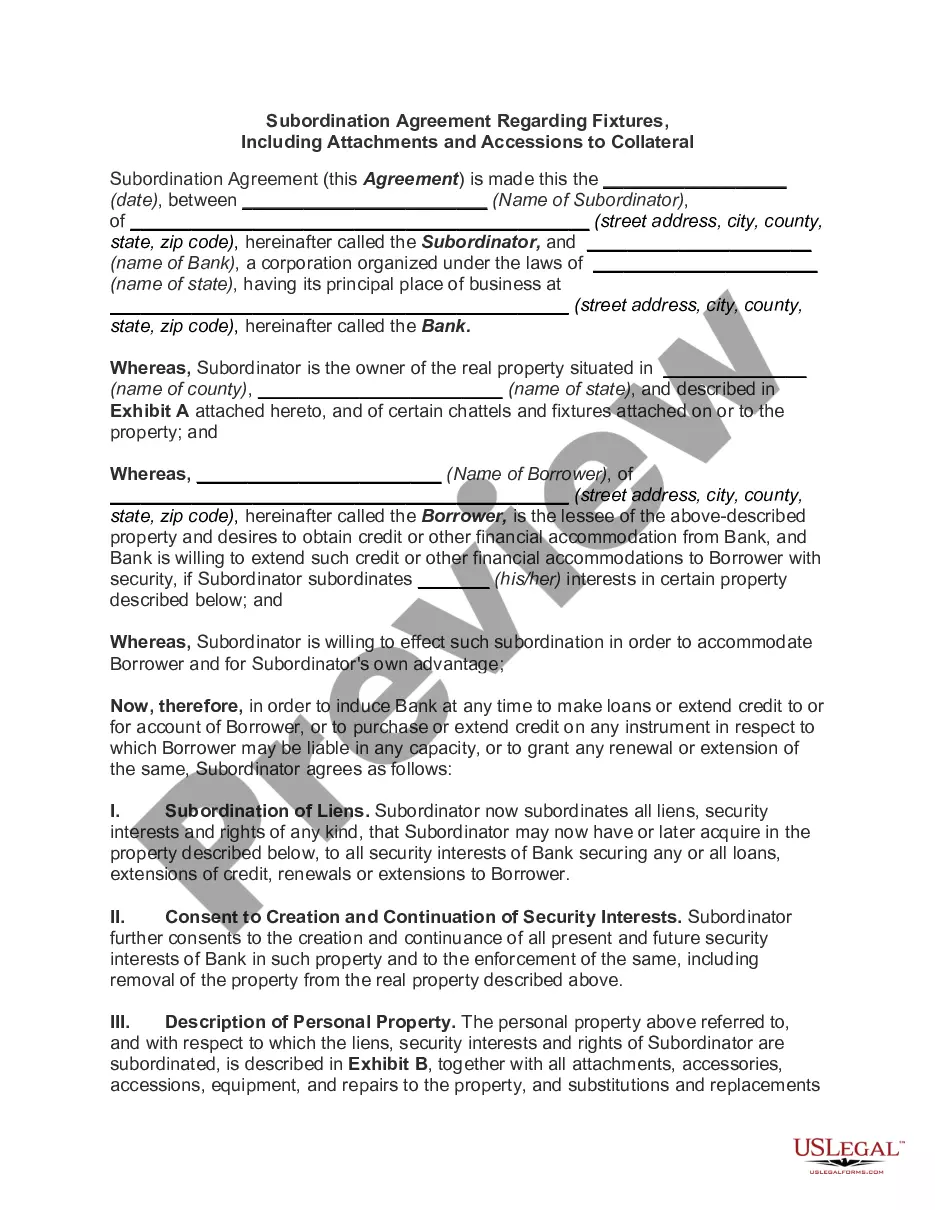

Arkansas Subordination Agreement - Lien

Description

How to fill out Subordination Agreement - Lien?

If you want to finalize, download, or print valid document templates, utilize US Legal Forms, the largest selection of valid forms available online.

Employ the site's straightforward and convenient search to find the documents you require. A variety of templates for business and personal purposes are categorized by groups and states, or keywords.

Use US Legal Forms to acquire the Arkansas Subordination Agreement - Lien in just a few clicks.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Arkansas Subordination Agreement - Lien. Each legal document template you obtain is yours forever. You will have access to every form you downloaded within your account. Click on the My documents section and select a form to print or download again. Complete, download, and print the Arkansas Subordination Agreement - Lien with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click on the Download option to retrieve the Arkansas Subordination Agreement - Lien.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form's details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. After you have identified the form you need, select the Purchase now option. Choose the pricing plan you prefer and input your information to register for the account.

Form popularity

FAQ

A subordinated loan is debt that's only paid off after all primary loans are paid off, if there's any money left. It's also known as subordinated debt, junior debt or a junior security, while primary loans are also known as senior or unsubordinated debt.

Any subsequent loan that is taken out after your initial purchase loan is considered to be a junior-lien or subordinate mortgage. Therefore, subordinate financing is the use of two or more mortgages to finance the purchase of real estate or using your home's equity for liquid cash.

When you get a mortgage loan, the lender will likely include a subordination clause essentially stating that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender if a homeowner defaults.

Payment subordination establishes the hierarchy of interest and principal payments in case of default or liquidation. Senior debt is paid first, followed by junior debt. Lien subordination does not imply payment subordination. In the case of default, payments must continue to be made to all senior lenders equally.

Subordination agreements are used to legally establish the order in which debts are to be repaid in the event of a foreclosure or bankruptcy. In return for the agreement, the lender with the subordinated debt will be compensated in some manner for the additional risk.

A mortgage subordination refers to the order the outstanding liens on your property get repaid if you stop making your mortgage payments. For example, your first home loan (primary mortgage) is repaid first, with any remaining funds paying off additional liens, including second mortgages, HELOCs and home equity loans.

Subordination agreements are used to legally establish the order in which debts are to be repaid in the event of a foreclosure or bankruptcy. In return for the agreement, the lender with the subordinated debt will be compensated in some manner for the additional risk.