Alabama Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

How to fill out Private Annuity Agreement With Payments To Last For Life Of Annuitant?

It is feasible to spend hours online trying to locate the proper legal format that fulfills the state and federal requirements you need.

US Legal Forms offers thousands of legal templates that are reviewed by experts.

You can effortlessly download or print the Alabama Private Annuity Agreement with Payments to Last for Life of Annuitant from the platform.

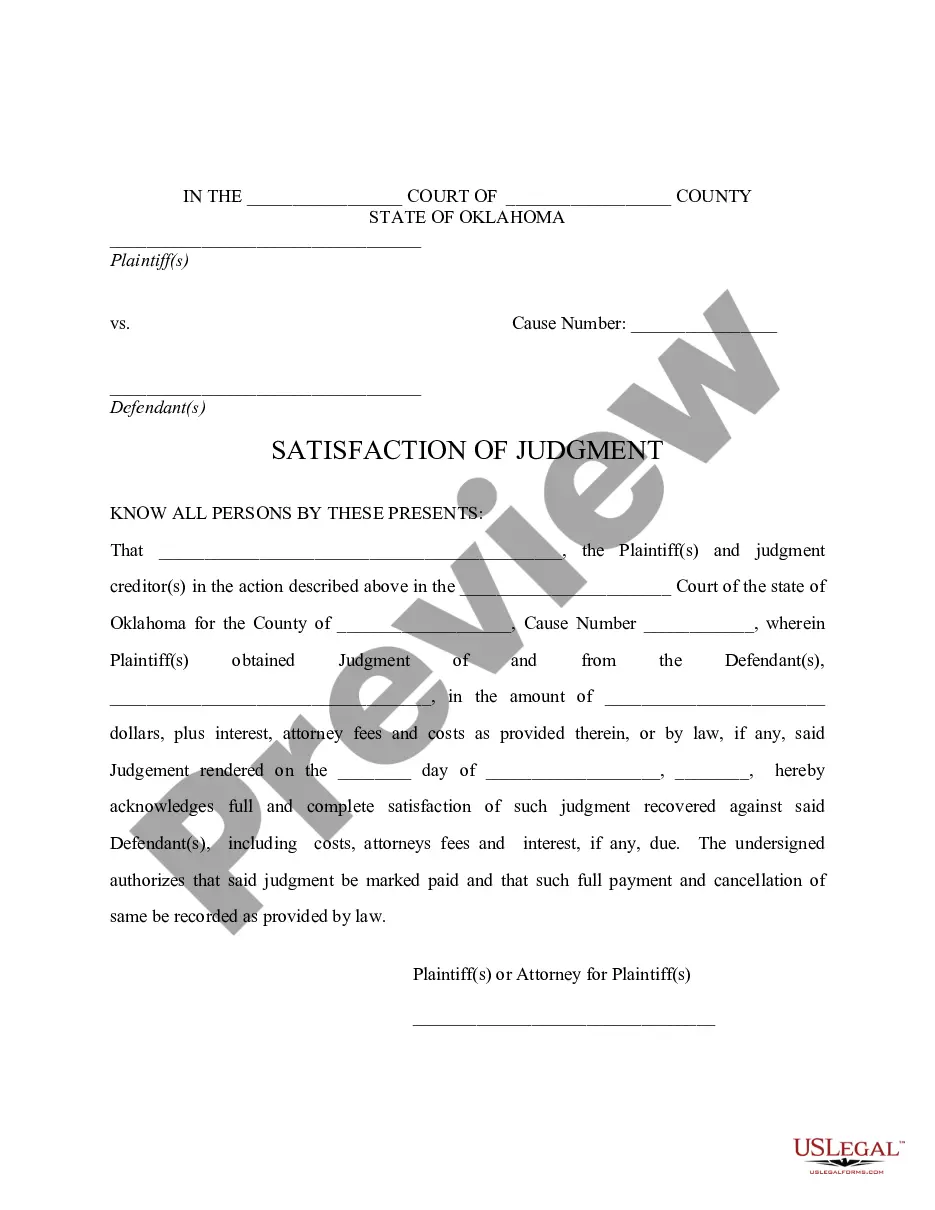

First, ensure you have selected the right format for the area/city that you choose. Check the form description to confirm you have opted for the appropriate form. If available, use the Preview button to review the format as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can complete, modify, print, or sign the Alabama Private Annuity Agreement with Payments to Last for Life of Annuitant.

