This form is an Application for Release of Right to Redeem Property from IRS After Foreclosure. Check for compliance with your specific facts and circumstances.

Arkansas Application for Release of Right to Redeem Property from IRS After Foreclosure

Description

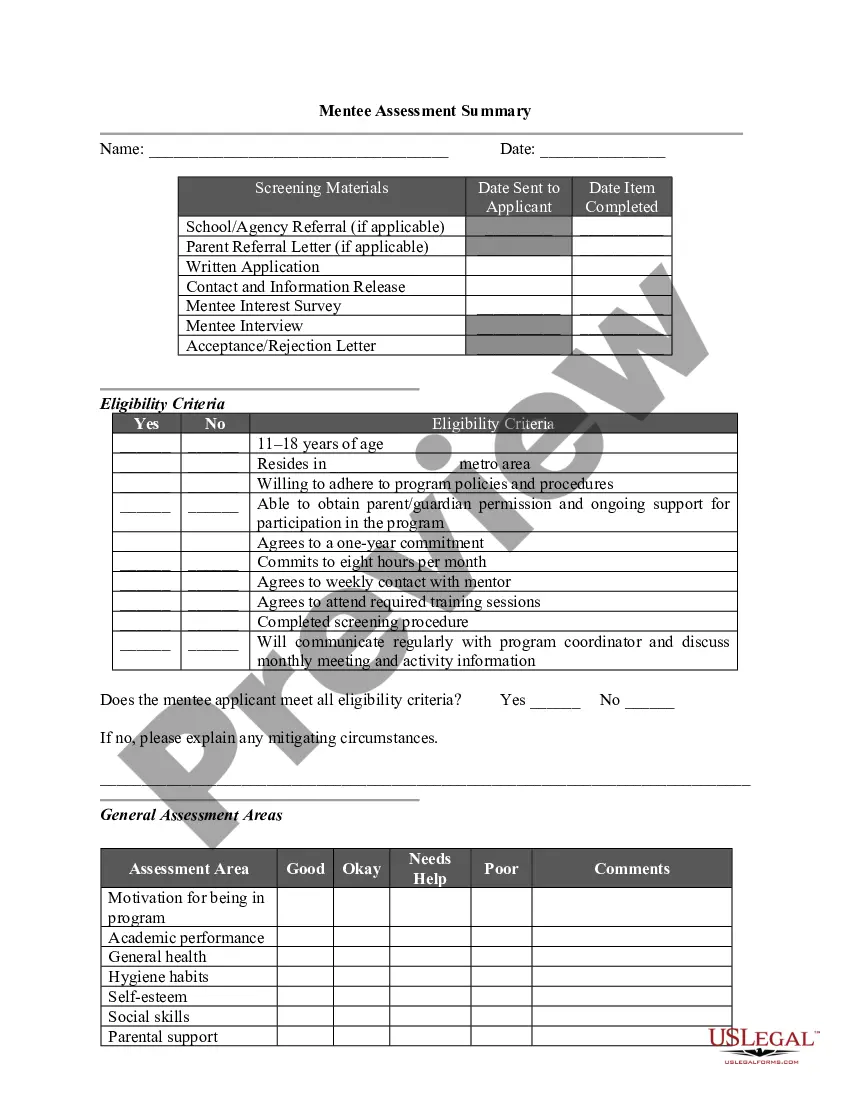

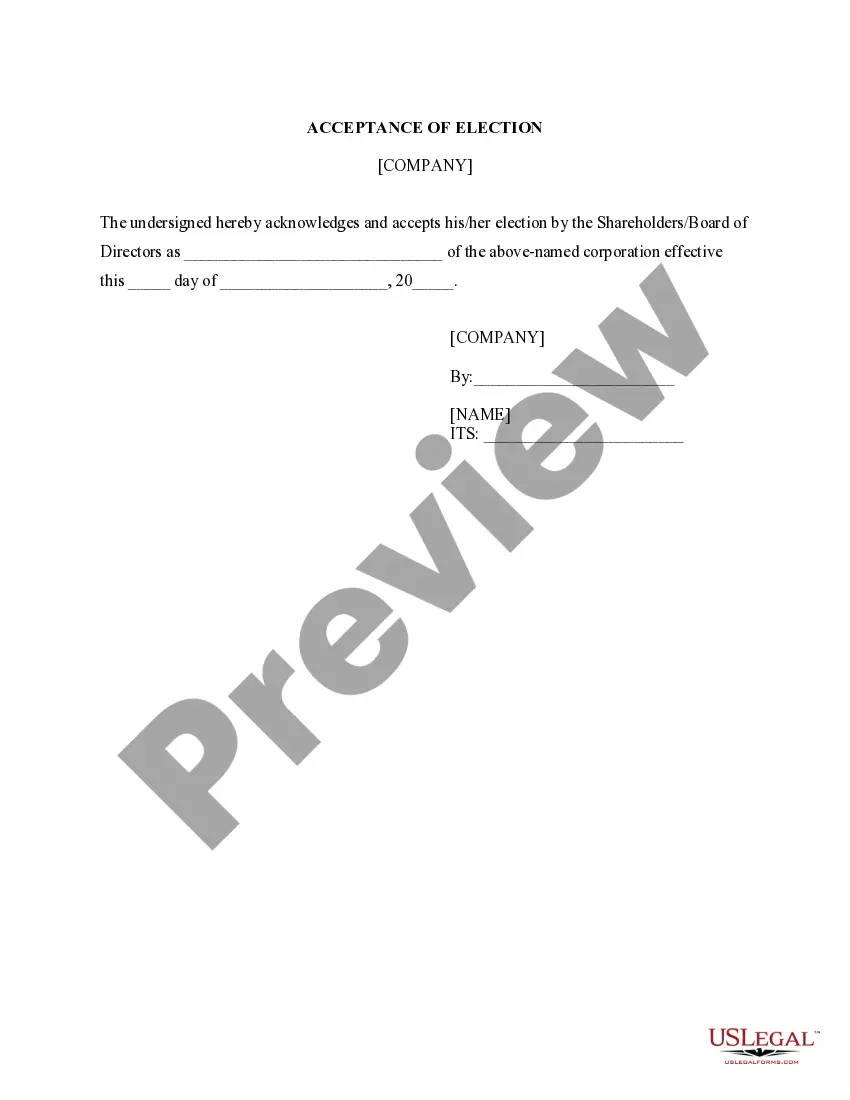

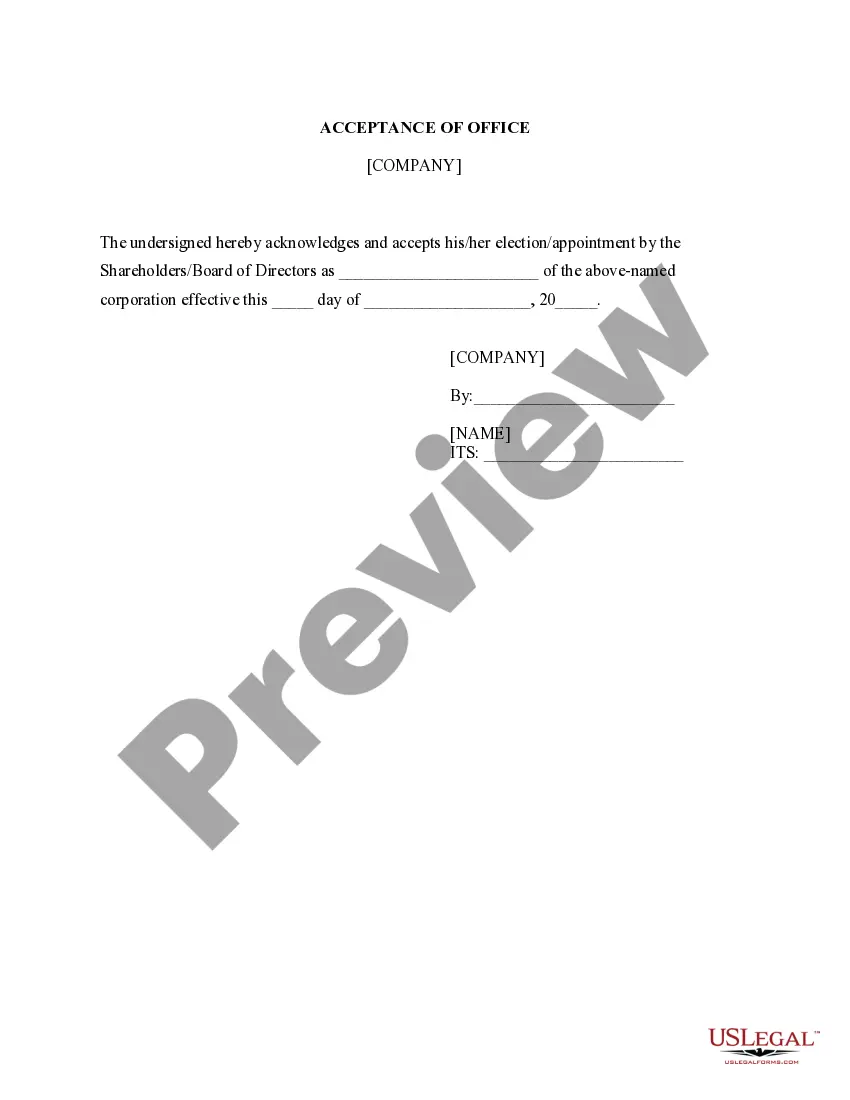

How to fill out Application For Release Of Right To Redeem Property From IRS After Foreclosure?

You can dedicate multiple hours online trying to find the proper legal document template that satisfies the federal and state requirements you have. US Legal Forms provides a wide array of legal forms that can be examined by experts.

You have the option to download or print the Arkansas Application for Release of Right to Redeem Property from IRS After Foreclosure from my service.

If you already have a US Legal Forms account, you can sign in and click the Download button. After that, you can fill out, modify, print, or sign the Arkansas Application for Release of Right to Redeem Property from IRS After Foreclosure. Every legal document template you purchase becomes your property indefinitely. To obtain another copy of any acquired form, visit the My documents section and click the corresponding button.

Select the format of your document and download it to your device. Make edits to your document if necessary. You can fill out, modify, sign, and print the Arkansas Application for Release of Right to Redeem Property from IRS After Foreclosure. Download and print numerous document templates using the US Legal Forms website, which offers the largest selection of legal forms. Use professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple steps outlined below.

- First, ensure you have selected the correct document template for your county/city of choice. Review the document details to confirm you have chosen the right form.

