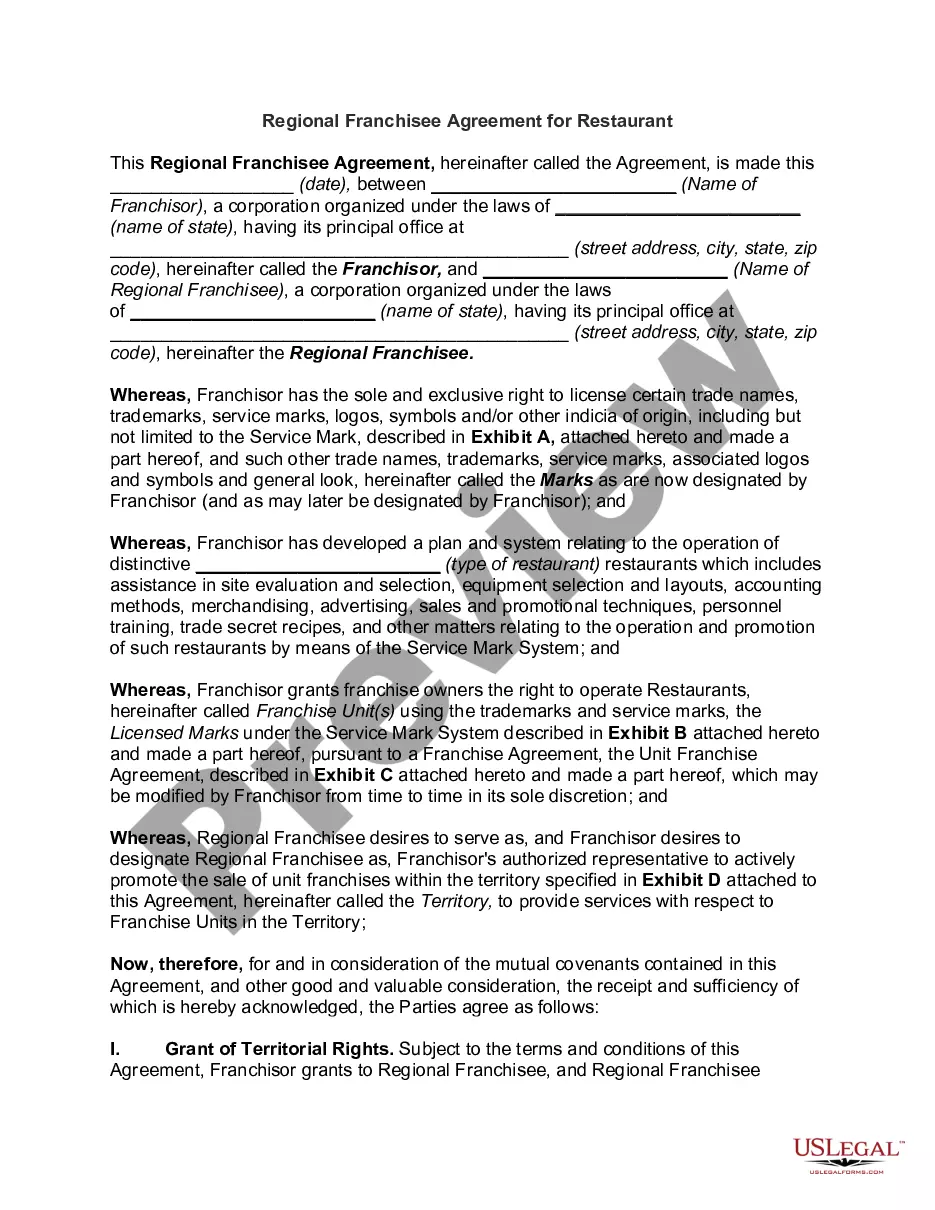

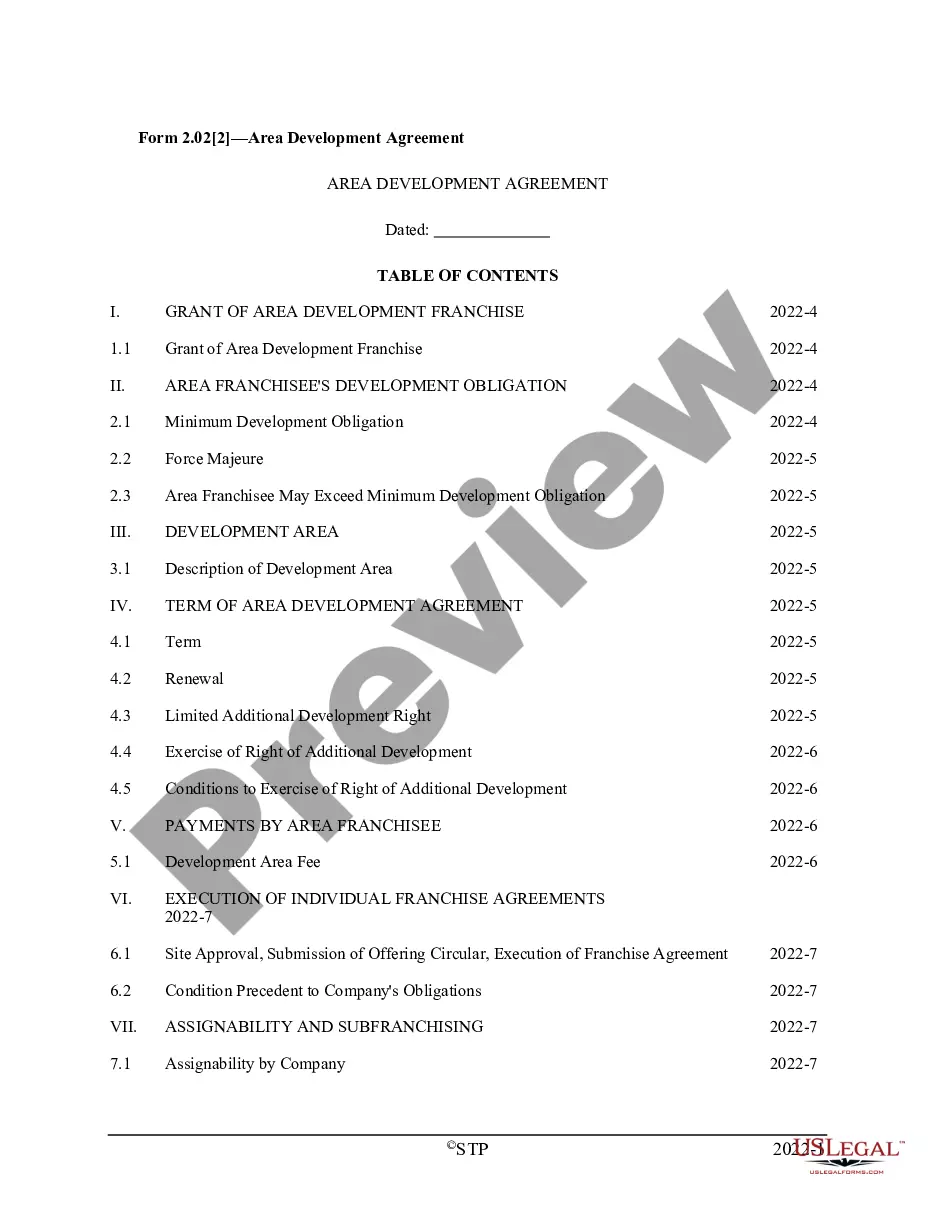

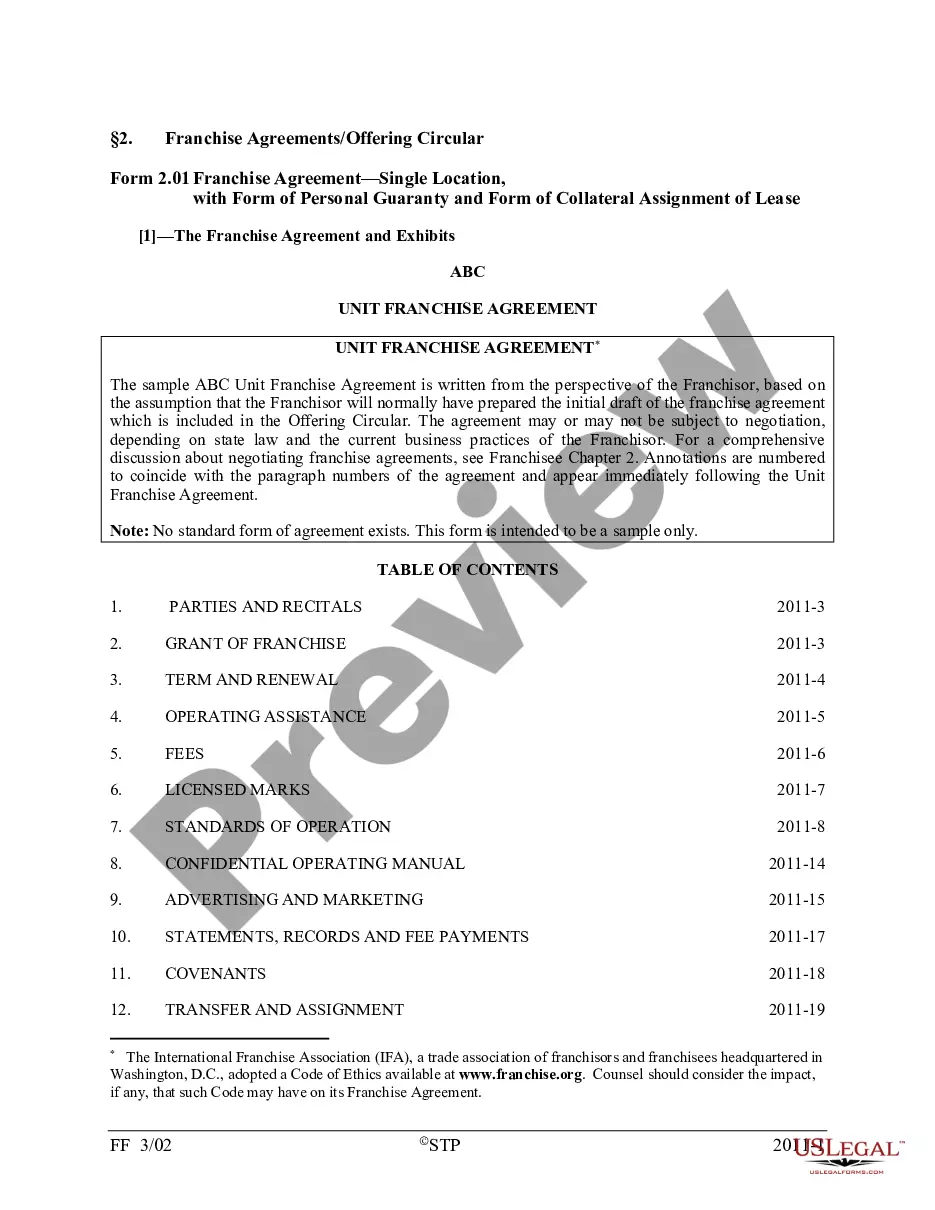

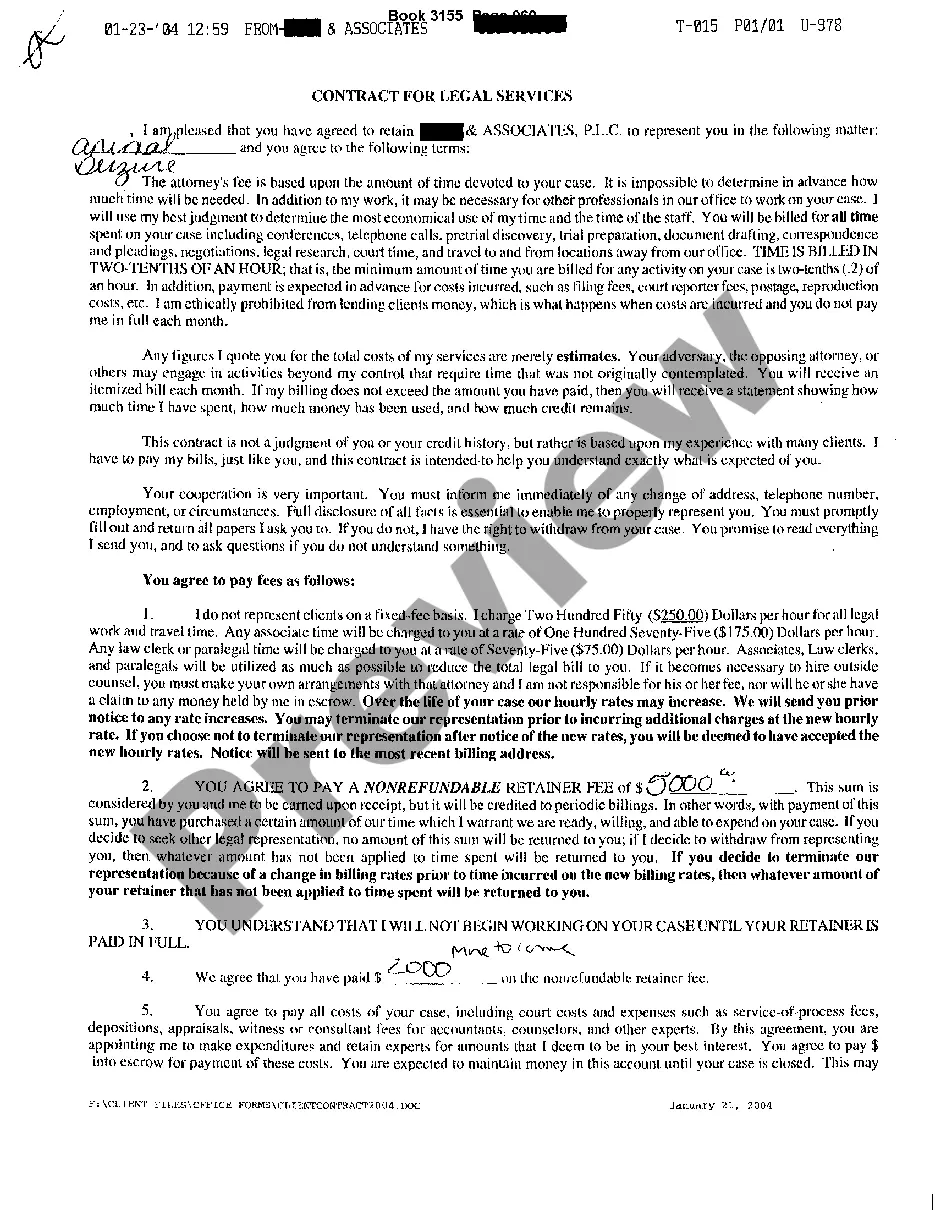

Alabama Area Representative Agreement

Description

How to fill out Area Representative Agreement?

US Legal Forms - one of the most significant libraries of authorized types in the States - gives a wide array of authorized file templates it is possible to acquire or produce. Using the website, you will get 1000s of types for enterprise and specific reasons, categorized by classes, states, or keywords and phrases.You will find the most recent models of types like the Alabama Area Representative Agreement in seconds.

If you already have a membership, log in and acquire Alabama Area Representative Agreement from the US Legal Forms collection. The Acquire button will appear on each form you look at. You have accessibility to all formerly downloaded types from the My Forms tab of your own accounts.

If you want to use US Legal Forms for the first time, listed below are easy directions to help you began:

