Alabama Cosmetologist Agreement - Self-Employed Independent Contractor

Description

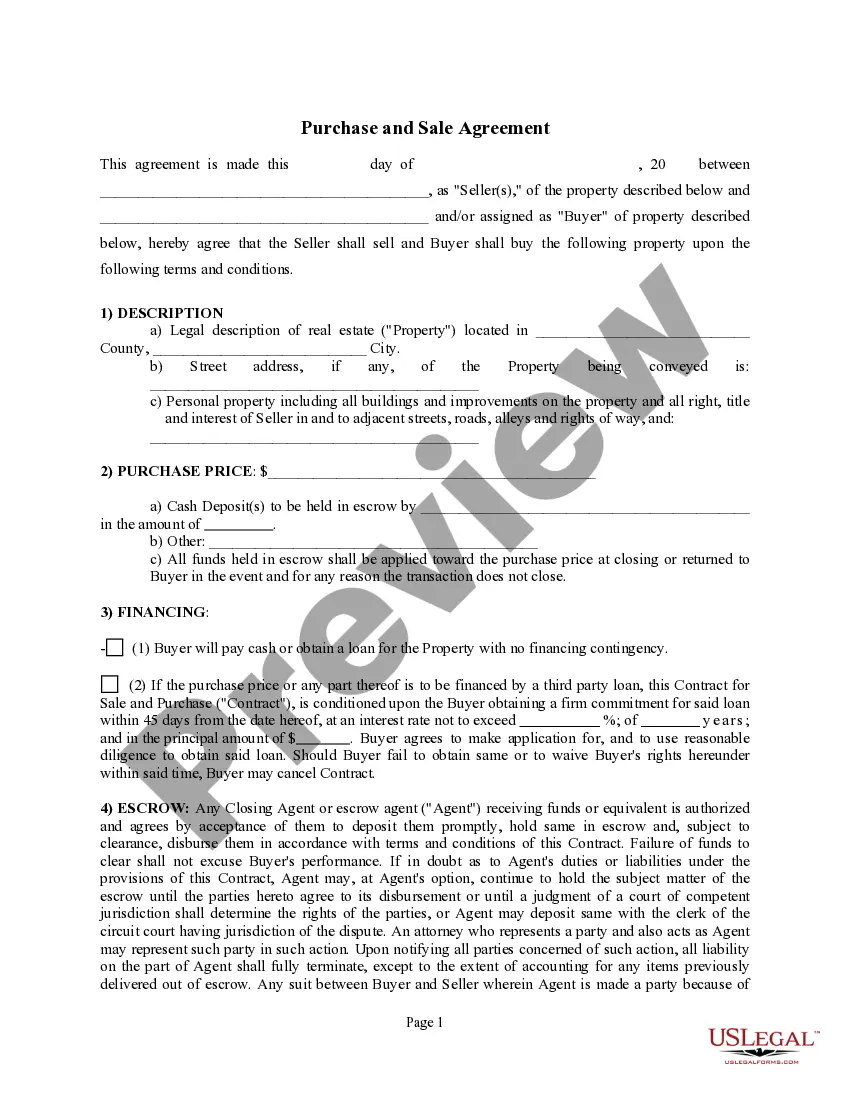

How to fill out Cosmetologist Agreement - Self-Employed Independent Contractor?

Selecting the optimal authentic document template might be challenging. Of course, there are numerous templates accessible online, but how can you find the genuine template you need? Utilize the US Legal Forms website. The platform offers thousands of templates, such as the Alabama Cosmetologist Agreement - Self-Employed Independent Contractor, which can be utilized for business and personal purposes. All the forms are verified by experts and comply with state and federal regulations.

