Alabama Deck Builder Contractor Agreement - Self-Employed

Description

How to fill out Deck Builder Contractor Agreement - Self-Employed?

If you need to total, acquire, or print legitimate document templates, utilize US Legal Forms, the largest compilation of lawful forms available online.

Take advantage of the website's user-friendly and convenient search feature to find the documents you require. Various templates for business and personal purposes are categorized by types and categories, or keywords.

Utilize US Legal Forms to locate the Alabama Deck Builder Contractor Agreement - Self-Employed with just a few clicks.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction. Step 6. Select the format of your legal form and download it to your device. Step 7. Complete, modify, and print or sign the Alabama Deck Builder Contractor Agreement - Self-Employed.

Each legal document template you obtain is yours forever. You will have access to every form you saved in your account. Click on the My documents section and choose a form to print or download again. Be proactive and download, and print the Alabama Deck Builder Contractor Agreement - Self-Employed with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Download option to retrieve the Alabama Deck Builder Contractor Agreement - Self-Employed.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your appropriate city/state.

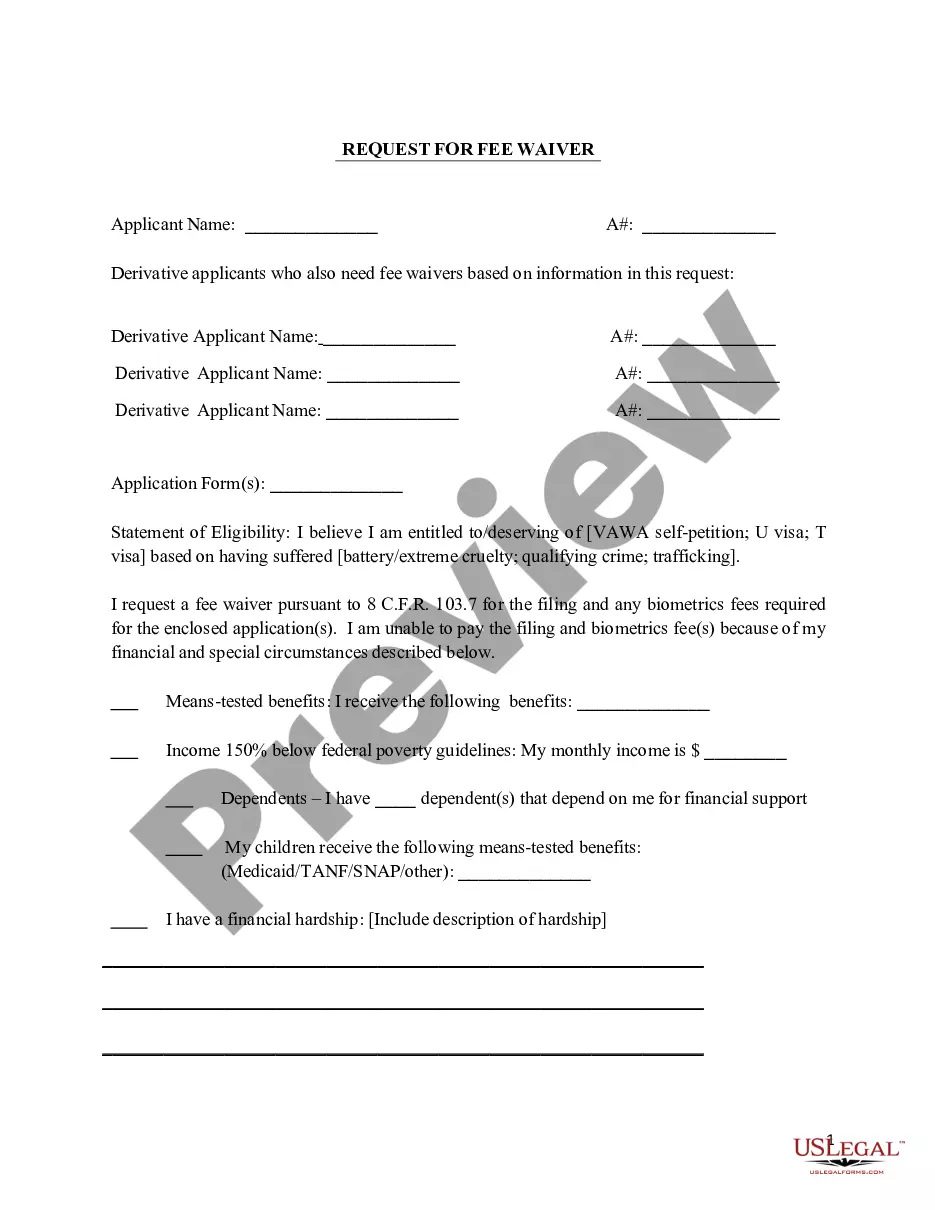

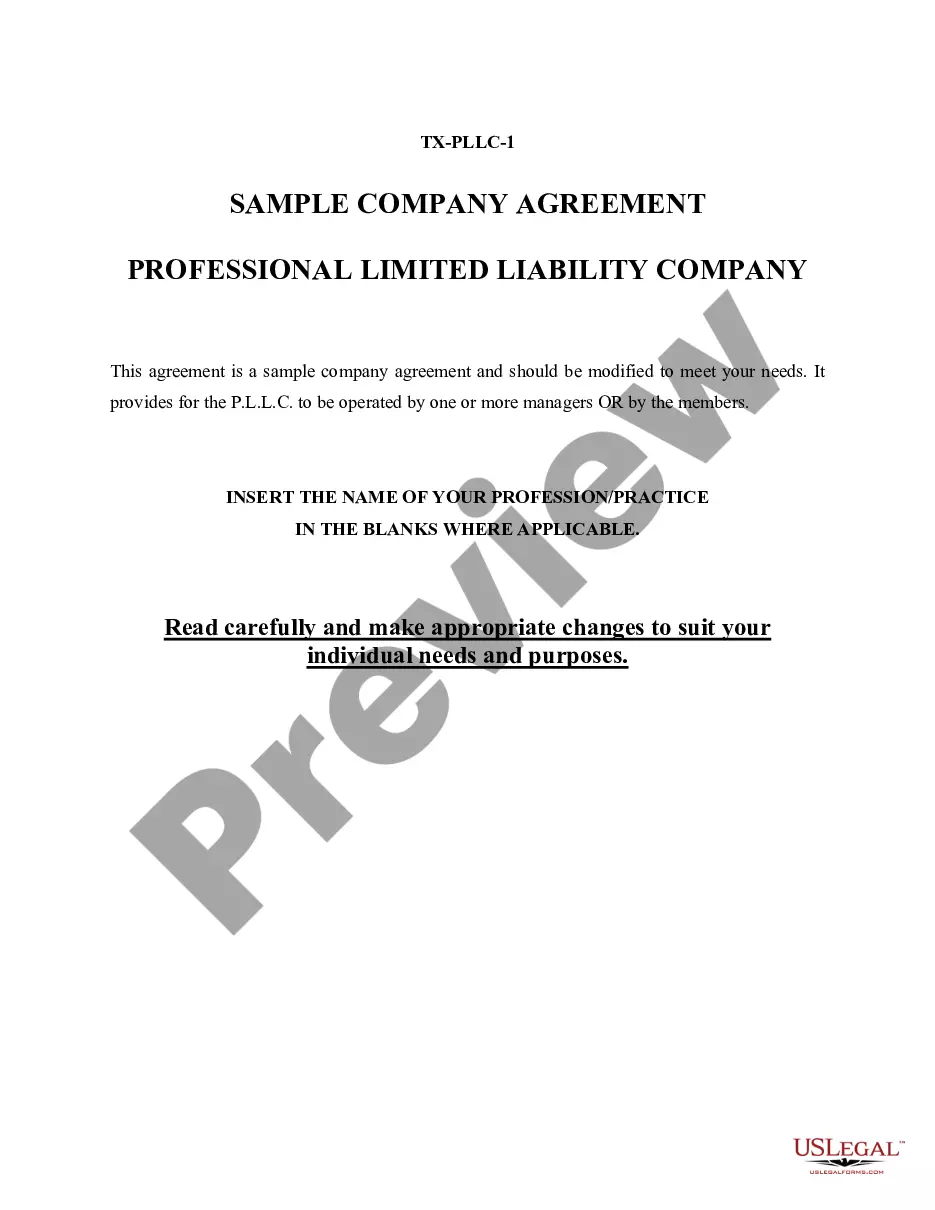

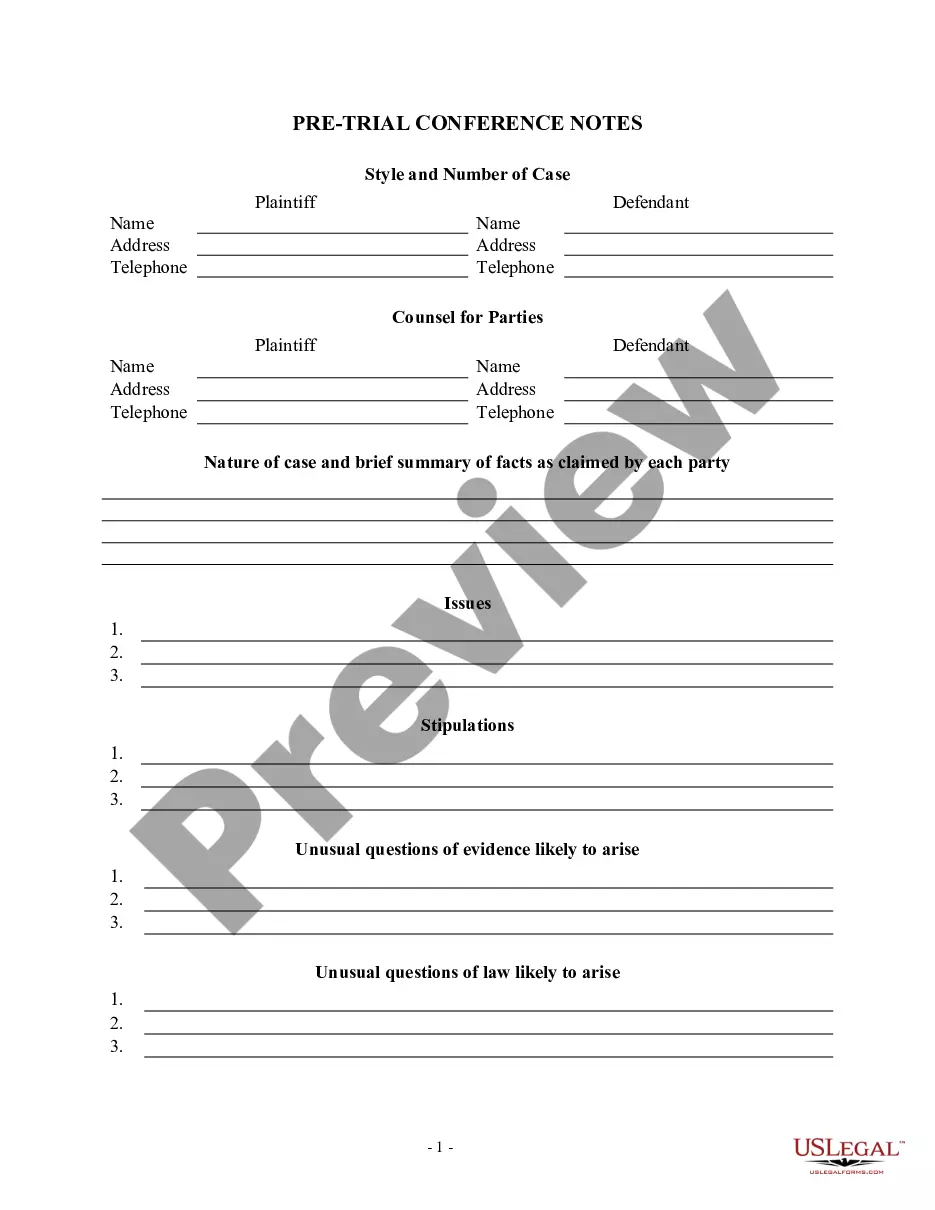

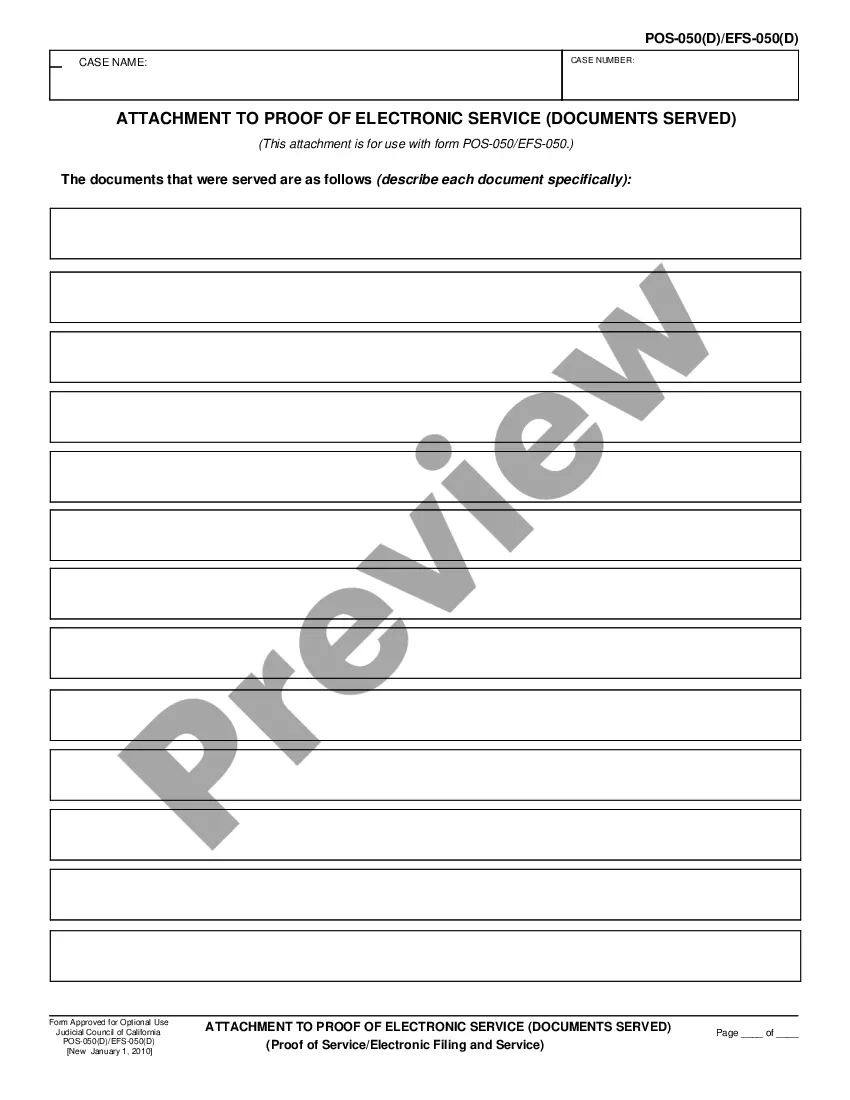

