Alabama Proposal to adopt and approve management stock purchase plan

Description

How to fill out Proposal To Adopt And Approve Management Stock Purchase Plan?

Are you presently in a position in which you need files for possibly organization or specific uses virtually every day time? There are plenty of legitimate file templates accessible on the Internet, but locating kinds you can trust isn`t simple. US Legal Forms gives a large number of type templates, like the Alabama Proposal to adopt and approve management stock purchase plan, that are written in order to meet state and federal demands.

If you are currently informed about US Legal Forms web site and possess a free account, simply log in. Next, you may download the Alabama Proposal to adopt and approve management stock purchase plan design.

Unless you have an profile and want to start using US Legal Forms, follow these steps:

- Find the type you want and ensure it is for that right metropolis/county.

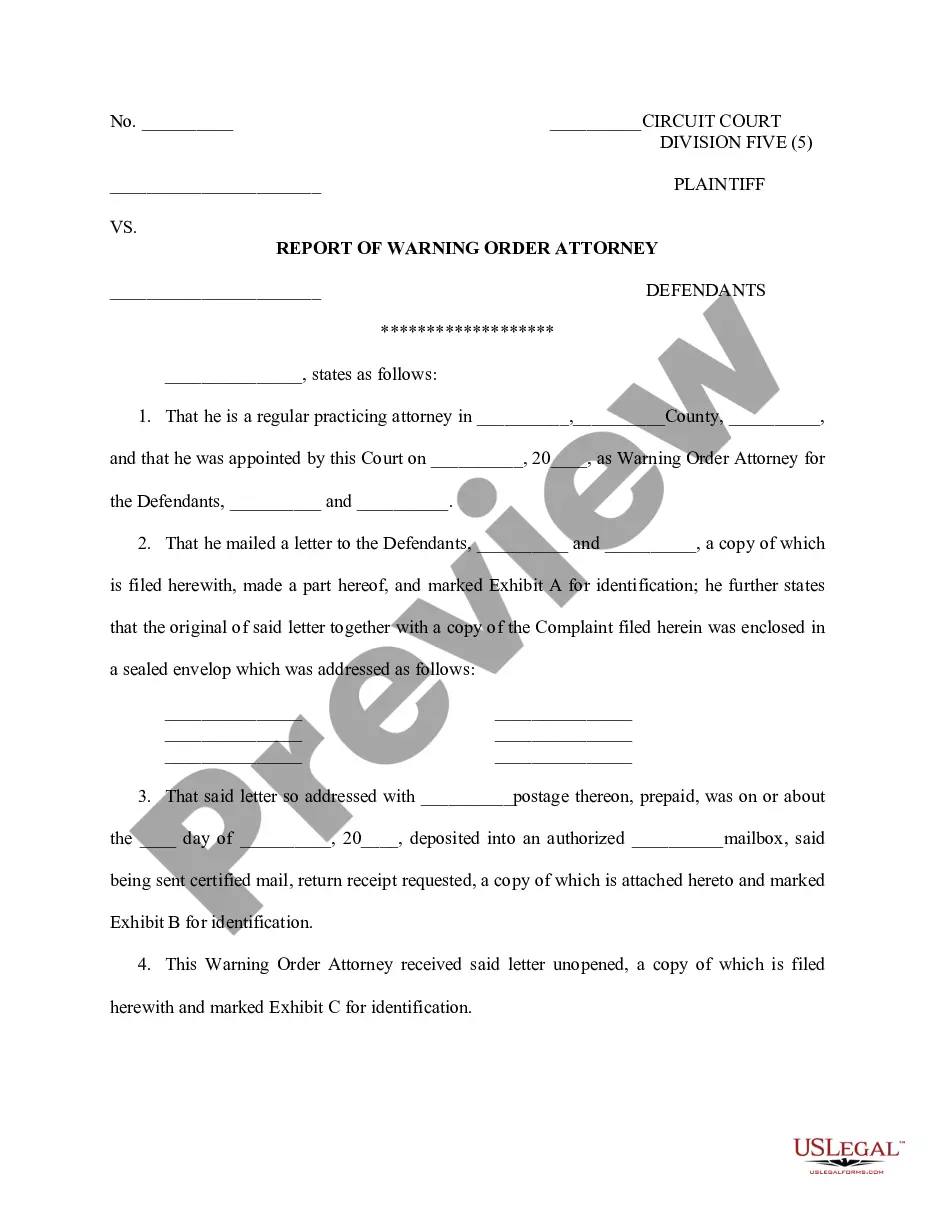

- Utilize the Review button to analyze the shape.

- Look at the explanation to actually have chosen the appropriate type.

- In the event the type isn`t what you`re searching for, use the Research field to discover the type that fits your needs and demands.

- When you get the right type, just click Get now.

- Opt for the prices program you need, fill out the specified information to create your bank account, and pay for the transaction using your PayPal or credit card.

- Choose a hassle-free paper file format and download your copy.

Discover all the file templates you possess purchased in the My Forms menus. You can get a more copy of Alabama Proposal to adopt and approve management stock purchase plan any time, if needed. Just click on the needed type to download or produce the file design.

Use US Legal Forms, by far the most extensive selection of legitimate varieties, in order to save some time and stay away from faults. The support gives professionally made legitimate file templates which you can use for a variety of uses. Generate a free account on US Legal Forms and begin producing your lifestyle easier.

Form popularity

FAQ

Employee Stock Purchase Plans (ESPPs) are widely regarded as one of the most simple and straightforward equity compensation strategies available to businesses today. There are two major types of ESPP: 1) Qualified ESPP offering tax advantages and 2) Non-qualified ESPP offering flexibility. Qualified vs Non-Qualified ESPP. Know The Score. - Global Shares globalshares.com ? academy ? qualified-non... globalshares.com ? academy ? qualified-non...

Can I Sell ESPP Stock Right Away? Yes, you can sell stock purchased through your ESPP plan immediately if you want to guarantee that you profit from your discount. Otherwise, the value of the stock may go up, which increases your profit, or it may go down, causing you to lose money. Employee Stock Purchase Plan (ESPP): What It Is and How It ... Investopedia ? terms ? espp Investopedia ? terms ? espp

ESPP Eligibility Cannot participate in an ESPP if an employee owns more than 5% of the company's stock. Must be employed with the company for a specific period of time. (e.g., 1 to 2 years). ESPPs are a benefit. Employee Stock Purchase Plan (ESPP) - Corporate Finance Institute corporatefinanceinstitute.com ? resources ? career corporatefinanceinstitute.com ? resources ? career

An ESPP must be approved by the stockholders of the sponsoring corporation within the period commencing 12 months before and ending 12 months after the ESPP is adopted by the sponsoring corporation's board of directors.

You meet the holding period requirement if you don't sell the stock until the end of the later of: The 1-year period after the stock was transferred to you, or. The 2-year period after the option was granted.

The IRS limits your Employee Stock Purchase Plan (ESPP) contributions to a pre-discounted $25,000 per calendar year. Companies can further restrict your contributions, if they choose, to either a percentage of your salary or a flat dollar amount. Employee Stock Purchase Plan (ESPP): The 5 Things You Need to ... cordantwealth.com ? espp cordantwealth.com ? espp