Arkansas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate

Description

How to fill out Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

Finding the appropriate legal document format can be a challenge. Of course, there are numerous templates accessible online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. This service provides thousands of templates, such as the Arkansas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, which you can utilize for both professional and personal purposes. All templates are reviewed by experts and comply with federal and state regulations.

If you are already registered, sign in to your account and click the Download button to obtain the Arkansas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Use your account to browse the legal documents you have previously acquired. Visit the My documents section of your account to get an additional copy of the document you need.

Complete, edit, print, and sign the received Arkansas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. US Legal Forms is the largest repository of legal templates where you can find various document formats. Use the service to obtain professionally-crafted documents that adhere to state requirements.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

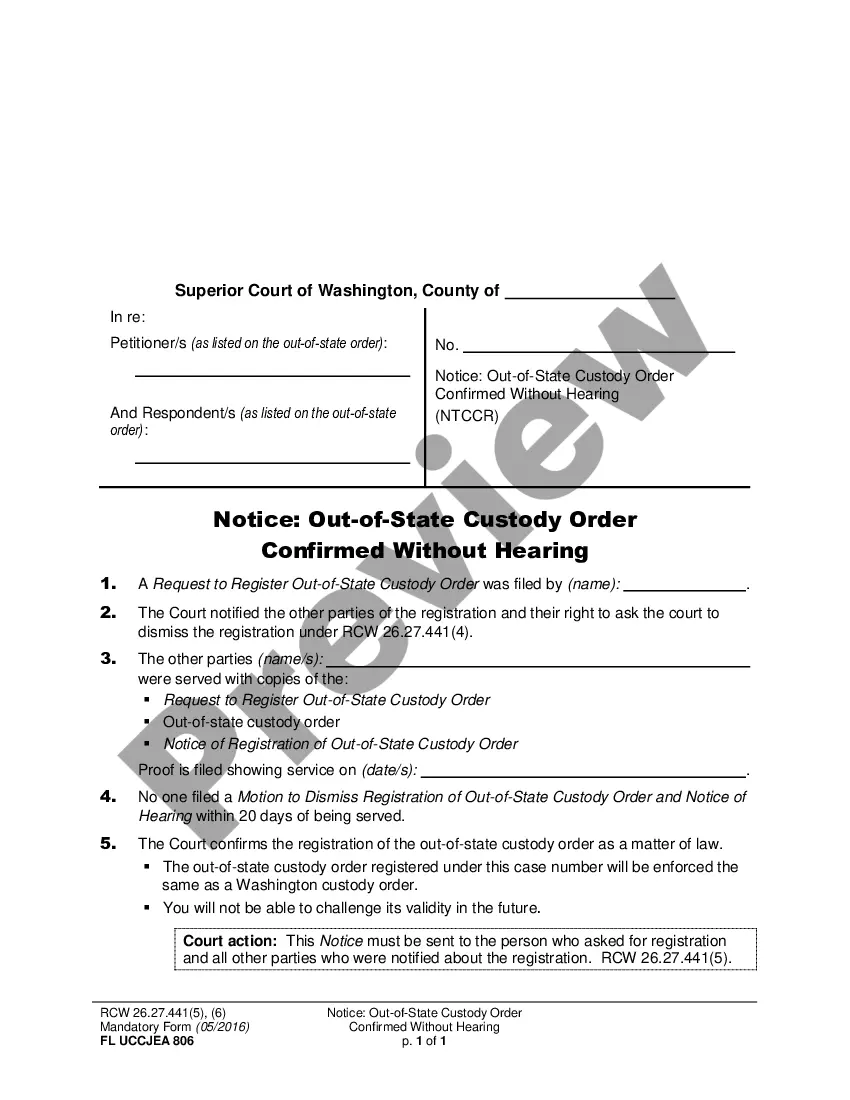

- First, ensure that you have selected the correct form for your location/state. You can preview the form using the Review option and read the form description to confirm this is indeed the right one for you.

- If the form does not meet your requirements, utilize the Search field to find the appropriate document.

- Once you are confident that the form is suitable, click the Get now button to retrieve the form.

- Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card.

- Select the file format and download the legal document format to your device.

Form popularity

FAQ

In Arkansas, the taxability of rentals depends on the type of property being rented. Generally, rentals of tangible personal property are subject to sales tax, while rentals of real estate are usually exempt. However, specific conditions can apply, affecting how taxes are assessed on an Arkansas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

Several categories of individuals and organizations qualify for sales tax exemption in Arkansas, including nonprofits, government entities, and certain educational institutions. Moreover, specific purchases related to manufacturing or processing might also be exempt. If you operate an Arkansas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, understanding these exemptions can significantly enhance your financial strategy.

A person may qualify as tax exempt if they meet specific criteria established by federal or state law. This often includes nonprofit organizations, certain educational entities, and individuals who meet particular financial or situational thresholds. Understanding tax exemption qualifications is crucial for those engaged in an Arkansas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, as it can influence their overall tax obligations.

Avoiding Arkansas capital gains tax on real estate typically requires careful planning. Strategies may include reinvesting the proceeds into another property, utilizing a 1031 exchange, or holding property long-term to benefit from lower tax rates. Individuals looking to minimize their tax burdens should understand how these strategies can align with their Arkansas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

Yes, Arkansas does have a gross receipts tax that applies to various types of transactions. This tax is particularly relevant for businesses, including those managing an Arkansas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. It impacts how businesses calculate overall tax liabilities on sales and services rendered.

In Arkansas, certain exemptions apply to sales tax, particularly for specific items and services. For example, retail sales of food for home consumption are exempt. Additionally, sales of certain medical supplies and farm-related goods may also qualify for exemption, which can significantly impact businesses operating under an Arkansas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

The formula for the percentage of agreement in an Arkansas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate typically involves the division of additional rent by total gross sales. This percentage helps both landlords and tenants understand their obligations under the lease. Clarity in this formula can prevent disputes and contribute to a smooth rental relationship.

The formula for calculating a lease, particularly in the context of an Arkansas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, includes determining base rent plus any applicable additional rent based on a percentage of gross receipts. Therefore, the total amount equals base rent plus (gross sales x lease factor percentage). This formula helps ensure transparency and fairness in rental agreements.

The most common lease for retail properties is the percentage lease, commonly used in Arkansas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. This type of lease allows landlords to benefit from successful tenants, while also providing tenants with a level of predictability in their rent expenses. This structure can incentivize both parties to work towards increasing sales.

Breakpoint refers to the sales threshold at which percentage rent begins to apply under an Arkansas Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Once a tenant's gross sales exceed this specified breakpoint, they start paying additional rent based on that sales percentage. Clear identification of the breakpoint is essential for both tenants and landlords to manage expectations and financial planning.