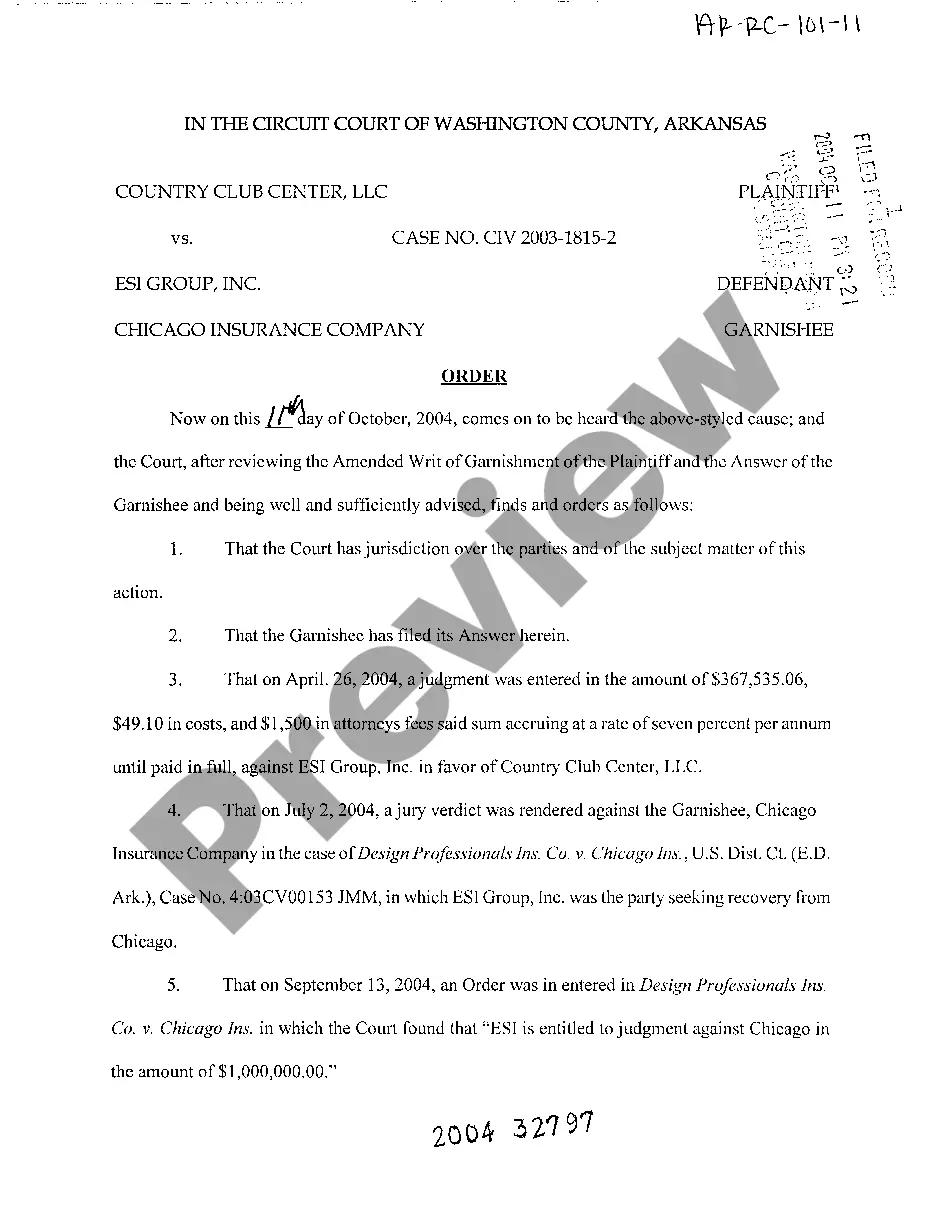

Arkansas Amended Writ of Garnishment

Description

How to fill out Arkansas Amended Writ Of Garnishment?

Among countless paid and free templates available on the internet, you cannot guarantee their precision and dependability.

For instance, who designed them or if they possess the necessary expertise to handle the matters you require assistance with.

Stay composed and utilize US Legal Forms!

