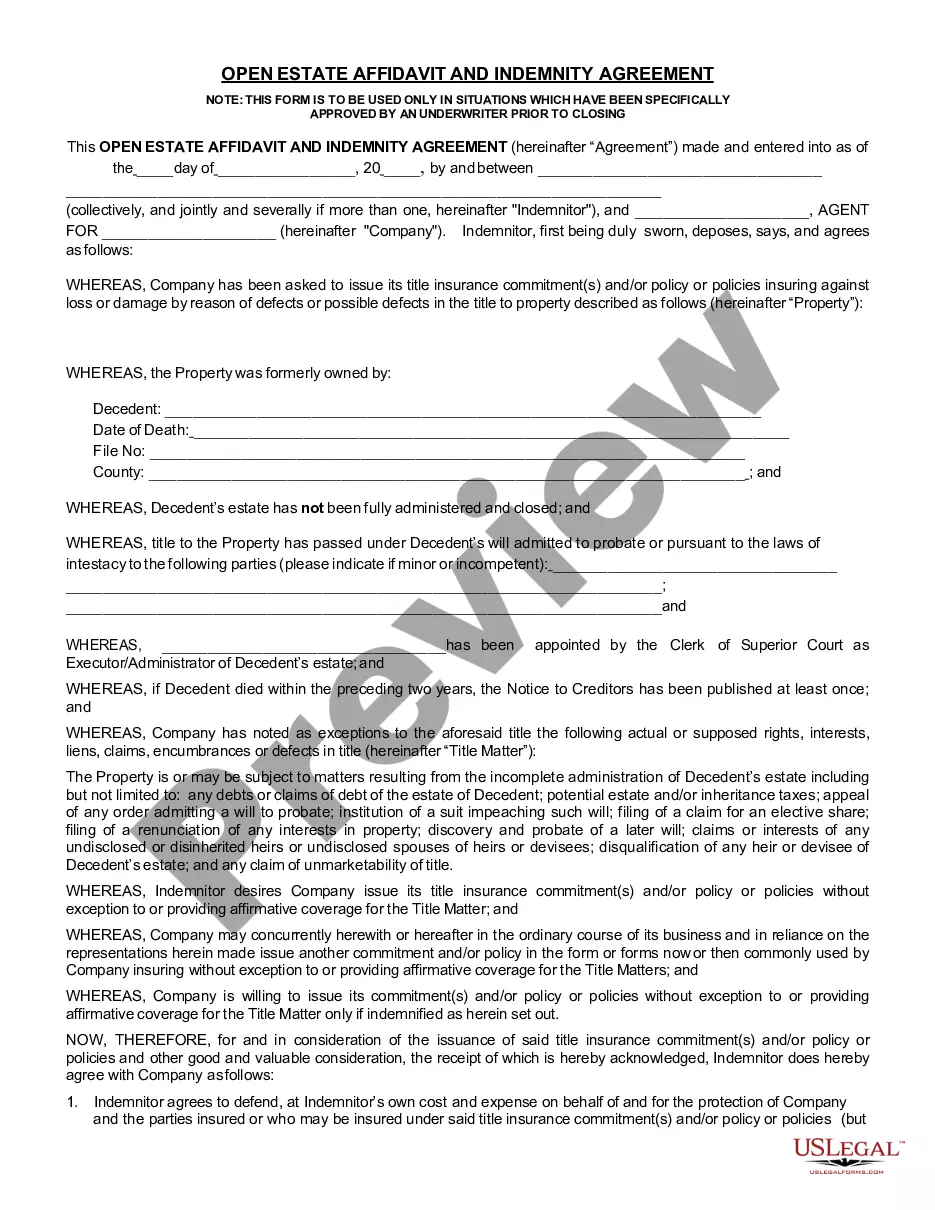

US Legal Forms - one of the largest libraries of authorized types in the United States - offers a wide range of authorized papers themes you are able to obtain or printing. Utilizing the web site, you can find a large number of types for organization and personal purposes, categorized by groups, claims, or keywords and phrases.You will find the most recent versions of types just like the Arkansas Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement within minutes.

If you already possess a monthly subscription, log in and obtain Arkansas Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement through the US Legal Forms library. The Obtain button will show up on each form you view. You have access to all earlier saved types from the My Forms tab of your accounts.

