Alabama Notice of Claim of Breach of Oil, Gas, and Mineral Lease by the original Lessor's Successor

Description

How to fill out Notice Of Claim Of Breach Of Oil, Gas, And Mineral Lease By The Original Lessor's Successor?

If you have to complete, acquire, or produce legitimate papers templates, use US Legal Forms, the largest assortment of legitimate varieties, which can be found online. Make use of the site`s simple and easy convenient lookup to get the paperwork you require. Different templates for business and personal reasons are categorized by groups and suggests, or search phrases. Use US Legal Forms to get the Alabama Notice of Claim of Breach of Oil, Gas, and Mineral Lease by the original Lessor's Successor in just a number of clicks.

When you are presently a US Legal Forms client, log in to your profile and click the Obtain switch to obtain the Alabama Notice of Claim of Breach of Oil, Gas, and Mineral Lease by the original Lessor's Successor. You may also accessibility varieties you earlier delivered electronically within the My Forms tab of the profile.

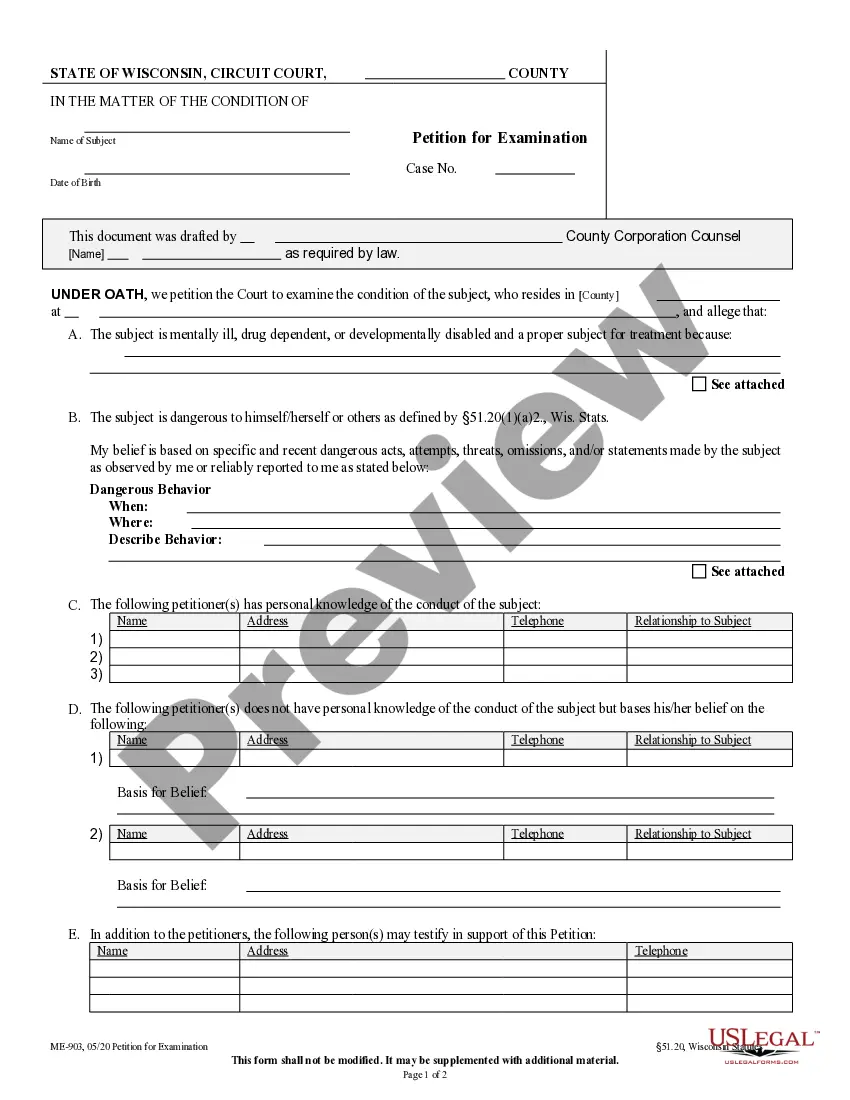

Should you use US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the shape to the appropriate town/land.

- Step 2. Make use of the Review option to look over the form`s information. Never neglect to read the description.

- Step 3. When you are unsatisfied with the develop, use the Research field on top of the display to find other variations in the legitimate develop design.

- Step 4. When you have discovered the shape you require, click the Acquire now switch. Select the pricing program you favor and add your references to sign up for the profile.

- Step 5. Process the financial transaction. You can utilize your credit card or PayPal profile to accomplish the financial transaction.

- Step 6. Pick the file format in the legitimate develop and acquire it on your own device.

- Step 7. Comprehensive, modify and produce or sign the Alabama Notice of Claim of Breach of Oil, Gas, and Mineral Lease by the original Lessor's Successor.

Each legitimate papers design you buy is your own property permanently. You possess acces to each and every develop you delivered electronically inside your acccount. Click the My Forms segment and pick a develop to produce or acquire yet again.

Be competitive and acquire, and produce the Alabama Notice of Claim of Breach of Oil, Gas, and Mineral Lease by the original Lessor's Successor with US Legal Forms. There are millions of professional and state-particular varieties you may use to your business or personal needs.

Form popularity

FAQ

Royalty Clause: The Lessor's only right to receive payments in addition to the Bonus Payment is through Royalties. Royalties are calculated as a percentage of the value of all minerals produced, typically 25%.

What is the granting clause? The granting clause is the clause under which the owner of the oil and gas rights leases the oil and gas rights to the oil and gas company along with the right to develop the oil and gas on a specifically described piece of real estate.

Implied Covenant to Develop the Lease: This implied covenant requires the Lessee to protect against drainage and typically arises when a neighbor's land is drilled and that lease could be draining oil out from under the leased land.

The right of governments to levy royalties from oil and gas companies derives from their ownership of natural resources. Through royalty payments, governments are compensated by oil and gas companies for the extraction of public natural resources.

Royalty Rates: The royalty agreement or rate is a percentage of total revenue gotten from the sale of oil and gas, and it's always outlined in the lease agreement. The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations.

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, ing to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.

Royalty Clause There are two types of royalties, a net and a gross royalty. Normally, the oil and gas lease contains a net royalty. If the lease provides for a net royalty, this means that post-production deductions will be taken from the royalty.

Under the Mineral Leasing Act as amended and the Mineral Leasing Act for Acquired Lands of 1947 as amended, coal leases are initially obtained for a 20-year period but can be terminated in 10 years if the resources are not sufficiently developed.