- If available, utilize the Preview button to review the document template as well.

- If you wish to find another version of your form, use the Search section to locate the template that fits your needs and requirements.

- Once you have found the template you want, click Get now to proceed.

- Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal document.

Form popularity

FAQ

In Arkansas, the redemption period is generally one year following a foreclosure sale. During this time, the original property owner can reclaim their property by paying the outstanding debt, including any accrued interest. For individuals considering the Arkansas Application for Release of Right to Redeem Property from IRS After Foreclosure, being aware of this timeframe is vital. This knowledge enables you to act promptly and protect your property rights.

The right to redeem property after a foreclosure allows the original owner to recover their property by paying off the total amount owed. This right is typically available for a limited time following the foreclosure sale, varying by state. For those involved in the Arkansas Application for Release of Right to Redeem Property from IRS After Foreclosure, understanding this right is crucial. It provides an opportunity to regain ownership and stabilize one’s financial situation.

The IRS right to redeem foreclosure means that the IRS can reclaim a property after foreclosure if the taxpayer pays the amount owed, including interest and penalties. This right is crucial for taxpayers to understand, especially when dealing with the Arkansas Application for Release of Right to Redeem Property from IRS After Foreclosure. By knowing this information, taxpayers can better navigate their financial obligations and make strategic decisions regarding their property.

