Arkansas Subordination Agreement Subordinating Existing Mortgage to New Mortgage

Description

How to fill out Subordination Agreement Subordinating Existing Mortgage To New Mortgage?

If you wish to total, acquire, or produce legal papers web templates, use US Legal Forms, the greatest collection of legal varieties, which can be found on the web. Use the site`s simple and easy convenient look for to find the documents you want. A variety of web templates for enterprise and person reasons are sorted by types and suggests, or keywords and phrases. Use US Legal Forms to find the Arkansas Subordination Agreement Subordinating Existing Mortgage to New Mortgage in just a handful of click throughs.

Should you be presently a US Legal Forms client, log in to the bank account and click on the Download switch to get the Arkansas Subordination Agreement Subordinating Existing Mortgage to New Mortgage. You may also accessibility varieties you earlier delivered electronically in the My Forms tab of your own bank account.

If you are using US Legal Forms for the first time, refer to the instructions below:

- Step 1. Ensure you have chosen the form for the proper town/country.

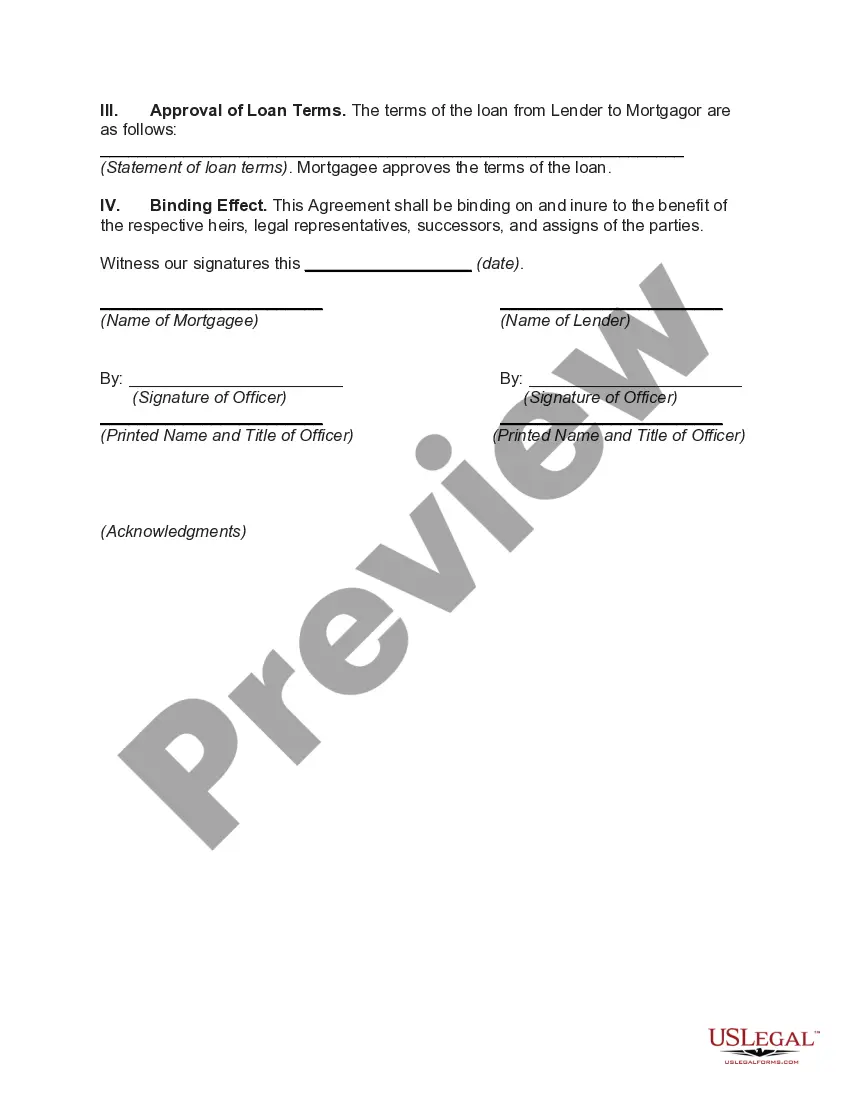

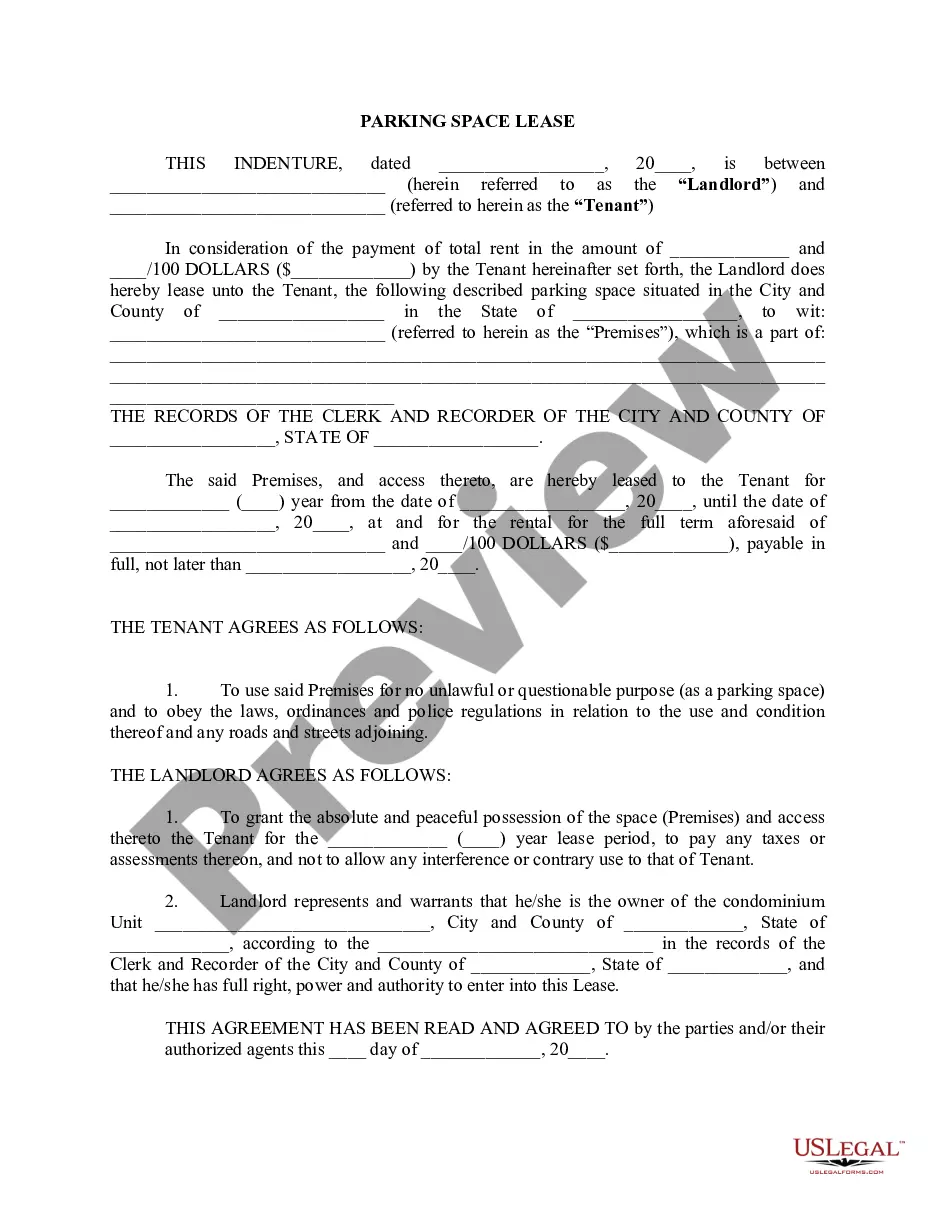

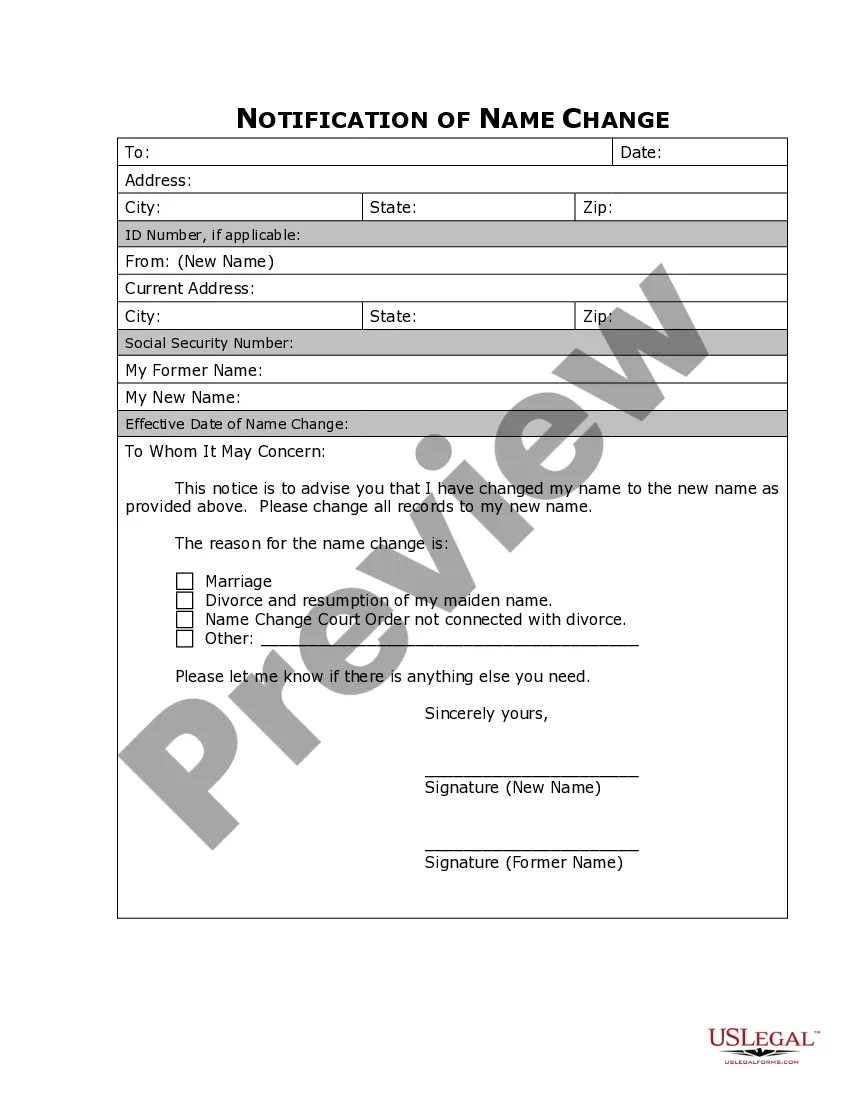

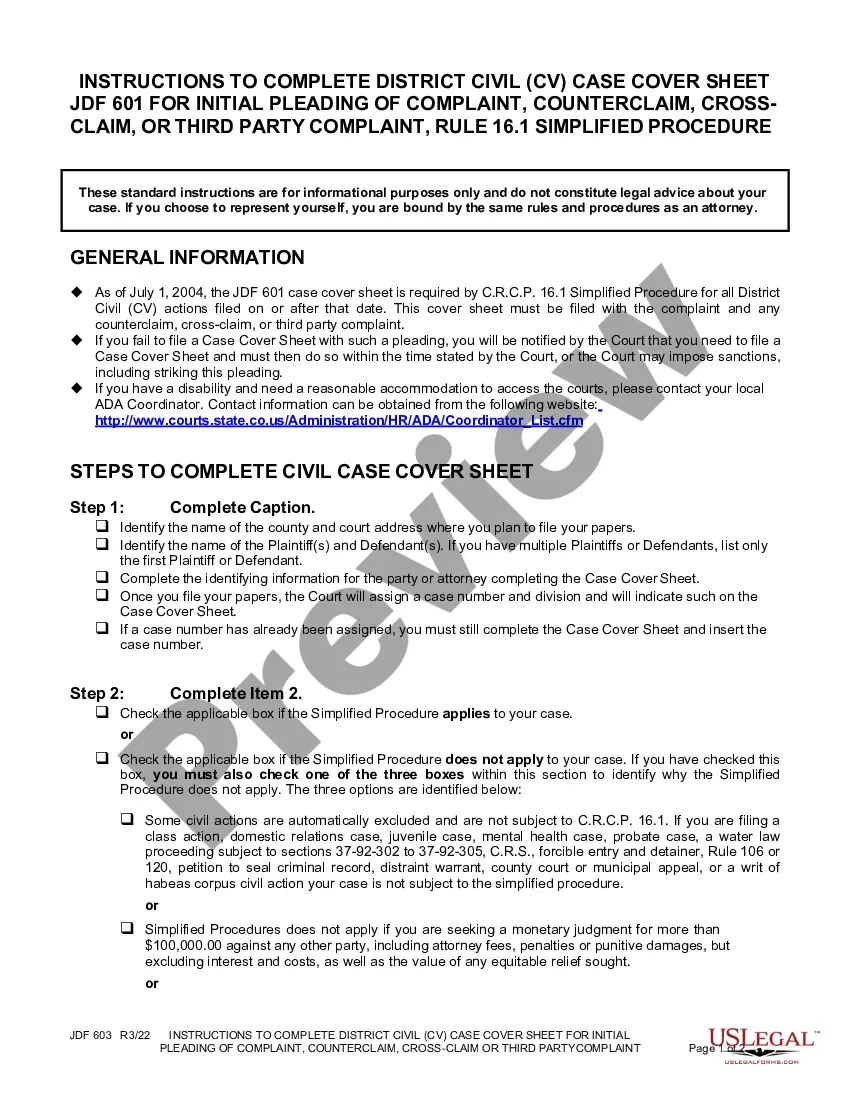

- Step 2. Use the Preview choice to examine the form`s articles. Don`t forget to learn the outline.

- Step 3. Should you be unsatisfied together with the develop, make use of the Search industry near the top of the display screen to locate other versions in the legal develop format.

- Step 4. When you have found the form you want, click the Acquire now switch. Select the rates strategy you like and add your qualifications to register to have an bank account.

- Step 5. Approach the deal. You may use your bank card or PayPal bank account to finish the deal.

- Step 6. Select the structure in the legal develop and acquire it on your device.

- Step 7. Complete, revise and produce or indicator the Arkansas Subordination Agreement Subordinating Existing Mortgage to New Mortgage.

