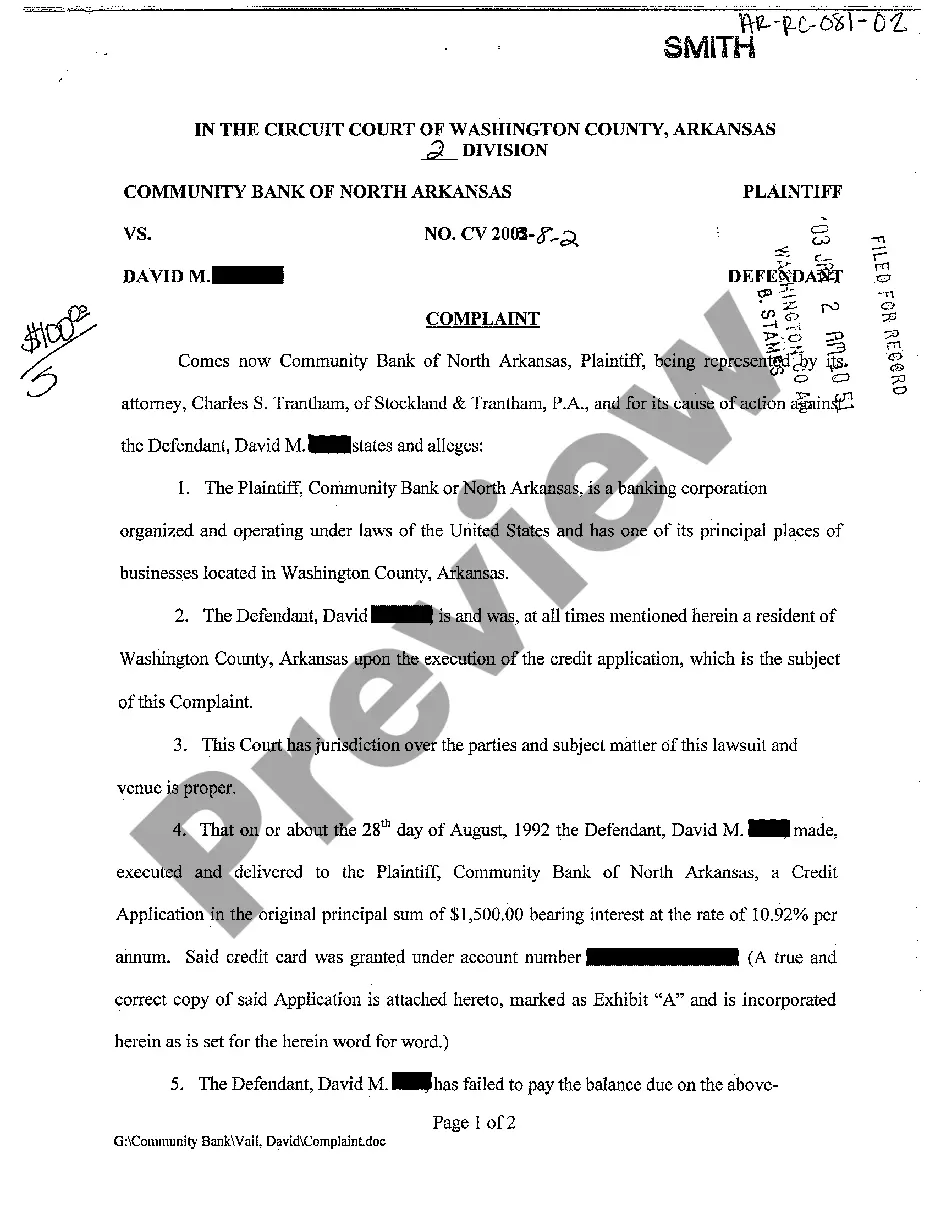

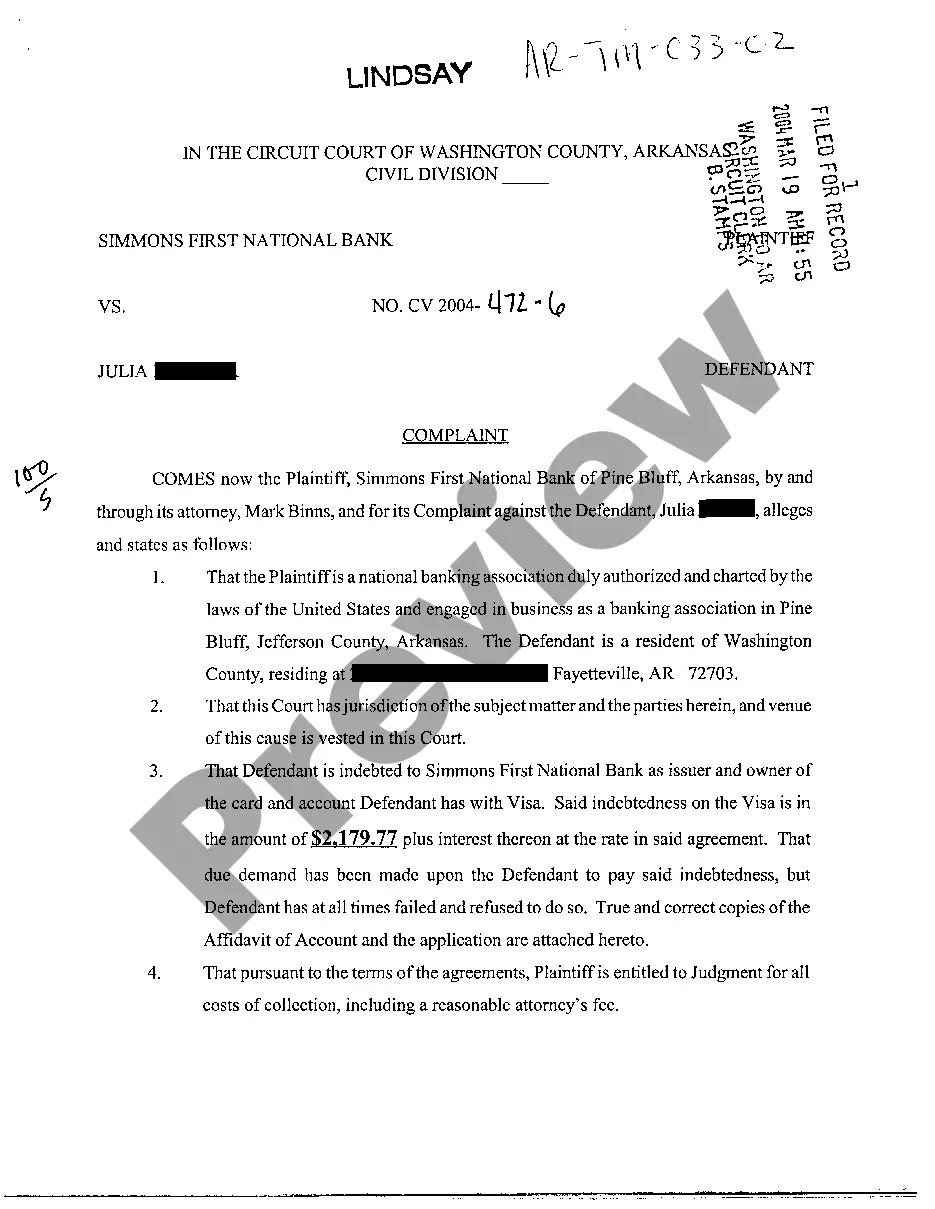

Arkansas Complaint for Collection of Debt on an Open Account

Description

How to fill out Arkansas Complaint For Collection Of Debt On An Open Account?

Among numerous no-cost and paid templates that you can find online, you cannot be assured of their precision.

For instance, who developed them or if they possess the necessary qualifications to handle what you need them for.

Stay composed and take advantage of US Legal Forms!