Click Buy Now to initiate the purchasing process or locate another example through the Search bar in the header. Choose a payment plan, register for an account, pay for the subscription using your credit/debit card or PayPal, and download the form in your preferred format. Once subscribed and purchased, you can use your Arkansas Amended Writ of Garnishment as often as necessary or until your subscription remains active in your state. Modify it with your preferred online or offline editor, complete it, sign it, and generate a printed copy. Accomplish more for less with US Legal Forms!

- Obtain Arkansas Amended Writ of Garnishment templates crafted by experienced lawyers and avoid the expensive and lengthy process of searching for a lawyer only to pay them to draft documents you can easily obtain yourself.

- If you already hold a subscription, Log In to your account and locate the Download button next to the document you need.

- You will also gain access to all of your previously obtained documents in the My documents section.

- If you are utilizing our platform for the first time, follow the steps outlined below to obtain your Arkansas Amended Writ of Garnishment quickly.

- Ensure that the template you find is valid in your residing state.

- Review the template by checking the description using the Preview feature.

Form popularity

FAQ

To file an exemption for wage garnishment in Arkansas, you need to submit a notice of exemption to the court. This notice must explain your financial situation and why you believe the garnishment is unjust. Resources like UsLegalForms provide templates that can simplify this process, ensuring your exemption request is clear and complies with Arkansas laws, particularly concerning an Arkansas Amended Writ of Garnishment.

In Arkansas, the maximum amount that can be garnished from your paycheck is typically 25% of your disposable earnings or a lesser amount based on state and federal limits. This helps ensure you maintain a portion of your income to cover living expenses. If you're struggling with an Arkansas Amended Writ of Garnishment, knowing your rights regarding paycheck garnishment can empower you to make informed choices.

Garnishment laws in Arkansas allow creditors to collect debts directly from a debtor’s wages or bank accounts. These laws outline the procedures creditors must follow and provide protections for debtors, including limits on how much can be garnished. Familiarizing yourself with these laws, especially regarding the Arkansas Amended Writ of Garnishment, can help you navigate your financial obligations more effectively.

The new law for theft of property in Arkansas includes stricter penalties for individuals convicted of theft offenses. These changes focus on increasing fines and potential jail time, depending on the value of the stolen property. If you're involved in any legal complications, such as an Arkansas Amended Writ of Garnishment stemming from theft accusations, staying informed about these changes is essential.

The removal of disabilities of minority in Arkansas allows individuals who are 18 years or older to engage in contracts and take legal actions as adults. This process is vital for those who may have been protected under guardianship laws. If you seek to address issues surrounding the Arkansas Amended Writ of Garnishment, understanding this concept can be crucial for your rights and responsibilities.

To stop a writ of garnishment in Arkansas, you may file a motion with the court. This motion should detail your reasons for stopping the garnishment, such as financial hardship or errors in the writ process. Utilizing legal resources, like UsLegalForms, can provide templates and guidance to ensure your motion meets all necessary criteria under Arkansas law.

In Arkansas, the penalty for contempt of court can vary based on the nature of the contempt. Generally, a person may face fines or even jail time if they fail to comply with a court order. For instance, if an individual ignores a court order related to an Arkansas Amended Writ of Garnishment, this may lead to significant legal consequences. Understanding these penalties can help you avoid complications.

Stopping a writ of garnishment in Arkansas requires you to file a motion with the court that issued the writ. You can present your reasons for stopping the garnishment, such as a payment agreement or a change in financial circumstances. Seeking assistance from platforms like USLegalForms can guide you through this process effectively.

To amend a garnishment in Arkansas, you need to file the appropriate documents with the court that issued the original writ. This process involves drafting an Arkansas Amended Writ of Garnishment, which should include the updated information you wish to change. It is wise to consult with a legal professional or use legal forms to ensure compliance with court requirements.

In Arkansas, the statute of limitations for enforcing a judgment is generally ten years. This period begins from the date the judgment is entered. If necessary, you can file for an Arkansas Amended Writ of Garnishment within this timeframe to collect on an unpaid judgment. It’s important to track your deadlines to ensure enforcement.