Alabama Adoption of Stock Option Plan of WSFS Financial Corporation

Description

How to fill out Adoption Of Stock Option Plan Of WSFS Financial Corporation?

Discovering the right legal record template might be a have a problem. Needless to say, there are tons of templates available online, but how do you obtain the legal develop you require? Take advantage of the US Legal Forms site. The services provides 1000s of templates, including the Alabama Adoption of Stock Option Plan of WSFS Financial Corporation, that you can use for organization and private demands. Each of the kinds are checked by experts and meet federal and state requirements.

Should you be presently signed up, log in to the accounts and click the Obtain key to get the Alabama Adoption of Stock Option Plan of WSFS Financial Corporation. Make use of accounts to appear throughout the legal kinds you possess ordered earlier. Proceed to the My Forms tab of your own accounts and have yet another version of your record you require.

Should you be a whole new end user of US Legal Forms, listed here are basic directions that you should stick to:

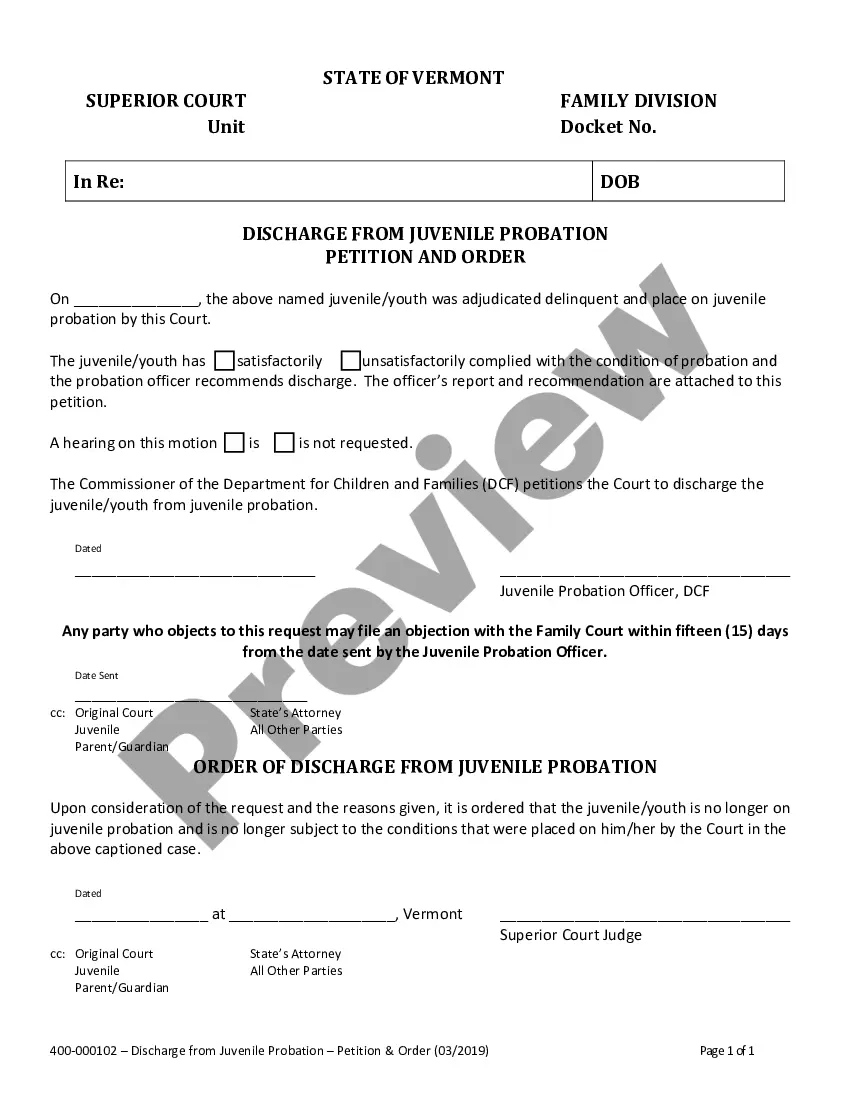

- Initially, make certain you have chosen the proper develop for your personal city/area. You can check out the shape utilizing the Review key and read the shape description to make certain it is the right one for you.

- If the develop does not meet your expectations, make use of the Seach field to discover the proper develop.

- When you are certain that the shape would work, go through the Purchase now key to get the develop.

- Pick the costs plan you want and enter the necessary info. Design your accounts and pay for your order with your PayPal accounts or Visa or Mastercard.

- Pick the document structure and download the legal record template to the product.

- Total, edit and printing and sign the attained Alabama Adoption of Stock Option Plan of WSFS Financial Corporation.

US Legal Forms is the biggest collection of legal kinds for which you can discover different record templates. Take advantage of the company to download skillfully-created files that stick to express requirements.

Form popularity

FAQ

WSFS common stock is traded on the NASDAQ stock exchange under the symbol WSFS.

Usually, you have several choices when you exercise your vested stock options: Hold Your Stock Options. Initiate an Exercise-and-Hold Transaction (cash for stock) Initiate an Exercise-and-Sell-to-Cover Transaction.

A transfer of employee stock options out of the employee's estate (i.e., to a family member or to a family trust) offers two main estate planning benefits: first, the employee is able to remove a potentially high growth asset from his or her estate; second, a lifetime transfer may also save estate taxes by removing ...

The transfer of the vested option is treated as a completed gift for gift-tax purposes. In 2023, you can generally give annual gifts of up to $17,000 (married couples $34,000) to each donee. Any gifts that exceed these aggregate annual limits go against the lifetime gift-tax exclusion.

Your stock options give you the right to exercise if and when you want to, but you're never obligated to do so. If you choose to exercise your stock options, you can hold on to your company shares or sell them.