Alabama Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

How to fill out Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

It is feasible to spend hours online searching for the proper legal document template that fulfills the state and federal requirements you desire. US Legal Forms offers thousands of legal templates that are evaluated by professionals.

You can effortlessly download or print the Alabama Instructions for Completing Request for Loan Modification and Affidavit RMA Form from the service.

If you possess a US Legal Forms account, you can Log In and select the Download button. After that, you can fill out, modify, print, or sign the Alabama Instructions for Completing Request for Loan Modification and Affidavit RMA Form. Every legal document template you obtain is yours permanently.

Complete the transaction. You may use your credit card or PayPal account to pay for the legal form. Choose the format of your document and download it to your device. Make edits to your document if possible. You can fill out, modify, and sign and print the Alabama Instructions for Completing Request for Loan Modification and Affidavit RMA Form. Download and print thousands of document templates using the US Legal Forms site, which features the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain another version of a purchased form, navigate to the My documents tab and select the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the area/city that you select. Review the form description to confirm you have chosen the right form.

- If available, utilize the Preview button to review the document template as well.

- If you wish to find another edition of your form, use the Search field to locate the template that meets your needs and requirements.

- Once you have identified the template you want, click on Purchase now to proceed.

- Select the pricing plan you prefer, input your details, and register for a free account on US Legal Forms.

