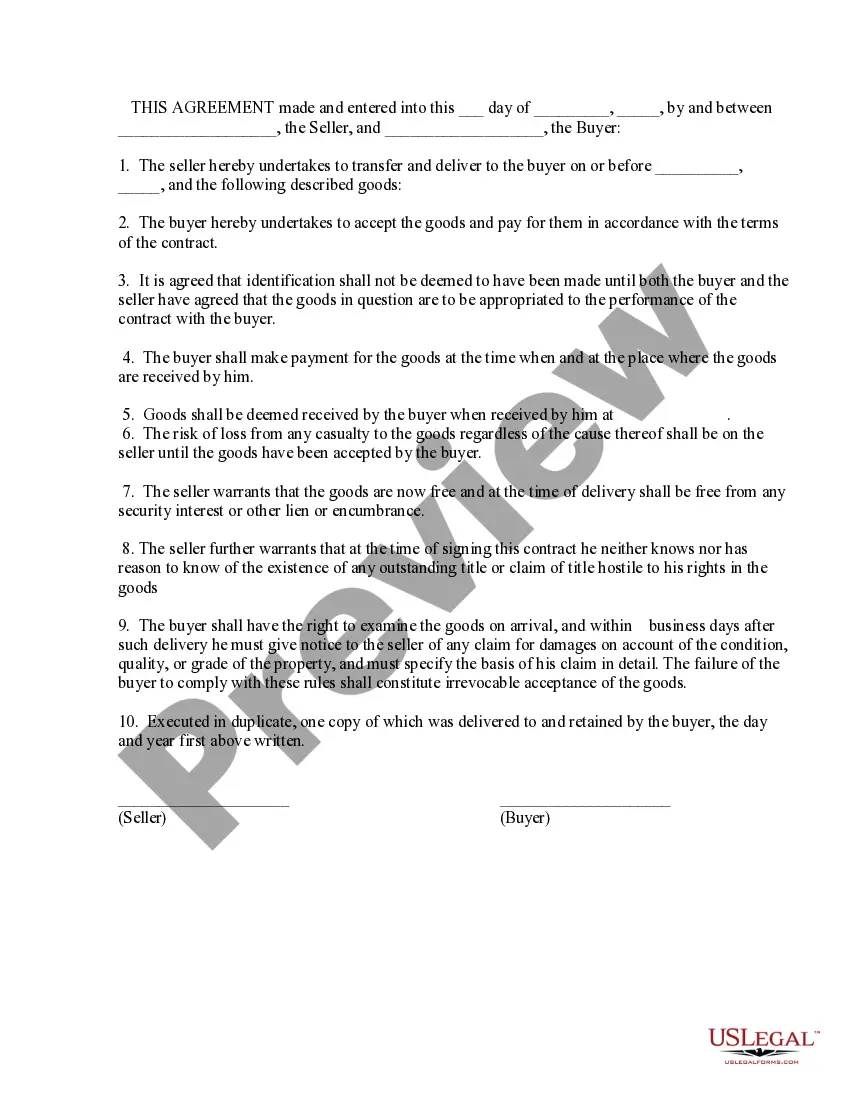

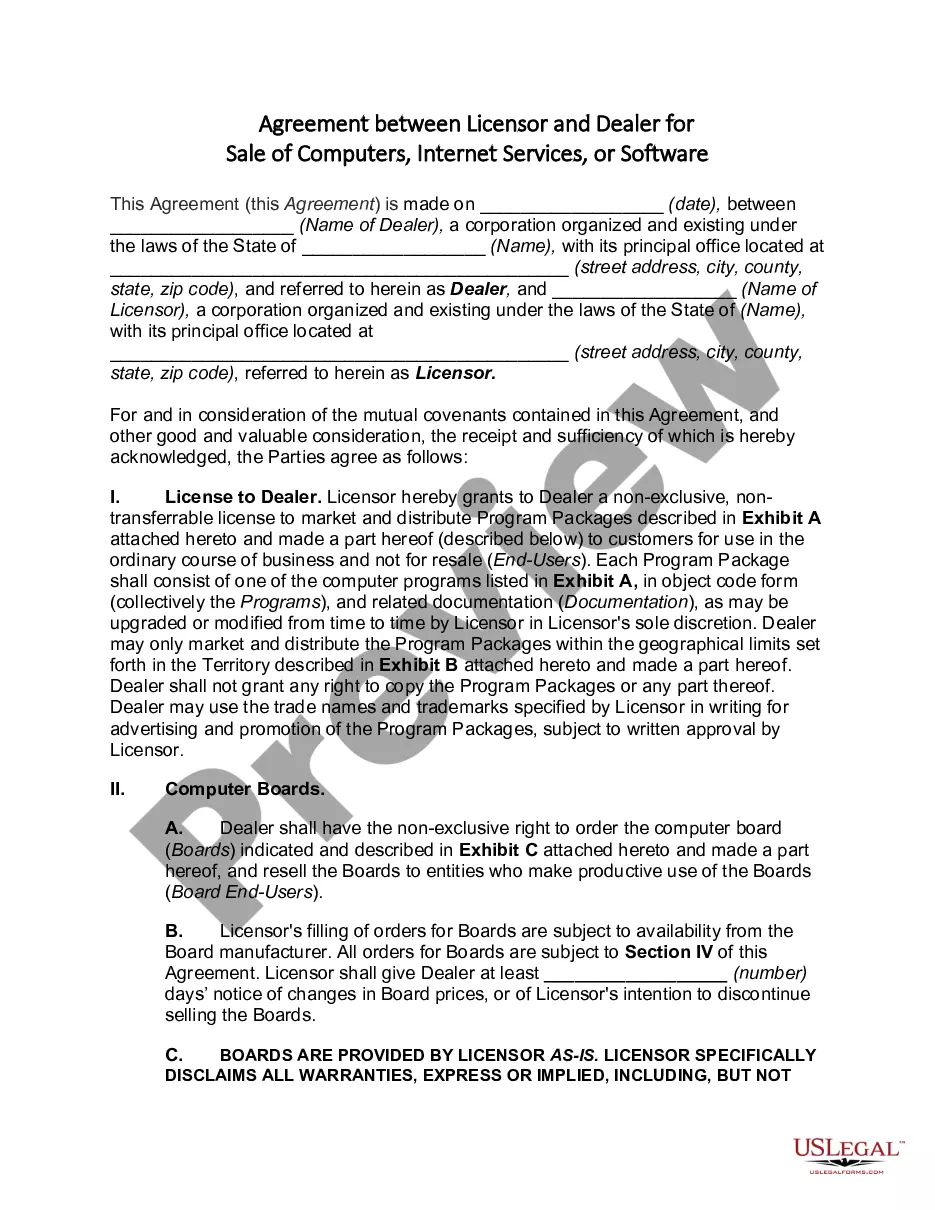

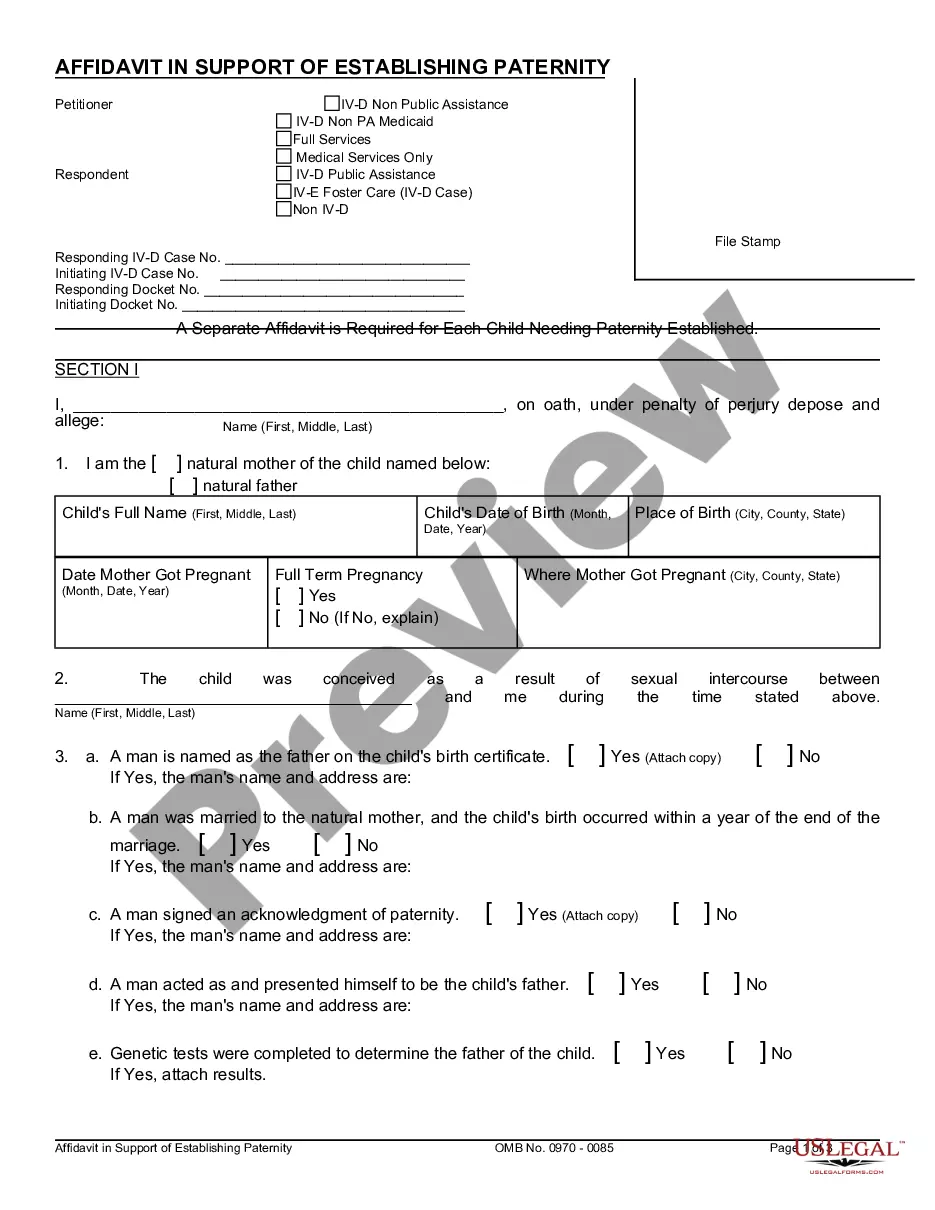

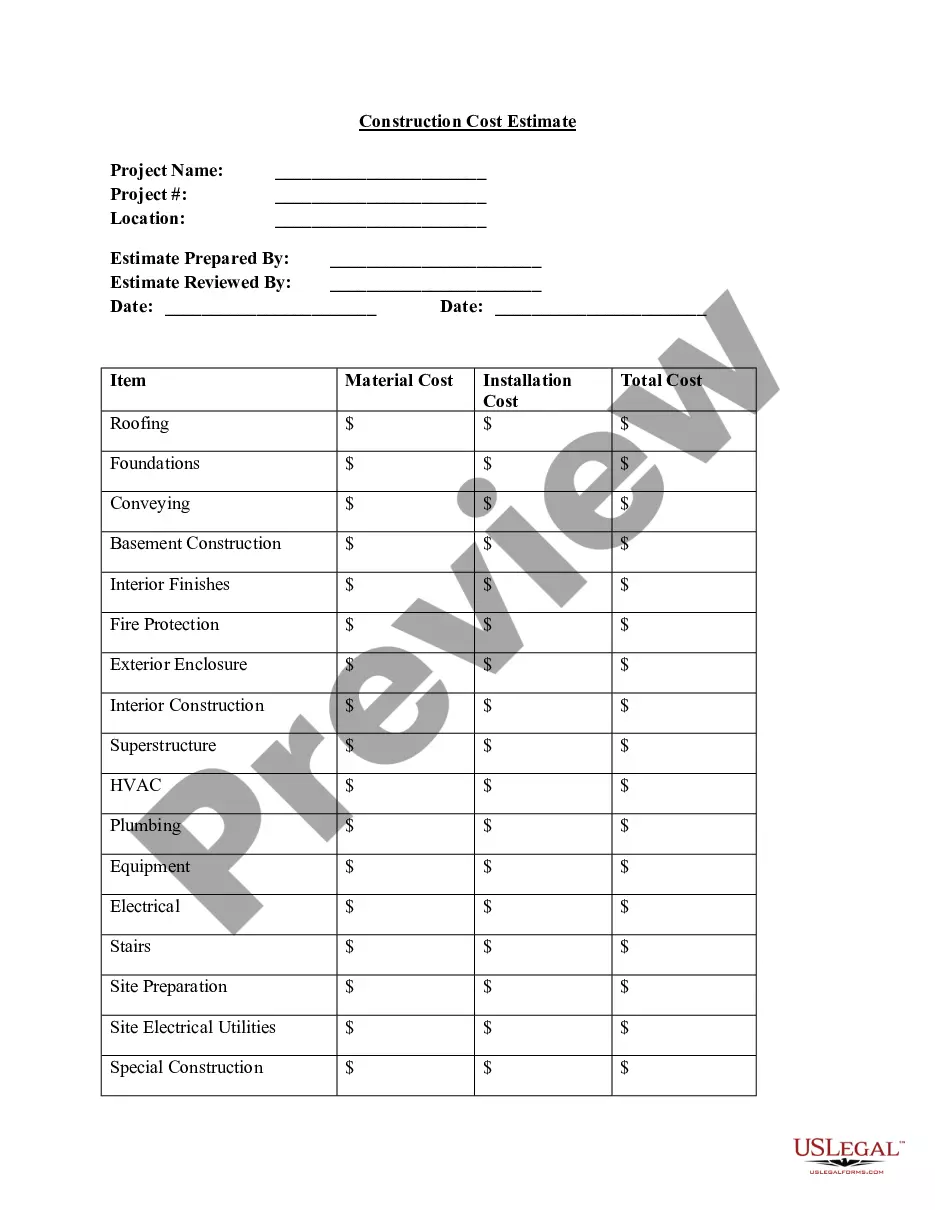

Alabama Product Sales Order Form

Description

How to fill out Product Sales Order Form?

If you need to finish, retrieve, or create approved document templates, utilize US Legal Forms, the foremost collection of legal documents available online.

Employ the site's straightforward and user-friendly search feature to locate the files you need.

Various templates for commercial and personal uses are categorized by type and region, or by keywords and phrases.

Every legal document you acquire is yours indefinitely.

You have access to all forms you downloaded in your account. Click the My documents section and choose a form to print or download again. Complete and download, and print the Alabama Product Sales Order Form with US Legal Forms. There are numerous professional and state-specific forms available for your personal or business needs.

