Alabama Computer Repairman Services Contract - Self-Employed

Description

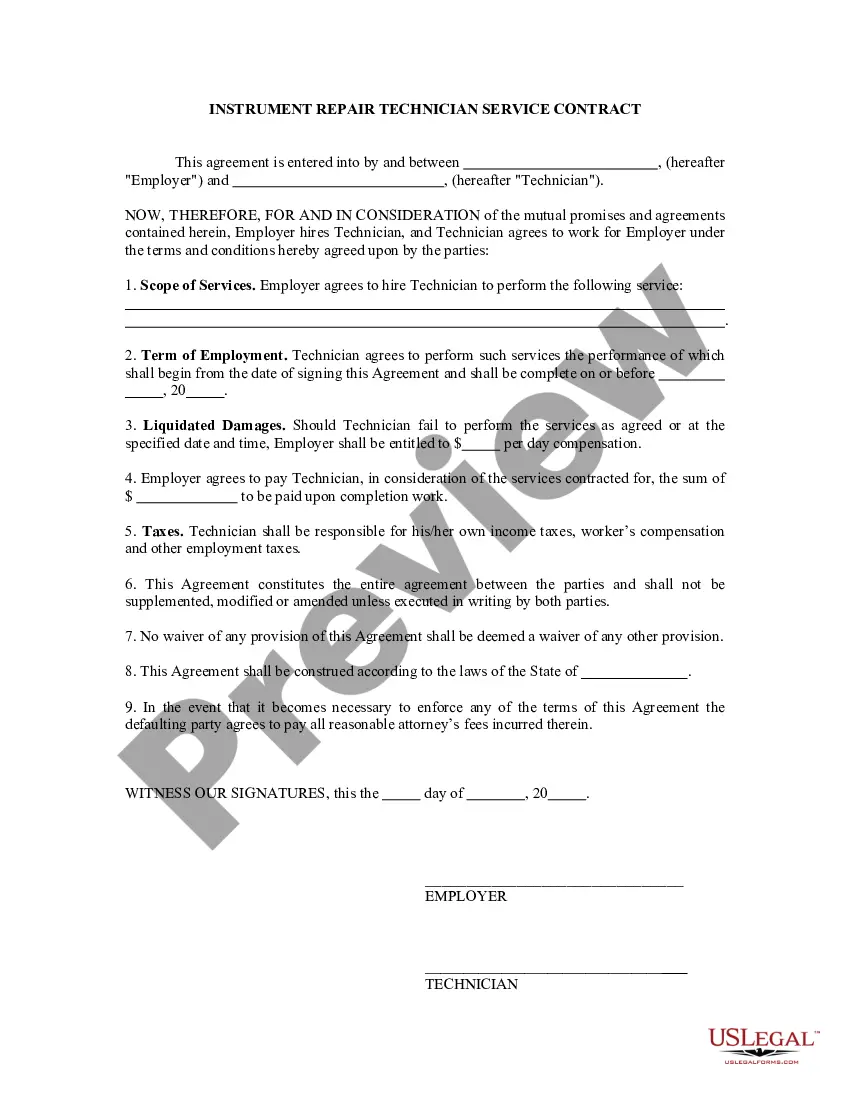

How to fill out Computer Repairman Services Contract - Self-Employed?

