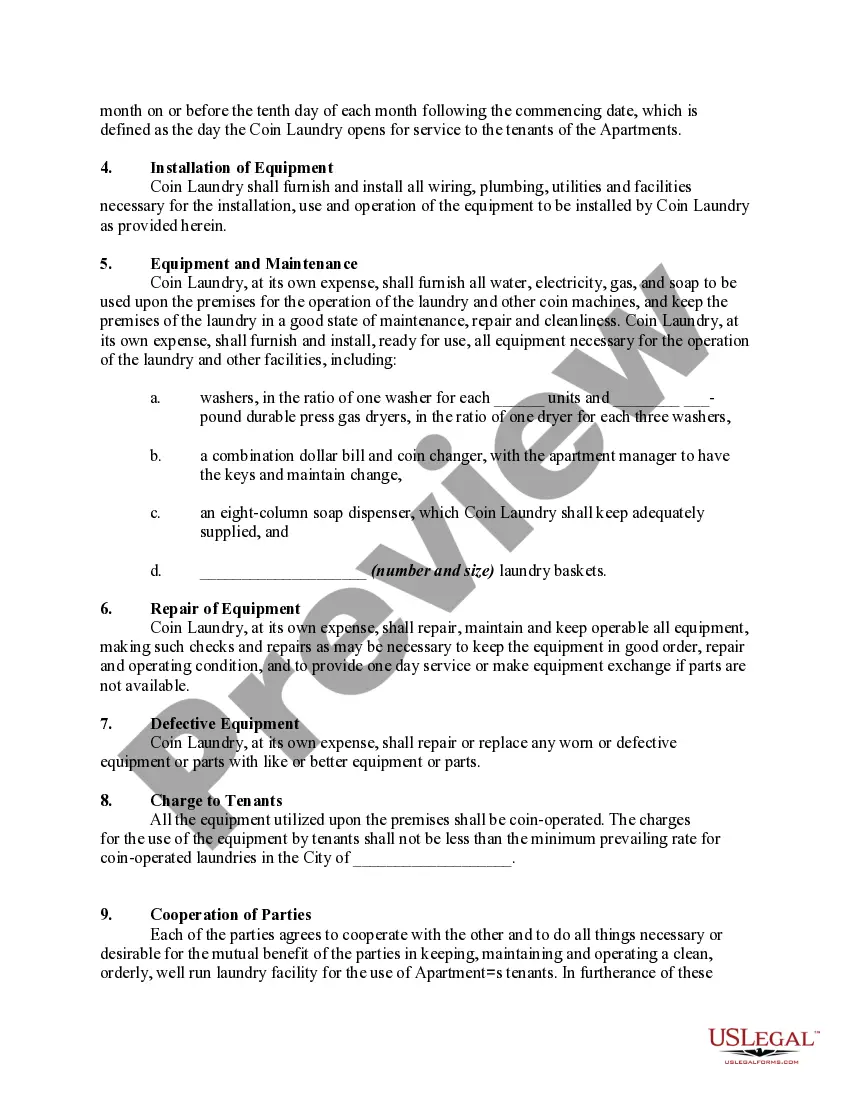

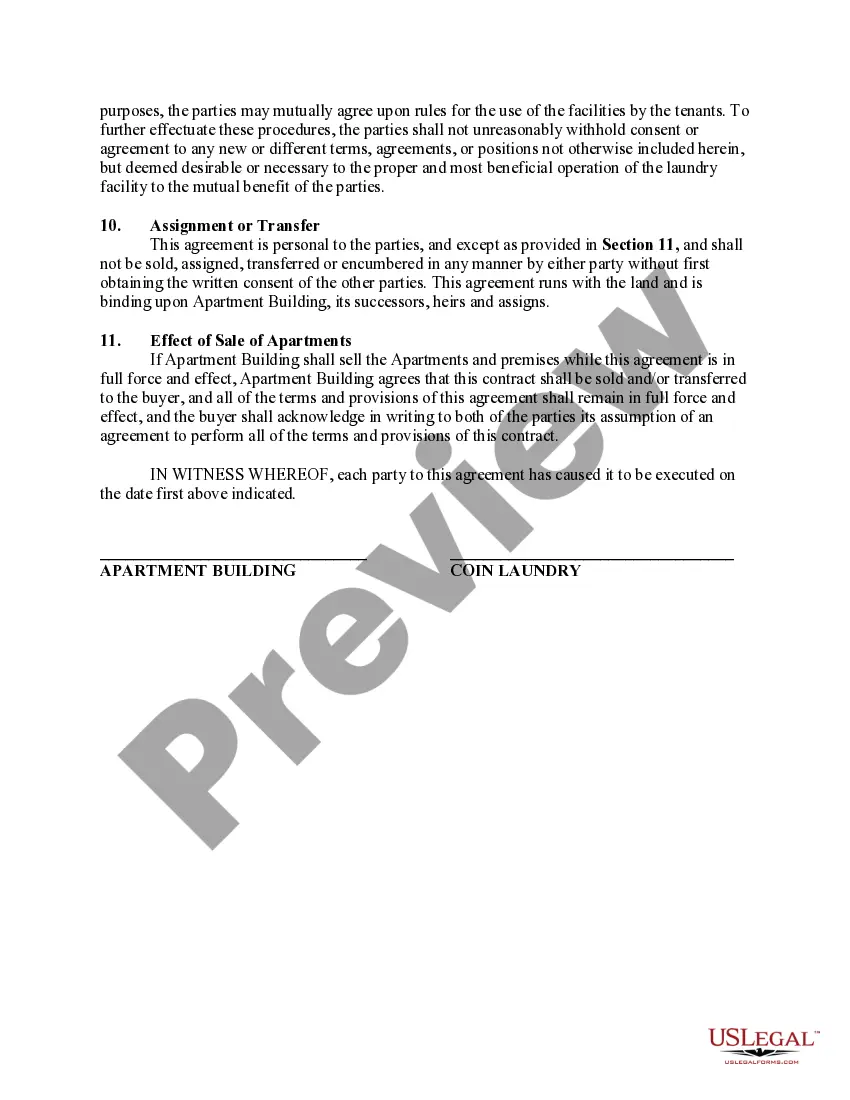

Arkansas Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building

Description

Coin-Operated Laundry in an Apartment Building.

How to fill out Agreement Granting Exclusive Right To Install, Operate And Maintain Coin-Operated Laundry In Apartment Building?

Finding the appropriate legal document template can be quite challenging.

Clearly, there are numerous formats available online, but how will you locate the legal template you need.

Utilize the US Legal Forms website, which offers a vast array of templates, including the Arkansas Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building, which you can use for business and personal needs.

If the form does not meet your requirements, use the Search field to find the right form. Once you're certain the form will work, click the Buy now button to obtain it. Select the pricing plan you prefer and enter the required information. Create your account and process the payment via your PayPal account or credit card. Choose the submission format and download the legal document template to your device. Complete, edit, print, and sign the downloaded Arkansas Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building. US Legal Forms is the largest repository of legal forms where you can find various document templates. Leverage this service to obtain professionally crafted paperwork that complies with state regulations.

- All templates are reviewed by experts and meet state and federal regulations.

- If you are already registered, Log In to your account and click the Acquire button to download the Arkansas Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building.

- Use your account to view the legal templates you have purchased before.

- Visit the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

- First, ensure you've selected the correct template for your city/county. You can review the form using the Preview button and examine the form description to confirm it's the correct one for you.

Form popularity

FAQ

