This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

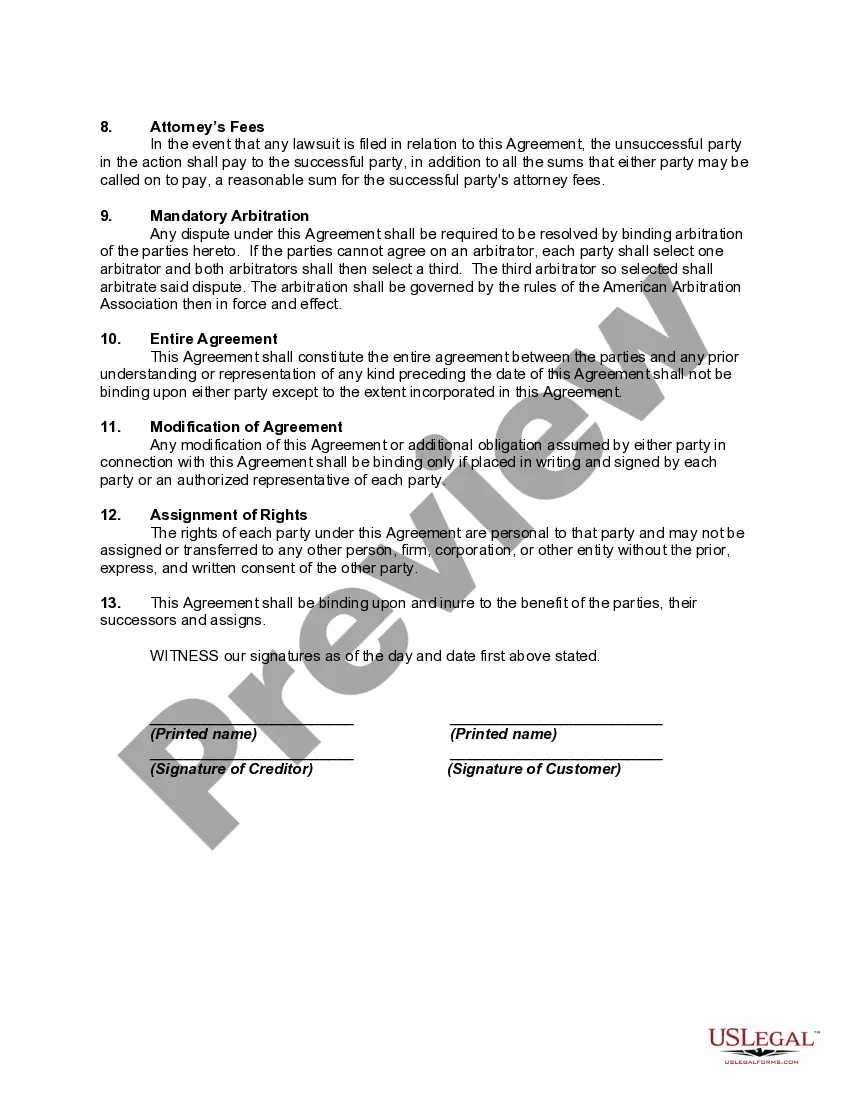

Arkansas Agreement to Extend Debt Payment

Description

How to fill out Agreement To Extend Debt Payment?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal template options that you can download or print.

By utilizing the website, you will access thousands of forms for business and personal purposes, categorized by sectors, states, or keywords.

You can find the most recent forms like the Arkansas Agreement to Extend Debt Payment in just moments.

If the form does not meet your needs, utilize the Search bar at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your choice by clicking on the Buy now button. Then, select your preferred payment plan and provide your details to register for an account.

- If you hold a subscription, Log In to download the Arkansas Agreement to Extend Debt Payment from the US Legal Forms library.

- The Download button will appear on each form you view.

- You have access to all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are some straightforward steps to get you started.

- Make sure you have selected the correct form for your location.

- Preview the form to examine its contents.

Form popularity

FAQ

Yes, you can file a state tax extension online in Arkansas. This convenient option is available through the Arkansas Department of Finance and Administration’s e-file system. By completing the Arkansas Agreement to Extend Debt Payment, you can gain valuable time to prepare your taxes without incurring penalties. Online filing streamlines the process and provides immediate confirmation of your extension.

Filing for an extension online is straightforward. You can visit the official Arkansas Department of Finance and Administration’s website and use their e-filing system. By opting for the Arkansas Agreement to Extend Debt Payment, you can efficiently manage your tax responsibilities. This online process saves you time and ensures your extension is submitted correctly.

To file an extension for Arkansas state taxes, you typically need to submit Form AR1000I, which formally requests an extension. This form allows you to extend your payment if you meet the requirements. Utilizing the Arkansas Agreement to Extend Debt Payment can help you manage your financial obligations without stress. Make sure to file this form before the original tax deadline.

The deadline to file state taxes in Arkansas generally aligns with the federal deadline, typically April 15. However, if you file for an extension, you can push this deadline back. Remember, if you are seeking an Arkansas Agreement to Extend Debt Payment, be proactive about your deadlines to avoid late fees and penalties. Always check the official Arkansas Department of Finance and Administration website for the most current dates.

Yes, Arkansas recognizes the federal extension for S corporations. If you obtain a federal extension, it usually applies to your state tax obligations as well. This means you can have extra time to complete your Arkansas Agreement to Extend Debt Payment. It's important to ensure you file any required paperwork to confirm your extension with the state.

In Arkansas, the statute of limitations on debt collection is typically six years for most types of unsecured debts. This means that creditors have up to six years to take legal action to recover debts. Understanding this timeline is crucial, and if you're facing challenges, consider an Arkansas Agreement to Extend Debt Payment as a way to tackle your debts head-on.

Debt collectors in Arkansas can initiate a lawsuit within the statute of limitations, which is often six years for most debt types. If they file after this period, it can be challenging for them to succeed in court. It’s essential to be aware of your rights and consider an Arkansas Agreement to Extend Debt Payment as a proactive approach to manage your debts before legal action arises.

In Arkansas, a debt generally becomes uncollectible after a period specified by law, which is typically six years for most debts. This means creditors can no longer legally pursue collection after this timeframe. However, even with an older debt, an Arkansas Agreement to Extend Debt Payment can provide a solution to negotiate payments and settle outstanding obligations.

The Fair Debt Collection Practices Act (FDCPA) in Arkansas protects consumers from abusive debt collection practices. It establishes guidelines for how debt collectors can interact with debtors to ensure fair treatment. Understanding your rights under the FDCPA helps you manage your financial circumstances and empowers you to seek an Arkansas Agreement to Extend Debt Payment if needed.

Certainly, Arkansas debt relief is a genuine option available to individuals struggling with financial obligations. Many organizations and professionals provide assistance in negotiating lower payments or settling debts. These services often include crafting an Arkansas Agreement to Extend Debt Payment, which can provide much-needed relief and a structured plan to manage your debts effectively.