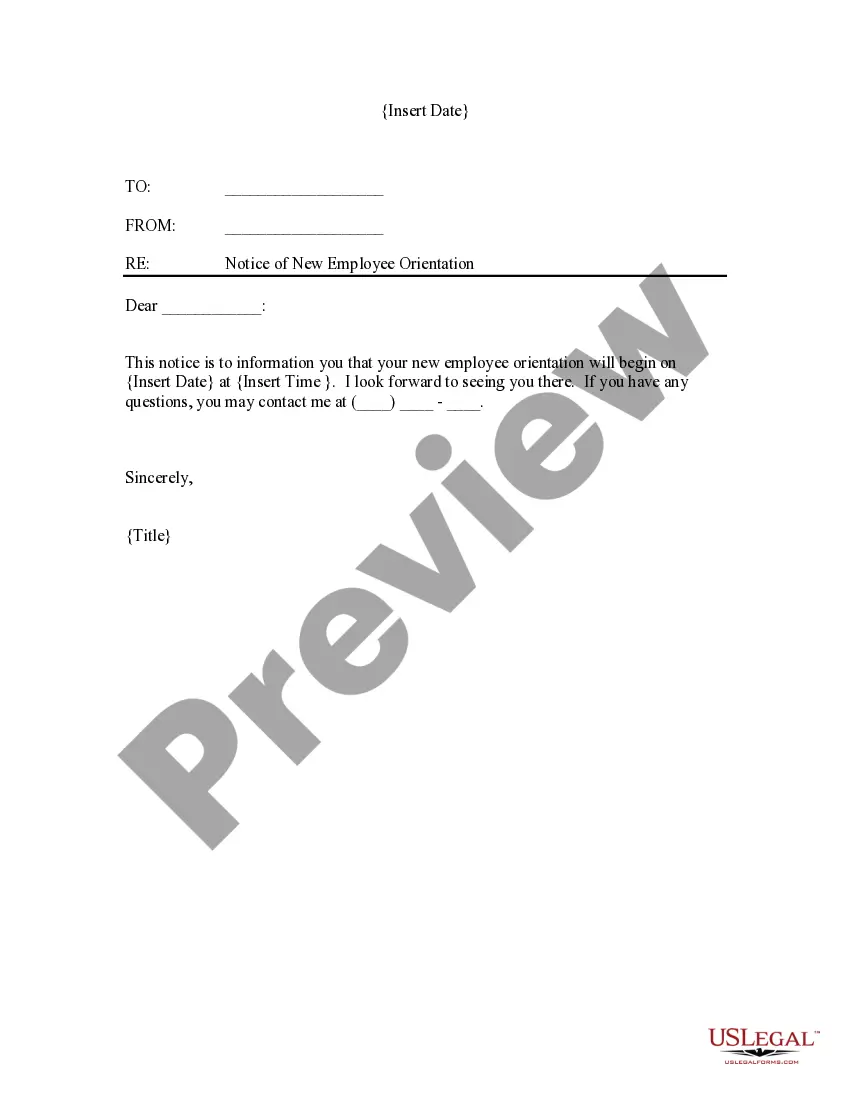

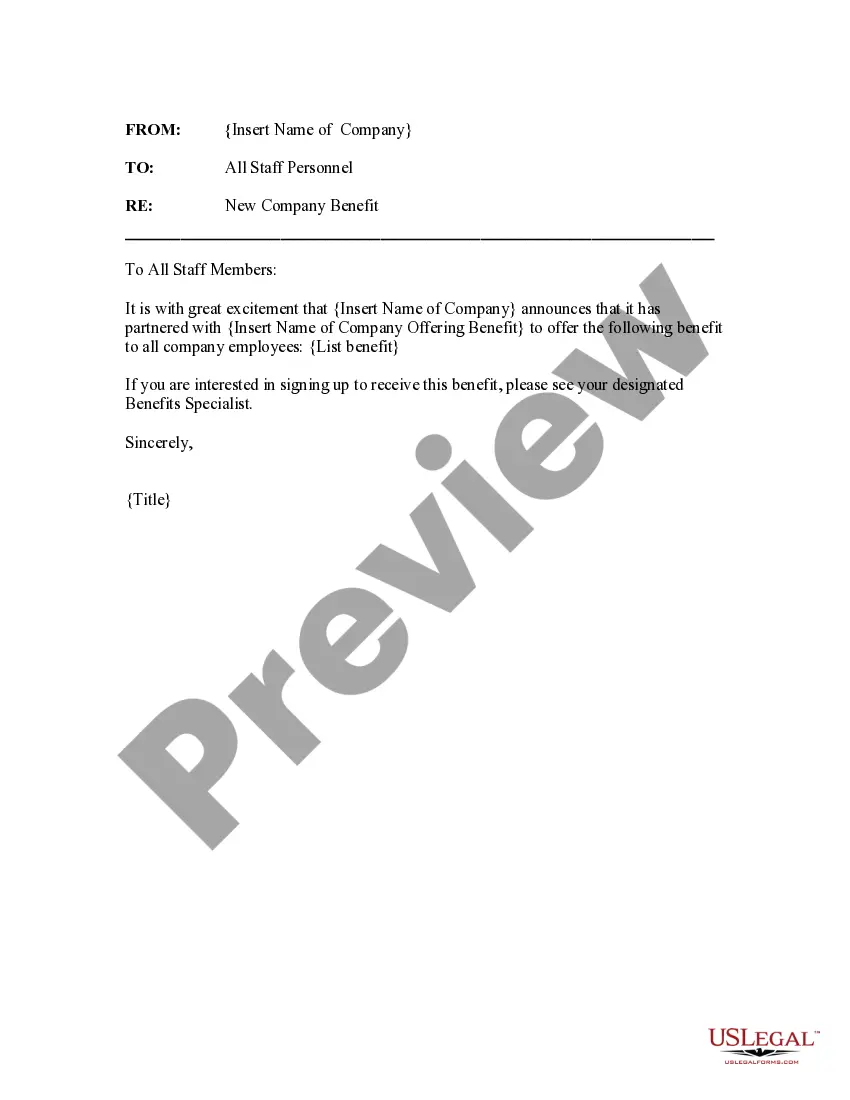

Alabama New Company Benefit Notice

Description

How to fill out New Company Benefit Notice?

Are you in a situation where you require documentation for both business or personal purposes almost every workday? There are numerous legal document templates accessible online, yet finding forms you can trust is not easy.

US Legal Forms provides thousands of template formats, including the Alabama New Company Benefit Notice, designed to meet federal and state stipulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Subsequently, you can download the Alabama New Company Benefit Notice template.

- Acquire the form you need and ensure it is for your specific city/region.

- Use the Preview button to examine the form.

- Review the details to confirm that you have selected the correct form.

- If the form is not what you’re looking for, utilize the Search area to find the form that meets your needs and criteria.

- Once you find the right form, click Buy now.

- Choose the pricing plan you prefer, fill in the required information to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient document format and download your copy.

Form popularity

FAQ

Collecting Unemployment After Being FiredAbsences or tardiness, failing to follow the rules, endangering the safety of coworkers, and disregarding instructions or orders are all considered misconduct.

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

In general, individuals are disqualified for the week(s) they are unemployed due to a work stoppage resulting from a labor dispute. Other requirements for remaining eligible to receive unemployment benefits include: 1. You must be available for work during each week that you wish to draw benefits.

