Alabama Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office

Description

How to fill out Notice Of Violation Of Fair Debt Act - Letter To Attorney Generals Office?

Choosing the right authorized record template could be a have a problem. Needless to say, there are tons of web templates available online, but how will you discover the authorized kind you want? Utilize the US Legal Forms internet site. The support offers 1000s of web templates, including the Alabama Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office, which can be used for enterprise and private demands. All the types are inspected by professionals and fulfill state and federal requirements.

Should you be currently registered, log in in your bank account and click on the Download switch to get the Alabama Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office. Make use of bank account to appear from the authorized types you have purchased in the past. Visit the My Forms tab of your respective bank account and have another duplicate from the record you want.

Should you be a fresh user of US Legal Forms, allow me to share easy guidelines that you can comply with:

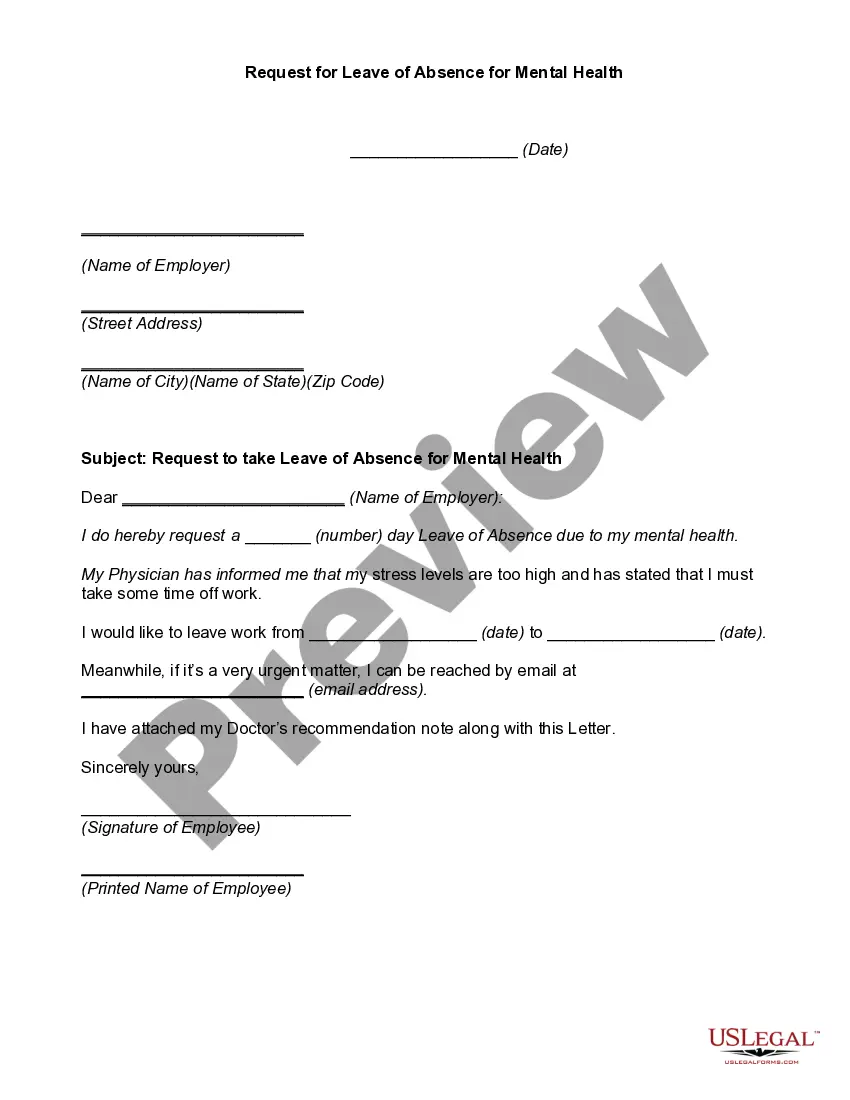

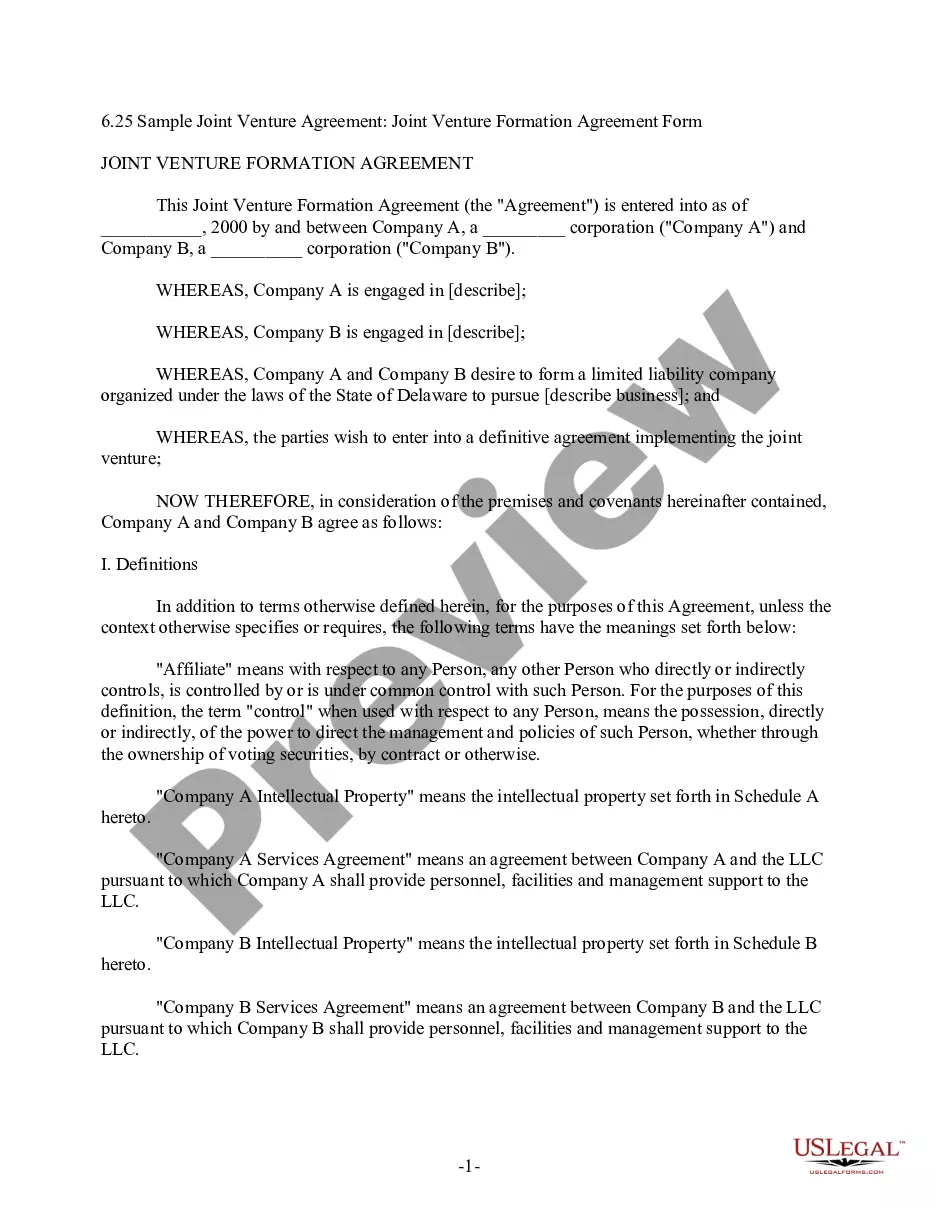

- Initial, be sure you have chosen the right kind for your city/county. You are able to check out the shape using the Review switch and browse the shape information to guarantee it is the best for you.

- In case the kind will not fulfill your expectations, take advantage of the Seach discipline to get the correct kind.

- Once you are sure that the shape is suitable, click the Buy now switch to get the kind.

- Opt for the prices strategy you need and enter the necessary details. Create your bank account and pay money for an order using your PayPal bank account or credit card.

- Pick the submit file format and down load the authorized record template in your device.

- Complete, revise and print and indicator the received Alabama Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office.

US Legal Forms may be the most significant local library of authorized types for which you can find various record web templates. Utilize the company to down load appropriately-manufactured papers that comply with state requirements.

