Arkansas Sample Letter for Asset Sale

Description

How to fill out Sample Letter For Asset Sale?

Are you inside a situation where you need paperwork for sometimes enterprise or individual uses almost every working day? There are plenty of legal file layouts available on the Internet, but getting versions you can rely is not easy. US Legal Forms offers a large number of kind layouts, much like the Arkansas Sample Letter for Asset Sale, that happen to be created to satisfy federal and state needs.

If you are already acquainted with US Legal Forms website and have an account, basically log in. Afterward, it is possible to download the Arkansas Sample Letter for Asset Sale design.

Unless you provide an account and wish to begin using US Legal Forms, abide by these steps:

- Get the kind you will need and make sure it is for that right metropolis/state.

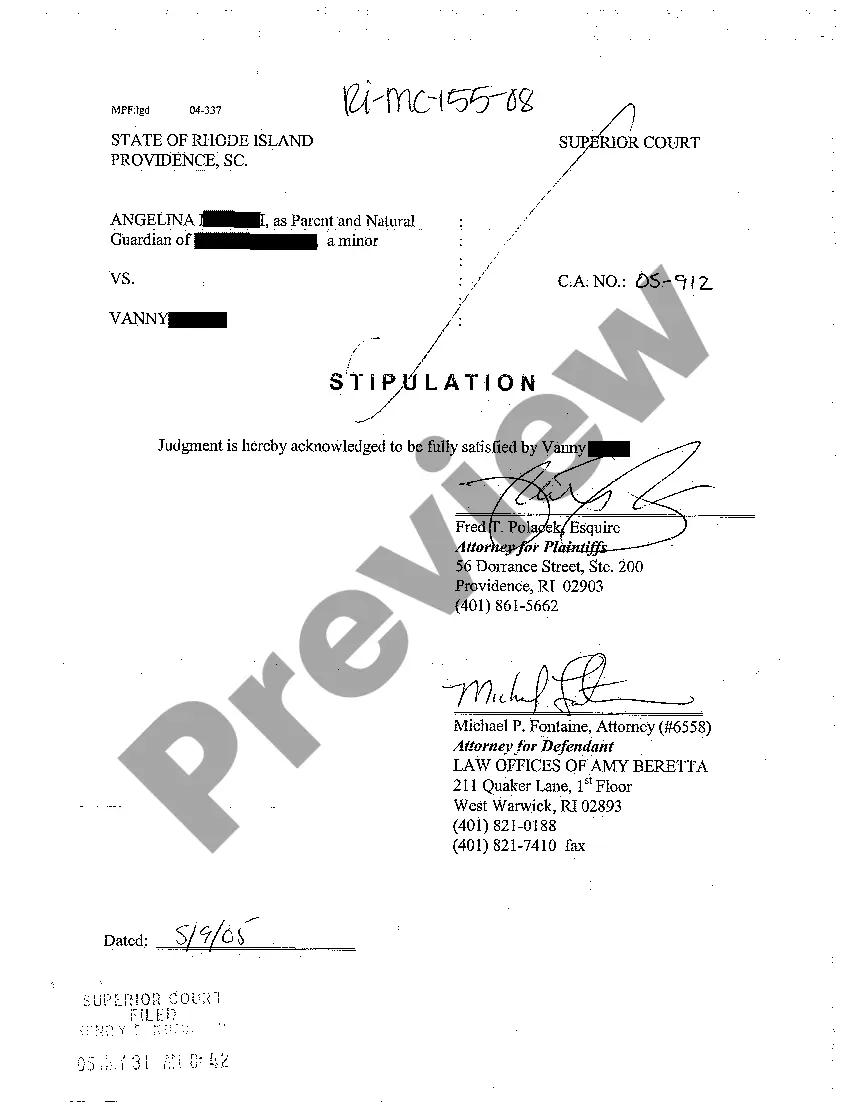

- Make use of the Review switch to examine the shape.

- Read the explanation to actually have selected the proper kind.

- When the kind is not what you`re trying to find, use the Look for field to discover the kind that meets your needs and needs.

- When you find the right kind, click Get now.

- Pick the pricing strategy you would like, fill out the required information to create your money, and pay money for the transaction with your PayPal or bank card.

- Decide on a practical paper formatting and download your backup.

Discover all the file layouts you have bought in the My Forms food selection. You can aquire a further backup of Arkansas Sample Letter for Asset Sale whenever, if needed. Just click on the essential kind to download or produce the file design.

Use US Legal Forms, by far the most substantial collection of legal types, to save time and stay away from errors. The service offers professionally produced legal file layouts which you can use for a range of uses. Make an account on US Legal Forms and initiate making your life a little easier.

Form popularity

FAQ

Follow these steps to calculate the net results of any asset sales and record them ingly in your accounting: Determine the initial value of the assets. ... Calculate depreciation. ... Negotiate the sale price. ... Calculate loss or gain. ... Record your loss or gain.

A Letter of Intent (LOI) is a short non-binding contract that precedes a binding agreement, such as a share purchase agreement or asset purchase agreement (definitive agreements). There are some provisions, however, that are binding such as non-disclosure, exclusivity, and governing law.

This free template Letter of Intent for an Asset Purchase Agreement is a non-binding document outlining the general terms and price by which a buyer proposes to purchase the assets of a particular business. If signed by the seller, it indicates that both parties intend to move forward in completing the transaction.

Asset Sale Checklist List of Assumed Contracts. List of Liabilities Assumed. Promissory Note. Security Agreement. Escrow Agreement. Disclosure of Claims, Liens, and Security Interests. List of Trademarks, Trade Names, Assumed Names, and Internet Domain Names. Disclosure of Licenses and Permits.

How to record disposal of assets Calculate the asset's depreciation amount. The first step is to ensure you have the accurate value of the asset recorded at the time of its disposal. ... Record the sale amount of the asset. ... Credit the asset. ... Remove all instances of the asset from other books. ... Confirm the accuracy of your work.

Your due diligence should include the company's: General ledger. Company credit report. Financial statements from the past 3 years. Summary of all debts and contingent liabilities. Summary of inventory, accounts receivable, and accounts payable. Depreciation, amortization, and accounting methods.

In an asset sale, a business can choose what it's selling. While the buyer purchases any or all of these individual assets, the seller retains possession of the legal business entity. The buyer may create a new company or use an existing subsidiary to acquire the selected assets, along with management and contracts.