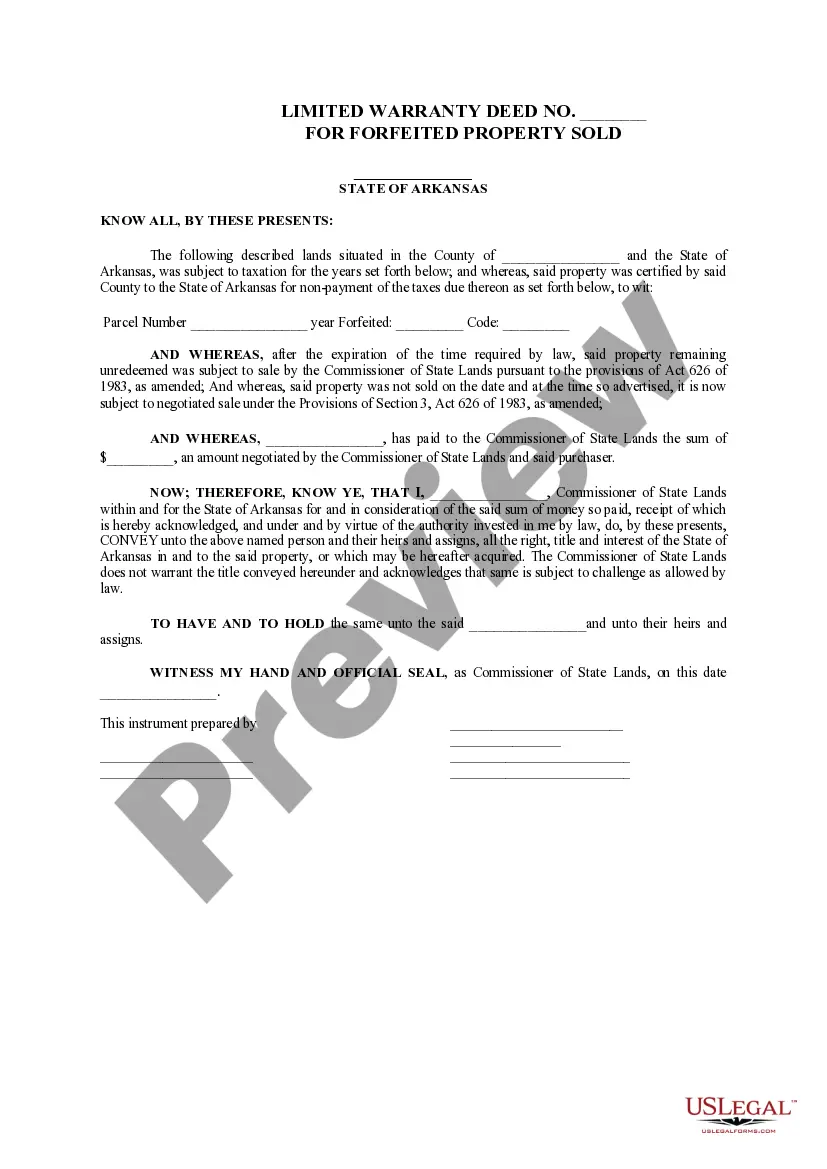

Arkansas Limited Warranty Deed For