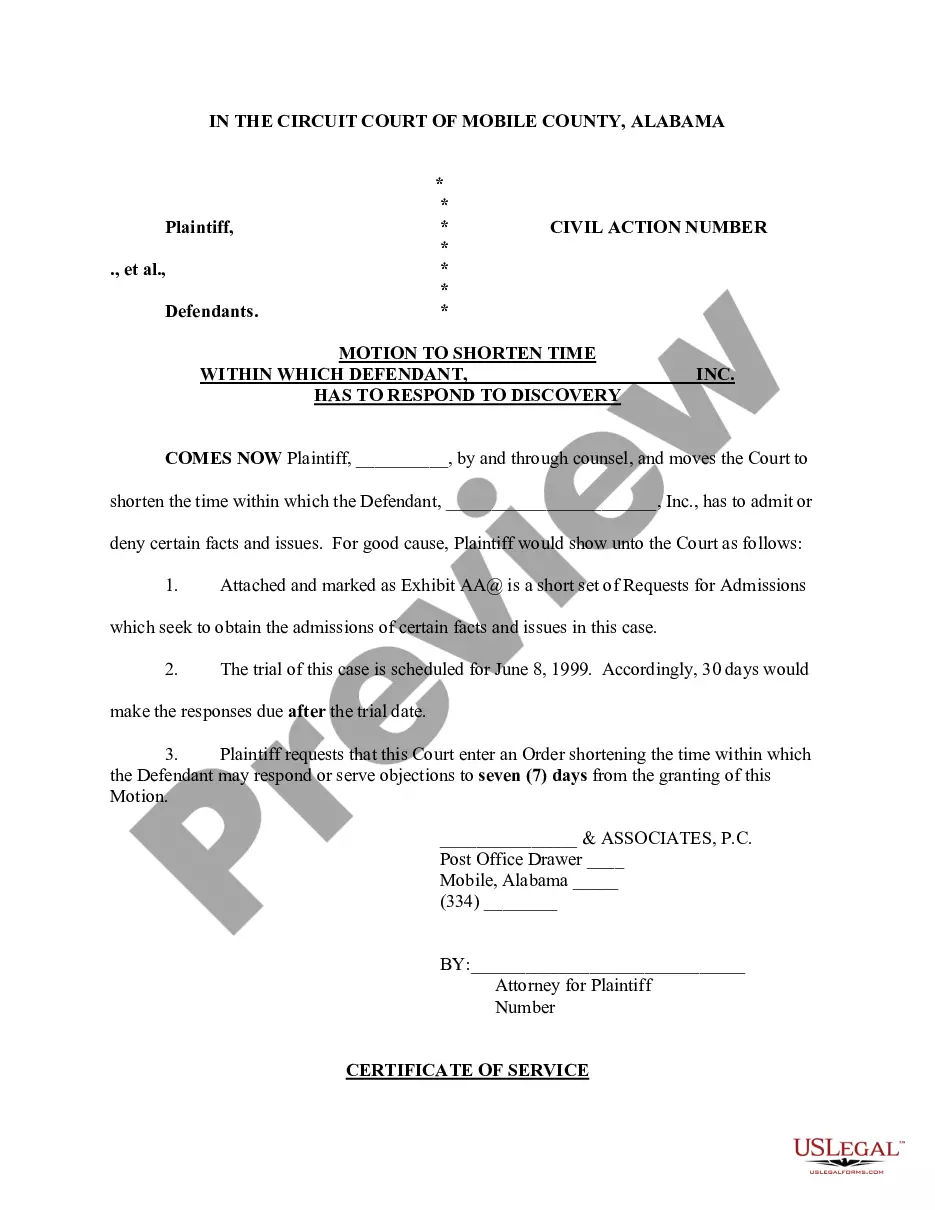

Alabama Sample Letter for Demand on Guarantor

Description

How to fill out Sample Letter For Demand On Guarantor?

