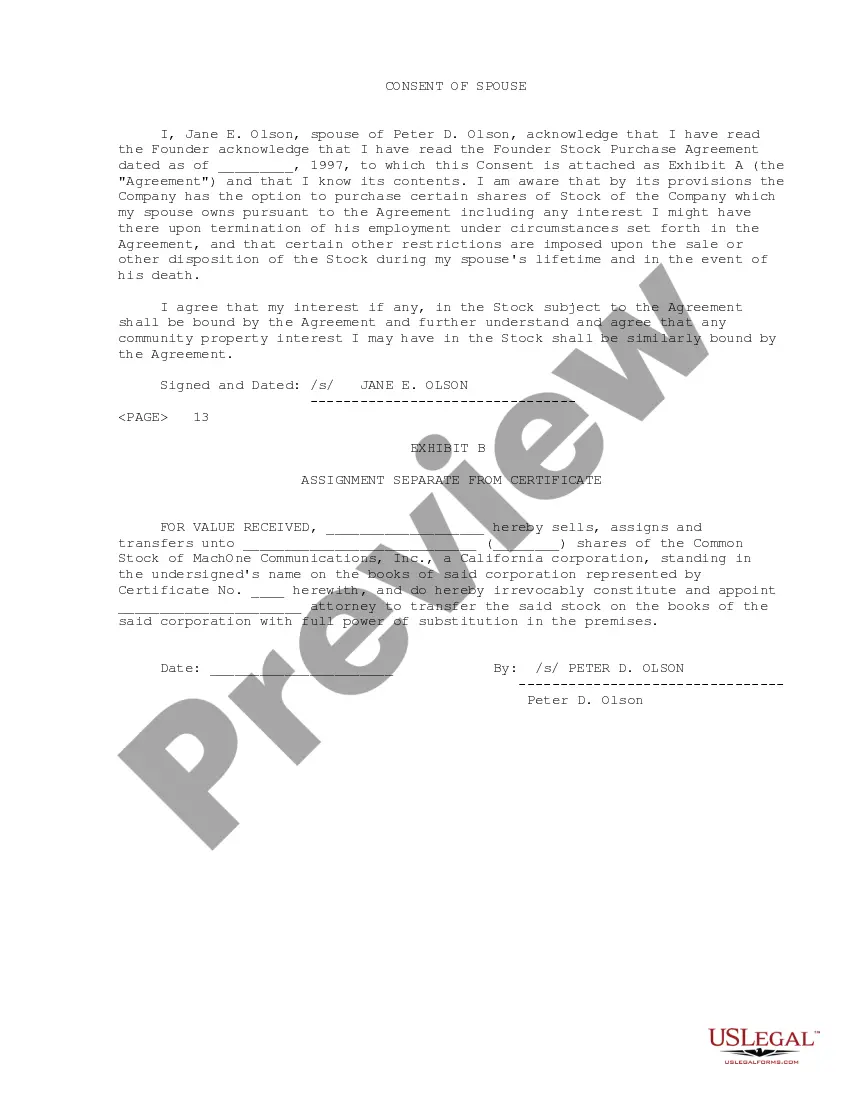

Alabama Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson

Description

How to fill out Sample Founder Stock Purchase Agreement Between MachOne Communications, Inc. And Peter D. Olson?

Discovering the right legal record template can be a have a problem. Naturally, there are a variety of layouts available on the Internet, but how do you discover the legal form you need? Utilize the US Legal Forms site. The services gives 1000s of layouts, like the Alabama Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson, that you can use for company and private demands. All the forms are examined by experts and meet state and federal specifications.

In case you are previously authorized, log in in your bank account and click on the Download option to have the Alabama Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson. Utilize your bank account to look from the legal forms you might have purchased previously. Visit the My Forms tab of your bank account and acquire another version of your record you need.

In case you are a fresh consumer of US Legal Forms, allow me to share simple guidelines for you to comply with:

- Initial, ensure you have selected the appropriate form to your area/state. You may look over the shape using the Preview option and study the shape information to make sure this is the right one for you.

- If the form will not meet your needs, take advantage of the Seach field to get the proper form.

- When you are positive that the shape is acceptable, select the Purchase now option to have the form.

- Pick the rates prepare you need and enter in the needed details. Design your bank account and pay for an order with your PayPal bank account or bank card.

- Opt for the submit formatting and download the legal record template in your device.

- Full, modify and print and indication the acquired Alabama Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson.

US Legal Forms is the most significant library of legal forms for which you can see numerous record layouts. Utilize the company to download professionally-manufactured papers that comply with condition specifications.

Form popularity

FAQ

Hear this out loud PauseAn RSPA will typically allow the Company to buyback shares from the founder through a repurchase option. The repurchase option can be triggered by a number of events, including the founder being fired or force to quit. Single / Double Trigger Acceleration.

Hear this out loud PauseConsult a business attorney to help write your stock purchase agreement or review it and make suggestions before you present it to your investor. A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks.

A restricted stock unit is a promise made to an employee by an employer to grant a given number of shares of the company's stock to the employee at a predetermined time in the future. Since RSUs are not actually stocks, but only a right to the promised stock, they carry no voting rights.

Hear this out loud PauseThis agreement allows the founders to document their initial ownership in the Company, including standard transfer restrictions and any vesting provisions with respect to their shares.

Hear this out loud PauseA Restricted Stock Purchase Agreement (RSPA) is an agreement issuing restricted stock. RSPAs are typically granted to founders to prevent the founder from leaving the company prematurely and taking a lot of the ownership with her. The RSPA establishes when the shares will fully vest and belong to the founder.

A: The most common provisions included in restricted stock purchase agreements are restrictions on when and how stock can be sold or transferred; non-compete agreements; rights of first refusal; and termination clauses which allow either party to terminate the agreement under specified conditions.

Restricted stock (also called letter stock or section 1244 stock) is usually awarded to company directors and other high-level executives, whereas restricted stock units (RSUs) are typically awarded to lower-level employees. Restricted stock tends to have more conditions and restrictions than an RSU.

A stock restriction agreement or SRA refers to the agreement made between a company and its founder for allotment of stock that places certain restrictions on its transfer.