If you are currently registered, Log In to your account and click on the Download button to acquire the Alabama Cosmetologist Agreement - Self-Employed Independent Contractor. Use your account to search for the legal forms you have purchased previously. Navigate to the My documents section of your account to obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have chosen the correct form for your city/region. You can review the form using the Review button and examine the form description to confirm this is suitable for you. If the form does not meet your requirements, utilize the Search field to find the appropriate form. Once you are certain that the form is suitable, select the Buy now button to obtain the form. Choose the pricing plan you need and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template for your records. Complete, edit, print, and sign the obtained Alabama Cosmetologist Agreement - Self-Employed Independent Contractor.

Make the most of US Legal Forms to simplify your document creation process and ensure compliance with legal standards.

- US Legal Forms is the largest library of legal forms where you can find numerous document templates.

- Utilize the service to obtain professionally-crafted paperwork that complies with state requirements.

- There are various templates available for both business and personal use.

- All forms are reviewed by professionals to ensure they meet legal standards.

- Easy navigation and user-friendly interface for efficient document searching.

- Secure payment options available for a hassle-free purchasing experience.

Form popularity

FAQ

Hair stylists can show proof of income by maintaining organized financial records, including bank statements, invoices, and payment receipts. Many independent contractors also use 1099 forms received from clients that outline the income earned. By following the guidelines in the Alabama Cosmetologist Agreement - Self-Employed Independent Contractor, you can ensure your income documentation is thorough and accurate.

As a hairstylist, you file taxes by completing the IRS Form 1040 and attaching Schedule C to report your business income and expenses. Be sure to collect all income documentation, including 1099 forms if applicable. The Alabama Cosmetologist Agreement - Self-Employed Independent Contractor can assist you in keeping track of income and deductions year-round, simplifying your tax filing process.

Filing taxes as an independent contractor can be challenging, especially if you lack experience with tax forms. You need to track income, gather receipts for deductions, and understand tax obligations like self-employment tax. However, utilizing resources like the Alabama Cosmetologist Agreement - Self-Employed Independent Contractor can help you maintain organized records, making tax time easier.

To create an independent contractor agreement, start by outlining the terms of engagement, including payment details, work scope, and duration. It's important to clearly define any obligations and rights of both parties. The Alabama Cosmetologist Agreement - Self-Employed Independent Contractor provides a comprehensive template that can simplify this process and ensure all critical aspects are covered.

An independent contractor in cosmetology is a professional who provides services independently rather than as an employee of a salon. They operate their own business, setting their own hours and determining their service prices. The Alabama Cosmetologist Agreement - Self-Employed Independent Contractor outlines the terms of this arrangement, ensuring legal clarity and mutual understanding.

Yes, receiving a 1099 form typically indicates that you are self-employed. This means your income is reported directly to the IRS, rather than through payroll. When engaging in an Alabama Cosmetologist Agreement - Self-Employed Independent Contractor, this status reinforces your business autonomy and clarifies your role with clients.

Writing an independent contractor agreement involves detailing the terms of the work arrangement. Start by including essential elements like the scope of work, payment terms, and duration of the contract in your Alabama Cosmetologist Agreement - Self-Employed Independent Contractor. To simplify this process, consider using platforms like uslegalforms, which provide templates tailored for your specific needs.

To be considered self-employed, you must earn income from your business activities, not as an employee. An Alabama Cosmetologist Agreement - Self-Employed Independent Contractor can help outline your responsibilities and revenue structure. This agreement typically requires you to manage your taxes and ensure compliance with local regulations related to self-employment.

Yes, an independent contractor is a type of self-employed individual. When you sign an Alabama Cosmetologist Agreement - Self-Employed Independent Contractor, you operate your business instead of working as an employee for someone else. This status allows you to enjoy specific benefits, such as choosing your own clients and setting your own rates.

When discussing the Alabama Cosmetologist Agreement - Self-Employed Independent Contractor, the terms self-employed and independent contractor are often interchangeable. However, using 'independent contractor' can clarify your business relationship with clients, especially in legal documents. This distinction helps underline your autonomy and the nature of your work, making it easier for clients to understand the agreement.