement account like a 401(k) to borrow against or draw from, and no one can predict the total value of your benefits until you have finished collecting them. After you retire, APERS pays you a monthly pension for the rest of your life, whether that's 5 more years or 50.

With 4+ years of TCDRS service time, your beneficiary can receive a lifetime monthly payment from your account if you pass away before you retire even if you're no longer at your county or district job. The monthly payment is made up of your deposits and interest, as well as employer matching.

Your retirement benefit is calculated using a formula with three factors: Service credit (Years) multiplied by your benefit factor (percentage per year) multiplied by your final monthly compensation equals your unmodified allowance. Service Credit - Total years of employment with a CalPERS employer.

Normal Retirement: Age 65 or more with at least 5 years of service (except for certain General Assembly members who must have at least ten years of service); Any age with 28 years of service; or. Age 60 or more with 20 years of service (contributory members prior to 07/01/2005)

Retirement Age and the Rule of 80Age 65 + 5 years of service or.Age 60 + 15 years of service or.Rule of 80 (at least age 48) when age + years of service = 80 or more.

What is the Rule of 80? This provision creates a so-called Rule of 80, a new definition of Normal Retirement for members of the Hybrid Defined Benefit Component. This allows members to claim a full, unreduced pension benefit if their combined age and years of service equal at least 80, beginning at age 50.

What is the Rule of 80? This provision creates a so-called Rule of 80, a new definition of Normal Retirement for members of the Hybrid Defined Benefit Component. This allows members to claim a full, unreduced pension benefit if their combined age and years of service equal at least 80, beginning at age 50.