Forfeited Property Sold

Description

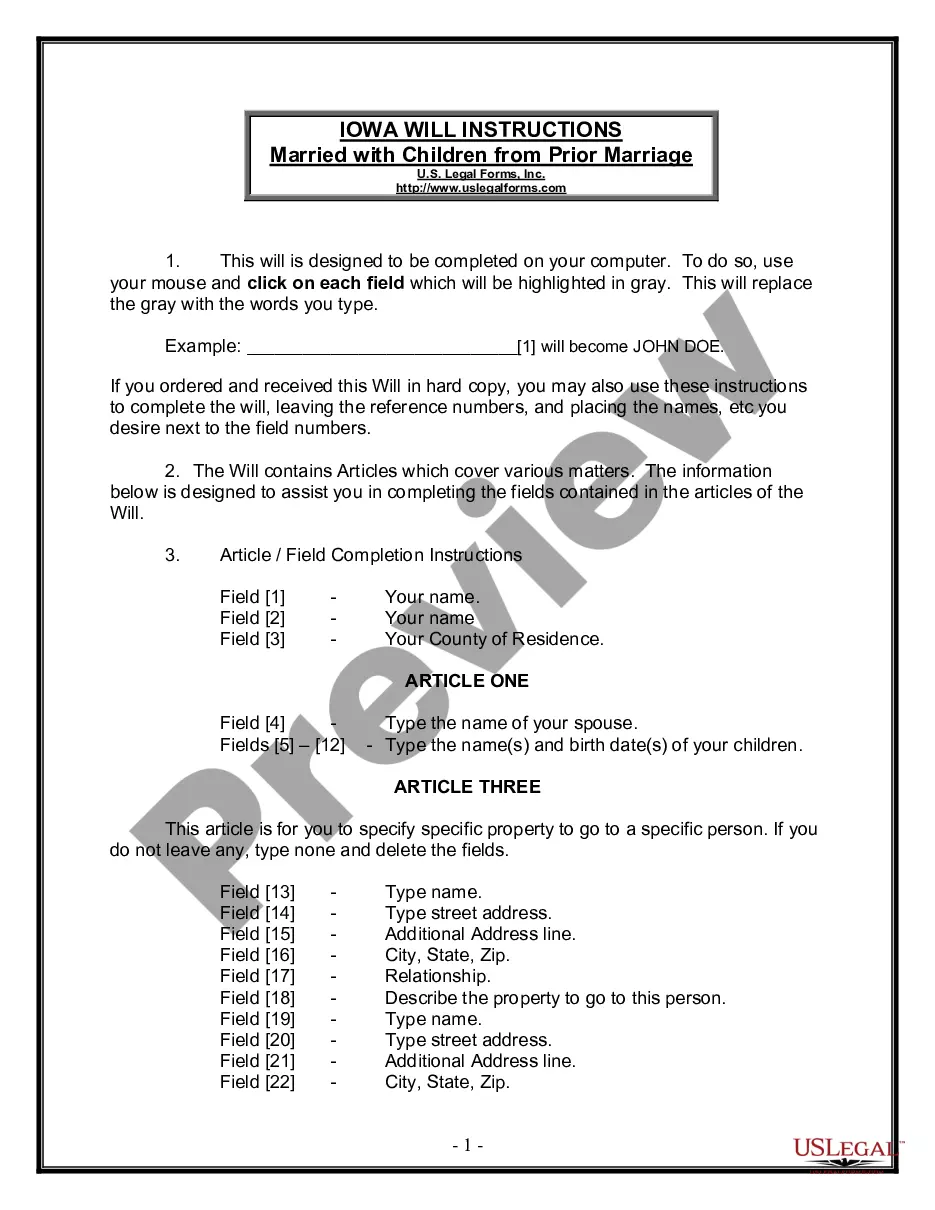