- Make sure you have chosen the proper form for your metropolis/region. Click on the Review button to analyze the form`s content material. Read the form outline to actually have selected the right form.

- In the event the form doesn`t suit your requirements, take advantage of the Lookup industry towards the top of the display to get the one which does.

- If you are pleased with the form, verify your decision by simply clicking the Acquire now button. Then, opt for the rates program you want and give your accreditations to sign up on an accounts.

- Approach the transaction. Make use of your credit card or PayPal accounts to finish the transaction.

- Select the structure and acquire the form on the system.

- Make alterations. Complete, edit and produce and indicator the downloaded Alabama Area Representative Agreement.

Every single design you put into your money lacks an expiration date which is your own permanently. So, if you wish to acquire or produce one more copy, just go to the My Forms area and click around the form you need.

Obtain access to the Alabama Area Representative Agreement with US Legal Forms, by far the most substantial collection of authorized file templates. Use 1000s of professional and condition-distinct templates that meet your company or specific demands and requirements.

Form popularity

FAQ

The Alabama Form 65 is similar to the federal Form 1065 in many ways. And, the Form 65 requires that an Alabama Schedule K-1 be completed for any entity that was a partner or owner during the taxable year.

Form 2210AL is designed to calculate underpayment of estimated tax penalty as prescribed in Section 40-2A-11 and 40-18-80 of the Code of Alabama 1975. 2. 100% of your 2021 tax. (Your 2021 tax return must cover a 12-month period.)

Individual Income FormMaking a PaymentCurrent Form 40 ? Individual Income Tax ReturnAlabama Department of Revenue P. O. Box 2401 Montgomery, AL 36140 -0001Current Form E40- Individual Income Tax Return (Payments)Alabama Department of Revenue P. O. Box 327467 Montgomery, AL 36132-74676 more rows

You can also avoid the underpayment penalty if: Your tax return shows you owe less than $1,000. You paid 90% or more of the tax that you owed for the taxable year or 100% of the tax that you owed for the year prior, whichever amount is less.2. Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One investopedia.com ? terms ? underpaymentpe... investopedia.com ? terms ? underpaymentpe...

Use Form 2210 to see if you owe a penalty for underpaying your estimated tax. The IRS will generally figure your penalty for you and you should not file Form 2210. You can, however, use Form 2210 to figure your penalty if you wish and include the penalty on your return. 2022 Instructions for Form 2210 - IRS IRS (.gov) ? pub ? irs-pdf ? i2210 IRS (.gov) ? pub ? irs-pdf ? i2210 PDF

The penalty is 10% of each quarterly under payment. 2220AL 2021 - Alabama Department of Revenue alabama.gov ? uploads ? 2022/06 alabama.gov ? uploads ? 2022/06

Under the Alabama Sales Representative's Commission Contracts Act, businesses must pay the independent representative commissions based on the terms of their agreement or industry customs.

Alabama residents should file a Resident Individual Income Tax Return, Form 40 or 40A, each year. If I am not a resident of Alabama, but earned income from Alabama sources, am I required to file an Alabama tax return? Yes. Who must file an Alabama Individual Income Tax Return? alabama.gov ? faqs ? who-must-file... alabama.gov ? faqs ? who-must-file...