Alabama New Hire Orientation Checklist

Description

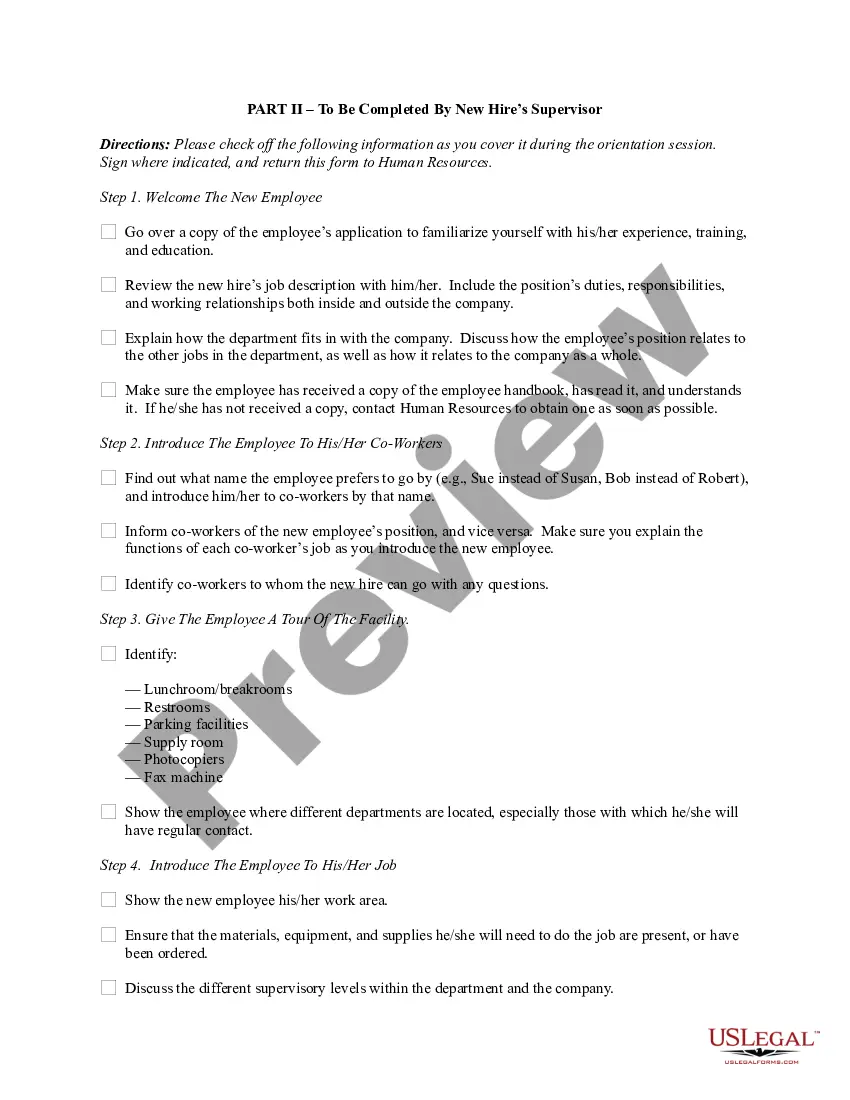

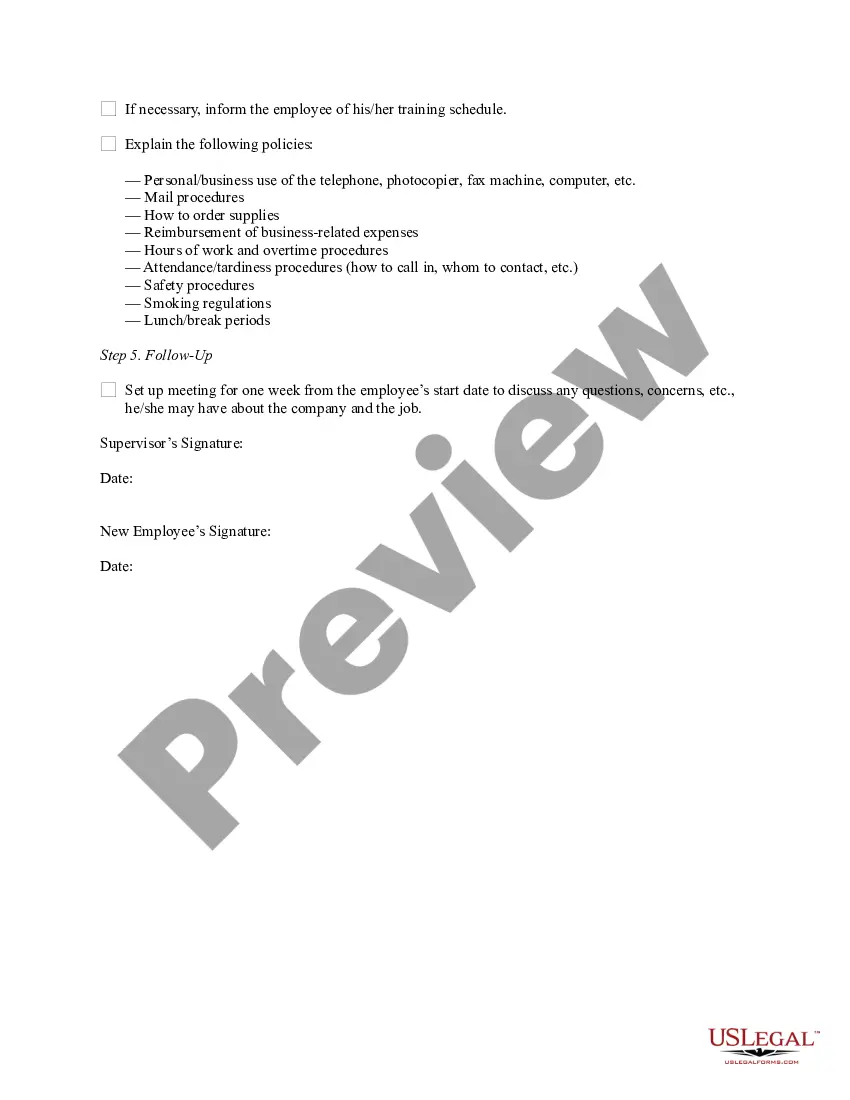

How to fill out New Hire Orientation Checklist?

If you want to finalize, retrieve, or print sanctioned document templates, make use of US Legal Forms, the premier assortment of legal forms, available online.

Utilize the site’s user-friendly and accessible search to find the documents you require.

Various templates for business and personal uses are categorized by type and categories, or terms.

Every legal document template you acquire is yours forever. You will have access to every form you downloaded within your account. Click on the My documents section and choose a form to print or download again.

Compete to download, and print the Alabama New Hire Orientation Checklist with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- Employ US Legal Forms to locate the Alabama New Hire Orientation Checklist in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Acquire option to access the Alabama New Hire Orientation Checklist.

- You can also access forms you previously submitted electronically in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct state/country.

- Step 2. Use the Review option to examine the form’s details. Don’t forget to read the information.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you want, click the Buy now option. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to conduct the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Alabama New Hire Orientation Checklist.

Form popularity

FAQ

New Hires means a new employee who, as an inducement essential to the individual's entering into an employment relationship with the Company, is to receive Options.

New Hire Paperwork: AlabamaAlabama employers must obtain a completed Form A-4, Employee's Withholding Tax Exemption Certificate, from each employee. Alabama does not accept the federal Form W-4.Employers must provide notice to new hires regarding misrepresentations with respect to workers' compensation benefits.

