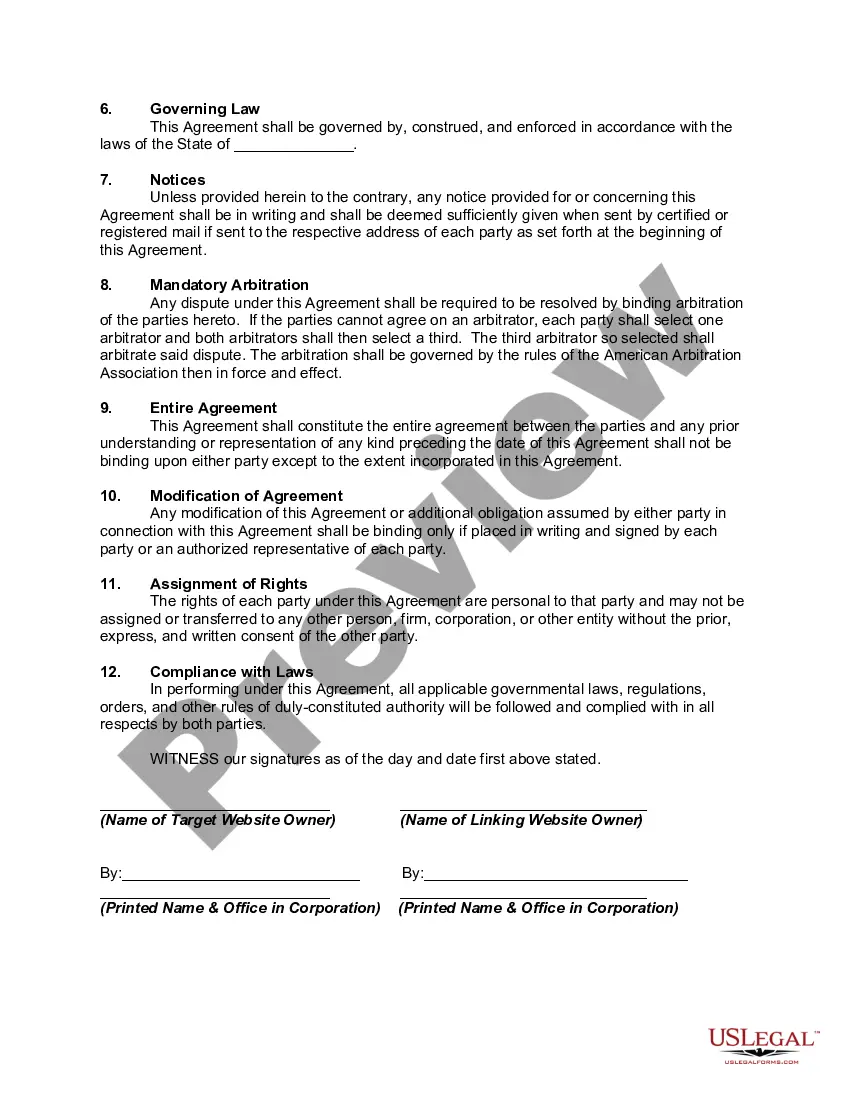

Arkansas Free Linking Agreement

Description

How to fill out Free Linking Agreement?

Are you currently in a circumstance where you require documents for both business or personal purposes every day.

There are numerous legal document templates accessible online, but finding ones you can trust isn't straightforward.

US Legal Forms provides thousands of form templates, such as the Arkansas Free Linking Agreement, designed to fulfill federal and state regulations.

Once you find the correct form, click Buy now.

Select the payment plan you desire, complete the required information to create your account, and purchase your order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms site and have an account, just Log In.

- Then, you can download the Arkansas Free Linking Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct city/region.

- Utilize the Review button to assess the document.

- Examine the details to confirm that you have selected the right form.

- If the form isn't what you're looking for, use the Search field to find the form that matches your needs.

Form popularity

FAQ

The absolute bare minimum it costs to start an LLC in Arkansas is $45. This is the cost of the Articles of Organization Fee. Your Articles of Organization are what make your business official with the state.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

Arkansas does not legally require LLC owners to submit an operating agreement to the Secretary of State when filing the Articles of Organization (the formal paperwork needed to form an LLC officially).

How long does it take to get an LLC in Arkansas? It normally takes 2-3 business days to process online LLC filings to 2 weeks for mailed filings in Arkansas. Expedited processing is also available for an additional fee.

Every Arkansas LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

Like S corporations, standard LLCs are pass-through entities and are not required to pay income tax to either the federal government or the State of Arkansas. Instead, income from the business is distributed to individual LLC members, who then pay federal and state taxes on the amount distributed to them.

How much does it cost to form an LLC in Arkansas? The Arkansas Secretary of State charges a $45 fee to file the Articles of Organization online and $50 if filed by mail. You can reserve your LLC name with the Arkansas SOS for $25 if filed by mail or $22.50 if filed online.

An Arkansas LLC operating agreement is a legal document that outlines the internal operations of a company and protects individual members' stake. The document also offers tax advantages to the business and its contributing members.

As of 2022, the average LLC annual fee in the US is $91. Most states call this the Annual Report, however, it has many other names: Annual Certificate.