Have you been within a position where you need documents for sometimes organization or specific purposes almost every working day? There are plenty of legal record layouts available on the net, but discovering ones you can trust isn`t simple. US Legal Forms offers thousands of form layouts, like the Arkansas Instruction to Jury as to Determining Value of Household or Personal Goods , which can be published to meet state and federal demands.

Should you be currently familiar with US Legal Forms web site and also have an account, merely log in. Afterward, you can acquire the Arkansas Instruction to Jury as to Determining Value of Household or Personal Goods format.

Unless you have an bank account and want to begin using US Legal Forms, follow these steps:

- Discover the form you require and ensure it is for that proper town/county.

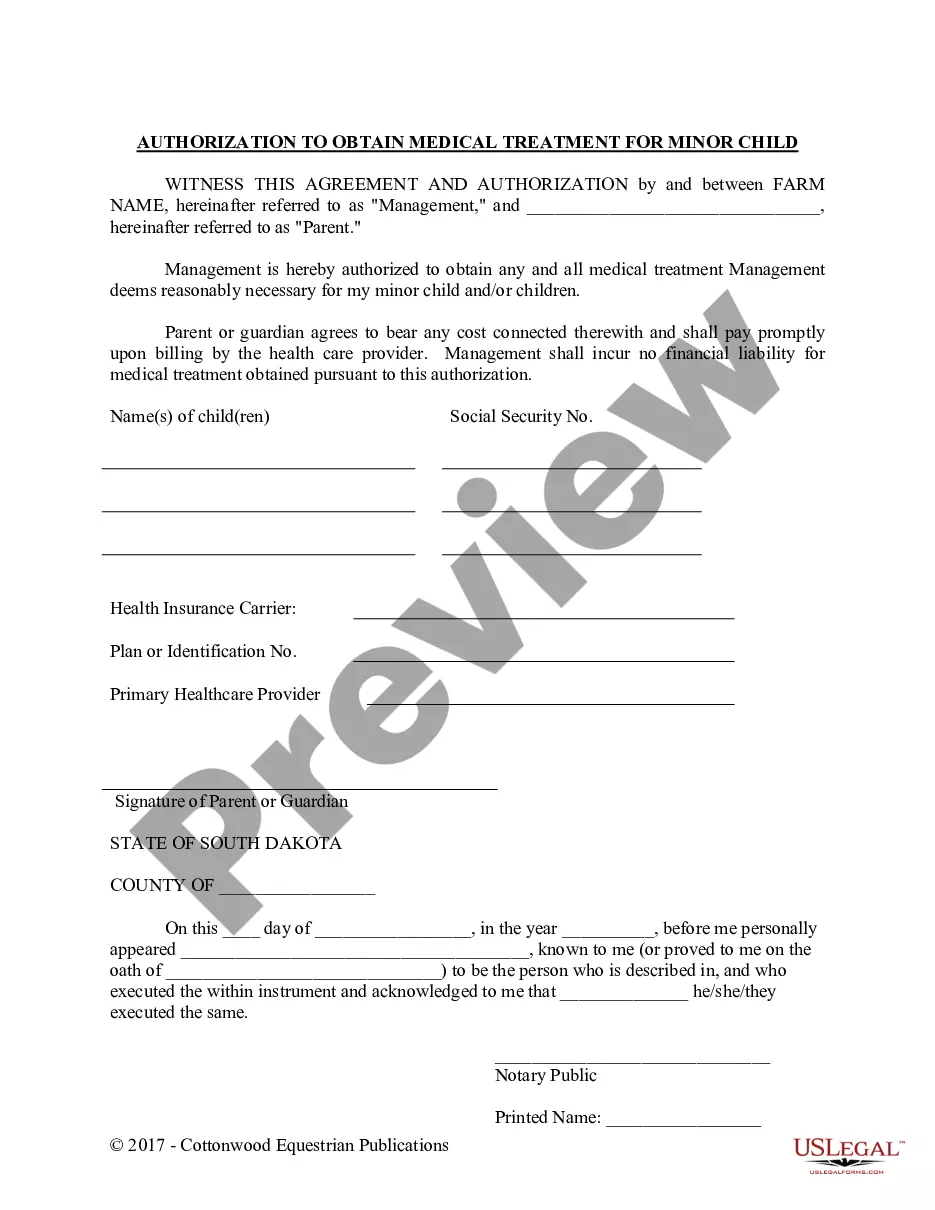

- Make use of the Preview switch to review the shape.

- Look at the description to ensure that you have selected the appropriate form.

- When the form isn`t what you`re trying to find, make use of the Research industry to obtain the form that fits your needs and demands.

- Whenever you obtain the proper form, just click Get now.

- Choose the prices strategy you desire, fill out the required information to produce your account, and pay for your order with your PayPal or charge card.

- Choose a practical document file format and acquire your backup.

Discover every one of the record layouts you possess bought in the My Forms menus. You can obtain a additional backup of Arkansas Instruction to Jury as to Determining Value of Household or Personal Goods whenever, if required. Just click the required form to acquire or produce the record format.

Use US Legal Forms, probably the most substantial selection of legal forms, to save time and avoid faults. The services offers appropriately made legal record layouts that can be used for a selection of purposes. Produce an account on US Legal Forms and start producing your life a little easier.