Alabama Plan of Merger between two corporations

Description

How to fill out Plan Of Merger Between Two Corporations?

If you want to total, download, or print out authorized record templates, use US Legal Forms, the most important variety of authorized varieties, that can be found online. Make use of the site`s basic and convenient look for to find the paperwork you want. Different templates for organization and individual purposes are categorized by categories and suggests, or key phrases. Use US Legal Forms to find the Alabama Plan of Merger between two corporations with a number of clicks.

Should you be currently a US Legal Forms buyer, log in in your bank account and click on the Obtain button to have the Alabama Plan of Merger between two corporations. You can also entry varieties you previously downloaded in the My Forms tab of your own bank account.

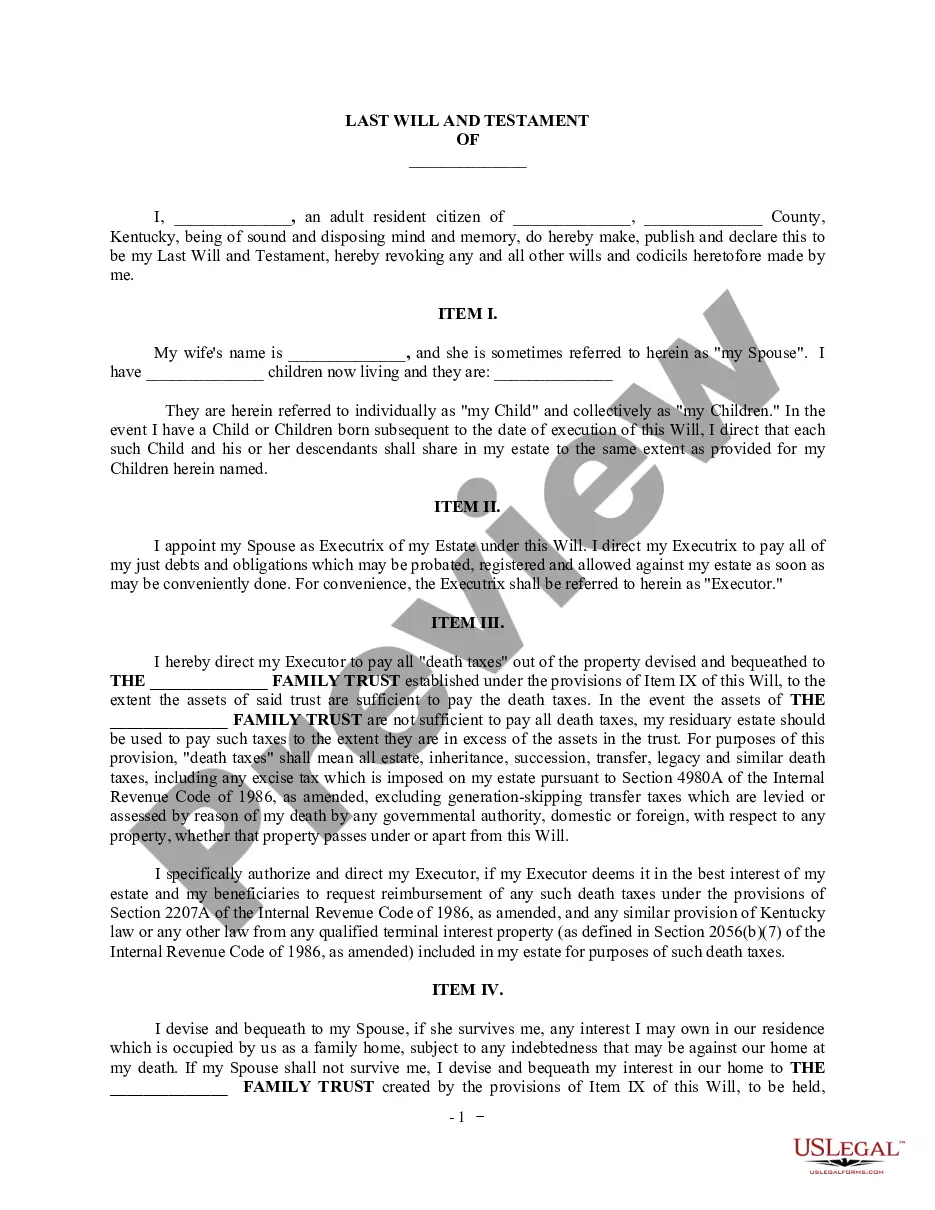

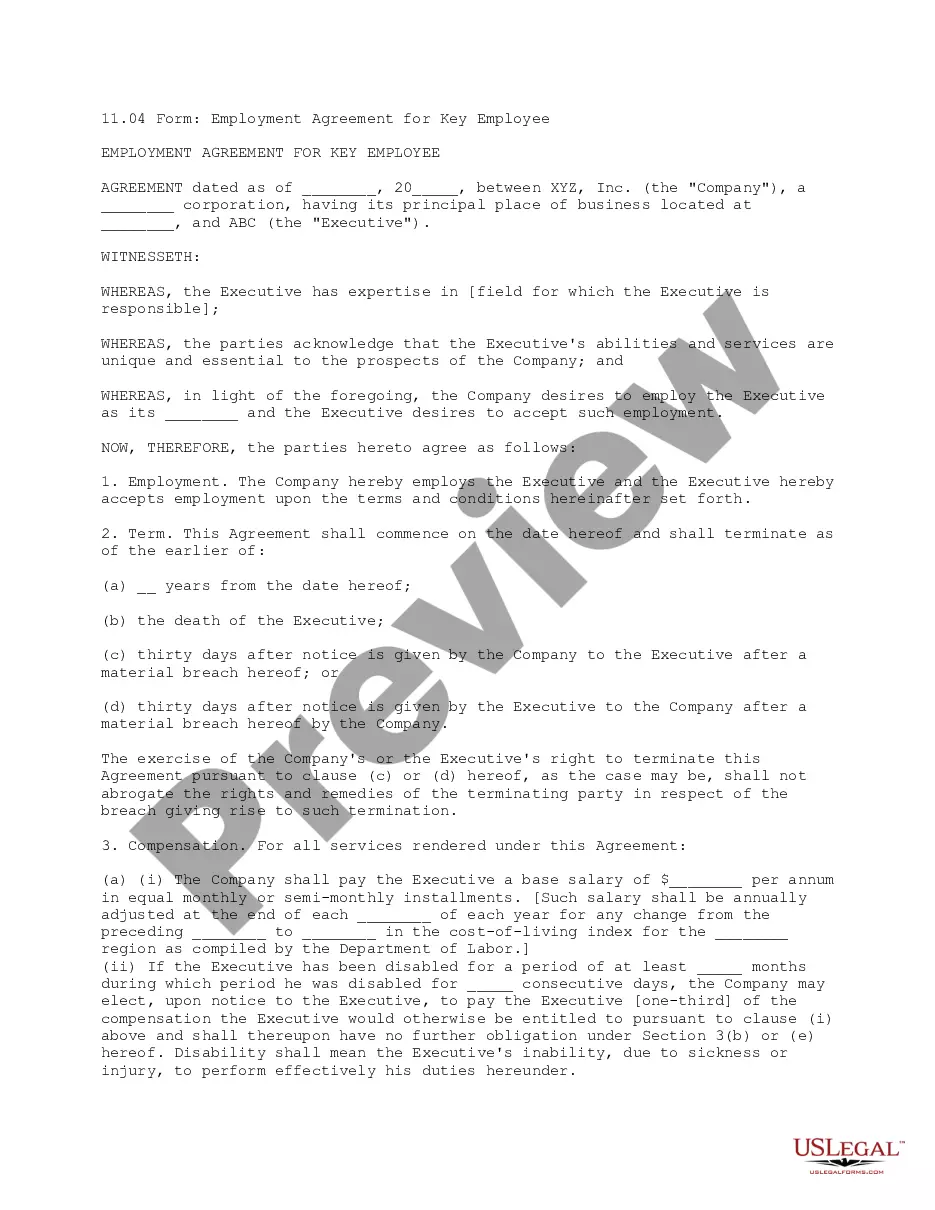

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Ensure you have chosen the shape to the appropriate area/country.

- Step 2. Make use of the Review option to look over the form`s information. Don`t forget about to learn the outline.

- Step 3. Should you be unsatisfied with all the form, take advantage of the Research field on top of the monitor to get other types of your authorized form design.

- Step 4. When you have discovered the shape you want, go through the Buy now button. Choose the costs program you favor and include your qualifications to sign up to have an bank account.

- Step 5. Process the deal. You may use your bank card or PayPal bank account to complete the deal.

- Step 6. Pick the format of your authorized form and download it on the device.

- Step 7. Comprehensive, edit and print out or sign the Alabama Plan of Merger between two corporations.

Each authorized record design you buy is your own property eternally. You may have acces to each form you downloaded within your acccount. Select the My Forms area and pick a form to print out or download once more.

