Alabama Sample Letter for Closing Statement

Description

How to fill out Sample Letter For Closing Statement?

You may commit several hours on the Internet looking for the authorized record design which fits the federal and state needs you want. US Legal Forms gives a large number of authorized kinds that happen to be examined by specialists. It is possible to down load or print out the Alabama Sample Letter for Closing Statement from your services.

If you have a US Legal Forms account, you can log in and click the Acquire button. Next, you can full, modify, print out, or indicator the Alabama Sample Letter for Closing Statement. Every single authorized record design you purchase is your own property permanently. To acquire one more version associated with a bought develop, check out the My Forms tab and click the related button.

If you are using the US Legal Forms website for the first time, follow the straightforward directions listed below:

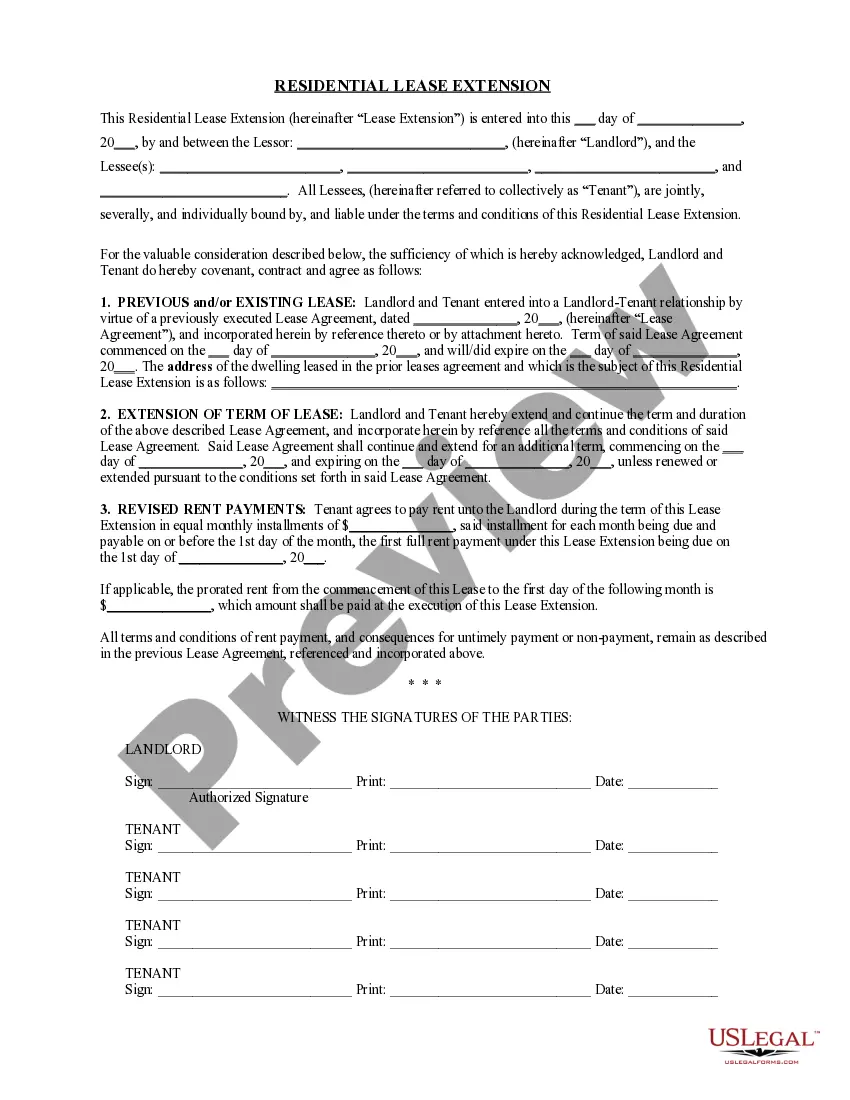

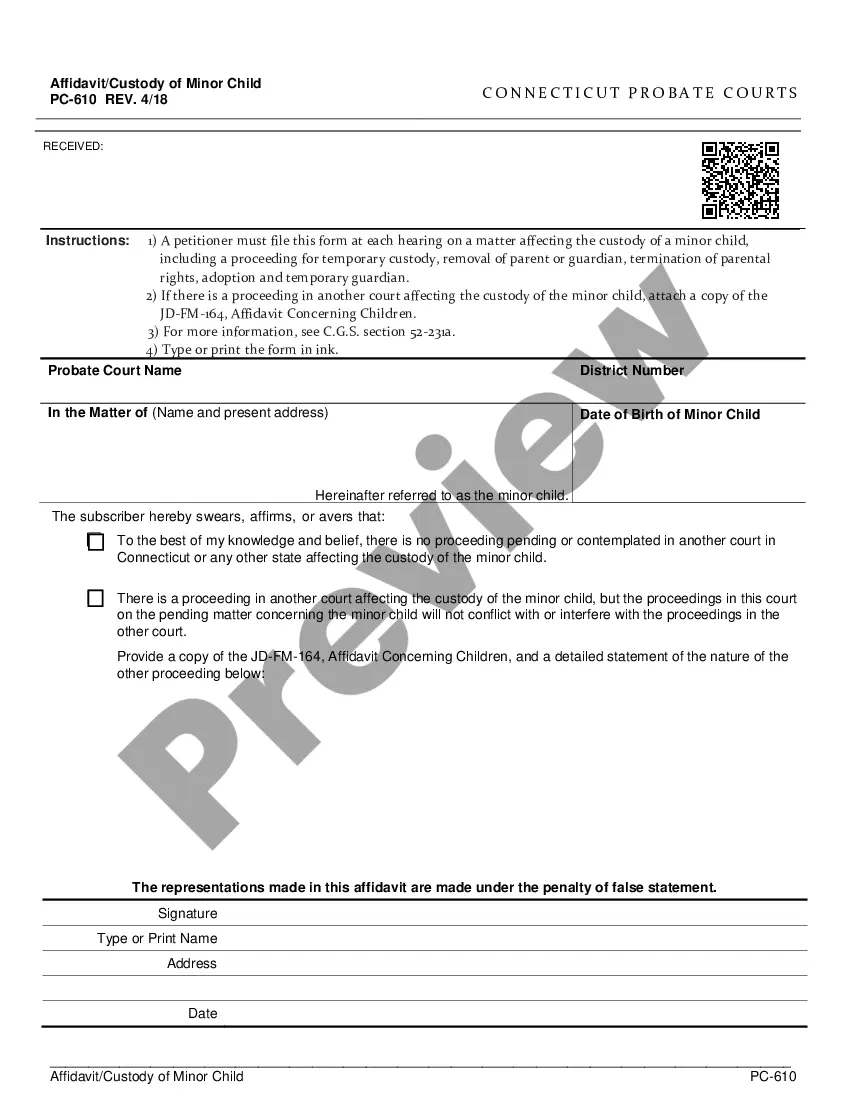

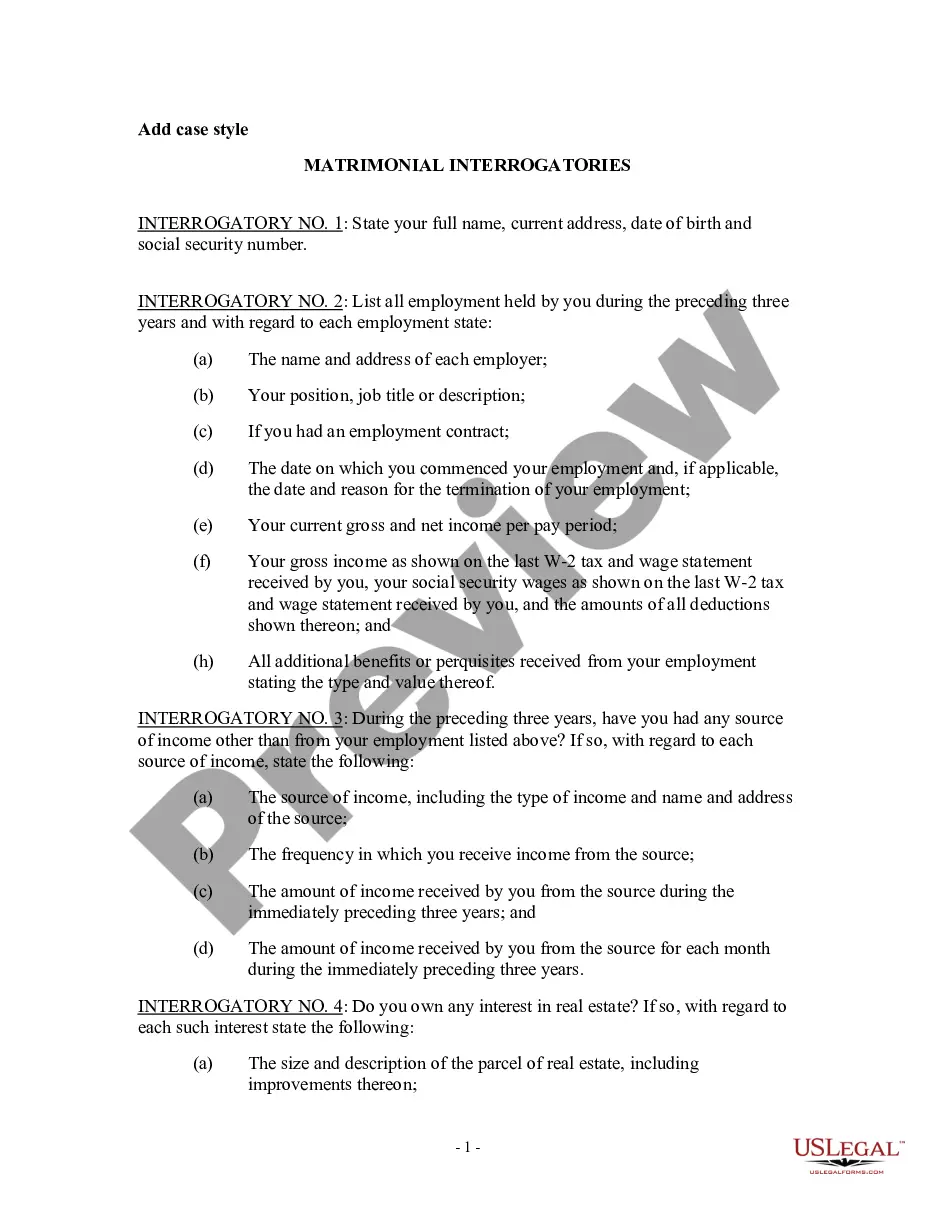

- First, make certain you have chosen the right record design to the state/city of your choice. Read the develop explanation to make sure you have picked out the correct develop. If available, use the Review button to look through the record design too.

- If you wish to get one more model of the develop, use the Search area to obtain the design that meets your requirements and needs.