In general, Arkansas municipalities are not exempt from sales tax. However, specific exemptions may apply in certain circumstances or for certain purchases. When entering into agreements like an Arkansas Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building, be mindful of any potential municipal tax implications.

Yes, installation labor is subject to sales tax in Arkansas. When you are involved in an Arkansas Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building, understand that labor associated with installation can incur taxable obligations. Consulting professionals can help you navigate these complexities.

Sales tax in Arkansas applies to several services, including those directly related to tangible personal property. Services like installation or maintenance, including those for an Arkansas Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building, can also be taxable. Always verify current state tax regulations to ensure compliance.

In Arkansas, service contracts can be taxable, but the specifics depend on the nature of the services rendered. If the service contract pertains to equipment or maintenance related to an Arkansas Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building, be sure to clarify if tax applies. Considering different scenarios can help you make informed financial decisions.

Pressure washing is considered a taxable service in Arkansas. When engaging in such services, it’s essential to understand your obligations regarding sales tax, especially if you are including it in an Arkansas Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building. You may also want to track your expenses related to the service for tax records.

In Arkansas, security services are generally not subject to sales tax unless the services include something tangible, like physical security equipment. If you are considering an Arkansas Agreement Granting Exclusive Right to Install, Operate and Maintain Coin-Operated Laundry in Apartment Building, you might want to consult specific state guidelines for clarity on taxable services, especially if they involve installation.