Form popularity

FAQ

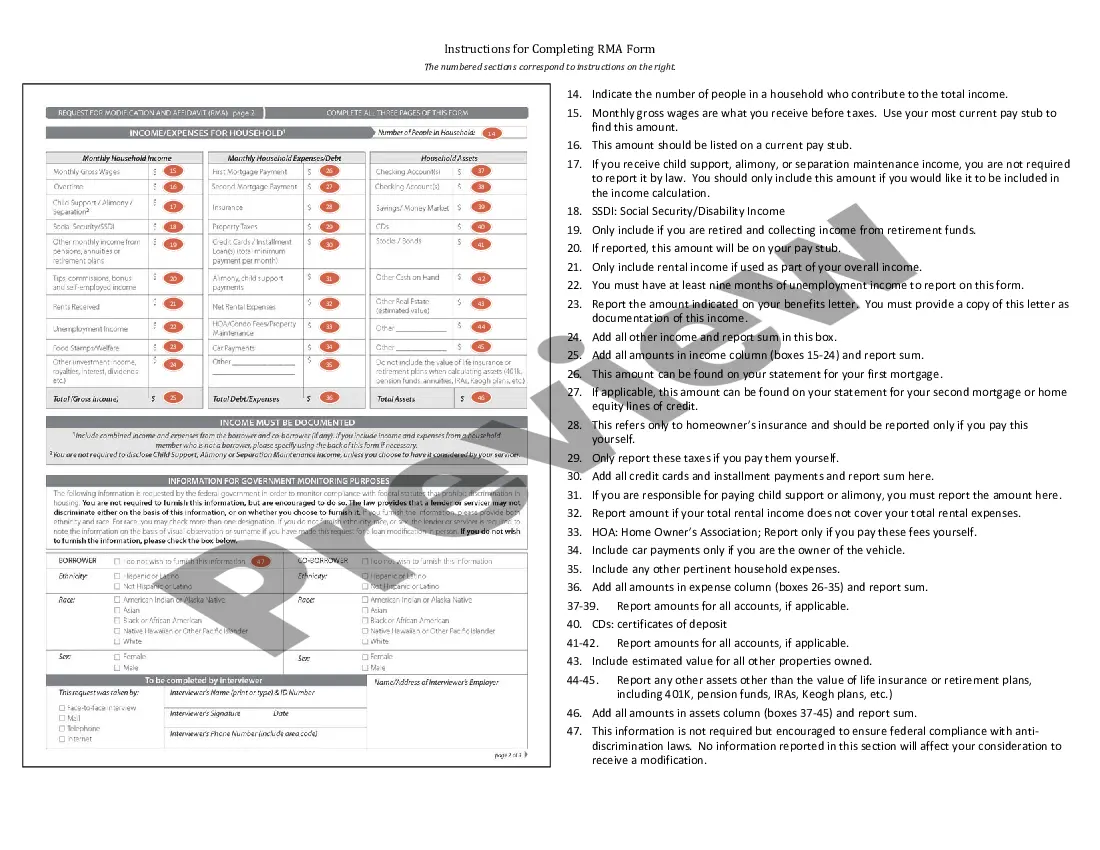

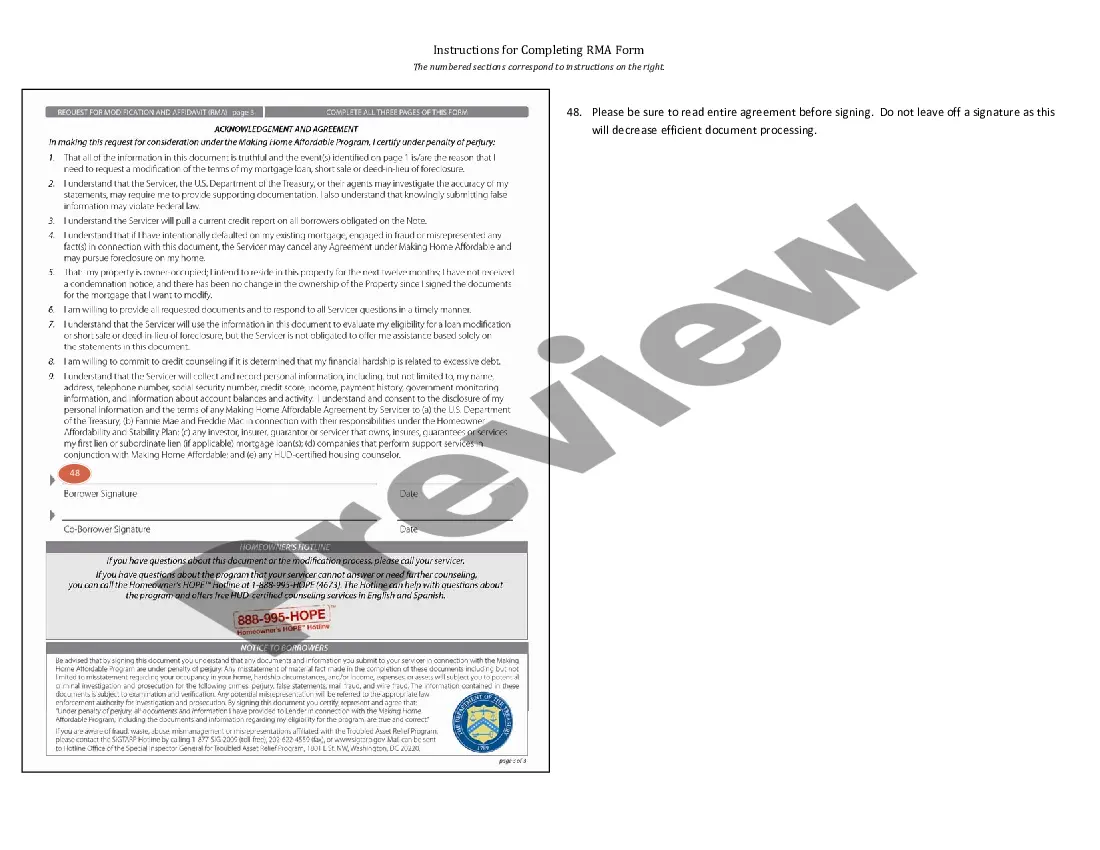

RMA in mortgage refers to the Request for Mortgage Assistance, which is a crucial step for homeowners facing financial difficulties. This process allows you to seek assistance from your lender to modify your loan terms and potentially lower your payments. Utilizing the Alabama Instructions for Completing Request for Loan Modification and Affidavit RMA Form can guide you through this process and help ensure all required details are adequately addressed.

A hardship affidavit is a sworn statement detailing your financial challenges and the reasons for your loan modification request. Begin by outlining your current financial situation, include specific examples of your hardship, and ensure that it is signed in front of a notary. Referencing the Alabama Instructions for Completing Request for Loan Modification and Affidavit RMA Form can provide you with the necessary format and specifics to include.

In real estate, RMA stands for Request for Mortgage Assistance. This term refers to the process by which homeowners can request modifications on their loans due to financial hardship. Understanding RMA is important as adhering to the Alabama Instructions for Completing Request for Loan Modification and Affidavit RMA Form can help streamline your request and improve your chances of approval.

A loan modification form is a request that homeowners submit to their lender when they need to change the terms of their existing mortgage. This change can involve reducing the interest rate, extending the loan term, or adjusting the monthly payment. For a smooth process, it's crucial to adhere to the Alabama Instructions for Completing Request for Loan Modification and Affidavit RMA Form when filling out the application.

The RMA mortgage form, or Request for Mortgage Assistance, is a document that homeowners complete when seeking help from their lenders to modify their loan terms. This form allows you to outline your financial situation, including details about income, expenses, and any hardships. It's essential to follow the Alabama Instructions for Completing Request for Loan Modification and Affidavit RMA Form to ensure your submission is accurate and complete.

A hardship letter is a document you submit to your lender to explain your financial difficulties. This letter should detail the reasons behind your hardship, such as job loss or medical expenses, and provide clear evidence of your situation. When you write this letter, refer to the Alabama Instructions for Completing Request for Loan Modification and Affidavit RMA Form for guidance on structure and content.

The full form of RMA is Request for Mortgage Assistance. This form plays a critical role in the mortgage modification process. By correctly completing the Alabama Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you help your lender understand your situation. Utilizing this form effectively can lead to more favorable loan modification terms.

Getting approved for loan modification involves a clear understanding of the requirements and submission of accurate paperwork. Begin by gathering your financial documents and carefully following the Alabama Instructions for Completing Request for Loan Modification and Affidavit RMA Form. Submit your application with all necessary documentation to your lender, and ensure you stay in communication with them throughout the process. A complete and well-prepared application significantly increases your chance of approval.

RMA stands for Request for Mortgage Assistance. This form is essential for homeowners seeking financial relief through loan modification. Understanding the Alabama Instructions for Completing Request for Loan Modification and Affidavit RMA Form will help you fill out the necessary details accurately and improve your chances of approval. By using the RMA, you communicate your need for assistance to your mortgage lender.