Alabama Graphic Artist Agreement - Self-Employed Independent Contractor

Description

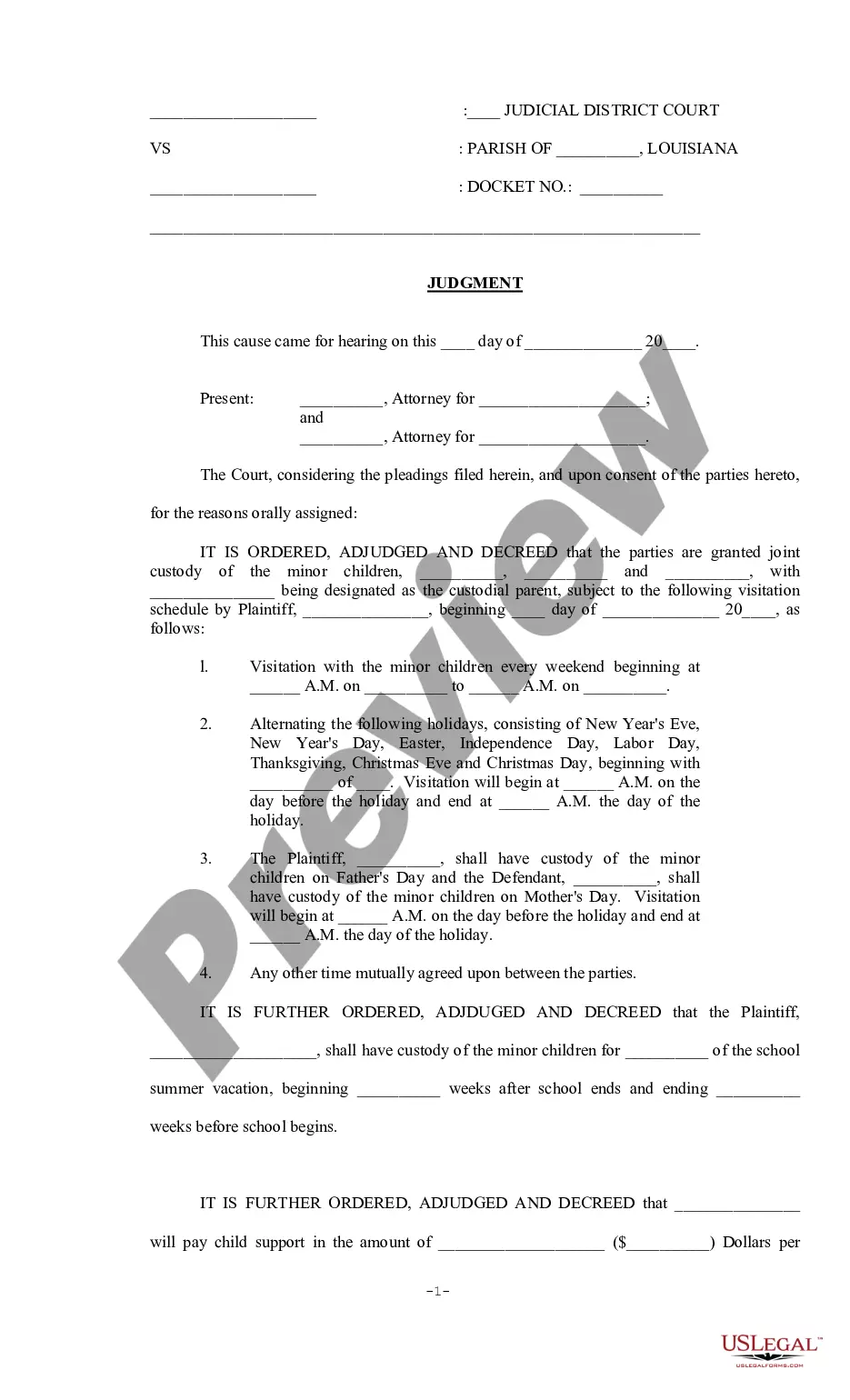

How to fill out Graphic Artist Agreement - Self-Employed Independent Contractor?

