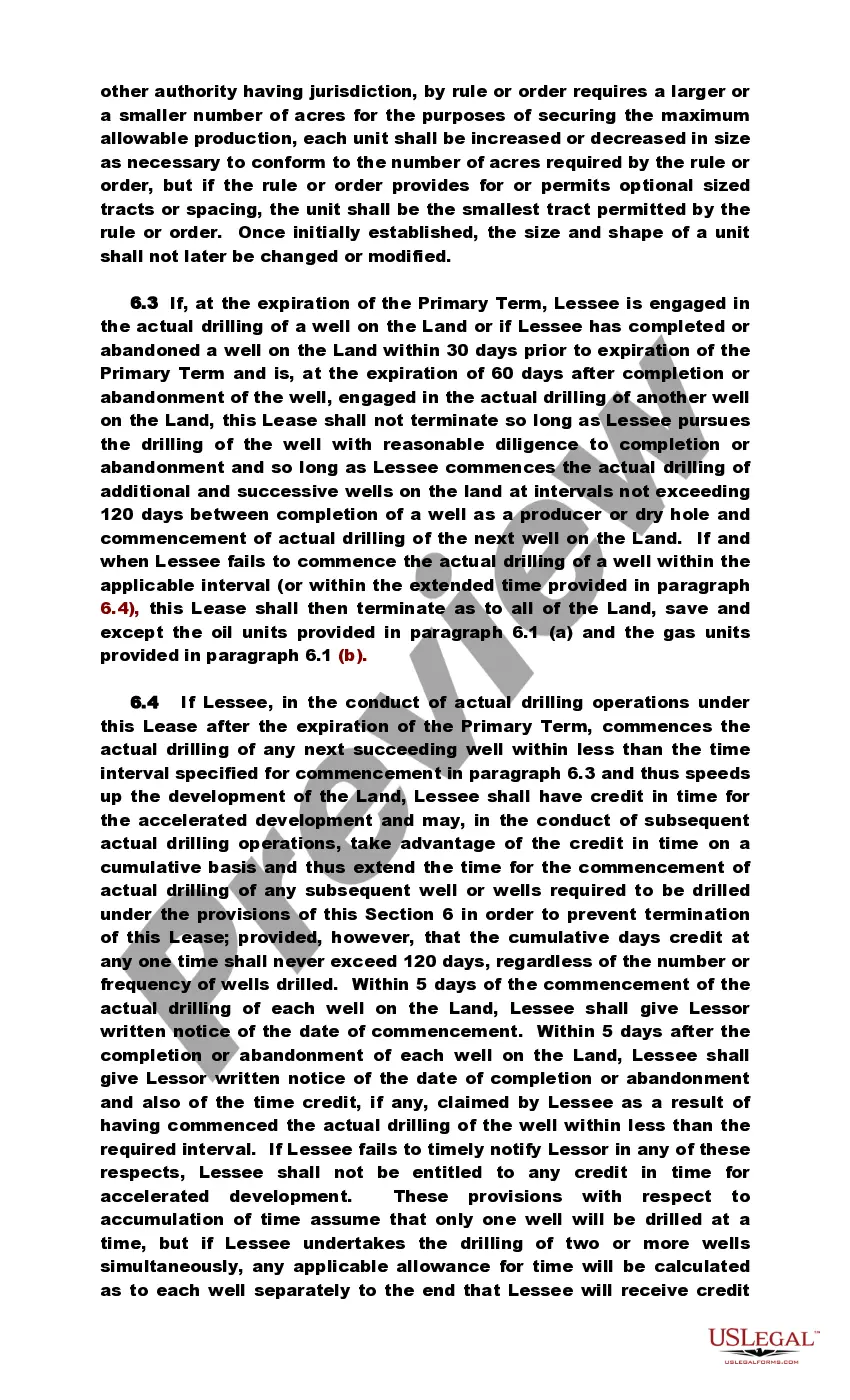

The lease form contains many detailed provisions not found in a standard oil and gas lease form. Due to its length, a summary would not adequately describe each of the terms. It is suggested that if you consider adopting the form for regular use, that you print the form and closely read and review it. The lease form is formatted in 8-1/2 x 14 (legal size).

Alabama Lessor's Form

Description

How to fill out Lessor's Form?

If you need to comprehensive, acquire, or print out legitimate file layouts, use US Legal Forms, the largest selection of legitimate kinds, that can be found on the web. Take advantage of the site`s simple and easy convenient search to obtain the paperwork you require. A variety of layouts for business and individual functions are sorted by categories and states, or search phrases. Use US Legal Forms to obtain the Alabama Lessor's Form in just a number of mouse clicks.

When you are presently a US Legal Forms consumer, log in to the profile and click the Acquire switch to have the Alabama Lessor's Form. You may also accessibility kinds you earlier acquired from the My Forms tab of the profile.

If you are using US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the shape to the appropriate town/land.

- Step 2. Use the Preview option to look over the form`s articles. Never overlook to see the description.

- Step 3. When you are not satisfied using the form, make use of the Search discipline at the top of the display screen to find other variations of the legitimate form format.

- Step 4. Once you have located the shape you require, click on the Purchase now switch. Pick the rates prepare you prefer and include your references to register for an profile.

- Step 5. Method the deal. You can utilize your Мisa or Ьastercard or PayPal profile to finish the deal.

- Step 6. Select the format of the legitimate form and acquire it on your own gadget.

- Step 7. Full, change and print out or sign the Alabama Lessor's Form.

Each and every legitimate file format you purchase is yours permanently. You may have acces to each and every form you acquired with your acccount. Select the My Forms segment and choose a form to print out or acquire once again.

Be competitive and acquire, and print out the Alabama Lessor's Form with US Legal Forms. There are many professional and express-distinct kinds you may use for your business or individual demands.

Form popularity

FAQ

Use Tax Filing: To file taxes, go to .myalabamataxes.alabama.gov. The leasing or renting of any automotive vehicle, truck trailer, semitrailer, or house trailer is subject to lease tax at the state rate of 1.5 percent of the gross proceeds of the lease.

(4) The completed and signed Alabama Form AL8453-PTE will serve as the filing declaration for the electronic Alabama partnership/LLC return of income and the Subchapter K Entities/S Corporations Nonresident Composite Payment Return.

State Tax Rates Tax TypeRate TypeRateRENTAL TAXAUTO1.500%RENTAL TAXLINENS/GARMENTS2.000%RENTAL TAXGENERAL4.000%SALES TAXAUTO2.000%22 more rows

Rental tax or Leasing is a tax charged by the government on the person lending a property. Therefore the amount of money the lessor earns by renting the different properties is taxable by law though the percentage may vary. The same rental tax is applied to the lessors in the state of Alabama.

Rental or leasing tax is a privilege tax levied on the lessor for renting or leasing of tangible personal property. The gross receipts, including any rental tax invoiced, from the rental or leasing of tangible personal property are subject to the state rental tax.

The Alabama car sales tax rate of 2% applies to used and new cars. When a used car is taken in trade as a credit or partial payment on selling a new or used car, you pay the sales tax based on the net difference.

The Alabama Form 65 is similar to the federal Form 1065 in many ways. And, the Form 65 requires that an Alabama Schedule K-1 be completed for any entity that was a partner or owner during the taxable year.

The yearly Ad Valorem, or Property Tax, is based on the values assigned by the State of Alabama Department of Revenue. ing to Act1999-363 (STARS Act), if back taxes are owed on a motor vehicle, they must be paid before the owner can register the vehicle.