- Every legal template you purchase is yours indefinitely.

- To obtain another copy of the acquired form, navigate to the My documents tab and click the corresponding button.

- If you’re using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

Yes, Alabama does impose taxes on annuity payments, including those from an Alabama Private Annuity Agreement with Payments to Last for Life of Annuitant. This means that annuitants should expect to include their annuity payments as part of their taxable income. It's important to familiarize yourself with both state and federal tax obligations to ensure proper compliance. Professional tax services can assist in optimizing your tax strategy related to annuities.

Upon death, the taxation of annuities can vary depending on the type of annuity and the beneficiary. In an Alabama Private Annuity Agreement with Payments to Last for Life of Annuitant, beneficiaries may inherit the annuity and could be responsible for income taxes on future payments. However, the specific tax treatment will depend on whether the beneficiary is a spouse, other family member, or a non-relative. Consulting a financial advisor can provide clarity on potential tax ramifications.

Generally, an Alabama Private Annuity Agreement with Payments to Last for Life of Annuitant is taxed based on the annuity payments received. These payments usually consist of a return of principal and interest, with only the interest portion being taxable as income. It's crucial to keep accurate records of each payment received to ensure compliance with tax regulations. Seeking professional guidance can help you understand your specific tax situation.

When the annuitant of an Alabama Private Annuity Agreement with Payments to Last for Life of Annuitant passes away, certain tax implications arise. The remaining payments may be subject to income tax under IRS rules. Additionally, the estate of the annuitant may also need to account for estate taxes, depending on the overall value of the estate, including the annuity's proceeds. Consult a tax advisor to navigate these complexities effectively.

Payments stop at the annuitant's death in an annuity option known as a life-only settlement. By utilizing this option in your Alabama Private Annuity Agreement with Payments to Last for Life of Annuitant, you can ensure a guaranteed income for life, but it's important to recognize that no further payments will be made after your passing. Assess your choices carefully to find the right balance between financial support for yourself and potential legacy for your beneficiaries.

A life annuity is specifically designed to stop all payments when the annuitant passes away. This type of structure within your Alabama Private Annuity Agreement with Payments to Last for Life of Annuitant may not provide ongoing benefits for your heirs. Therefore, it's essential to evaluate your needs and consider options that may offer financial support for your loved ones after your death.

In many cases, yes, annuity payments do stop at the death of the annuitant, unless otherwise specified in the contract. However, with an Alabama Private Annuity Agreement with Payments to Last for Life of Annuitant, you can choose the structure that continues to provide benefits to your beneficiaries. It's vital to understand the terms of your agreement to ensure your financial plans align with your expectations.

An irrevocable annuity is a financial product that cannot be modified or canceled once it is established. This means that once you set up your Alabama Private Annuity Agreement with Payments to Last for Life of Annuitant, you cannot change the payment structure or beneficiaries. This stability can be beneficial for long-term financial planning, as it offers predictability in your income.

The type of annuity that provides payments until the death of the last annuitant is known as a joint and survivor annuity. This option ensures that your Alabama Private Annuity Agreement with Payments to Last for Life of Annuitant guarantees a steady income stream for both you and a co-annuitant. It's a great choice for couples who want to secure their financial future together.

After the death of the annuitant, the fate of the annuity payments depends on the terms of the specific Alabama Private Annuity Agreement with Payments to Last for Life of Annuitant. Some agreements may provide for continuing payments to beneficiaries, while others may cease entirely. It's crucial to understand the beneficiaries' rights and the options available to them. You can learn more about these details by consulting resources like uslegalforms.