Alabama Correction Assignment of Overriding Royalty Interest Correcting Lease Description

Description

How to fill out Correction Assignment Of Overriding Royalty Interest Correcting Lease Description?

If you wish to total, download, or produce authorized document layouts, use US Legal Forms, the biggest variety of authorized types, that can be found on-line. Take advantage of the site`s simple and convenient search to discover the paperwork you want. Different layouts for enterprise and personal functions are sorted by types and suggests, or key phrases. Use US Legal Forms to discover the Alabama Correction Assignment of Overriding Royalty Interest Correcting Lease Description in a few click throughs.

When you are already a US Legal Forms consumer, log in in your account and click on the Down load button to obtain the Alabama Correction Assignment of Overriding Royalty Interest Correcting Lease Description. You can even accessibility types you in the past delivered electronically from the My Forms tab of your own account.

Should you use US Legal Forms the first time, refer to the instructions listed below:

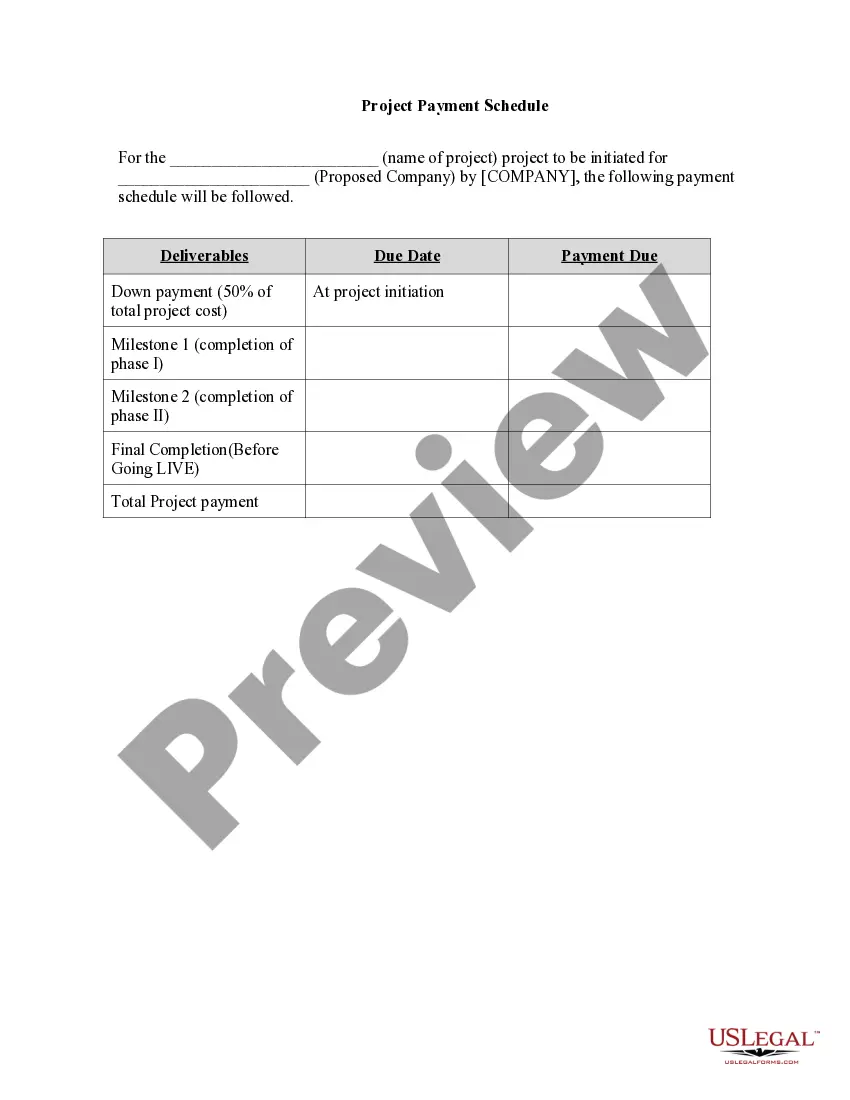

- Step 1. Be sure you have selected the shape to the correct city/country.

