Alabama Form - Large Quantity Sales Distribution Agreement

Description

How to fill out Form - Large Quantity Sales Distribution Agreement?

Discovering the right legitimate file format might be a battle. Naturally, there are a lot of web templates available online, but how do you get the legitimate type you require? Utilize the US Legal Forms web site. The support delivers a huge number of web templates, including the Alabama Form - Large Quantity Sales Distribution Agreement, that you can use for business and private requires. Every one of the types are checked out by specialists and fulfill state and federal requirements.

If you are currently registered, log in to the profile and then click the Acquire button to obtain the Alabama Form - Large Quantity Sales Distribution Agreement. Make use of profile to search through the legitimate types you have bought formerly. Visit the My Forms tab of your profile and obtain yet another version of the file you require.

If you are a brand new end user of US Legal Forms, listed below are simple recommendations so that you can follow:

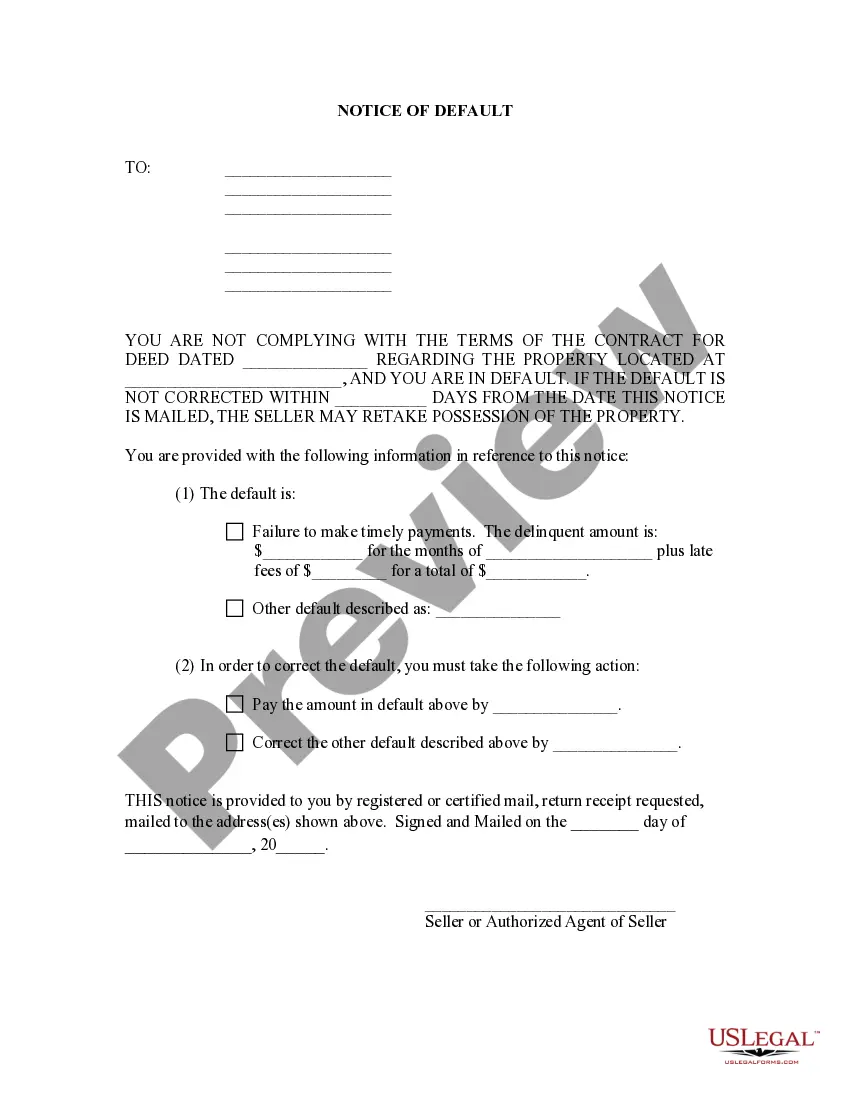

- First, ensure you have chosen the correct type for your metropolis/state. It is possible to examine the shape making use of the Review button and browse the shape outline to guarantee it will be the best for you.

- When the type fails to fulfill your expectations, use the Seach area to discover the appropriate type.

- Once you are certain the shape would work, select the Get now button to obtain the type.

- Choose the pricing plan you would like and enter the required info. Design your profile and pay for the transaction making use of your PayPal profile or charge card.

- Opt for the file structure and obtain the legitimate file format to the device.

- Comprehensive, revise and produce and indication the acquired Alabama Form - Large Quantity Sales Distribution Agreement.

US Legal Forms is the greatest local library of legitimate types where you can discover numerous file web templates. Utilize the service to obtain professionally-created documents that follow condition requirements.

Form popularity

FAQ

The penalty for failure to timely file an Alabama business privilege tax return by the due date is 10% of the tax shown due with the return or $50, whichever is greater.

Required Attachments to the Alabama Form PPT: ? A copy of pages 1 through 4 of the federal tax Form 1120S or pages 1 through 5 of the federal tax Form 1065.

Minimum privilege tax is $100; plus the $10 Secretary of State annual report fee for corporations. For the taxable year beginning after December 31, 2022, taxpayers who would otherwise be subject to the minimum tax due of $100 shall pay $50 in lieu thereof.

PPT ? S Corps, Limited Liability Companies, and PLLCs file a PPT form for their business privilege tax. The PPT form also includes the AL-, which is used for the annual report. Both are filed with Alabama's Department of Revenue.

09. Section 810-6-5-. 09 - Leasing and Rental of Tangible Personal Property (1) The term "rental tax" as used in this rule shall mean the privilege or license tax levied in Section 40-12-222, Code of Ala.

The business privilege tax is an annual tax paid by corporations and limited liability entities (including disregarded entities) for the privilege of conducting business in Alabama.

Per the Form PPT Instructions: "Minimum Business Privilege Tax. Alabama Act 2022-252 amends Section 40-14(A)-22. For taxable year 2023, taxpayers who would be subject to the minimum tax due of one hundred dollars ($100) shall pay fifty dollars ($50)."