Arkansas Agreement to Compromise Debt

Description

How to fill out Agreement To Compromise Debt?

Selecting the ideal valid document template can be challenging. Of course, there are numerous designs accessible online, but how can you locate the genuine type you require.

Utilize the US Legal Forms website. The service offers a wide array of templates, including the Arkansas Agreement to Compromise Debt, which you can utilize for professional and personal purposes.

All templates are reviewed by experts and comply with state and federal regulations.

When you are confident that the document is suitable, proceed by clicking the Get Now option to obtain the form. Choose the pricing plan you prefer and input the necessary information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document template for your device. Complete, modify, print, and sign the acquired Arkansas Agreement to Compromise Debt. US Legal Forms is the largest repository of legal documents where you can find various document templates. Utilize this service to download professionally crafted papers that adhere to state regulations.

- If you are already registered, Log In to your account and click on the Download button to retrieve the Arkansas Agreement to Compromise Debt.

- Use your account to browse through the legal forms you have previously purchased.

- Visit the My documents section of your account and obtain an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

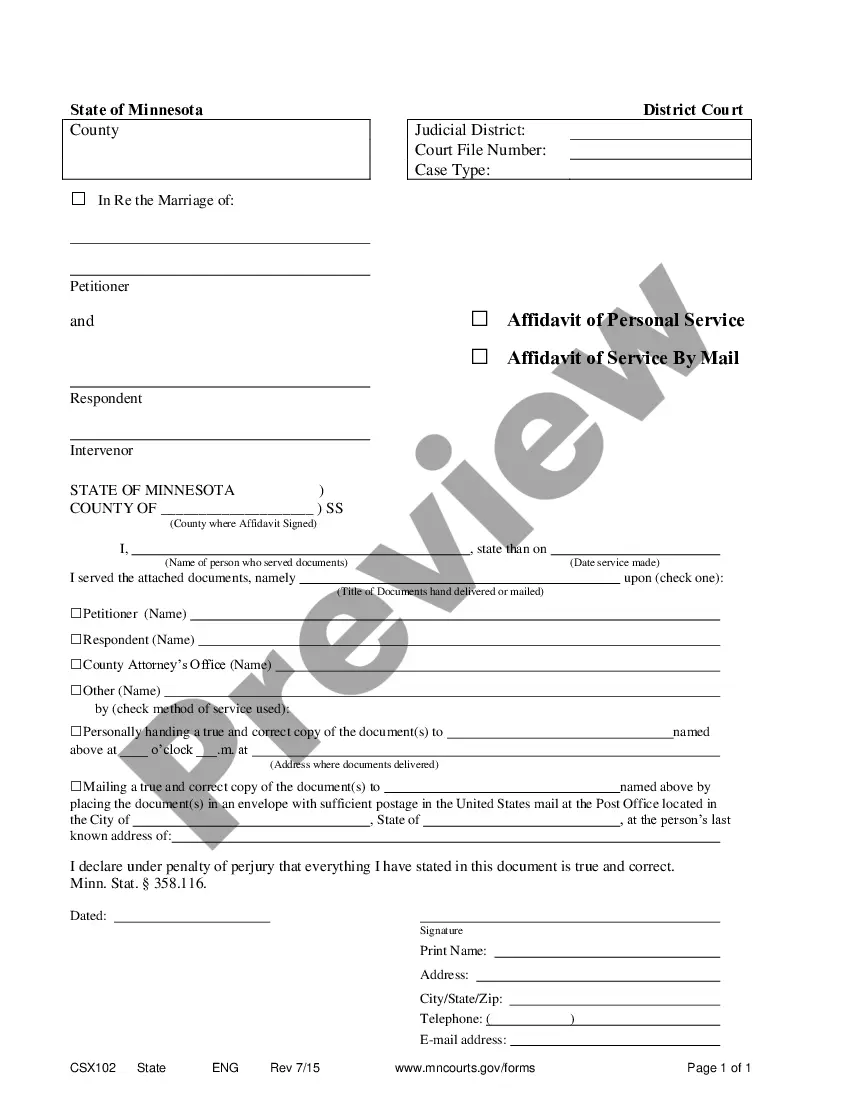

- First, ensure you have selected the correct form for your city/state. You can preview the document using the Review option and examine the form details to confirm it suits your needs.

- If the form does not fulfill your requirements, use the Search field to find the appropriate document.

Form popularity

FAQ

Tax liens are risky because they can severely impact your financial standing and ability to obtain credit. A lien becomes part of the public record, which can deter lenders and affect overall trustworthiness. Additionally, failing to resolve a tax lien may lead to other financial complications, making it wise to consider options like the Arkansas Agreement to Compromise Debt as a path to resolution and financial stability.

A state tax lien in Arkansas occurs when the state government claims a legal right to your property due to unpaid state taxes. This lien serves as public notice that you owe taxes and can affect your credit score. Understanding the implications of a tax lien is crucial, especially if you are considering an Arkansas Agreement to Compromise Debt. Utilizing this agreement can help you negotiate and settle your tax liabilities effectively.

The IRS does accept offers in compromise; however, approvals are selective. The key is to demonstrate that your Arkansas Agreement to Compromise Debt is reasonable based on financial hardship. When presented correctly, your offer can lead to a favorable outcome.

A certificate of indebtedness in Arkansas serves as a formal acknowledgment of your debt owed to the state. This document is crucial when navigating tax obligations and potential compromises. Incorporating this understanding into your Arkansas Agreement to Compromise Debt can help clarify your financial stance.

Yes, you can set up a payment plan for Arkansas state taxes. The Arkansas Department of Finance and Administration allows taxpayers to arrange installment agreements, helping you manage your tax liabilities effectively. By considering an Arkansas Agreement to Compromise Debt, you may also explore options that ease your financial burden further.

To set up a payment plan for your Arkansas state taxes, you must first assess your total tax liability. Consider using an Arkansas Agreement to Compromise Debt to negotiate payment terms with the state. Once you know your total amount due, you can contact the Arkansas Department of Finance and Administration to discuss your options and establish a manageable payment schedule.

A certificate of indebtedness is a document that confirms a debtor's outstanding financial obligations. In the context of an Arkansas Agreement to Compromise Debt, it can help you understand your total debt amount, including any fees or penalties. This certificate can provide a clear picture of your financial status and guide you in negotiating better terms with your creditors.

The statute of limitations for taxes in Arkansas usually ranges from three to five years. This timeframe can differ based on the type of tax and any specific conditions surrounding the case. Understanding these limits is crucial for effectively managing your tax obligations. An Arkansas Agreement to Compromise Debt can assist in navigating these limitations and finding the best resolution for your financial situation.

Generally, liens in Arkansas last for a period of five years. However, this duration can vary based on specific circumstances or actions taken by the creditor. It’s crucial to address any liens promptly to avoid complications. An Arkansas Agreement to Compromise Debt may significantly ease negotiations concerning lingering liens.

To file an offer in compromise with the IRS, you need to complete Form 656 and provide supporting documentation of your financial situation. This process allows you to settle your tax debt for less than the total amount owed. Utilizing resources like the Arkansas Agreement to Compromise Debt can guide you through this complex process efficiently and effectively.