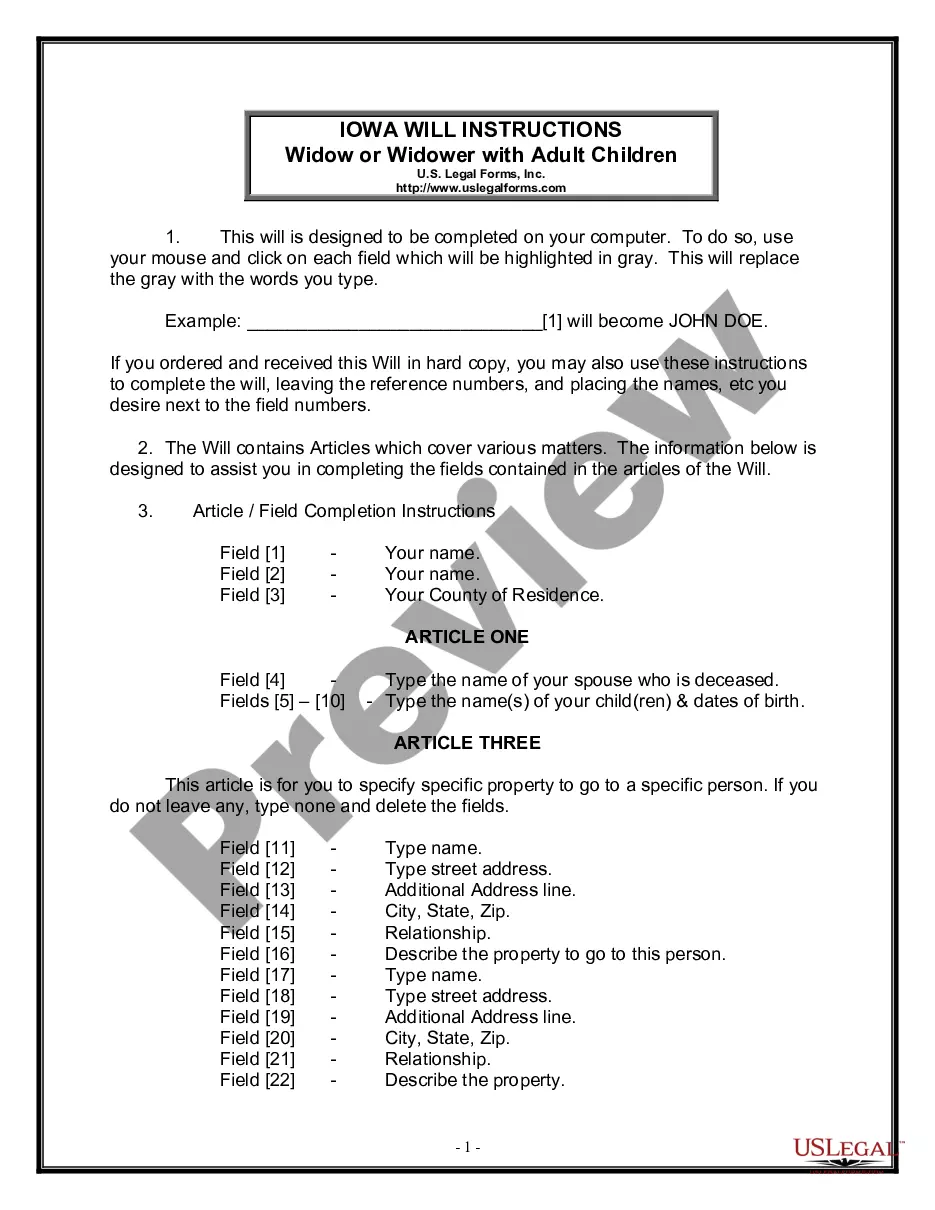

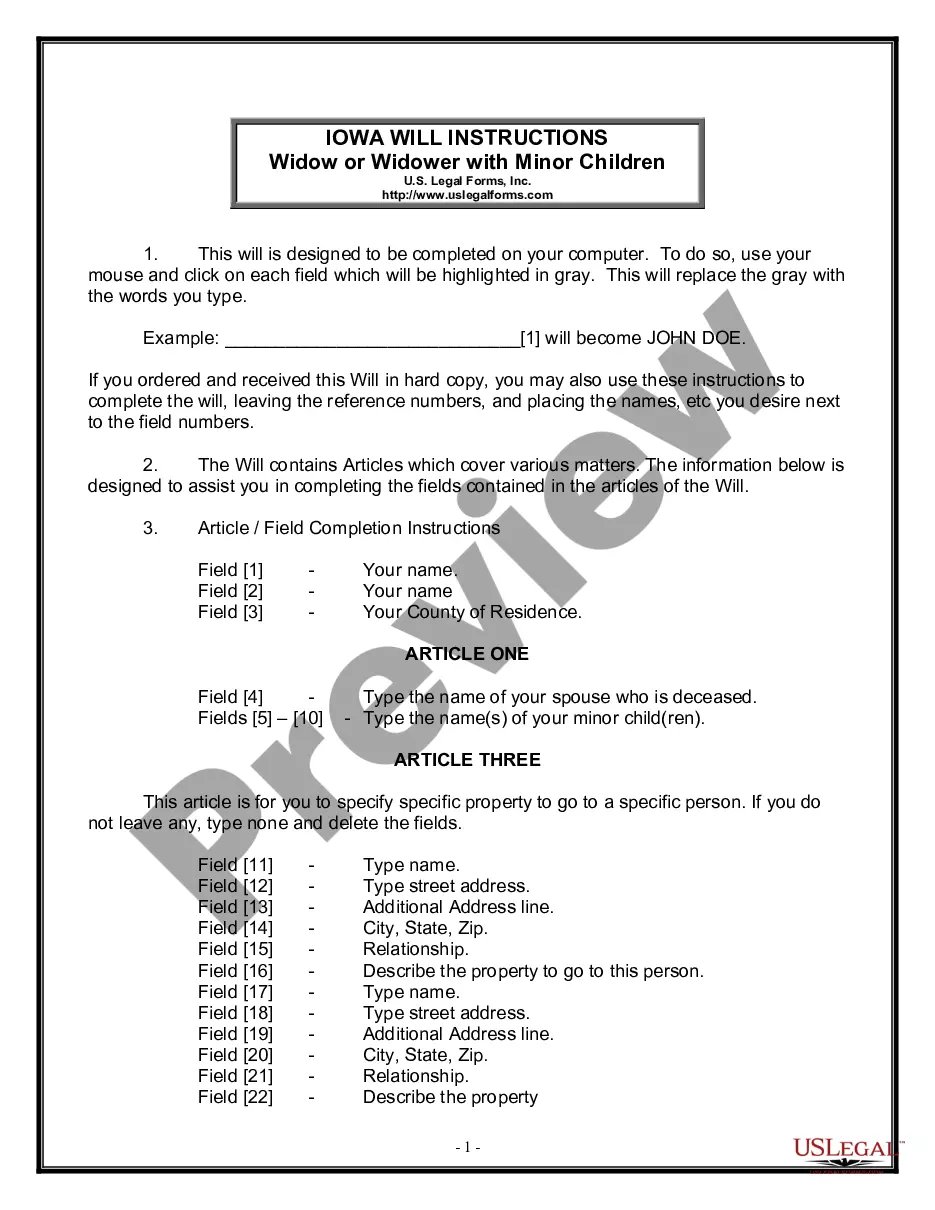

