Alabama Escrow Check Receipt Form

Description

How to fill out Escrow Check Receipt Form?

Are you presently in the situation where you require documents for potential organizational or individual activities almost every day.

There are numerous legal document templates available online, but finding ones you can rely on isn’t easy.

US Legal Forms provides thousands of form templates, such as the Alabama Escrow Check Receipt Form, designed to comply with state and federal regulations.

Once you find the appropriate form, click Buy now.

Select the pricing plan you prefer, complete the required information to create your account, and place an order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can obtain the Alabama Escrow Check Receipt Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/county.

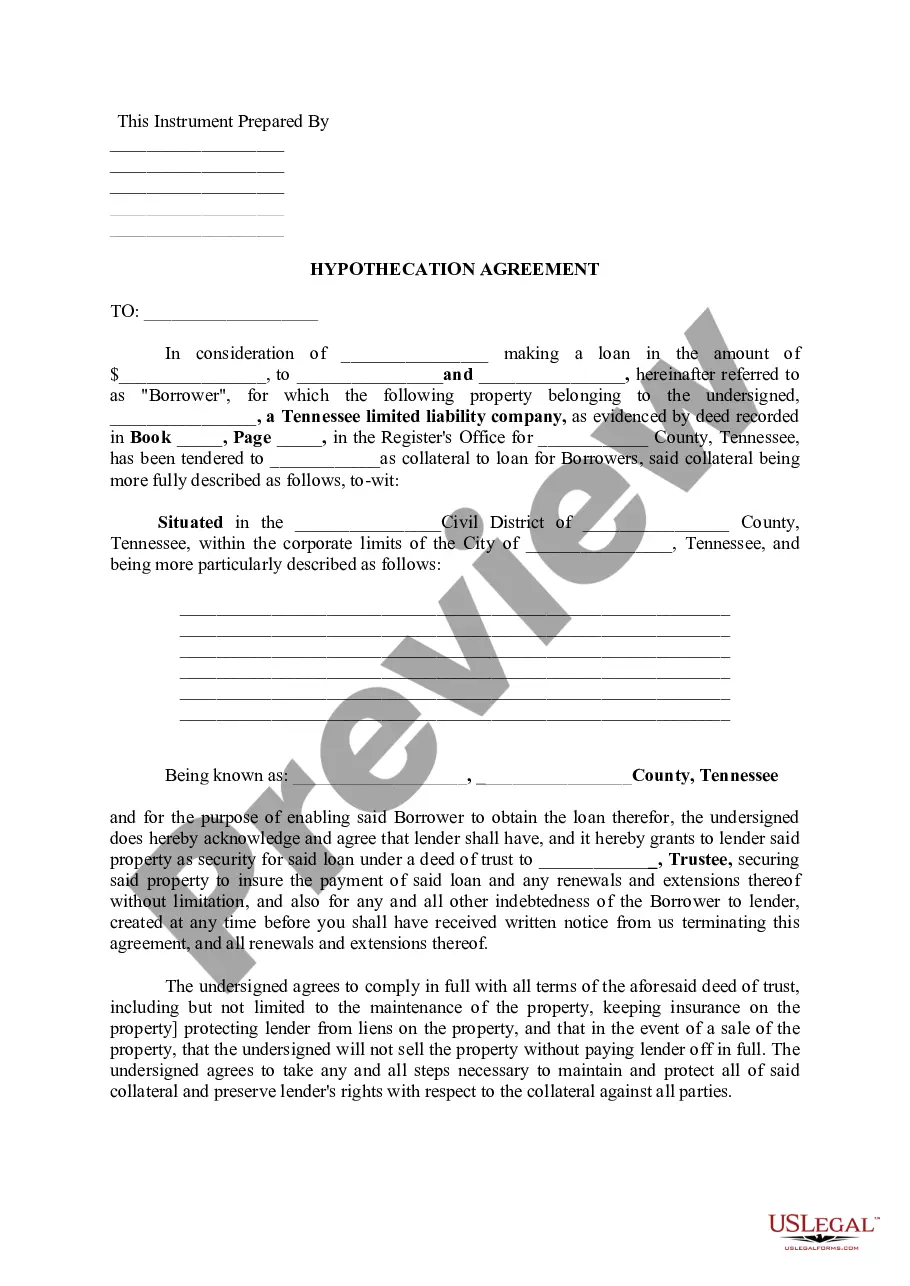

- Utilize the Preview option to inspect the document.

- Review the description to ensure you have selected the correct form.

- If the document isn’t what you’re seeking, take advantage of the Research section to find the form that suits your needs.

Form popularity

FAQ

An escrow receipt, such as the Alabama Escrow Check Receipt Form, is a legal document acknowledging the receipt of funds held in escrow. It outlines essential details like the parties involved, the amounts, and the purpose of the escrow. This receipt serves as proof of the transaction and is essential for managing funds compliant with legal requirements. Using a clear and accurate escrow receipt fosters trust and transparency among parties.

To properly fill out a check receipt like the Alabama Escrow Check Receipt Form, you must follow a structured format. Begin with the date and the names of the payer and payee. Clearly list the check number and the total amount received. Make sure to provide a concise description for proper documentation and future reference.

When filling out a check receipt, such as the Alabama Escrow Check Receipt Form, it is crucial to note the details systematically. Start with the date, followed by the names of both parties involved. Include the check number, the amount, and a description of the service or goods for which the check is being received. This structured approach ensures clarity and eases future reference.

Filling out a receipt form like the Alabama Escrow Check Receipt Form involves entering specific details correctly. Begin with the transaction date, followed by the names of the payer and payee. Indicate the amount being received and provide a brief explanation of what the funds are for. Finally, ensure the form is signed and dated to validate the transaction.

The proper format for the Alabama Escrow Check Receipt Form should include clear headings for each section. Typically, start with the date, followed by the names of the involved parties, the amounts, and a brief description of the transaction. Remember to format the amounts properly, using currency symbols and commas as necessary. Using a professional format enhances clarity and helps maintain records.

To fill out the Alabama Escrow Check Receipt Form, start by entering the date of the transaction. Next, provide the names of both the payer and the payee. Make sure to include the amount being placed in escrow and specify the purpose of the escrow. Carefully review the information to ensure everything is accurate before finalizing the form.

Yes, you can electronically file an Alabama tax return, making it easier to comply with state tax regulations. This option allows for quicker processing and feedback regarding your filings. Having resources like the Alabama Escrow Check Receipt Form ensures you're organized and ready for your electronic submission.

Yes, Alabama Form PPT can be filed electronically, offering convenience for businesses to meet their tax obligations on time. This electronic process simplifies record-keeping and submission. To help with your paperwork, using the Alabama Escrow Check Receipt Form can provide additional support.

Certain tax forms in Alabama, particularly those that require signatures from multiple parties or additional documentation, may not be eligible for electronic filing. This includes specific local forms and some supporting documents. To find alternatives, consider using the Alabama Escrow Check Receipt Form for effective management.

The initial Business Privilege Tax (BPT) return in Alabama is the first form an entity files after doing business in the state. This form establishes your business's tax obligations moving forward. Ensuring you have the Alabama Escrow Check Receipt Form readily available can ease your initial filing process.