If you are using our service for the first time, follow the guidelines below to obtain your Arkansas Complaint for Collection of Debt on an Open Account quickly: Ensure that the document you find is applicable in the state where you reside. Review the template by examining the details provided in the Preview feature. Click Buy Now to begin the purchasing process or search for another template using the Search box located in the header. Select a pricing plan and register for an account. Complete the payment for the subscription via your credit/debit card or Paypal. Download the form in your desired format. Once you have registered and paid for your subscription, you can utilize your Arkansas Complaint for Collection of Debt on an Open Account as many times as you wish or for as long as it remains valid in your state. Modify it in your preferred offline or online editor, fill it out, sign it, and print it. Achieve more for less with US Legal Forms!

- Locate Arkansas Complaint for Collection of Debt on an Open Account examples prepared by expert attorneys.

- and evade the expensive and time-consuming process of searching for a lawyer.

- and then compensating them to create a document for you that you can easily obtain by yourself.

- If you already possess a subscription, Log In to your account.

- and find the Download button next to the document you’re looking for.

- You will also have access to all your previously saved documents in the My documents section.

Form popularity

FAQ

The worst a debt collector can do generally includes harassing you, contacting your employer, or threatening legal action without intent to follow through. While they have the right to pursue debts, they must adhere to the Fair Debt Collection Practices Act. If you feel overwhelmed, platforms like USLegalForms offer resources to help you respond to an Arkansas Complaint for Collection of Debt on an Open Account.

The statute of limitations in Arkansas varies depending on the type of debt. For written contracts and open accounts, it is three years. Familiarizing yourself with this law can help you effectively address an Arkansas Complaint for Collection of Debt on an Open Account.

In Arkansas, a debt becomes uncollectible after three years, as defined by the statute of limitations. After this period, debt collectors can no longer file a lawsuit against you for the debt. Understanding this timeline helps you know your rights when facing an Arkansas Complaint for Collection of Debt on an Open Account.

In Arkansas, a debt collector can legally pursue old debt for up to three years. This timeframe applies specifically to certain types of debts, such as open accounts or installment contracts. Knowing this period is vital if you plan to respond to an Arkansas Complaint for Collection of Debt on an Open Account.

Yes, a debt collector can restart the clock on your old debt if you make a payment or acknowledge the debt in writing. This action can allow them to pursue an Arkansas Complaint for Collection of Debt on an Open Account. Therefore, it is crucial to understand your rights and the implications of any communication you have with debt collectors.

Outsmarting a debt collector involves knowing your rights and staying informed about the debt collection process. With knowledge of how the Arkansas Complaint for Collection of Debt on an Open Account works, you can negotiate more effectively. Use strategies like requesting validation of the debt and keeping detailed records of all your communications. Additionally, consider using resources from uslegalforms, which provide tools to strengthen your case and empower you in negotiations.

If you want to stop debt collectors, you can request that they cease communication. Mention the Arkansas Complaint for Collection of Debt on an Open Account if it is linked to your situation, and emphasize your intent to resolve the matter responsibly. You should also consider sending a formal cease and desist letter through platforms like uslegalforms, which offers templates for your specific needs. This can give you peace of mind by ensuring that you take the right steps.

While the 11-word phrase specifically applies to India, the principle remains relevant in other contexts. Informing debt collectors that you are familiar with your rights can help you manage the Arkansas Complaint for Collection of Debt on an Open Account. This statement serves as a reminder to collectors that you understand regulations regarding communication and collections. You can craft your reply firmly yet politely to assert your position.

When speaking with debt collectors, it’s crucial to stay calm and collected. You should clearly state your dispute about the Arkansas Complaint for Collection of Debt on an Open Account if applicable. Avoid providing personal information that could lead to identity theft, and do not admit liability for the debt unless you are certain it is valid. Remember, staying assertive yet respectful can help you manage the conversation effectively.

A collection account may remain listed as open depending on the creditor's reporting methods and whether the debt is contested or unresolved. An open status indicates the creditor still tries to recover the unpaid balance. This can affect your credit score significantly, making it necessary to address the matter promptly. If you find yourself facing such a situation, utilizing the Arkansas Complaint for Collection of Debt on an Open Account can assist you in navigating the complexities of your debt.