This due diligence form lists certain documents, items and information which are required in order to complete the due diligence investigation with respect to the company's risk management procedures in business transactions.

Alabama Insurance and Liability Coverage Due Diligence Request List

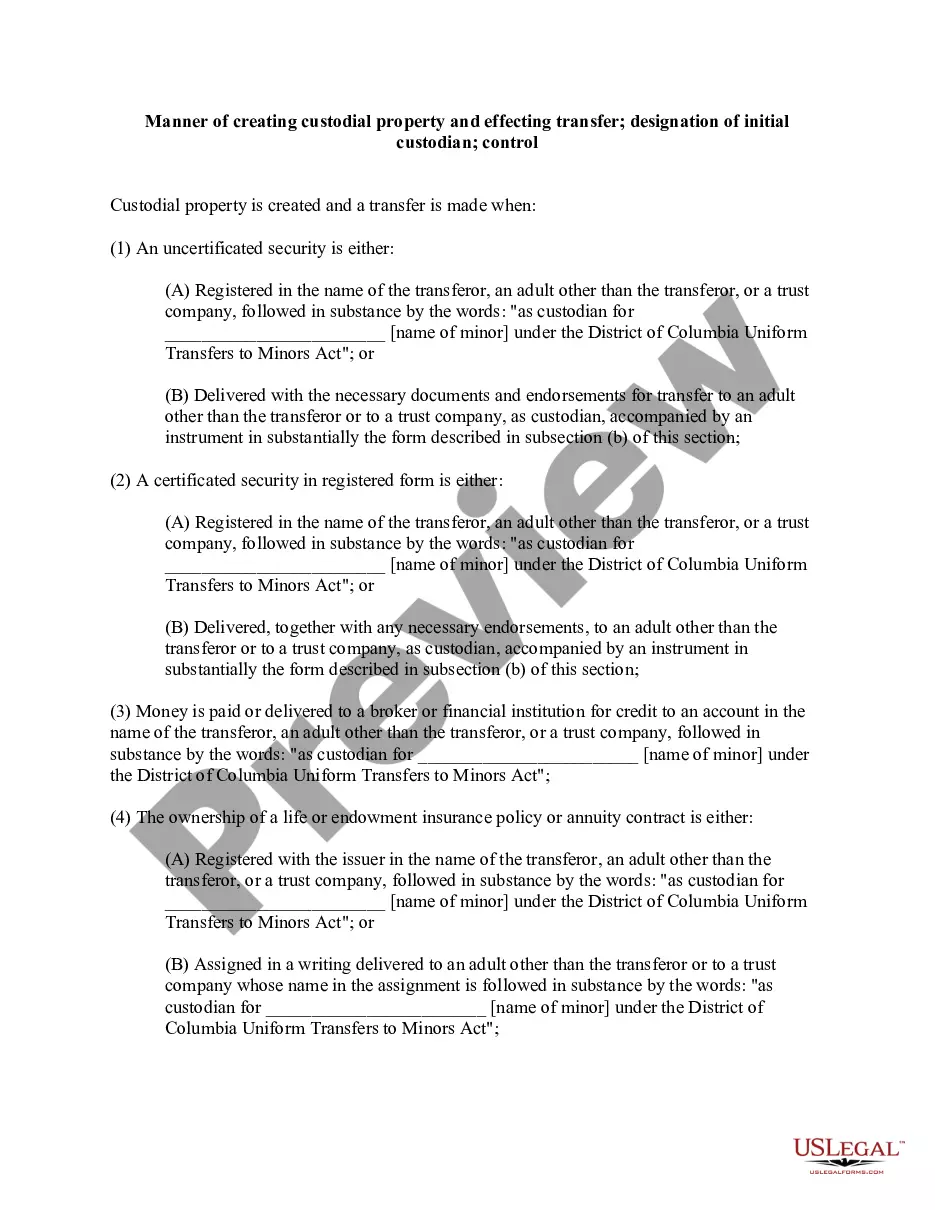

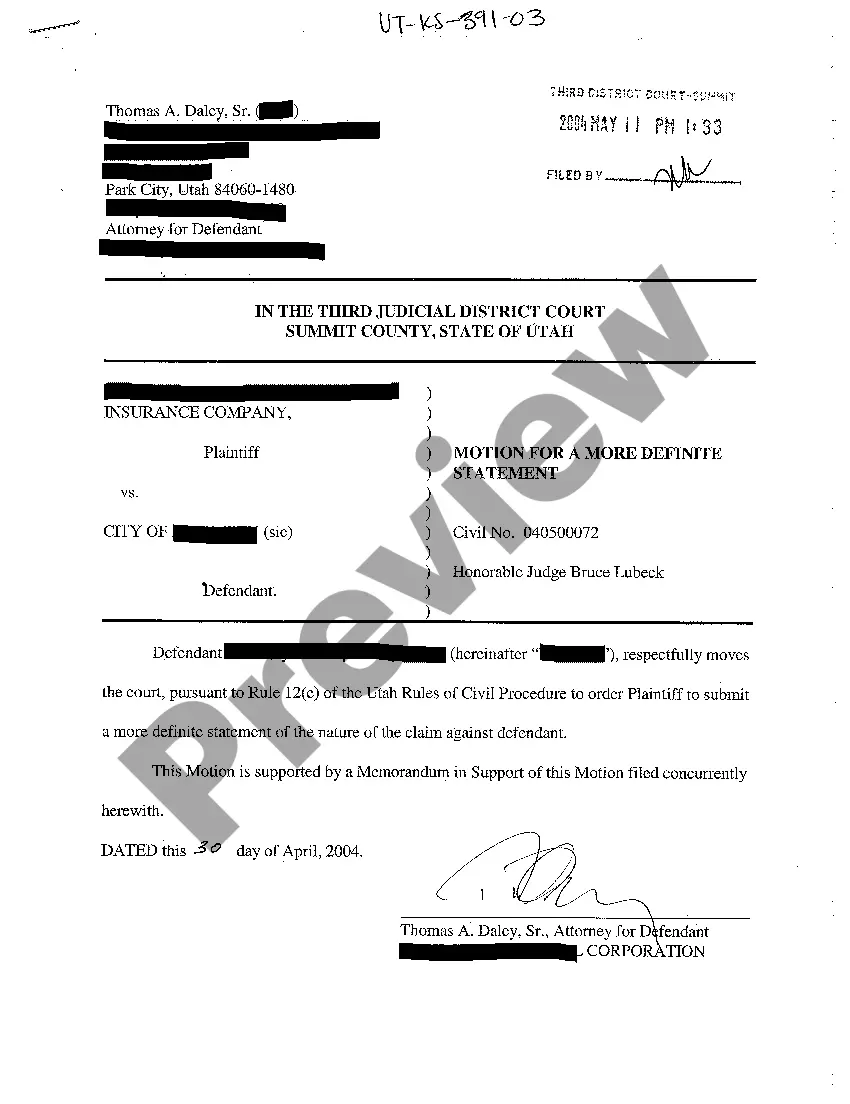

Description

How to fill out Insurance And Liability Coverage Due Diligence Request List?

If you wish to be thorough, obtain, or print sanctioned document formats, utilize US Legal Forms, the leading assortment of legal templates, available online.

Take advantage of the site’s straightforward and user-friendly search feature to locate the documents you require.

Various forms for commercial and personal use are organized by categories and states, or keywords.

Step 4. After identifying the form you need, click the Get now button. Choose the payment plan you prefer and enter your credentials to sign up for an account.

Step 5. Complete the purchase. You may use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to secure the Alabama Insurance and Liability Coverage Due Diligence Request List within just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Get button to retrieve the Alabama Insurance and Liability Coverage Due Diligence Request List.

- Additionally, you can access files you previously downloaded from the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s details. Remember to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative forms within the legal template category.

Form popularity

FAQ

What Is Due Diligence? Due diligence is an investigation, audit, or review performed to confirm facts or details of a matter under consideration. In the financial world, due diligence requires an examination of financial records before entering into a proposed transaction with another party.

