This Redevelopment and Tax Increment Financing Plan and Interlocal Agreement to Implement Plan is the implementation of a Plan through issuance of the Bonds and completion of a Redevelopment Project to have a beneficial financial impact on the City and County in that both will enjoy increased tax receipts from the Site when the Bonds are retired and will enjoy increased tax receipts from nearby properties whose development is influenced and induced by the Redevelopment Project. This Plan can be used in any state.

Arkansas Redevelopment and Tax Increment Financing Plan and Interlocal Agreement to Implement Plan

Description

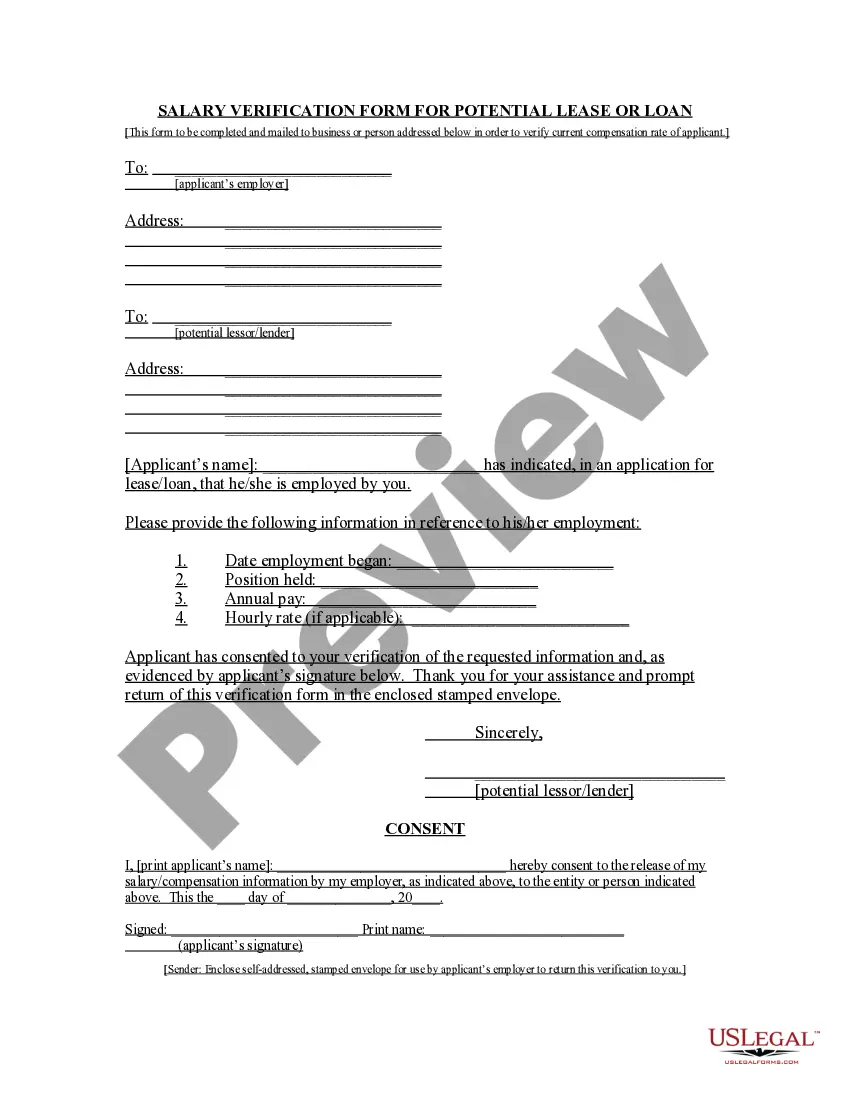

How to fill out Redevelopment And Tax Increment Financing Plan And Interlocal Agreement To Implement Plan?

Are you presently in the position where you require documents for either organizational or personal purposes nearly every working day.

There are numerous legal document templates available online, but finding ones you can trust is not easy.