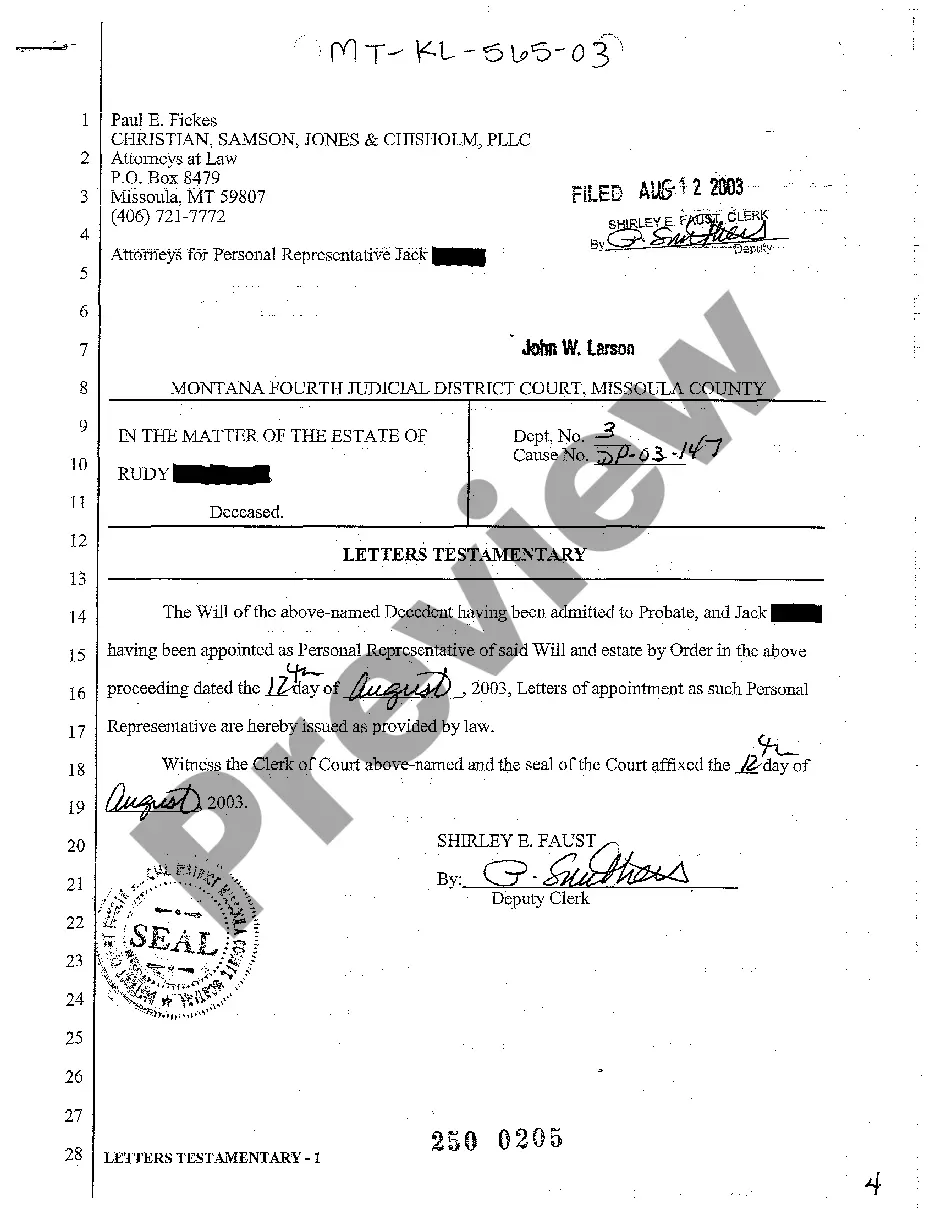

Selecting the optimal legal document template can be challenging. Clearly, there are numerous templates accessible online, but how do you find the legal form you require? Turn to the US Legal Forms website. The platform offers thousands of templates, including the Alabama Computer Repairman Services Agreement - Self-Employed, suitable for both business and personal purposes.

If you are already registered, Log In to your account and click on the Download button to obtain the Alabama Computer Repairman Services Agreement - Self-Employed. Use your account to access the legal forms you have previously purchased. Navigate to the My documents section of your account and retrieve another copy of the document you require.

If you are a new user of US Legal Forms, here are straightforward instructions that you should follow: First, ensure you have selected the correct form for your specific city/state. You may review the document using the Preview feature and read the document description to confirm it suits your needs. If the form does not meet your expectations, utilize the Search field to find the appropriate form. Once you are certain the form is right, click the Purchase now button to obtain the document. Choose the pricing plan you wish and fill in the required information. Create your account and pay for your order using your PayPal account or credit card. Choose the file format and download the legal document template for your device. Complete, modify, and print the received Alabama Computer Repairman Services Agreement - Self-Employed.

- US Legal Forms is the largest repository of legal documents where you can find various document templates.

- Utilize the service to download professionally crafted documents that comply with state requirements.

