Alabama Affidavit As to Termination of Production Payment

Description

How to fill out Affidavit As To Termination Of Production Payment?

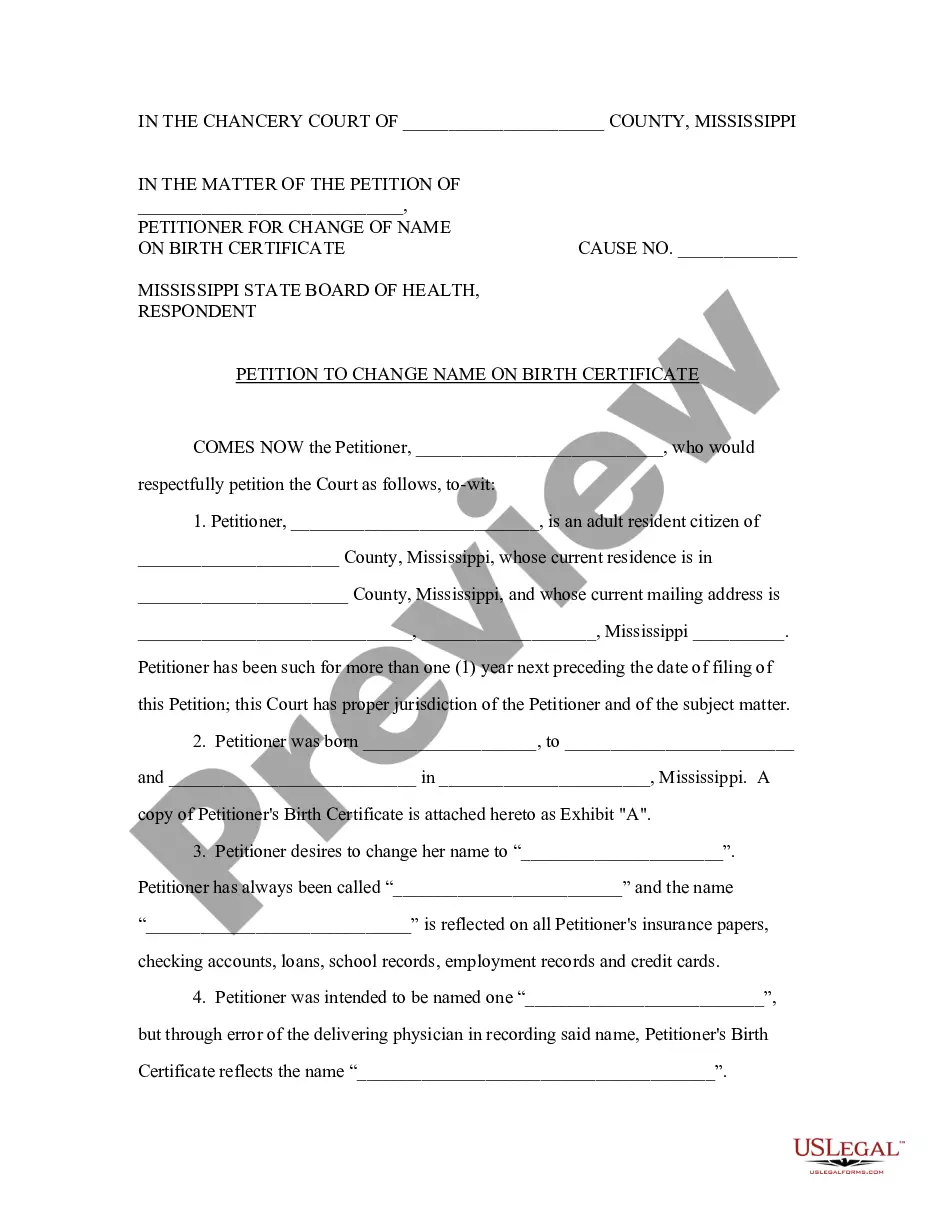

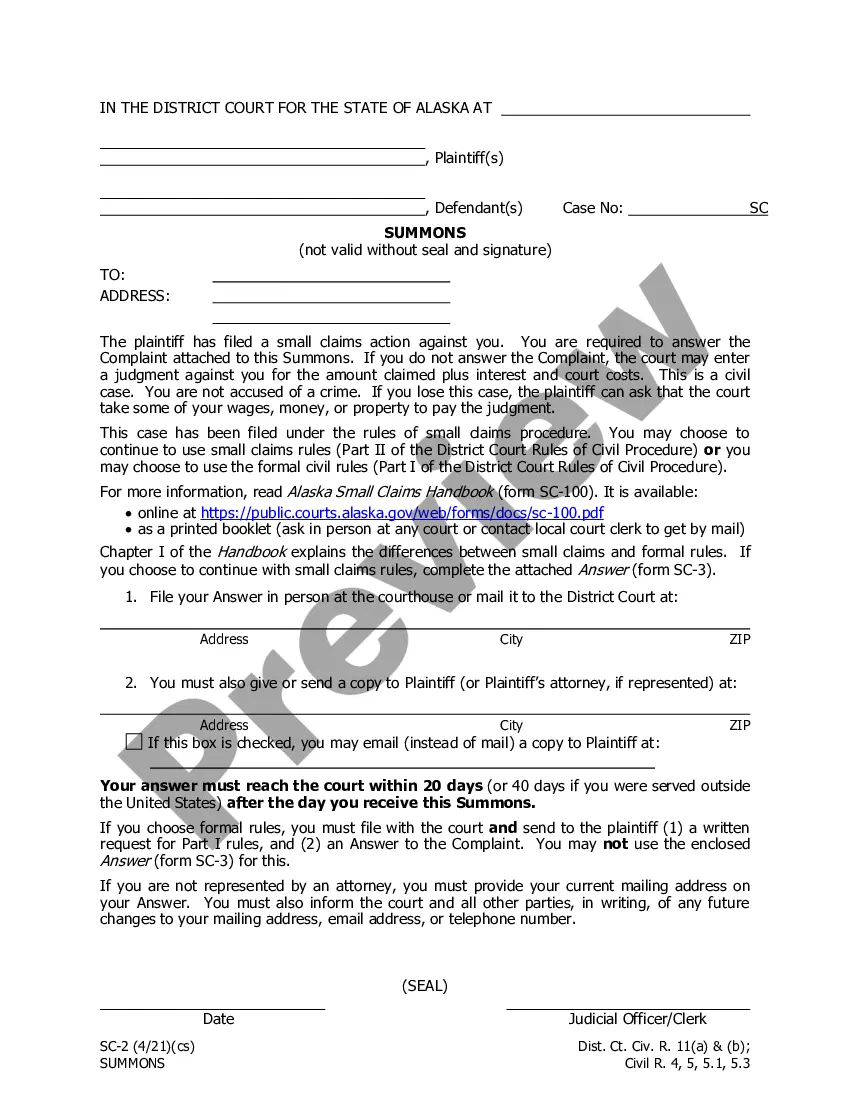

It is possible to spend time on-line attempting to find the legitimate file design that suits the state and federal requirements you will need. US Legal Forms supplies 1000s of legitimate forms which can be evaluated by specialists. It is simple to acquire or printing the Alabama Affidavit As to Termination of Production Payment from my services.

If you already have a US Legal Forms accounts, you are able to log in and click on the Download switch. Next, you are able to full, change, printing, or indication the Alabama Affidavit As to Termination of Production Payment. Each legitimate file design you purchase is the one you have for a long time. To acquire another backup for any purchased kind, check out the My Forms tab and click on the related switch.

If you are using the US Legal Forms web site initially, stick to the simple recommendations beneath:

- Very first, make certain you have chosen the correct file design for your state/metropolis of your choosing. Browse the kind information to ensure you have selected the appropriate kind. If offered, use the Review switch to appear from the file design as well.

- If you would like locate another version from the kind, use the Look for industry to obtain the design that meets your requirements and requirements.

- Once you have found the design you want, click Purchase now to carry on.

- Find the rates program you want, key in your qualifications, and sign up for a free account on US Legal Forms.

- Full the financial transaction. You can utilize your credit card or PayPal accounts to purchase the legitimate kind.

- Find the format from the file and acquire it to the device.

- Make alterations to the file if possible. It is possible to full, change and indication and printing Alabama Affidavit As to Termination of Production Payment.