- Step 2. Utilize the Preview choice to look through the form`s content material. Don`t overlook to see the outline.

- Step 3. When you are unhappy with the kind, take advantage of the Search industry at the top of the monitor to get other variations of the authorized kind template.

- Step 4. When you have discovered the shape you want, go through the Get now button. Pick the costs strategy you choose and include your accreditations to sign up for an account.

- Step 5. Procedure the transaction. You can use your bank card or PayPal account to finish the transaction.

- Step 6. Find the formatting of the authorized kind and download it on your product.

- Step 7. Total, edit and produce or sign the Alabama Correction Assignment of Overriding Royalty Interest Correcting Lease Description.

Each authorized document template you purchase is yours eternally. You may have acces to every kind you delivered electronically in your acccount. Click on the My Forms segment and pick a kind to produce or download once again.

Compete and download, and produce the Alabama Correction Assignment of Overriding Royalty Interest Correcting Lease Description with US Legal Forms. There are many expert and condition-certain types you may use for your personal enterprise or personal needs.

Form popularity

FAQ

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

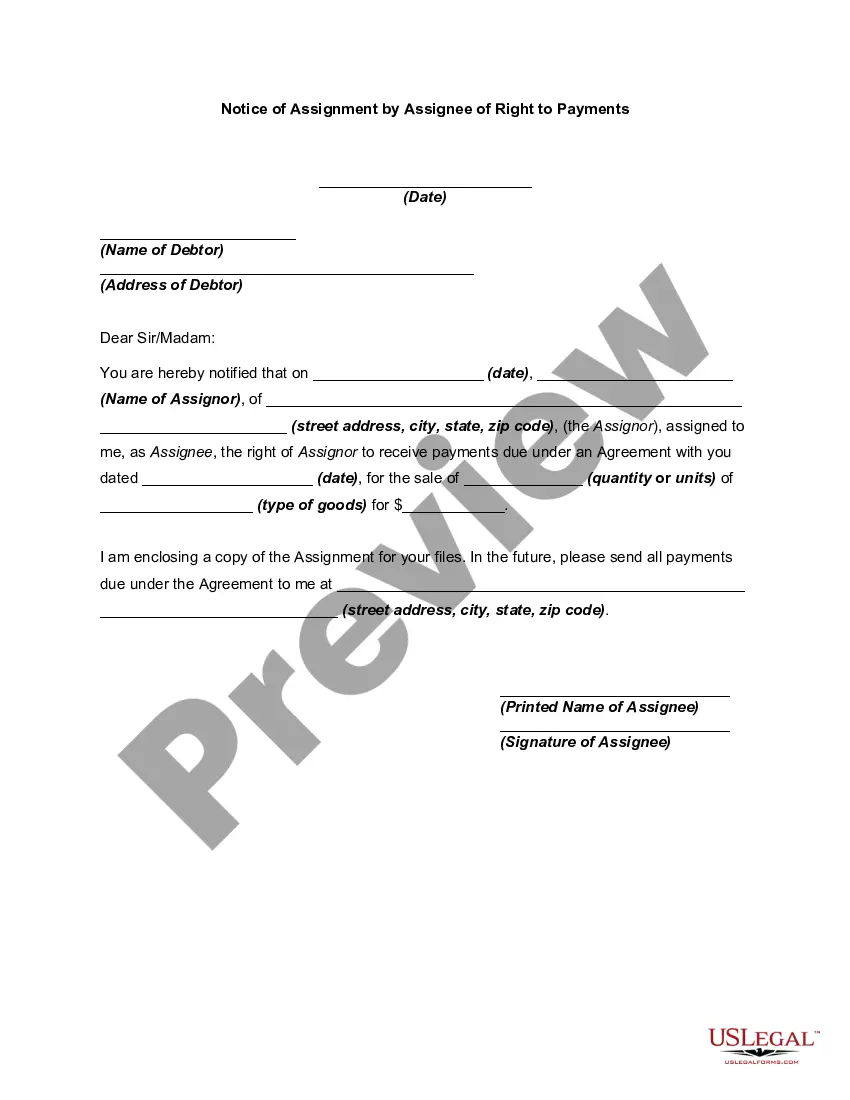

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

How Do Overriding Royalty Interest Payments Work? The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