In Alabama, the state's Mandatory Liability Insurance law requires vehicle owners to have the following minimum amounts of liability car insurance coverage: $25,000 for death or bodily injury liability to one person injured or killed in an accident you cause.

Alabama Mandatory Liability Insurance Law. The Alabama Mandatory Liability Insurance (MLI) law provides that no person shall operate, register, or maintain registration of a motor vehicle designed to be used on a public road or highway unless it is covered by a liability insurance policy.

There are two types of automobile third-party liability coverage:Bodily injury liability covers costs resulting from injuries to a person.Property damage liability covers costs resulting from damages to or loss of property.

Mandatory Liability Insurance - Login The Alabama Mandatory Liability Insurance Law provides that no person shall operate, register, or maintain registration of a motor vehicle designed to be used on a public road or highway unless it is covered by a liability insurance policy.

What Does Insurance Due Diligence Involve? Review and analyze business profile (i.e. SEC reports, financial statements, annual reports, bylaws, market reports, minutes, etc.) to identify key risks.

Below, we take a closer look at the three elements that comprise human rights due diligence identify and assess, prevent and mitigate and account , quoting from the Guiding Principles.

Sample Due Diligence Request ListFormation documents and operating agreements.Detailed ownership information and member register.Details of any other investment or ownership interest in any other entity held by the company.More items...

To register and operate a vehicle in Alabama, your auto insurance coverage must meet the following minimum requirements:Bodily injury liability: $25,000 per person and $50,000 per accident.Property damage liability: $25,000 per person.More items...

Liability coverage in Alabama Liability coverage is the only legally required car insurance in Alabama. This coverage is usually split into bodily injury and property damage coverages.