The IRS right of redemption allows property owners to reclaim their property after a foreclosure by paying off the outstanding debt. This right is often limited to a specific period, which varies by state. In Arkansas, understanding this right is essential for individuals looking at the Arkansas Application for Release of Right to Redeem Property from IRS After Foreclosure. Knowing your rights can help you make informed decisions and take timely actions.

Foreclosure redeemed refers to the process where a property owner pays off the amount owed to reclaim their property after a foreclosure sale. In some states, including Arkansas, this right allows the borrower a chance to recover their home within a specific time frame. When considering the Arkansas Application for Release of Right to Redeem Property from IRS After Foreclosure, it’s vital to understand your rights and the associated timelines. This knowledge can empower you to take the necessary steps to redeem your property.

To obtain a lien payoff from the IRS, you must request a payoff amount through Form 668(Y), which is specifically designed for this purpose. After submitting this form, the IRS will provide you with the exact amount needed to release the lien. This process is essential when you are preparing for the Arkansas Application for Release of Right to Redeem Property from IRS After Foreclosure. Ensure you follow all instructions carefully to avoid delays.

The IRS 7 year rule refers to the period during which a taxpayer can face tax consequences from a foreclosure or short sale. After this period, the IRS typically cannot collect on tax debts related to forgiven mortgage amounts. For those considering an Arkansas Application for Release of Right to Redeem Property from IRS After Foreclosure, understanding this rule is crucial. This knowledge helps in planning for potential tax impacts after a foreclosure.