Alabama Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan

Description

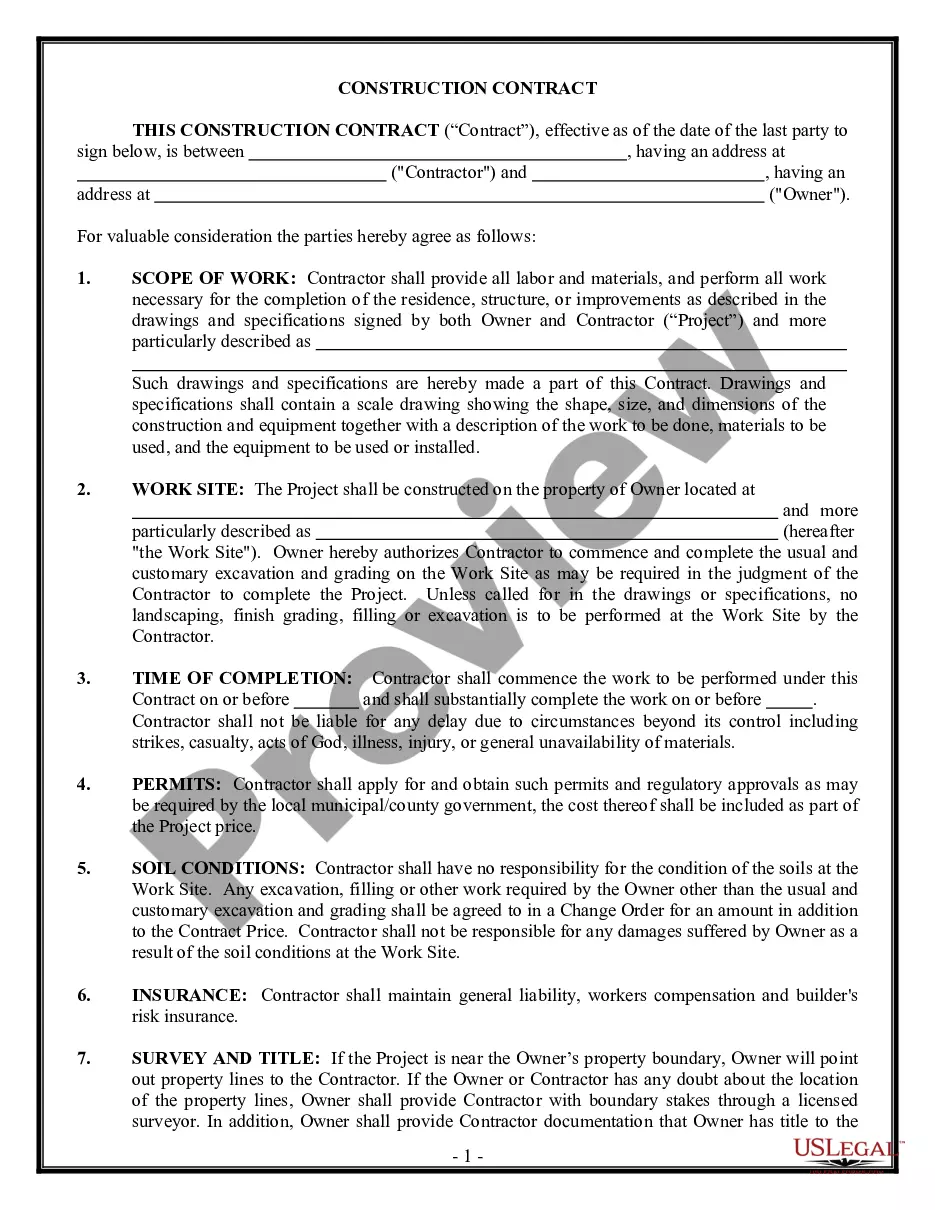

How to fill out Exhibit To UCC-1 Financing Statement Regarding A Fixture Filing For A Commercial Loan?

US Legal Forms - one of many greatest libraries of lawful forms in the United States - gives a variety of lawful file templates you can acquire or print. Making use of the web site, you will get 1000s of forms for company and individual purposes, sorted by groups, says, or search phrases.You can find the most up-to-date models of forms much like the Alabama Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan in seconds.

If you currently have a monthly subscription, log in and acquire Alabama Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan through the US Legal Forms collection. The Download switch will show up on each and every kind you perspective. You have access to all previously saved forms within the My Forms tab of the accounts.

If you want to use US Legal Forms the first time, here are basic guidelines to help you started off:

- Be sure to have picked out the best kind to your city/state. Go through the Review switch to examine the form`s content. See the kind explanation to actually have selected the right kind.

- When the kind does not suit your needs, use the Research industry on top of the monitor to discover the the one that does.

- In case you are pleased with the form, affirm your choice by simply clicking the Get now switch. Then, pick the pricing strategy you want and offer your references to register for the accounts.

- Process the deal. Use your credit card or PayPal accounts to finish the deal.

- Select the structure and acquire the form in your product.

- Make modifications. Fill out, change and print and indication the saved Alabama Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan.

Every format you included in your money lacks an expiry particular date and is your own eternally. So, if you want to acquire or print yet another duplicate, just visit the My Forms segment and click on about the kind you want.

Obtain access to the Alabama Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan with US Legal Forms, the most substantial collection of lawful file templates. Use 1000s of professional and status-certain templates that satisfy your organization or individual requires and needs.

Form popularity

FAQ

The UCC filing establishes a lien against the collateral the borrower uses to secure the loan ? giving the lender the right to claim that collateral as repayment in the case of default. However, in many cases, the terms UCC lien and UCC filing are used interchangeably.

However, the main purpose of a UCC is to perfect the secured interest of the secured party in personal property collateral. UCC1: This form is for initial filings of all types (except FARM) and can be filled out on your. computer and then printed.

Remember: as long as an asset has a UCC lien filed against it, you're not allowed to transfer, sell, or use it as collateral for any other loan.

"Amendment" means a UCC record that amends the information contained in a financing statement. Amendments include assignments, continuations and terminations. "Assignment" is an amendment that assigns all or part of a secured party's power to authorize an amendment to a financing statement.

In general, a UCC filing is not bad for your business ? it simply serves as an official notice to other creditors that your lender has a security interest in one or all of your assets. However, UCC filings can impact your business credit, risk your company's assets and/or hinder your ability to get future financing.

In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

A fixture filing is a UCC-1 financing statement authorized and made in ance with the UCC adopted in the state in which the related real property is located. It covers property that is, or will be, affixed to improvements to such real property.

In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.