US Legal Forms offers thousands of document templates, such as the Arkansas Redevelopment and Tax Increment Financing Plan and Interlocal Agreement to Implement Plan, which are designed to meet federal and state regulations.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Arkansas Redevelopment and Tax Increment Financing Plan and Interlocal Agreement to Implement Plan template.

- If you do not have an account and wish to use US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for the correct city/state.

- Utilize the Preview button to review the form.

- Read the description to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

- When you find the correct form, click on Get now.

- Select the pricing plan you desire, fill in the required information to create your account, and complete the payment using your PayPal or Visa or Mastercard.

- Choose a suitable file format and download your copy.

- Find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Arkansas Redevelopment and Tax Increment Financing Plan and Interlocal Agreement to Implement Plan at any time if needed. Just click on the necessary form to download or print the document template.

- Utilize US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid mistakes. The service provides properly crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

Form popularity

FAQ

In Arkansas, to request a tax extension, you need to complete the appropriate forms provided by the state tax authority. This process ensures that you can manage your tax obligations without facing penalties. For those working with the Arkansas Redevelopment and Tax Increment Financing Plan and Interlocal Agreement to Implement Plan, understanding tax extensions can aid in financial planning related to property investments and redevelopment projects.

Tax increment financing (TIF) is a funding method used to promote development in a specific area. This process allows municipalities to capture future tax revenue from a designated district, reinvesting it back into local improvements. In the context of the Arkansas Redevelopment and Tax Increment Financing Plan and Interlocal Agreement to Implement Plan, this strategy aims to stimulate economic growth while enhancing infrastructure and community services.

Tax increment financing (TIF) is a financial strategy designed to promote urban development by capturing the increase in property taxes that result from new investments. Essentially, it allows cities to reinvest future tax revenues in the same area, fostering growth and improving community infrastructure. The Arkansas Redevelopment and Tax Increment Financing Plan and Interlocal Agreement to Implement Plan exemplifies this approach, offering a structured way for cities to leverage this financing method for sustainable development. It is important for stakeholders to understand how TIF can impact their local economy and community.

The effectiveness of tax increment financing can vary based on its implementation and the specific circumstances of a project. On one hand, TIF can stimulate economic growth, attract new businesses, and revitalize distressed areas by funding vital infrastructure. On the other hand, critics argue that it can divert funds from essential public services. Understanding the Arkansas Redevelopment and Tax Increment Financing Plan and Interlocal Agreement to Implement Plan can help clarify its benefits and limitations, enabling better decision-making.

Yes, Arkansas law provides a redemption period for tax lien sales, which generally lasts for a period of two years. During this time, property owners can reclaim their properties by paying the owed taxes, plus interest and fees. Understanding the Arkansas Redevelopment and Tax Increment Financing Plan and Interlocal Agreement to Implement Plan can help you navigate these situations more effectively. If you face tax lien issues, consider using platforms like uslegalforms for guidance and assistance.

To set up a payment plan for Arkansas state taxes, you typically need to contact the Arkansas Department of Finance and Administration. They offer various options to assist taxpayers in managing their tax liabilities. Utilizing the resources available on platforms like uslegalforms can simplify this process, ensuring you have the correct forms and guidance to comply with the Arkansas Redevelopment and Tax Increment Financing Plan and Interlocal Agreement to Implement Plan. This can help you avoid penalties while fulfilling your tax obligations.

No, Arkansas is not eliminating income tax at this time. Discussions about tax reforms and adjustments are ongoing, but any significant changes would require legislative approval. It's essential to stay informed about updates regarding the Arkansas Redevelopment and Tax Increment Financing Plan and Interlocal Agreement to Implement Plan, as these initiatives can impact local funding and taxes. Keeping an eye on these developments will help you make informed financial decisions.

Tax increment financing (TIF) is a public financing method used to stimulate economic development in designated areas. It allows municipalities to capture the future tax benefits generated by increased property values within those areas. Through the Arkansas Redevelopment and Tax Increment Financing Plan and Interlocal Agreement to Implement Plan, local governments can fund infrastructure improvements and attract new businesses. Essentially, TIF helps revitalize communities while managing the financial risks associated with these projects.