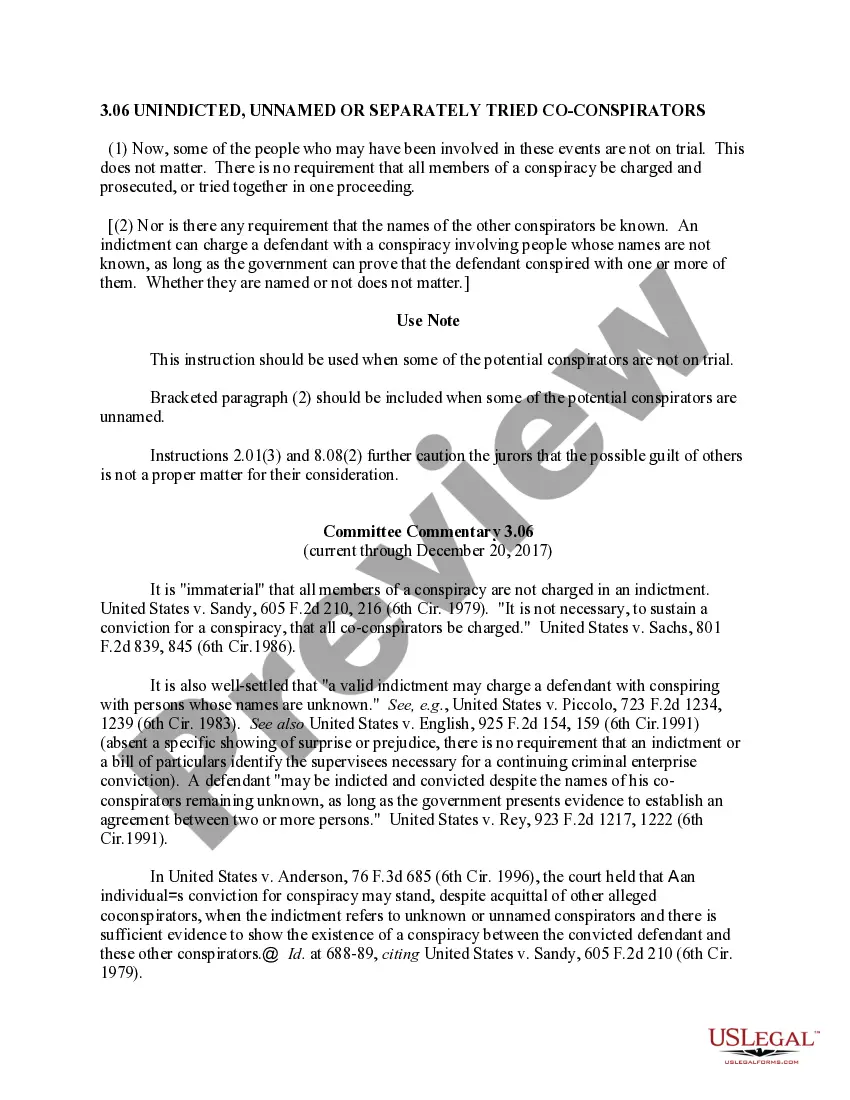

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

An ORRI is a fractional, undivided interest with the right to participate or receive proceeds from the sale of oil and/or gas. It is not an interest in the minerals, but an interest in the proceeds or revenue from the oil & gas minerals sold.