If you would like use US Legal Forms initially, here are easy instructions to help you started:

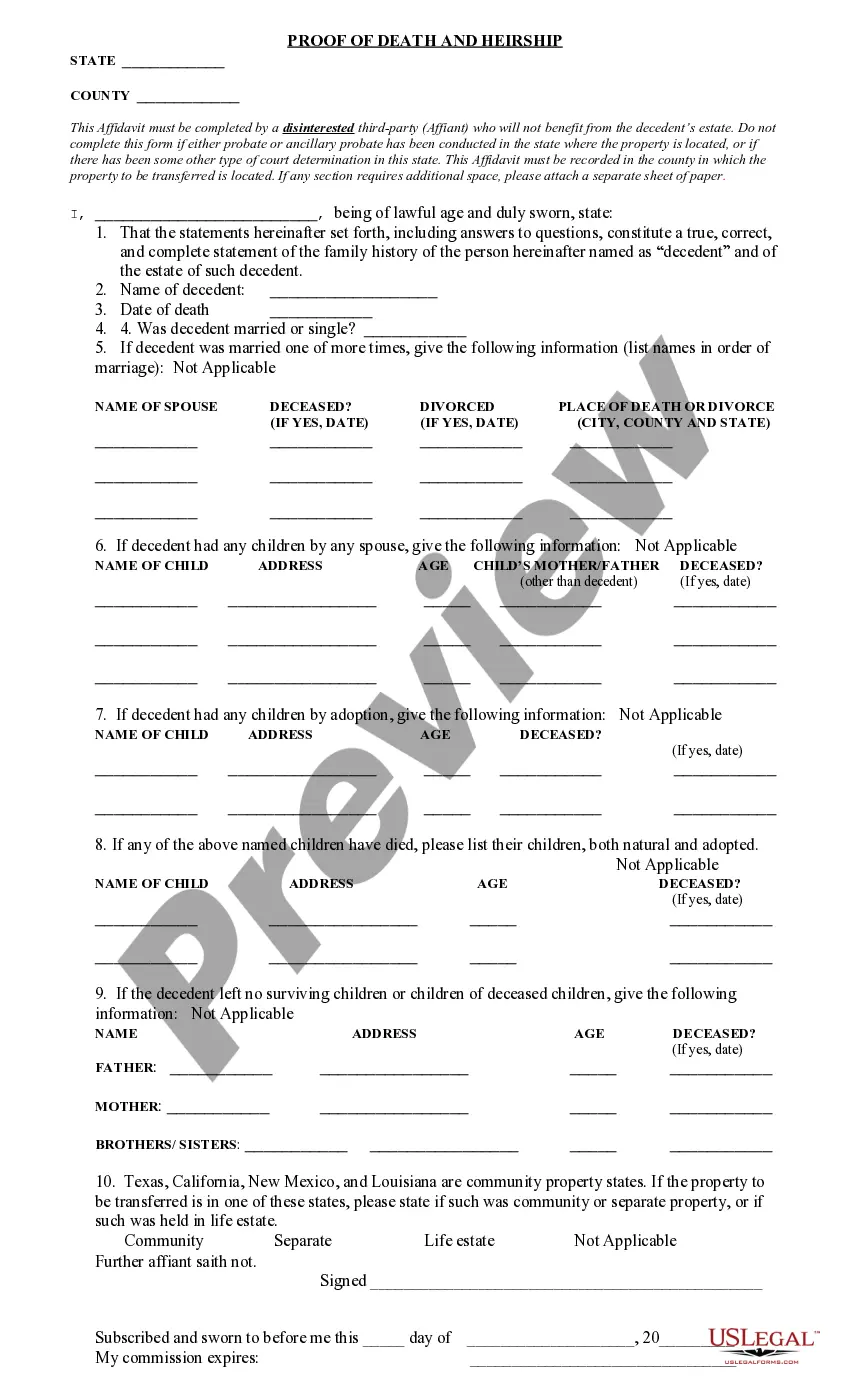

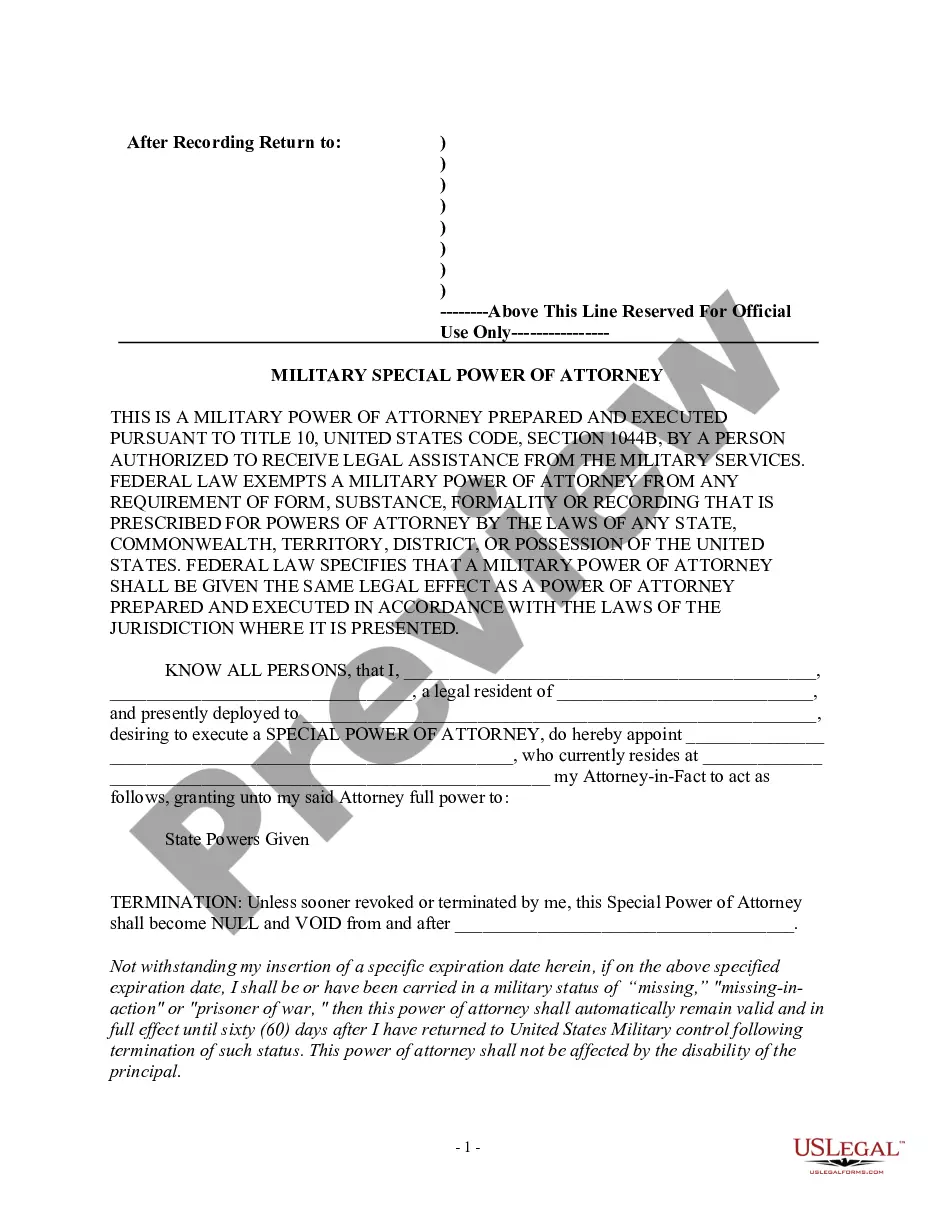

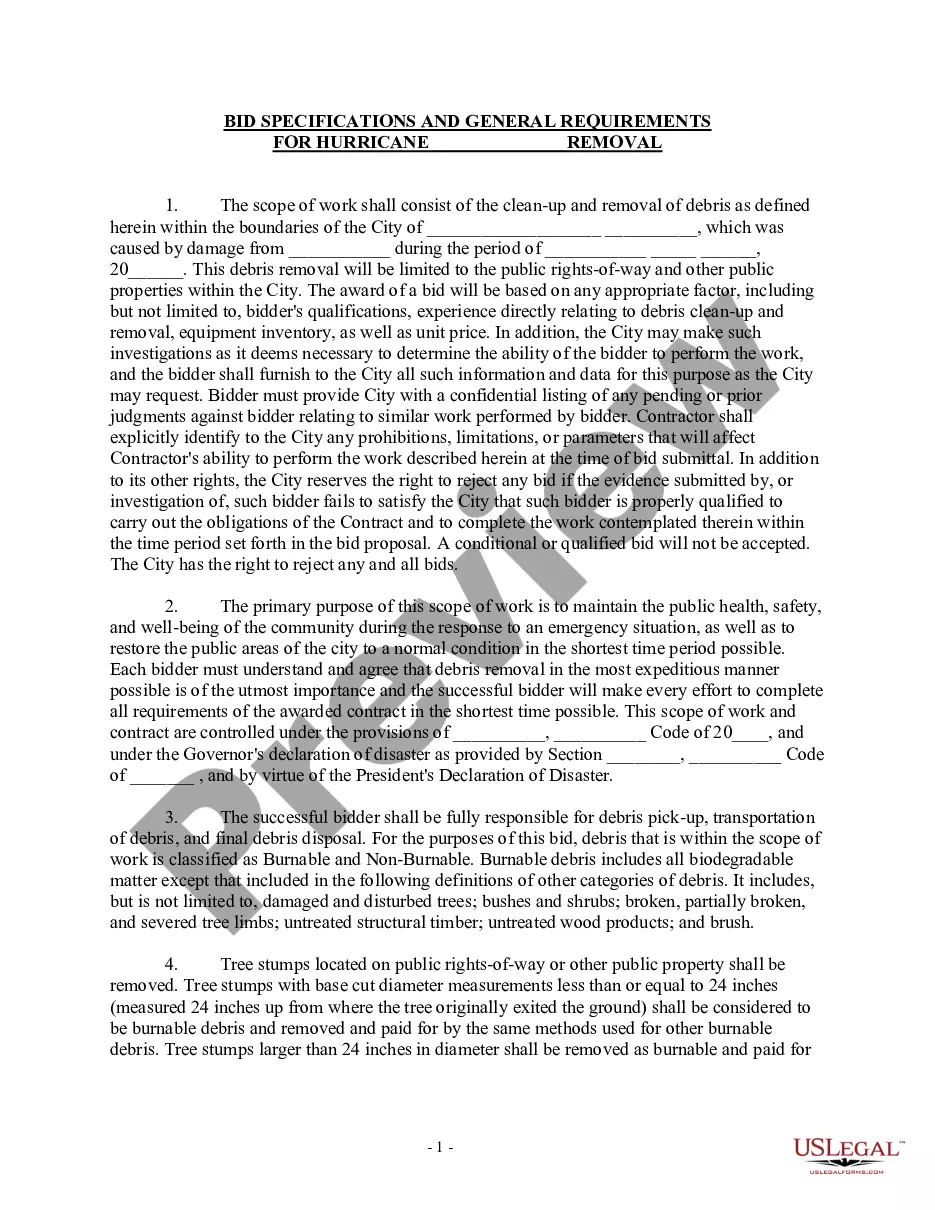

- Ensure you have picked the best form for your area/region. Click on the Review button to review the form`s content. Read the form information to ensure that you have selected the appropriate form.

- In case the form does not satisfy your needs, make use of the Research industry towards the top of the display screen to discover the the one that does.

- If you are satisfied with the shape, validate your option by simply clicking the Get now button. Then, opt for the prices plan you want and supply your credentials to sign up on an accounts.

- Procedure the financial transaction. Make use of your credit card or PayPal accounts to finish the financial transaction.

- Choose the file format and obtain the shape on your system.

- Make changes. Complete, modify and printing and indicator the saved Arkansas Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement.

Every single web template you included with your money does not have an expiration particular date and is the one you have eternally. So, in order to obtain or printing yet another version, just visit the My Forms segment and then click on the form you want.

Get access to the Arkansas Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement with US Legal Forms, probably the most comprehensive library of authorized papers themes. Use a large number of specialist and condition-particular themes that meet up with your business or personal requirements and needs.