28 U.S.C.A. § 1961 provides in part that interest shall be allowed on any money judgment in a civil case recovered in a district court. Such interest would continue to accrue throughout an appeal that was later affirmed.

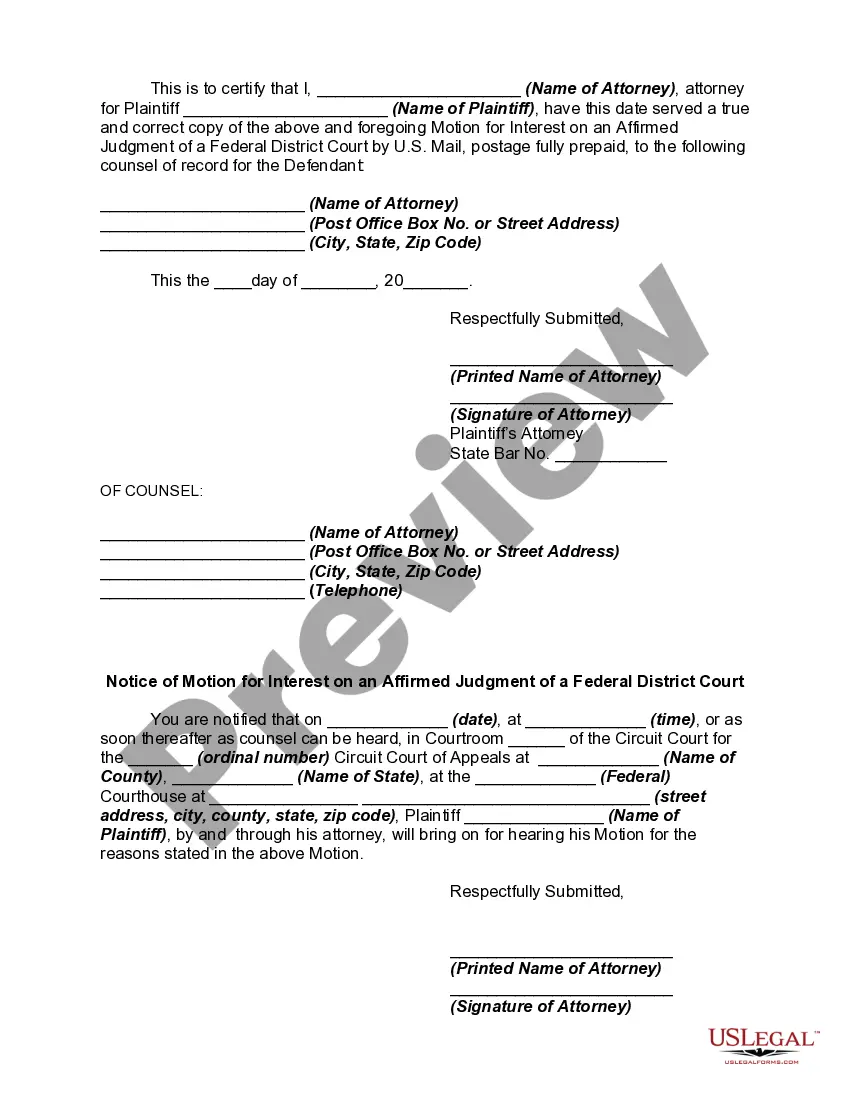

Arkansas Motion for Interest on an Affirmed Judgment of a Federal District Court

Description

How to fill out Motion For Interest On An Affirmed Judgment Of A Federal District Court?

If you need to total, obtain, or printing lawful record web templates, use US Legal Forms, the largest collection of lawful kinds, which can be found on the Internet. Use the site`s basic and handy search to discover the paperwork you will need. A variety of web templates for business and personal uses are sorted by categories and claims, or key phrases. Use US Legal Forms to discover the Arkansas Motion for Interest on an Affirmed Judgment of a Federal District Court in a number of click throughs.

If you are currently a US Legal Forms client, log in for your accounts and then click the Obtain button to have the Arkansas Motion for Interest on an Affirmed Judgment of a Federal District Court. Also you can entry kinds you formerly delivered electronically in the My Forms tab of your respective accounts.

If you are using US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape for the proper city/region.

- Step 2. Take advantage of the Preview choice to look through the form`s articles. Never overlook to see the outline.

- Step 3. If you are not satisfied together with the kind, utilize the Lookup industry towards the top of the monitor to discover other versions in the lawful kind design.

- Step 4. After you have identified the shape you will need, click the Acquire now button. Select the costs strategy you favor and include your references to sign up to have an accounts.

- Step 5. Approach the deal. You may use your Мisa or Ьastercard or PayPal accounts to complete the deal.

- Step 6. Select the format in the lawful kind and obtain it on your own system.

- Step 7. Comprehensive, revise and printing or indication the Arkansas Motion for Interest on an Affirmed Judgment of a Federal District Court.

Each lawful record design you purchase is your own property forever. You might have acces to each kind you delivered electronically with your acccount. Go through the My Forms portion and decide on a kind to printing or obtain once more.

Be competitive and obtain, and printing the Arkansas Motion for Interest on an Affirmed Judgment of a Federal District Court with US Legal Forms. There are millions of skilled and status-distinct kinds you may use for the business or personal requirements.

Form popularity

FAQ

Rule 11. Signing of Pleadings, Motions, and Other Papers; Sanctions. (a) Signatures. (1) Every pleading, written motion, and other paper of a party represented by an attorney shall be signed by at least one attorney of record in his or her individual name, whose address shall be stated.

In the practice of the court of appeals, it means that the court of appeals has concluded that the lower court decision is correct and will stand as rendered by the lower court. In the practice of appellate courts, the word means that the decision of the trial court is correct.

A party may serve upon any other party a written request for the admission, for purposes of the pending action, of the truth of any matters within the scope of Rule 26(b) set forth in the request that relate to statements or opinions of fact or the application of law to fact, including the genuineness of any documents ...

(See Warning Order in the form packet). This Warning Order will direct the defendant to enter an appearance within 30 days from the date of the first publication of the order. If the defendant does not file an answer within that time given by the court, he or she may be prevented from answering.

In Arkansas the prosecution has o 12 months to bring you to trial if you are not incarcerated, or o 9 months if you are incarcerated. However, if you or your lawyer asks for more time to prepare your case, that time will not count as a delay of your right to a speedy trial.

Affirmed - the judgment of the lower court is correct and should stand. Affirmed in part - a portion of the judgment of the lower court was affirmed. Dismissed - an order that disposes of the matter without a trial of the issues involved on their merits.

Rule 12 - Defenses and Objections; When and How Presented; by Pleading or Motion; Motion for Judgment on The Pleadings (a)When Presented. (1) A defendant shall file his or her answer within 30 days after the service of summons and complaint upon him or her.

Rule 10 - Form of Pleadings (a)Caption; Names of Parties; Contact information. Every pleading shall contain a caption setting forth the name of the court, the title of the action, the case number and a designation as in Rule 7(a).