Alabama Articles Supplementary - classifying Preferred Stock as Cumulative Convertible Preferred Stock

Description

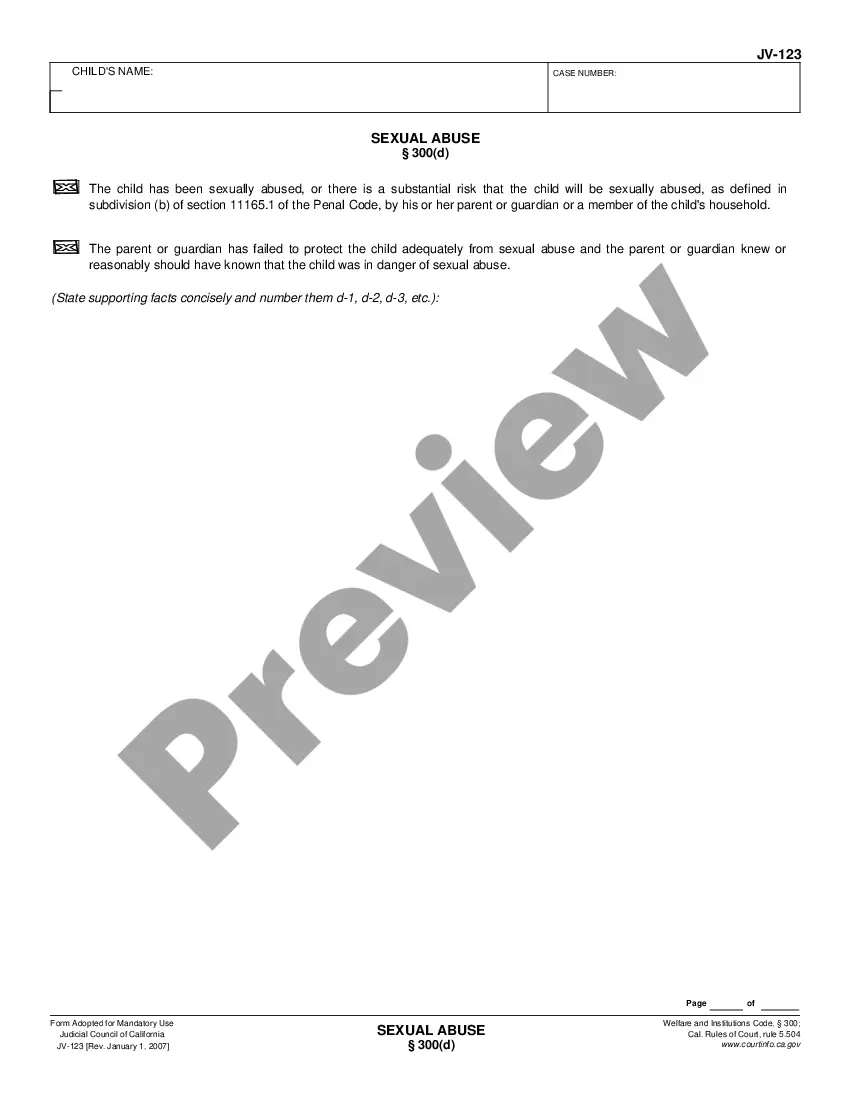

How to fill out Articles Supplementary - Classifying Preferred Stock As Cumulative Convertible Preferred Stock?

You may commit time on the web attempting to find the legal file design which fits the state and federal specifications you need. US Legal Forms offers thousands of legal kinds which can be analyzed by professionals. It is simple to down load or produce the Alabama Articles Supplementary - classifying Preferred Stock as Cumulative Convertible Preferred Stock from our services.

If you already have a US Legal Forms profile, you are able to log in and click the Obtain switch. After that, you are able to full, change, produce, or signal the Alabama Articles Supplementary - classifying Preferred Stock as Cumulative Convertible Preferred Stock. Every legal file design you acquire is yours eternally. To obtain yet another backup for any purchased type, proceed to the My Forms tab and click the related switch.

If you are using the US Legal Forms internet site the first time, keep to the simple directions below:

- Very first, be sure that you have chosen the proper file design to the area/area that you pick. Browse the type outline to ensure you have picked out the correct type. If offered, utilize the Preview switch to search from the file design too.

- If you want to discover yet another variation in the type, utilize the Look for industry to get the design that meets your requirements and specifications.

- Once you have discovered the design you desire, just click Buy now to carry on.

- Find the pricing program you desire, key in your qualifications, and register for an account on US Legal Forms.

- Total the financial transaction. You should use your Visa or Mastercard or PayPal profile to purchase the legal type.

- Find the format in the file and down load it to the system.

- Make changes to the file if needed. You may full, change and signal and produce Alabama Articles Supplementary - classifying Preferred Stock as Cumulative Convertible Preferred Stock.

Obtain and produce thousands of file layouts utilizing the US Legal Forms web site, which provides the largest selection of legal kinds. Use professional and condition-specific layouts to tackle your business or person needs.

Form popularity

FAQ

The four main types of preference shares are callable shares, convertible shares, cumulative shares, and participatory shares.

Convertible preferred shares can be converted into common stock at a fixed conversion ratio. Once the market price of the company's common stock rises above the conversion price, it may be worthwhile for the preferred shareholders to convert and realize an immediate profit.

Issuing convertible preferred stock is one of the many ways companies can raise capital to fund their operations and expansion. Companies will choose to sell convertible preferred stock because it enables them to avoid taking on debt while limiting the potential dilution of selling additional common stock.

Convertible preferred stock offers the investor the benefits of both preferred stock and common stock. Investors get the stability, liquidation priority, and higher dividends of preferred stock, but they also have the option to convert their shares into common stock later if they believe that the price will go up.

If preferred stock is non-cumulative, preferred shares never receive payments for past dividends that were missed. If preferred stock is cumulative, any past dividends that were missed are paid before any payments are applied to the current period.

After multiplying the number of preferred shares by the conversion ratio, we can calculate the number of convertible common shares. Then, the conversion price can be calculated by dividing the par value of the convertible preferred stock by the number of common shares that could be received.

However, convertible preferred stock also has several drawbacks, such as dilution of ownership, lower dividend rates, higher costs, and risk of conversion.

Convertible notes are usually faster and cheaper to negotiate and close than preferred equity, as they involve less legal documentation and due diligence. They also defer the valuation of the startup until the Series A round, which can be beneficial if the startup grows significantly in the meantime.