Every legal papers format you buy is your own forever. You possess acces to every single develop you delivered electronically inside your acccount. Click on the My Forms area and pick a develop to produce or acquire yet again.

Be competitive and acquire, and produce the Arkansas Subordination Agreement Subordinating Existing Mortgage to New Mortgage with US Legal Forms. There are many specialist and status-certain varieties you may use for your personal enterprise or person needs.

Form popularity

FAQ

Again, if you're refinancing your first mortgage and the property also has a subordinate mortgage, the refinancing lender will usually handle the process of getting the necessary subordination agreement. But you need to ensure that the required subordination agreement is completed before the new loan's closing date.

A subordination agreement must be signed and acknowledged by a notary and recorded in the official records of the county to be enforceable.

8) Keep the original signed subordination agreement in your file to be given to your title agent to record AT THE SAME TIME they record the RIM easement. Do not record the mortgage subordination agreement ahead of easement recording.

Many people have a subordinate mortgage in the form of a home equity line of credit or home equity loan. A subordinate mortgage is secured by your property but sits in second position, if you have a primary mortgage, for getting paid in the event you default.

Getting A Second Mortgage A second mortgage will become a subordinate loan. If you repay the primary loan within the term of the second mortgage, the second mortgage can take its place as the primary loan.

A subordinated loan agreement (SLA) must be filed with NFA at least ten days prior to the proposed effective date of the agreement.

A subordination agreement prioritizes debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

The order of subordination is determined based on the type of loan against your property. If you only have one home mortgage and no other liens, you'll find that mortgage subordination won't come into play until you have more than one lien on your home.