Compete and download, and print out the Alabama Plan of Merger between two corporations with US Legal Forms. There are millions of skilled and status-distinct varieties you may use for your organization or individual needs.

Form popularity

FAQ

Both terms often refer to the joining of two companies, but there are key differences involved in when to use them. A merger occurs when two separate entities combine forces to create a new, joint organization. Meanwhile, an acquisition refers to the takeover of one entity by another.

A merger occurs when individual organizations decide to join their forces and give rise to a new business entity. On the other hand, an acquisition is a situation wherein a larger, financially stronger organization takes over a smaller one.

The transferor and transferee company are eligible to file an application in the form of a petition with the NCLT to get the sanction for amalgamation. The application must be filed under section 230-232 of Companies Act, 2013.

Some of the most famous and successful examples of M&A transactions that have occurred over the last few decades include: Google's acquisition of Android. Disney's acquisition of Pixar and Marvel. Exxon and Mobile merger (a great example of a successful horizontal merger).

Asset Acquisition: the buyer buys the assets of the business. Stock Purchase: the buyer buys the stock of the business. Merger: the buyer merges or ?combines? with the business.

Small Business Merger Guidelines Compare and analyze the corporate structures. Determine the leadership of the new company. Compare the company cultures. Determine the branding of the new company. Analyze all financial positions. Determine operating costs. Do your due diligence. Conduct a valuation of all companies.

Mergers and acquisitions (M&A) are a general term that describes the consolidation of companies or assets through various types of financial transactions, including mergers, acquisitions, consolidations, tender offers, purchase of assets, and management acquisitions.

The three main types of mergers are: Horizontal. Vertical. Concentric.