If you need to obtain, acquire, or print valid document templates, utilize US Legal Forms, the most extensive collection of legal forms available online. Take advantage of the site’s straightforward and convenient search to locate the documents you need. Various templates for business and personal purposes are categorized by type and state, or keywords. Use US Legal Forms to find the Alabama Graphic Artist Agreement - Self-Employed Independent Contractor in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the Alabama Graphic Artist Agreement - Self-Employed Independent Contractor. You can also access forms you previously saved in the My documents tab of your account.

If you are using US Legal Forms for the first time, follow the steps below: Step 1. Ensure you have selected the form for your appropriate city/region. Step 2. Use the Review option to inspect the form’s content. Don’t forget to check the description. Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other forms from the legal form template. Step 4. Once you have found the form you need, select the Purchase now button. Choose your preferred pricing plan and enter your details to register for an account. Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase. Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Alabama Graphic Artist Agreement - Self-Employed Independent Contractor.

- Each legal document template you purchase is yours forever.

- You will have access to every form you saved in your account.

- Click on the My documents section and select a form to print or download again.

- Compete and obtain, and print the Alabama Graphic Artist Agreement - Self-Employed Independent Contractor with US Legal Forms.

- There are numerous professional and state-specific forms available for your business or personal needs.

Form popularity

FAQ

In Alabama, the amount of work you can perform without a contractor license varies depending on the type of project. For most graphic design tasks, you do not require a contractor license. However, having a solid Alabama Graphic Artist Agreement - Self-Employed Independent Contractor is vital to clarify your business relationship. Always verify local regulations to avoid complications.

Yes, graphic designers often work as independent contractors. This arrangement allows them to maintain control over their work and schedule. As a graphic designer, you can benefit from the flexibility that the Alabama Graphic Artist Agreement - Self-Employed Independent Contractor provides. Ensure your contract details your specific services and payment terms to protect your rights.

Creating an independent contractor agreement involves defining the roles and responsibilities of both parties. First, clearly outline the scope of work, payment terms, and deadlines. Use the Alabama Graphic Artist Agreement - Self-Employed Independent Contractor as a template to ensure you cover essential elements. Always consider consulting a legal expert for added peace of mind.

Filling out an independent contractor form requires you to input your business name, tax identification, and details about your services. Make sure to include payment information and any relevant terms of the agreement. Choosing the Alabama Graphic Artist Agreement - Self-Employed Independent Contractor from uslegalforms simplifies this process, ensuring you have a comprehensive and compliant form ready for your clients.

Writing an independent contractor agreement involves clearly defining the relationship between you and the client. Include essential elements like the scope of work, payment details, and termination clauses. For a precise and legally sound document, consider using the Alabama Graphic Artist Agreement - Self-Employed Independent Contractor offered by uslegalforms, which provides templates tailored for creative professionals.

To fill out an independent contractor agreement, start by including your personal details, the client’s information, and a description of the services you will provide. Specify payment terms, deadlines, and any other expectations clearly. An Alabama Graphic Artist Agreement - Self-Employed Independent Contractor from uslegalforms can guide you through this process to ensure you cover all necessary points.

An artist can be classified as an independent contractor, especially when they work on a freelance basis. This classification often allows for flexibility in projects and schedules, and it enables artists to set their rates. Utilizing an Alabama Graphic Artist Agreement - Self-Employed Independent Contractor ensures that your rights and obligations are protected as you navigate your career.

Yes, independent contractors file their taxes as self-employed individuals. They report their income using IRS Form 1040 and Schedule C to detail business profits or losses. By using the Alabama Graphic Artist Agreement - Self-Employed Independent Contractor, you can clearly outline your status and responsibilities, ensuring compliance with tax regulations.

An independent contractor is usually anyone who offers services on a contractual basis, rather than being an employee. Key qualifications include having control over their work, setting their hours, and invoicing clients for services rendered. To formalize this relationship, you can use an Alabama Graphic Artist Agreement - Self-Employed Independent Contractor, which delineates the terms of engagement clearly and professionally.

Yes, independent contractors are typically considered self-employed individuals. They provide services to clients without being an employee of a company. When you operate under an Alabama Graphic Artist Agreement - Self-Employed Independent Contractor, it reinforces your status as self-employed, clarifying your autonomy in managing your work and finances.