Employees must submit basic information including name, Social Security number and citizenship status. Employees also must supply documentation along with this form to prove they are eligible to work in the United States. Documentation examples include a current passport, state issued I.D. and Social Security card.

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Newly hired employee or New Hire means any employee, whether permanent, full-time, or part-time, hired by the Office and who is still employed as of the date of new employee orientation.

New Hire Paperwork: AlabamaAlabama employers must obtain a completed Form A-4, Employee's Withholding Tax Exemption Certificate, from each employee. Alabama does not accept the federal Form W-4.Employers must provide notice to new hires regarding misrepresentations with respect to workers' compensation benefits.

They are flexible, willing to change and can adapt to different roles. They are supportive and respectful of their colleagues. Engaged employees improve the morale of others and are more likely to go above and beyond for both their team and customers.

Reporting Requirements Since October 1,1997, all employers are required to report each newly hired or recalled employee to the Alabama Department of Labor. The information must be furnished within seven days from the date of hire or reemployment.

Register online with the Alabama Department of Revenue.Scroll to the Businesses tile.Click Register a business/Obtain a New Tax Account Number.Complete all remaining steps with the agencyif you have questions, contact the agency directly.

The law defines a "newly hired employee" as (i) an employee who has not previously been employed by the employer; or (ii) was previously employed by the employer but has been separated from such prior employment for at least 60 consecutive days.