Alabama Affidavit of Heirship for Motor Vehicle

Description

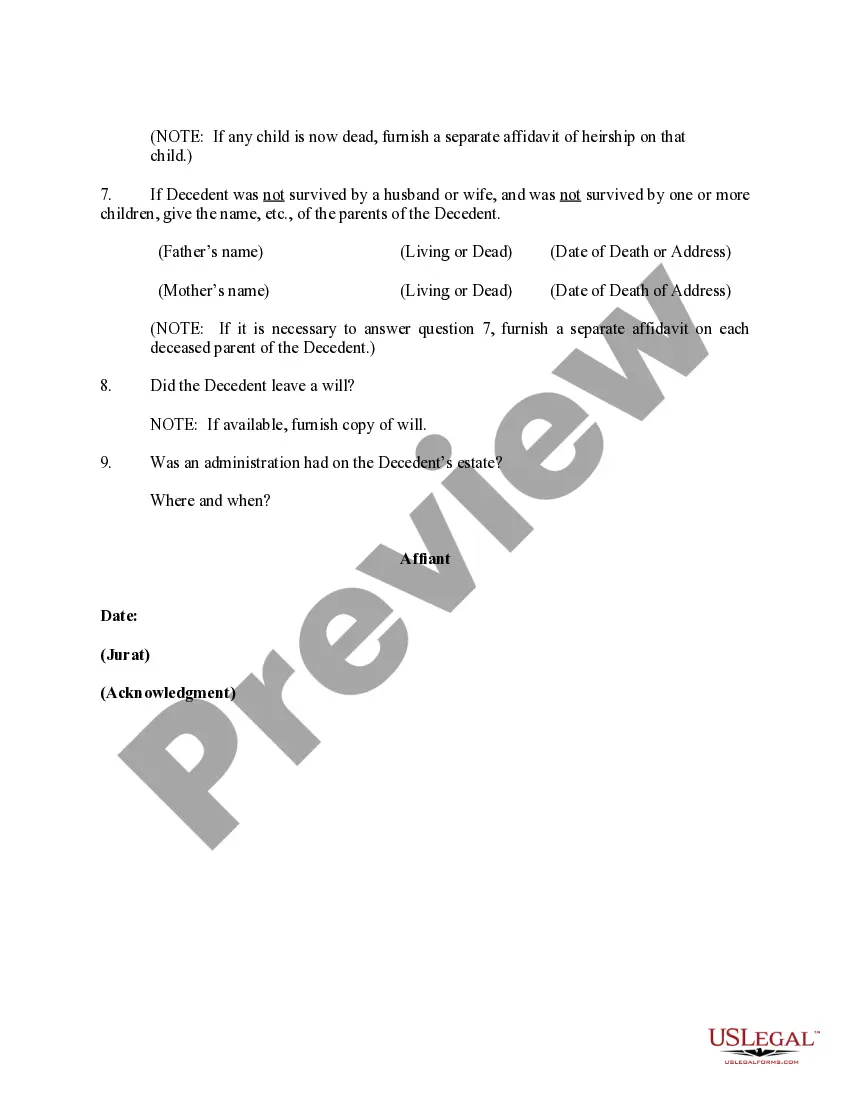

How to fill out Affidavit Of Heirship For Motor Vehicle?

You may spend time on the web attempting to find the legal file design that meets the federal and state demands you want. US Legal Forms gives a large number of legal types that are analyzed by experts. It is simple to obtain or print the Alabama Affidavit of Heirship for Motor Vehicle from our services.

If you have a US Legal Forms accounts, it is possible to log in and then click the Acquire option. Afterward, it is possible to comprehensive, change, print, or sign the Alabama Affidavit of Heirship for Motor Vehicle. Every single legal file design you acquire is your own property eternally. To get an additional copy associated with a acquired develop, go to the My Forms tab and then click the corresponding option.

Should you use the US Legal Forms website the very first time, adhere to the simple recommendations beneath:

- Initial, be sure that you have selected the best file design for your state/city of your choosing. See the develop information to ensure you have chosen the appropriate develop. If readily available, utilize the Review option to appear from the file design at the same time.

- If you wish to locate an additional model in the develop, utilize the Research area to find the design that meets your needs and demands.

- After you have discovered the design you need, simply click Get now to move forward.

- Choose the rates program you need, key in your references, and sign up for an account on US Legal Forms.

- Total the financial transaction. You can utilize your Visa or Mastercard or PayPal accounts to fund the legal develop.

- Choose the format in the file and obtain it to your product.

- Make modifications to your file if required. You may comprehensive, change and sign and print Alabama Affidavit of Heirship for Motor Vehicle.

Acquire and print a large number of file templates using the US Legal Forms website, which provides the most important selection of legal types. Use expert and state-particular templates to handle your organization or specific requirements.

Form popularity

FAQ

An Affidavit of Heirship is a legal document used to establish the heirs of a deceased person and their respective interests in the deceased person's estate when the deceased person dies without a will (intestate) or when there are uncertainties about the heirs and their inheritance rights.

Children and their descendants; Parents; Brothers and sisters, or, if all are deceased, nieces and nephews; Grandparents, aunts, and uncles or, if all are deceased, to their descendants; and.

Instead of a small estate affidavit, Alabama allows for distribution of small estates through an abbreviated estate process known as summary distribution. To qualify for summary distribution, the estate must meet the criteria of a ?small estate? as defined by the statute.

Bring the Application and the original title to the County Office where the new owner resides along with: Proof of Alabama auto insurance. Driver's license of the new owner. Proof of residency. Payment for fees and applicable taxes.

Step 1: ? Verify that the estate is eligible. This will include identifying and valuing all of the decedent's property to make sure it falls below the state maximum. ... Step 2 ? Contact all the Heirs. ... Step 3 ? Settle any remaining obligations. ... Step 4 ? Fill out, sign, and file the affidavit form.

If transfer involves a deceased owner and owner's estate has not and will not be probated, then the individual signing on behalf of deceased owner's estate must provide a Next of Kin Affidavit (MVT 5-6) and a copy of the deceased owner's death certificate. See Administrative Rule: 810-5-75-.

In Alabama, there are several instances where an estate will almost certainly have to be probated. But the process may be avoided if: The value of an estate is under the small estate threshold (see below) There is a Living Trust present.