- Use US Legal Forms to find the Alabama Product Sales Order Form in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Alabama Product Sales Order Form.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct region/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions in the legal form format.

- Step 4. After you find the form you wish to use, click the Get Now button. Select your preferred pricing plan and enter your details to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Alabama Product Sales Order Form.

Form popularity

FAQ

Non-residents who earn income in Alabama must file the Alabama Non-Resident Income Tax Return (Form 40NR). This form captures income earned within the state from various sources. If your business involves sales that require the Alabama Product Sales Order Form, it’s essential to comply with these requirements to avoid any tax implications.

Form 40 is the Alabama income tax return form for all full-time and part-time state residents (non-residents must file a Form 40NR). This tax return package includes Form 4952A, Schedules A, B, CR, D, E and OC. Form 40 requires you to list multiple forms of income, such as wages, interest, or alimony .

Forms OR-40, OR-40-P and OR-40-N can be found at or you can contact us to order it.

Alabama Form 40 is used by full-year and part-year residents to file their state income tax return. The purpose of Form 40 is to calculate how much income tax you owe the state. Nonresident filers will complete Alabama Form 40NR. Taxpayers with simple returns have the option to use Form 40A (Short Form).

Who Must File a Form 40 Every person who holds or controls a reportable position must file a CFTC Form 40, Statement of Reporting Trader. (See section 18.04 of the regulations under the Commodity Exchange Act.)

Form 40A is Alabama's Individual Resident Income Tax Return (short version) and it applies to full year residents only. Please keep in mind that if you file Form 40A close to the deadline, there might be a delay of 90 days until you receive the refund.

Form 40NR requires you to list multiple forms of income, such as wages, interest, or alimony . We last updated the Individual Nonresident Income Tax Return in January 2022, so this is the latest version of Form 40NR, fully updated for tax year 2021.

You must complete your U.S. income tax return first, before you can prepare the Alabama tax return. The UA Tax Office usually hosts several tax seminars with the Alabama Department of Revenue to assist nonresident aliens with filing the Alabama tax return.

Form 40 is the Alabama income tax return form for all full-time and part-time state residents (non-residents must file a Form 40NR). This tax return package includes Form 4952A, Schedules A, B, CR, D, E and OC. Form 40 requires you to list multiple forms of income, such as wages, interest, or alimony .

Also called the Registration and Annual Report for Canadian Securities Form, Form 40-F is a filing with the US Securities and Exchange Commission (SEC) used by Canadian companies that want to offer their securities to United States investors.