- Upon having found the design you need, click on Purchase now to carry on.

- Choose the pricing program you need, type your credentials, and register for a merchant account on US Legal Forms.

- Complete the deal. You should use your charge card or PayPal account to pay for the authorized develop.

- Choose the formatting of the record and down load it to your product.

- Make adjustments to your record if needed. You may full, modify and indicator and print out Alabama Sample Letter for Closing Statement.

Acquire and print out a large number of record layouts using the US Legal Forms website, that provides the most important collection of authorized kinds. Use skilled and status-distinct layouts to tackle your small business or individual requires.

Form popularity

FAQ

2. The licensee who presents a written offer to a seller in a single family residential transaction shall prepare and furnish to the seller a complete estimated closing statement at the time the offer is presented to the seller.

Is a HUD-1 Settlement Statement the Same as a Closing Statement? A HUD-1 is a type of closing statement. However, outside of reverse mortgages and mortgages closed on or before Oct. 3, 2015, most real estate transactions now use a closing form called the closing disclosure that you'll receive instead.

The closing statement is the attorney's final statement to the jury before deliberation begins. The attorney reiterates the important arguments, summarizes what the evidence has and has not shown, and requests jury to consider the evidence and apply the law in his or her client's favor.

Seller Credits are funds that the seller contributes to the buyers side of the transaction at settlement. These funds can be used to cover closing costs, pay for repairs and assist you in other areas based on lender approval.

The closing statement, also called a closing disclosure or settlement statement, is essentially a comprehensive list of every expense that either the buyer and seller must pay to complete the purchase of a home (or whatever the property is).

YOUR CLOSING STATEMENT IS "IMPORTANT": When your escrow has closed you will receive a closing statement which is a summary of the costs and financial settlement of your real estate transaction. This closing statement will be important for future tax needs and other possible considerations.

A mortgage closing statement lists all of the costs and fees associated with the loan, as well as the total amount and payment schedule. A closing statement or credit agreement is provided with any type of loan, often with the application itself.

Where closing disclosure is exclusively used by the buyer (or borrower for transactions that involve a mortgage), an ALTA settlement state is given to both the agents, brokers and consumers on both sides of the transaction. It's almost like a receipt that both parties acknowledge during the real estate closing process.