Alabama Employee Evaluation Form for Farmer

Description

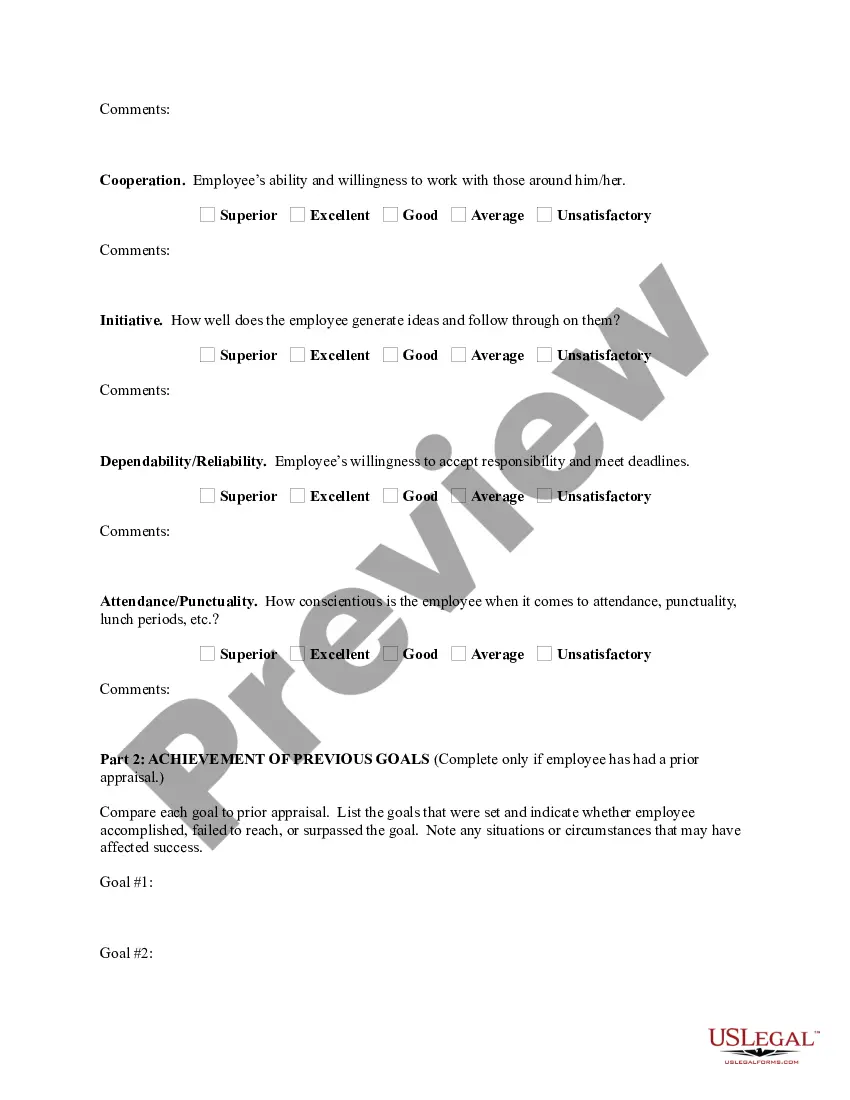

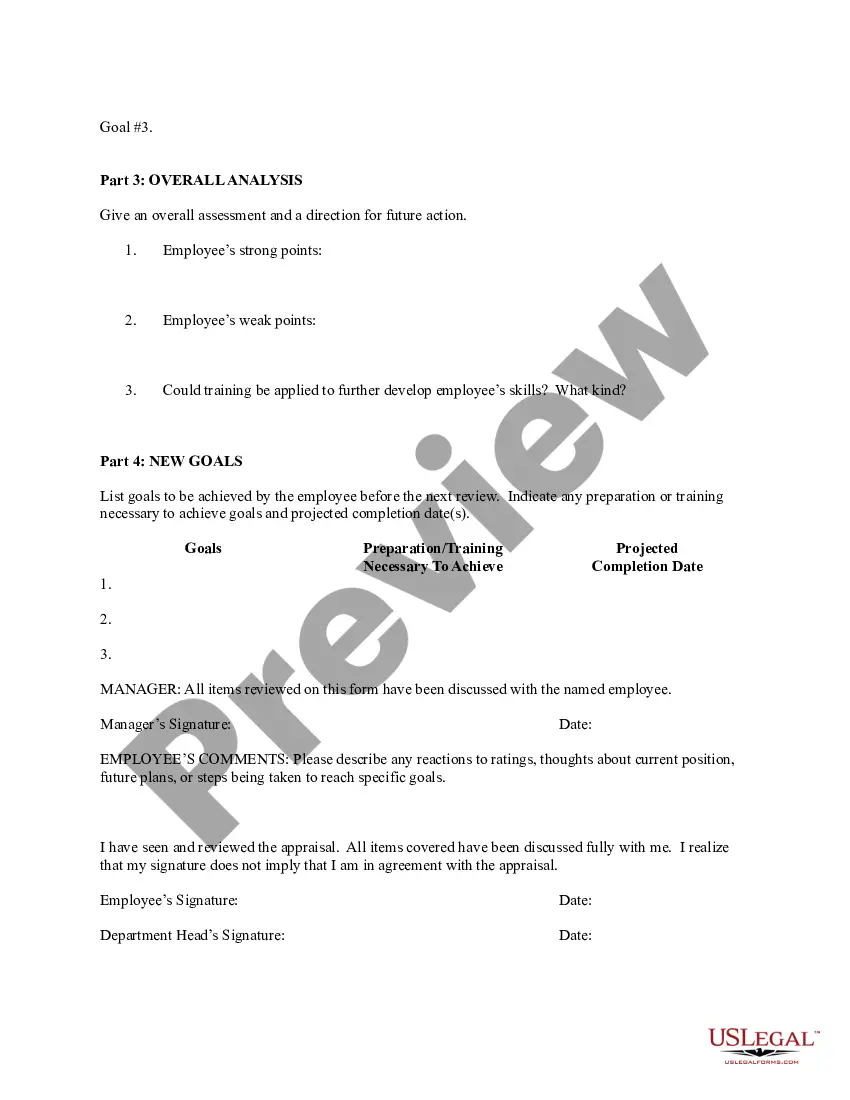

How to fill out Employee Evaluation Form For Farmer?

US Legal Forms - one of the most prominent collections of legal documents in the USA - provides a broad selection of legal form templates that you can purchase or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Alabama Employee Assessment Form for Farmers in no time.

If you are a member, Log In and obtain the Alabama Employee Assessment Form for Farmers from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the form to your device.

- Firstly, ensure you have selected the correct form for your city/county.

- Click the Preview button to review the content of the form.

- Read the description of the form to confirm you have chosen the right one.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- If you’re satisfied with the form, confirm your choice by clicking the Get now button.

- Next, select the pricing plan you prefer and provide your credentials to register for the account.

Form popularity

FAQ

Weekly, monthly, and bi-monthly payments should be paid online ( ). A farmer is required to file Form 943 annually to verify payments were correct. All non-farmers are required to file Form 941 quarterly.

The rates are to include an employment security assessment of 0.06%. The unemployment tax rate for new employers is to be 2.7% in 2020, unchanged from 2019. Alabama's unemployment-taxable wage base is to be $8,000 for 2020, unchanged from 2019.

Each new employee will need to fill out the I-9 Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services. The I-9 Form is used to confirm citizenship and eligibility to work in the U.S.

Please email status@labor.alabama.gov or call (334) 954-4730.

Inclusive of the 0.06% Employment Security Enhancement Assessment (ESA), an Employer's rate can vary from 0.20% to 6.80% depending on the one of four rate schedules in effect, plus any applicable shared cost.

New Hire Paperwork: AlabamaAlabama employers must obtain a completed Form A-4, Employee's Withholding Tax Exemption Certificate, from each employee. Alabama does not accept the federal Form W-4.Employers must provide notice to new hires regarding misrepresentations with respect to workers' compensation benefits.

The maximum rate is 6.2 percent. New employers will continue to pay the entry rate of 2.7 percent.

Tax rates range from 0.65% to 6.8% and include an employment security assessment of 0.06%. The unemployment tax rate for new employers is 2.7% in 2021, unchanged from 2020. Alabama's unemployment-taxable wage base is $8,000.

What is the new account rate? Employers newly liable under the Alabama UC law pay tax at the rate of 2.70% on the first $8,000 of wages for each employee. Subsequent rates are determined by Experience Rating.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.