Form popularity

FAQ

Collectors are required by Fair Debt Collection Practices Act (FDCPA) to send you a written debt validation notice with information about the debt they're trying to collect. It must be sent within five days of the first contact. The debt validation letter includes: The amount owed.

With regards to the debt collection agency, you will need to respond to their letters or phone calls. Written communication is the wisest idea in this situation, and make sure to keep copies of any correspondence.

A debt validation letter should include the name of your creditor and how much you owe, The letter will include information about when you need to pay the debt and how to dispute it.

You must fill out an Answer, serve the other side's attorney, and file your Answer form with the court within 30 days. If you don't, the creditor can ask for a default. If there's a default, the court won't let you file an Answer and can decide the case without you.

Consumers have 30 days from the initial communication about the debt (for example, the first letter received explaining the debt is in collections) to call the collector and ask for the debt to be verified in writing. The collector must return your request before it can start trying to collect the debt again.

Responding to a debt collection letter depends on the type of debt your creditors are claiming you owe. If you feel the amount of the proposed debt is correct and you can afford to pay it, do so. This will be a sufficient form of response and should halt any collection activity.

Responding to a debt collection letter depends on the type of debt your creditors are claiming you owe. If you feel the amount of the proposed debt is correct and you can afford to pay it, do so. This will be a sufficient form of response and should halt any collection activity.

If you receive a letter of claim and do not reply within 30 days, or you do not follow the pre-action protocol in any other way, the creditor can ask the court to increase the debt. They do not have to do this and are unlikely to do so if you agree you owe the money.