It is feasible to spend time online searching for the legal document format that meets the state and federal criteria you require. US Legal Forms offers a vast array of legal forms that are reviewed by professionals.

You can obtain or print the Alabama Sample Letter for Demand on Guarantor through my services.

If you already possess a US Legal Forms account, you can Log In and then click the Acquire button. After that, you can complete, edit, print, or sign the Alabama Sample Letter for Demand on Guarantor. Each legal document format you acquire is yours indefinitely.

Complete the purchase. You can use your credit card or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make modifications to your document if necessary. You can complete, edit, sign, and print the Alabama Sample Letter for Demand on Guarantor. Acquire and print numerous document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain an additional copy of any acquired form, go to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for your area or city of interest.

- Review the form description to ensure you have chosen the appropriate template. If available, use the Review button to browse through the document format as well.

- If you want to find another version of the document, utilize the Lookup section to identify the format that meets your requirements.

- Once you have located the format you need, click Buy now to continue.

- Select the pricing plan you prefer, enter your credentials, and create an account on US Legal Forms.

Form popularity

FAQ

An example of a demand letter often includes specific details about the obligation owed and a clear request for payment. In the context of an Alabama Sample Letter for Demand on Guarantor, this document serves as a formal notice to the guarantor regarding their responsibility. It outlines the amount due, any relevant dates, and the consequences of failing to respond. Using a well-structured sample letter can ensure that all necessary elements are included, making your demands clear and legally sound.

Writing a guarantor consent letter involves outlining the agreement between the creditor and the guarantor. You can refer to the Alabama Sample Letter for Demand on Guarantor to ensure you include all relevant details such as the terms of the guarantee and consent acknowledgment. Keep the tone formal and precise to avoid any misunderstandings.

An effective demand letter example often includes the parties involved, a summary of the obligation, and a request for payment or action. The Alabama Sample Letter for Demand on Guarantor serves as a valuable reference for crafting a solid letter, complete with necessary elements and a clear resolution path.

When writing a letter of request for demand, start with a courteous greeting and introduce the purpose of your letter. Clearly outline what you are requesting while referencing relevant details from the Alabama Sample Letter for Demand on Guarantor. Clarity and professionalism are key to securing compliance.

A good guarantor letter should clearly state the responsibilities and obligations of the guarantor. Utilize the Alabama Sample Letter for Demand on Guarantor to ensure you cover essential details, such as the amount guaranteed and the terms of repayment. Be specific about the situations that might trigger the guarantor's responsibility.

In a demand letter, avoid using aggressive language or making threats, as this can undermine your position. Instead, focus on facts. The Alabama Sample Letter for Demand on Guarantor can help you phrase your demands clearly and professionally. Keeping your communication respectful can foster better outcomes.

Writing a demand letter without an attorney is possible and straightforward. Use available templates like the Alabama Sample Letter for Demand on Guarantor to guide your writing process. Ensure you include essential details like the debt amount, a brief background of the situation, and your request for satisfaction within a specified timeframe.

Begin your demand payment letter by addressing the recipient directly and explaining the outstanding payment. Use the Alabama Sample Letter for Demand on Guarantor as a guideline for including important details such as amounts owed, payment deadlines, and any potential consequences of non-payment. Keep your tone firm yet professional to encourage prompt action.

To write a strong demand letter, start by clearly stating your purpose. Include specific details about the debt and any agreed-upon terms. Reference the Alabama Sample Letter for Demand on Guarantor for structure and phrases that can strengthen your message. Finally, conclude with a clear call to action, asking for a prompt response.

Yes, you can write a demand letter yourself, especially if you are using an Alabama Sample Letter for Demand on Guarantor as a guide. Crafting your own letter allows you to tailor it to your specific circumstances. Just ensure you include all necessary details, such as the amount owed and the payment deadline. If you are uncertain, platforms like uslegalforms can provide templates and expert guidance to help you create an effective demand letter.