- Step 2. Utilize the Preview option to review the form's content. Don't forget to check the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your information to register for an account.

Form popularity

FAQ

In Alabama, individuals can perform limited work without a contractor's license, specifically for projects valued under $50,000. However, when your work involves constructing or altering structures that fall outside this threshold, you will need a proper license. For tasks like deck building, it is wise to have an Alabama Deck Builder Contractor Agreement - Self-Employed in place to protect your interests. Utilizing platforms like uslegalforms can provide you with the necessary agreements and guidance to ensure compliance and professionalism.

Absolutely, an independent contractor is counted as self-employed. This classification applies to individuals who work without long-term employer ties, as described in the Alabama Deck Builder Contractor Agreement - Self-Employed. Being self-employed gives you the freedom to choose projects and clients. However, it's important to stay informed about your tax responsibilities and legal requirements.

Yes, an independent contractor is indeed considered self-employed. In the context of the Alabama Deck Builder Contractor Agreement - Self-Employed, independent contractors take on projects and clients independently, managing their own schedules and business affairs. This status allows for flexibility and the possibility of higher earnings. Remember that being an independent contractor comes with specific tax obligations and benefits.

The terms self-employed and independent contractor are often used interchangeably, but there are subtle differences. Self-employed individuals may run their own businesses, while independent contractors often work on specific projects for clients. When discussing your business in the context of the Alabama Deck Builder Contractor Agreement - Self-Employed, clarity about your role can help clients understand what you offer. It’s best to choose the term that best describes your work situation.

To qualify as self-employed, you must work for yourself and earn income directly from clients or customers. This could involve providing services, like those outlined in the Alabama Deck Builder Contractor Agreement - Self-Employed, rather than receiving a paycheck from an employer. Additionally, self-employed individuals usually report their earnings on their tax returns as business income. This status comes with unique benefits and responsibilities.

Yes, if you receive a 1099 form, it typically indicates you are self-employed. In the context of the Alabama Deck Builder Contractor Agreement - Self-Employed, this means you are working independently rather than as an employee. Being self-employed allows you to control your work hours and business operations. However, it's essential to understand your responsibilities regarding taxes and legal obligations.

To create an independent contractor agreement, start by clearly defining the scope of work and the expectations between both parties. Include essential details such as payment terms, duration of the contract, and any specific provisions related to hiring an Alabama Deck Builder Contractor Agreement - Self-Employed. After drafting the agreement, ensure both parties review and sign it to validate the terms and conditions. Utilizing a platform like uslegalforms can simplify this process by providing templates tailored to your needs.

An independent contractor usually needs to complete a contract agreement, W-9 form, and potentially other documents depending on the job type. This paperwork establishes the terms of work and tax responsibilities. Using a service like US Legal Forms can streamline the process, especially when creating an Alabama Deck Builder Contractor Agreement - Self-Employed to ensure all necessary paperwork is properly covered.

Yes, a contractor is typically considered self-employed. This classification means they run their business and handle their taxes. Often, contracts like the Alabama Deck Builder Contractor Agreement - Self-Employed clearly define this status, ensuring that both parties understand the contractor's independent role.

Start filling out an independent contractor form by entering your personal information alongside the contractor's details. Include the nature of the work, compensation structure, and any necessary compliance clauses. Utilizing resources from US Legal Forms can simplify this process, helping you create an efficient Alabama Deck Builder Contractor Agreement - Self-Employed that covers all essential details.