New Hire Paperwork: AlabamaAlabama employers must obtain a completed Form A-4, Employee's Withholding Tax Exemption Certificate, from each employee. Alabama does not accept the federal Form W-4.Employers must provide notice to new hires regarding misrepresentations with respect to workers' compensation benefits.

On the contrary, if an employer ignores these claims, they may find their unemployment taxes eating into their bottom line. If the employer does not respond or responds too late, the worker could automatically get UI benefits, in most states.

Please email status@labor.alabama.gov or call (334) 954-4730.

By emergency rule adopted July 10, 2020, the Alabama Department of Labor (ADOL) now requires all Alabama employers to provide notice of the potential availability of unemployment benefits to employees at the time of their separation. The requirement to notify employees took effect immediately.

Q. Can I receive unemployment if I am working part time, my hours have been reduced by my employer, or I have been furloughed? If you did not ask for a reduction in hours, it is possible to receive unemployment if you are working and your gross weekly earnings are LESS than your weekly benefit amount.

Such disqualification shall be for a period of not less than one nor more than 10 weeks from the date of said failure.

New Hire Paperwork: AlabamaAlabama employers must obtain a completed Form A-4, Employee's Withholding Tax Exemption Certificate, from each employee. Alabama does not accept the federal Form W-4.Employers must provide notice to new hires regarding misrepresentations with respect to workers' compensation benefits.