Arkansas Extended Date for Performance

Description

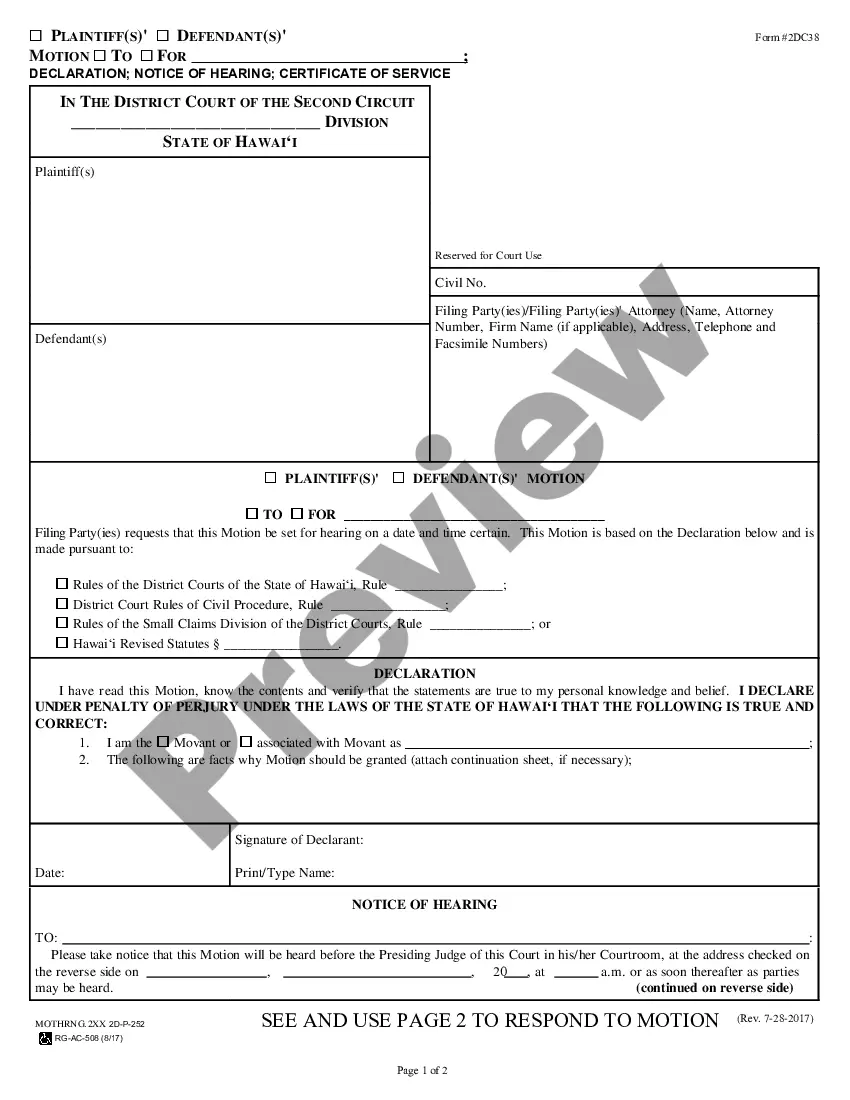

How to fill out Extended Date For Performance?

Selecting the most appropriate genuine document template can be quite a challenge.

Certainly, there are numerous templates accessible online, but how do you find the authentic form you need.

Make use of the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple steps you can follow.

- The service offers thousands of templates, including the Arkansas Extended Date for Performance, suitable for both business and personal needs.

- All forms are verified by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Arkansas Extended Date for Performance.

- Use your account to view the legal forms you have previously purchased.

- Navigate to the My documents section of your account to retrieve another copy of the document you require.

Form popularity

FAQ

The tax deadline for Arkansas generally falls on April 15th, matching the federal tax deadline. If you miss this deadline, filing an extension can provide an extended date for performance. Remember that this extra time is granted only after submitting the necessary extension form. You can easily find all the forms and guidance through the US Legal Forms platform to streamline your tax process.

Yes, Arkansas does follow federal extension guidelines concerning the extended date for performance. If you file for a federal tax extension, Arkansas typically honors that extension, providing you additional time. However, it's essential to file the proper state extension form to avoid any potential issues. US Legal Forms helps you navigate these requirements for both federal and Arkansas tax extensions.

The tax extension form for Arkansas is called the Arkansas Individual Income Tax Extension Form, specifically Form AR1050. This form allows you to request an extended date for performance on your tax filing. Filing this form grants you additional time to prepare your tax return without incurring late fees. To ensure a smooth process, you can access and complete this form easily through the US Legal Forms platform.

Extension agents are available in various counties throughout Arkansas, offering support and resources related to tax extensions among other services. You can find assistance in your local area, which can be especially handy when considering the Arkansas Extended Date for Performance. Use U.S. Legal Forms to identify your nearest extension office or agent who can help with any questions you may have.

The IRS extension is automatically granted when you file Form 4868. This allows you to benefit from the extended timeframe for federal tax returns, and subsequently, it may affect your Arkansas tax obligations as well. By taking advantage of the Arkansas Extended Date for Performance, you gain valuable time for preparation and submission. U.S. Legal Forms can provide guidance on how to complete this form accurately.

Yes, Arkansas does recognize federal extensions. When you successfully file an IRS extension, you automatically receive the benefits of the Arkansas Extended Date for Performance. This means both your federal and state tax deadlines are aligned, which simplifies your planning. Ensure you keep thorough records for both filings to avoid any issues down the line.

If you miss the deadline to file an extension in Arkansas, you can still prepare a request, although it may be more complicated. You will need to provide a reasonable explanation for the delay, as the Arkansas Extended Date for Performance typically does not apply after the due date. Using U.S. Legal Forms, you can find helpful resources and templates designed to assist you in navigating this process efficiently and correctly.

Yes, in Arkansas, if you file for an extension on your federal tax return, it automatically applies to your state taxes as well. This means you benefit from the Arkansas Extended Date for Performance without additional paperwork for state extensions. However, it's important to ensure that you meet the federal extension deadlines. This automatic process helps you stay on track and manage your tax obligations more easily.

In Arkansas, you are required to file an extension if you need additional time to submit your tax return. This ensures you can take advantage of the Arkansas Extended Date for Performance, allowing you to organize your documents and avoid penalties. Be mindful of the original due date, as a request for an extension doesn’t extend your payment obligations. Filing is simple, and online platforms like U.S. Legal Forms can guide you through the process effectively.

Yes, the return date has been extended in certain circumstances, particularly under the Arkansas Extended Date for Performance. This means you have more time to prepare and file your return. Understanding the specifics of the extended dates can help you avoid penalties and make timely decisions. For detailed assistance and access to forms, visit uslegalforms to streamline your tax-filing process.