Arkansas Promissory Note - Satisfaction and Release

Description

How to fill out Promissory Note - Satisfaction And Release?

You have the opportunity to spend hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast selection of legal forms that are reviewed by experts.

You can download or print the Arkansas Promissory Note - Satisfaction and Release from their services.

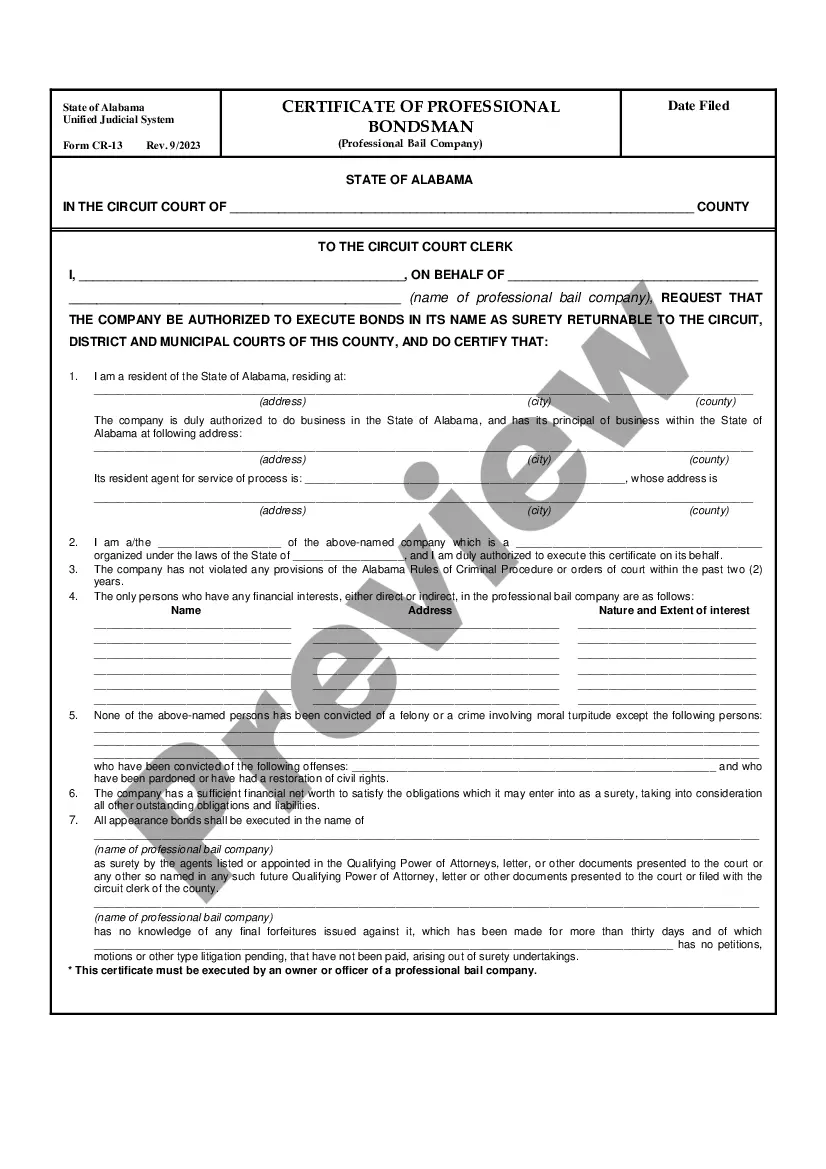

If available, use the Review button to browse through the document format as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Subsequently, you can complete, modify, print, or sign the Arkansas Promissory Note - Satisfaction and Release.

- Each legal document template you purchase is yours for life.

- To obtain an additional copy of a purchased form, navigate to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple steps outlined below.

- First, ensure that you have selected the correct document template for the region/town of your preference.

- Review the form description to confirm that you have selected the right document.

Form popularity

FAQ

To obtain your Arkansas promissory note, first, you need to ensure that the agreement is properly drafted and signed by all parties involved. If you have lost your original document, you can contact the lender or borrower to request a duplicate copy. Additionally, you can use platforms like US Legal Forms that provide templates and guidance to create or retrieve your Arkansas Promissory Note - Satisfaction and Release. This approach helps safeguard your interests and ensures all legal requirements are met.

The release and satisfaction of an Arkansas promissory note refers to the formal process of acknowledging that a debt has been fully repaid and that the lender relinquishes any right to further payments. This typically requires a written document that is signed by both parties. Completing this process can help prevent future disputes and creates a clear record that the obligation has been fulfilled. You can find resources on US Legal Forms to facilitate this process smoothly.

To fill out a promissory demand note, begin by clearly stating the names of the borrower and the lender at the top of the document. Next, specify the principal amount, the interest rate, and any payment terms, including due dates. Be sure to include a provision for default, so both parties understand the consequences if payments are missed. Utilizing the Arkansas Promissory Note - Satisfaction and Release can ensure that your document meets local legal requirements and protects both parties.

In Arkansas, a debt becomes uncollectible after the expiration of its statute of limitations, which is typically five or six years depending on the type of debt. After this time, creditors can lose their legal right to enforce collection. It’s crucial to monitor these timelines to ensure you're protecting your interests related to any Arkansas Promissory Note - Satisfaction and Release.

To release a promissory note, the borrower must first make all payments required by the note. Once completed, the lender should issue a release document confirming satisfaction of the debt. Utilizing services like US Legal Forms can streamline this process, ensuring that your Arkansas Promissory Note - Satisfaction and Release is handled correctly.

In Arkansas, the statute of limitations on debt after an individual's death typically follows the six-year timeline for most debts, including loans and promissory notes. However, the debt must be filed against the estate during probate. This emphasizes the importance of addressing any Arkansas Promissory Note - Satisfaction and Release swiftly following death.

In Arkansas, the statute of limitations for written contracts is generally six years. This includes various agreements, such as promissory notes and other formal contracts. Being aware of this timeline can help you navigate your legal rights effectively regarding Arkansas Promissory Note - Satisfaction and Release.

The statute of limitations for a promissory note in Arkansas is five years. This means lenders have five years from when the promissory note is due to initiate legal action to collect the debt. Keep this timeframe in mind to protect your interests regarding any Arkansas Promissory Note - Satisfaction and Release.

In Arkansas, the statute of limitations for enforcing a mortgage is typically six years from the date of default. This period allows lenders to take legal action to recover the debt if necessary. Understanding your rights and the timeline is vital, especially when dealing with an Arkansas Promissory Note - Satisfaction and Release.

To discharge a promissory note effectively, the borrower must fulfill the obligations outlined in the note, such as repaying the debt in full. After payment, the lender should provide a satisfaction and release document stating the debt has been settled. This process is crucial for maintaining accurate records and ensuring clear ownership of the Arkansas Promissory Note - Satisfaction and Release.