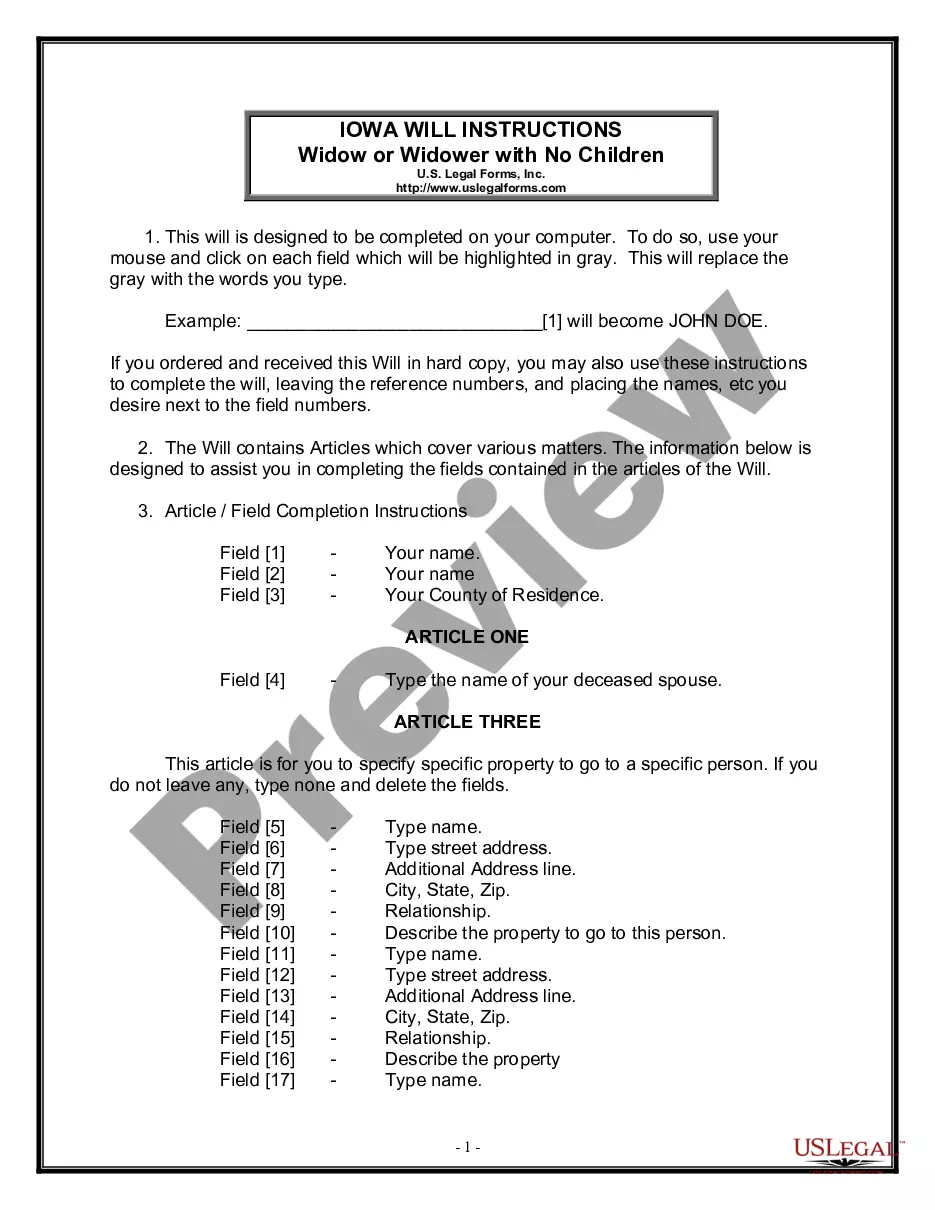

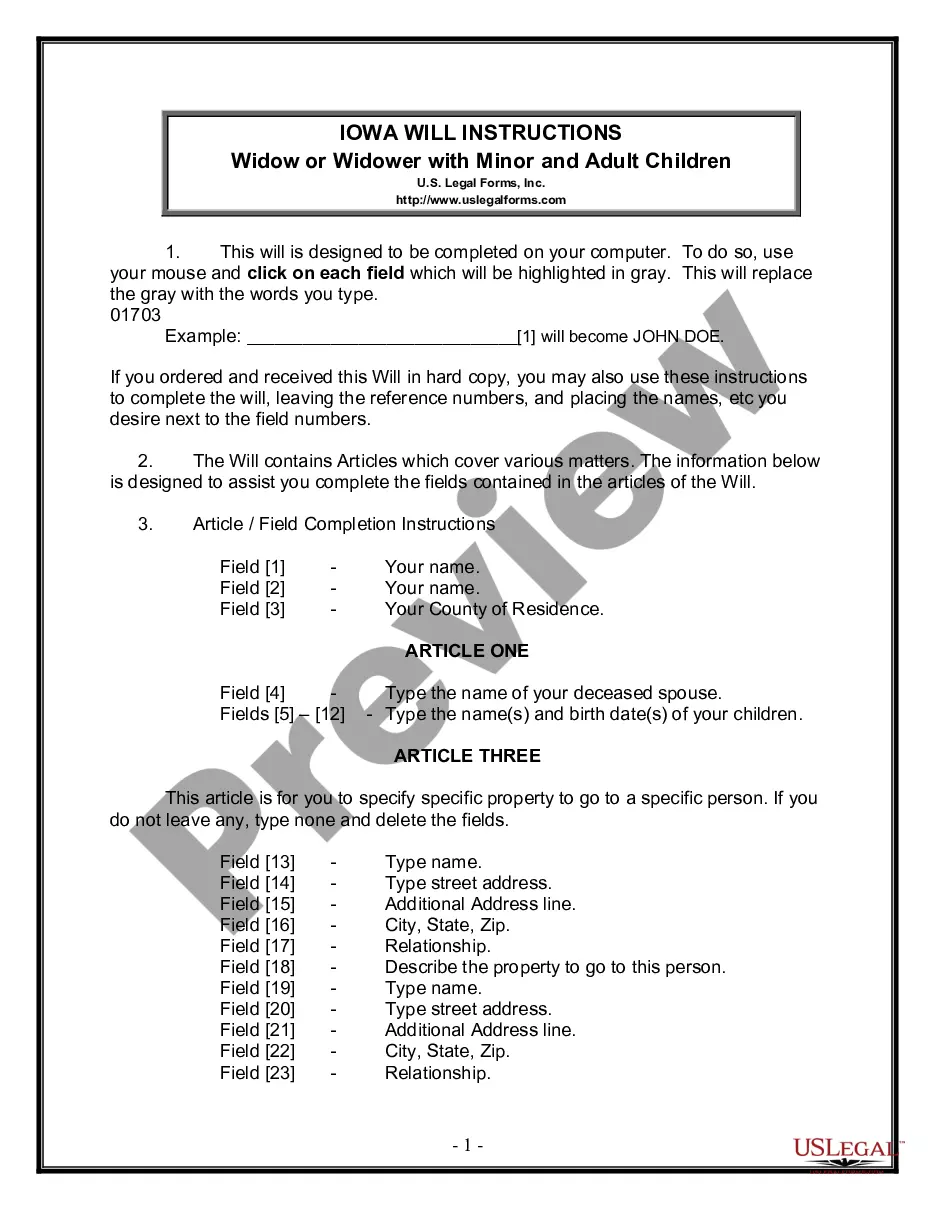

How to fill out Arkansas Limited Warranty Deed For Forfeited Property Sold?