Download and printing 1000s of file themes utilizing the US Legal Forms web site, that offers the biggest assortment of legitimate forms. Use skilled and status-certain themes to tackle your organization or specific requires.

Form popularity

FAQ

Alabama Form 40 is used by full-year and part-year residents to file their state income tax return. The purpose of Form 40 is to calculate how much income tax you owe the state. Nonresident filers will complete Alabama Form 40NR. Taxpayers with simple returns have the option to use Form 40A (Short Form).

Withholding Requirement on Sales/Transfers of Real Property & Tangible Personal Property by Nonresidents. Section 40-18-86, Code of Alabama 1975, provides for income tax withholding at a rate of 3% or 4% on sales or transfers of real property and associated tangible personal property by nonresidents of Alabama.

Alabama residents should file a Resident Individual Income Tax Return, Form 40 or 40A, each year. If I am not a resident of Alabama, but earned income from Alabama sources, am I required to file an Alabama tax return? Yes.

A dependent or student may claim a personal exemption even if claimed by someone else. Taxpayers using the Single and Married Filing Separately filing statuses are entitled to a $1,500 personal exemption.

You MUST Use Form 40NR If: You are not a resident of Alabama and you received taxable income from Alabama sources or for performing services within Alabama and your gross income from Alabama sources exceeds the allowable prorated personal exemption. Nonresidents must prorate the personal exemption.

Yes, a partnership, or other entity classified as a Subchapter K entity, is required to file a composite return and make composite payments on behalf of its nonresident owners or members if there are one or more nonresident owners or members at any time during the taxable year.

Nonresidents must file a return if their Alabama income exceeds the allowable prorated personal exemption. Part year residents whose filing status is ?Single? must file if gross income for the year is at least $4,000 while an Alabama resident.