Arkansas Reimbursement for Expenditures - Resolution Form - Corporate Resolutions

Description

How to fill out Reimbursement For Expenditures - Resolution Form - Corporate Resolutions?

Locating the appropriate authentic document format can pose a challenge. Naturally, there are numerous web templates accessible online, but how do you identify the authentic type you require.

Utilize the US Legal Forms website. The service provides a vast array of templates, including the Arkansas Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, which you can utilize for business and personal purposes. All of the forms are vetted by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Arkansas Reimbursement for Expenditures - Resolution Form - Corporate Resolutions. Use your account to review the legal forms you have requested in the past. Navigate to the My documents section of your account to retrieve another copy of the document you need.

Complete, modify, print, and sign the acquired Arkansas Reimbursement for Expenditures - Resolution Form - Corporate Resolutions. US Legal Forms is the largest repository of legal forms where you can find numerous document templates. Utilize the service to obtain correctly structured documents that adhere to state regulations.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

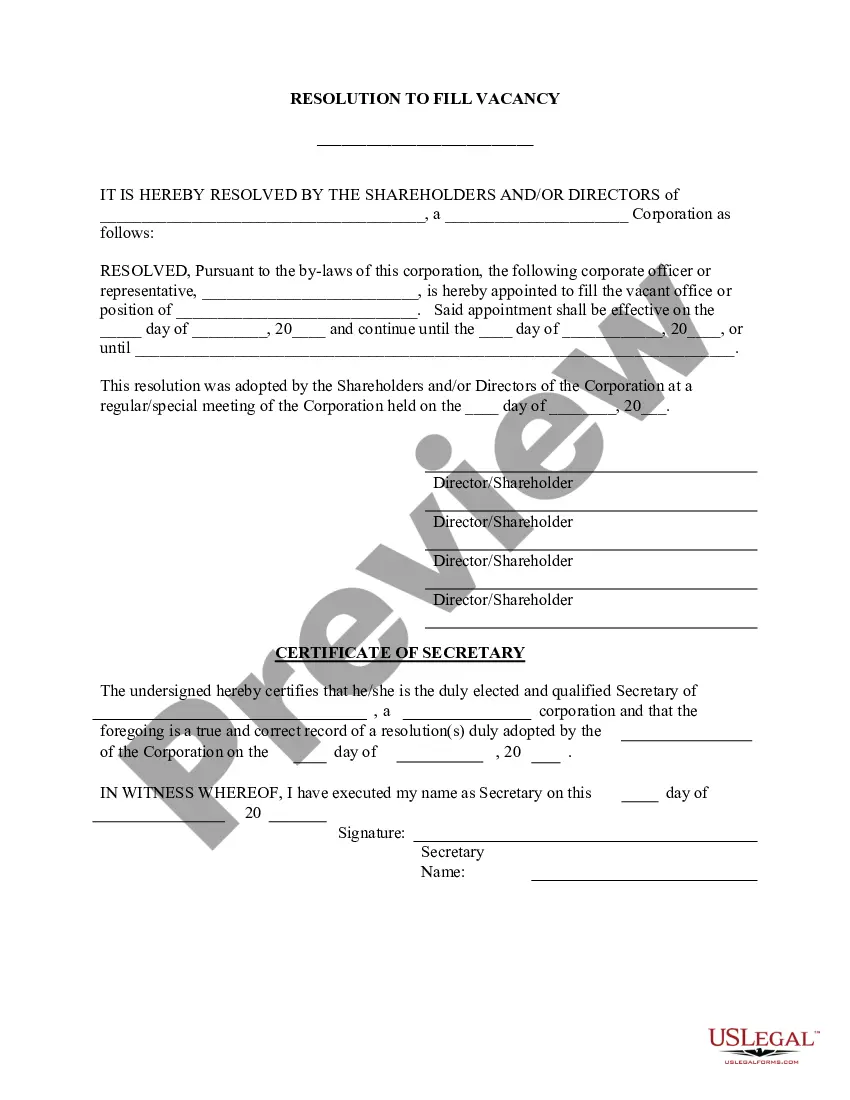

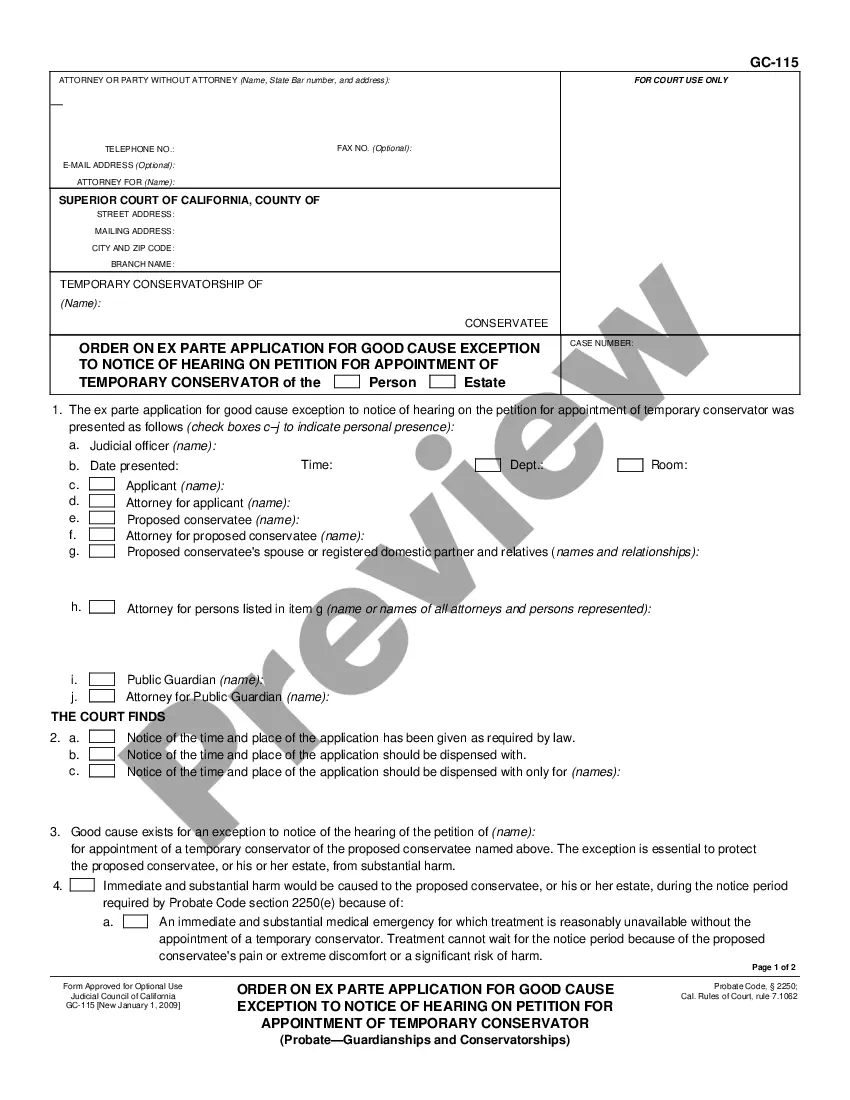

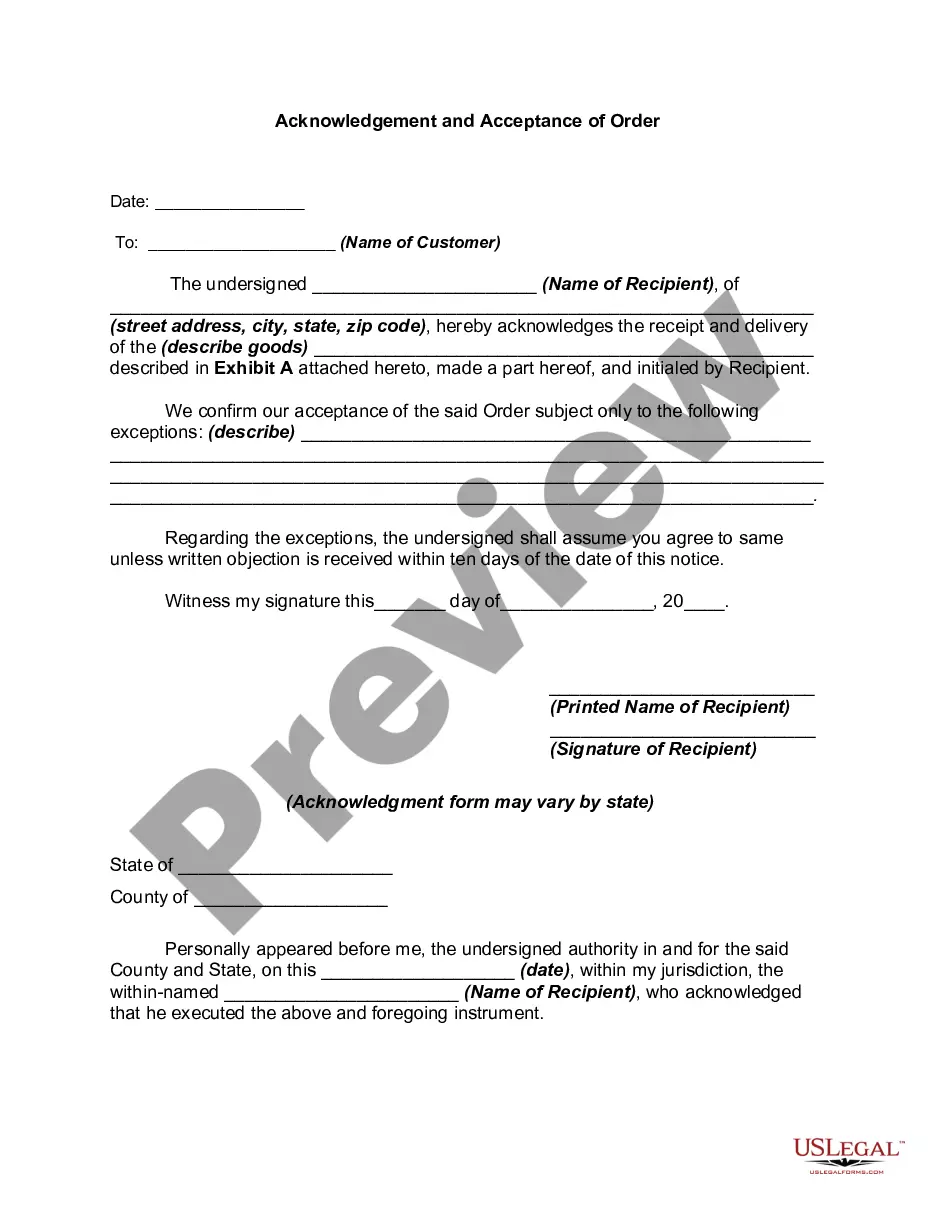

- First, ensure you have selected the appropriate form for your city/region. You can review the form using the Preview button and consult the form details to confirm it is the correct one for you.

- If the form does not meet your needs, utilize the Search area to find the correct form.

- When you are confident that the form is appropriate, click on the Download now button to acquire the form.

- Choose the pricing plan you desire and fill in the required information. Create your account and pay for the order using your PayPal account or credit card.

- Select the file format and download the legal document to your device.

Form popularity

FAQ

As of now, Arkansas has not made any definitive moves to eliminate income tax. Discussions about tax reforms do occur, so it’s valuable to stay updated on state legislative news. For your business, utilizing the Arkansas Reimbursement for Expenditures - Resolution Form - Corporate Resolutions can help navigate current tax regulations while maximizing your financial strategies.

To qualify for Section 179 deductions, a business must generate income and use the asset for its trade or business. This deduction applies to various property types, from machinery to office furniture. Understanding these qualifications is essential when filing for Arkansas Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, as it helps businesses maximize their deductions.

The $150 tax credit in Arkansas typically benefits individuals who meet certain income criteria. This credit can reduce your tax liability, offering valuable savings. Using the Arkansas Reimbursement for Expenditures - Resolution Form - Corporate Resolutions can help ensure you capture all eligible credits, assisting in effective tax planning.

Section 179 does apply at the federal level, and many states, including Arkansas, conform to these provisions. However, the implementation can vary from state to state. When filing for Arkansas Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, businesses should consult local tax guidelines to confirm how their Section 179 deductions may be affected.

In Arkansas, the requirement for a copy of your federal tax return can depend on various factors, such as the specific form you are filing. Generally, if you are seeking Arkansas Reimbursement for Expenditures using the Resolution Form for Corporate Resolutions, you will likely need to provide documentation that shows your income. It is advisable to check specific instructions or consult a tax professional for detailed guidance on your situation.