Form popularity

FAQ

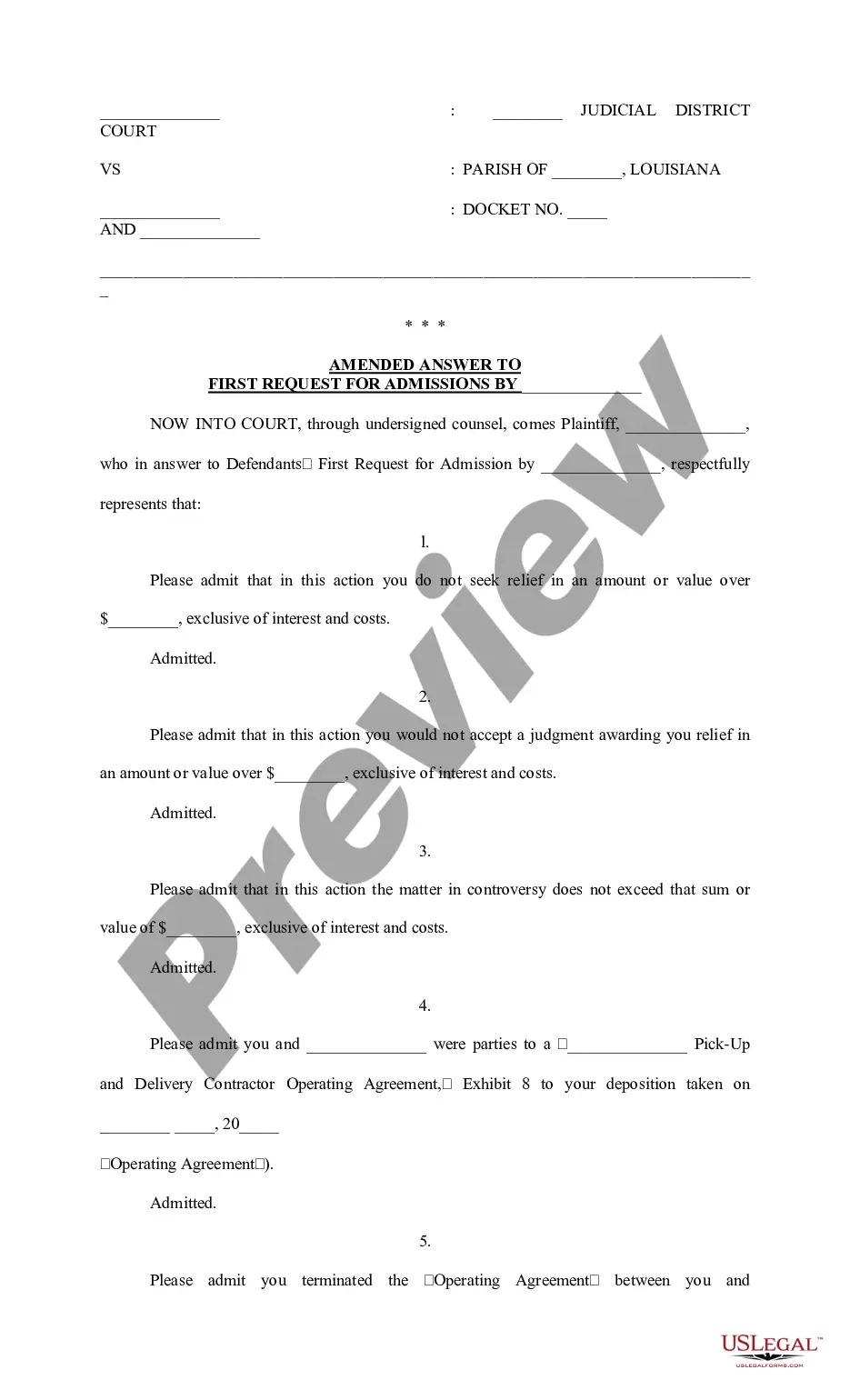

employed individual typically uses independent contractor agreements that specify the nature of the services provided. These contracts clarify the terms of the work relationship, including payment and deliverables. Creating an Alabama Computer Repairman Services Contract SelfEmployed allows you to navigate these agreements with confidence and professionalism.

employed contract should include details such as the scope of work, payment terms, and deadlines. Additionally, it should outline any conditions for termination and confidentiality clauses. To structure this contract effectively, the uslegalforms platform offers resources to help formulate an Alabama Computer Repairman Services Contract SelfEmployed tailored to your needs.

Independent contractors can be sued if they breach contract terms or fail to deliver the agreed-upon services. Liability also extends to areas such as negligence, so it’s important to safeguard yourself with solid contracts. The Alabama Computer Repairman Services Contract - Self-Employed can help mitigate these risks by outlining specific responsibilities.

Yes, contract workers are regarded as self-employed since they operate independently of traditional employment structures. They have more control over their work and can take on multiple clients. When you draft your Alabama Computer Repairman Services Contract - Self-Employed, it’s vital to acknowledge your status.

To fill out an independent contractor agreement, start by providing your contact information and the services you will offer. Next, clearly state the payment terms, including rates and schedules. Utilizing tools from the uslegalforms platform can simplify this process, especially when creating an Alabama Computer Repairman Services Contract - Self-Employed.

In an employment contract, you should clearly define job responsibilities, payment terms, and duration of the contract. It's also essential to include confidentiality clauses and any termination conditions. As you explore the Alabama Computer Repairman Services Contract - Self-Employed, consider how these elements create clarity in your working relationship.

Yes, a general contractor can perform work personally, but it is essential to balance management tasks with on-site labor. Doing the work may require additional time and can complicate scheduling if not managed well. Utilizing an Alabama Computer Repairman Services Contract - Self-Employed allows you to define your roles and streamline operations effectively.

Yes, you can act as your own general contractor in Alabama, provided you comply with local building codes and regulations. Being your own contractor allows you to control the project more directly. An Alabama Computer Repairman Services Contract - Self-Employed can help outline your roles and obligations, making the process smoother.

In Alabama, a handyman can perform some minor electrical repairs, but they must follow local laws and regulations. Major electrical work typically requires a licensed electrician to ensure safety and compliance. If you hire a handyman, consider an Alabama Computer Repairman Services Contract - Self-Employed for clarity on the scope of work and responsibilities.

In Alabama, it is not mandatory for a general contractor to form an LLC. However, creating an LLC can protect your personal assets and provide tax benefits. When you operate under an Alabama Computer Repairman Services Contract - Self-Employed, having an LLC may enhance your professional image and limit liability.