Utilizing Arkansas Limited Warranty Deed For Forfeited Property Sold examples crafted by skilled attorneys allows you to sidestep complications when completing paperwork.

Simply download the template from our site, fill it in, and request a legal expert to review it.

It will save you significantly more time and expenses than seeking a lawyer to create a document from the ground up for you would.

Remember to review all entered details for accuracy before sending it or mailing it out. Minimize the time spent on document creation with US Legal Forms!

- If you’ve previously purchased a US Legal Forms subscription, just Log In to your account and revisit the sample webpage.

- Locate the Download button next to the documents you are examining.

- After you download a document, you can access your saved templates in the My documents section.

- If you do not have a subscription, that's not a huge issue.

- Simply follow the steps below to register for an account online, obtain, and complete your Arkansas Limited Warranty Deed For Forfeited Property Sold template.

- Ensure you are downloading the correct state-specific form.

Form popularity

FAQ

Paying property taxes is a crucial element of maintaining ownership in Arkansas. While regular payments can solidify your claim, they are not the sole determinant of ownership. An Arkansas Limited Warranty Deed for Forfeited Property Sold emphasizes the importance of staying up to date with your tax obligations. If you are unsure about your status or need assistance navigating the deed process, consider using platforms like US Legal Forms for guidance.

In Arkansas, property owners can be delinquent on property taxes for several years, but after a specific period, the state can auction the property for unpaid taxes. Typically, once you’ve missed multiple payments, the risk of an Arkansas Limited Warranty Deed for Forfeited Property Sold arises. It’s wise to address delinquency as soon as possible to avoid complications. Regularly check your tax status to stay informed and maintain ownership.

Yes, Arkansas does have a redemption period. Typically, property owners have a window of 2 years to redeem their property after a tax sale. Understanding this period is crucial, especially if you're looking to recover a property associated with an Arkansas Limited Warranty Deed for Forfeited Property Sold. Failing to redeem within this time can result in losing ownership, so be vigilant.

The primary difference between a warranty deed and a quitclaim deed in Arkansas is the level of protection provided to the grantee. A warranty deed guarantees that the grantor holds clear title and is responsible for any claims against it. In contrast, a quitclaim deed transfers ownership without warranty, meaning you take the property 'as is.' Understanding these differences is essential when considering an Arkansas Limited Warranty Deed for Forfeited Property Sold.

To validly create a warranty deed in Arkansas, it must contain the names of the grantor and grantee, a legal description of the property, and the grantor's signature. Additionally, the deed must be notarized and filed with the appropriate county office. Ensuring compliance with these requirements is crucial, especially when dealing with Arkansas Limited Warranty Deed for Forfeited Property Sold.

A limited warranty deed in Arkansas guarantees that the grantor holds title to the property and has the right to convey it. However, it only covers claims that arose during the grantor's ownership, offering limited protection to the grantee. This type of deed is often relevant when dealing with Arkansas Limited Warranty Deed for Forfeited Property Sold.

To obtain a warranty deed in Arkansas, you need to draft the deed and ensure it meets the state’s legal requirements. After completing the document, you must sign it and notarize it before filing it with the county clerk’s office. An Arkansas Limited Warranty Deed for Forfeited Property Sold can also be easily acquired using reputable legal platforms like USLegalForms.

The process of obtaining a land deed in Arkansas can vary, typically taking anywhere from a few weeks to several months. Factors like county processing times and the complexity of the deed can influence the duration. To expedite the process, it helps to work with professionals who are familiar with the Arkansas Limited Warranty Deed for Forfeited Property Sold.

In Arkansas, if a property is not redeemed during the two-year redemption period, it becomes forfeited to the state. The owner loses all rights to the property, and it may be sold at a tax sale. This sale often involves obtaining an Arkansas Limited Warranty Deed for Forfeited Property Sold, which provides new ownership while ensuring the new owner has limited liability for previous claims.

Tax deed states include Arkansas, alongside others like Florida and Georgia. Each state has different rules and processes governing tax deeds. If you wish to explore the Arkansas Limited Warranty Deed For Forfeited Property Sold, understanding the broader context of tax deed states can be beneficial. This knowledge can improve your investment strategy in tax-related real estate transactions.