Alabama Agreement to Perform Farmhand Services including Operating Farm Machinery and Maintenance of Farm Equipment

Description

There are a number of factors which to consider in making the decision whether people are employees or independent contractors. One of the most important considerations is the degree of control exercised by the company over the work of the workers. An employer has the right to control an employee. It is important to determine whether the company had the right to direct and control the workers not only as to the results desired, but also as to the details, manner and means by which the results were accomplished. If the company had the right to supervise and control such details of the work performed, and the manner and means by which the results were to be accomplished, an employer-employee relationship would be indicated. On the other hand, the absence of supervision and control by the company would support a finding that the workers were independent contractors and not employees.

Another factor to be considered is the connection and regularity of business between the independent contractor and the hiring party. Important factors to be considered are separate advertising, procurement of licensing, maintenance of a place of business, and supplying of tools and equipment by the independent contractor. If the service rendered is to be completed by a certain time, as opposed to an indefinite time period, a finding of an independent contractor status is more likely.

How to fill out Agreement To Perform Farmhand Services Including Operating Farm Machinery And Maintenance Of Farm Equipment?

Should you want to finalize, acquire, or reproduce legal document templates, utilize US Legal Forms, the most extensive selection of legal documents, available online.

Leverage the site’s straightforward and convenient search to find the documents you need.

A multitude of templates for commercial and personal use are organized by categories and states, or keywords.

Step 4. After locating the form you need, click the Acquire now button. Choose the pricing plan you prefer and provide your credentials to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to acquire the Alabama Agreement to Carry Out Farmhand Services such as Operating Farm Equipment and Maintenance of Agricultural Tools in a few clicks.

- If you are a current US Legal Forms customer, Log In to your account and click the Obtain button to access the Alabama Agreement to Carry Out Farmhand Services such as Operating Farm Machinery and Maintenance of Farm Equipment.

- Additionally, you can retrieve forms you previously stored from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure that you have selected the form for the correct city/state.

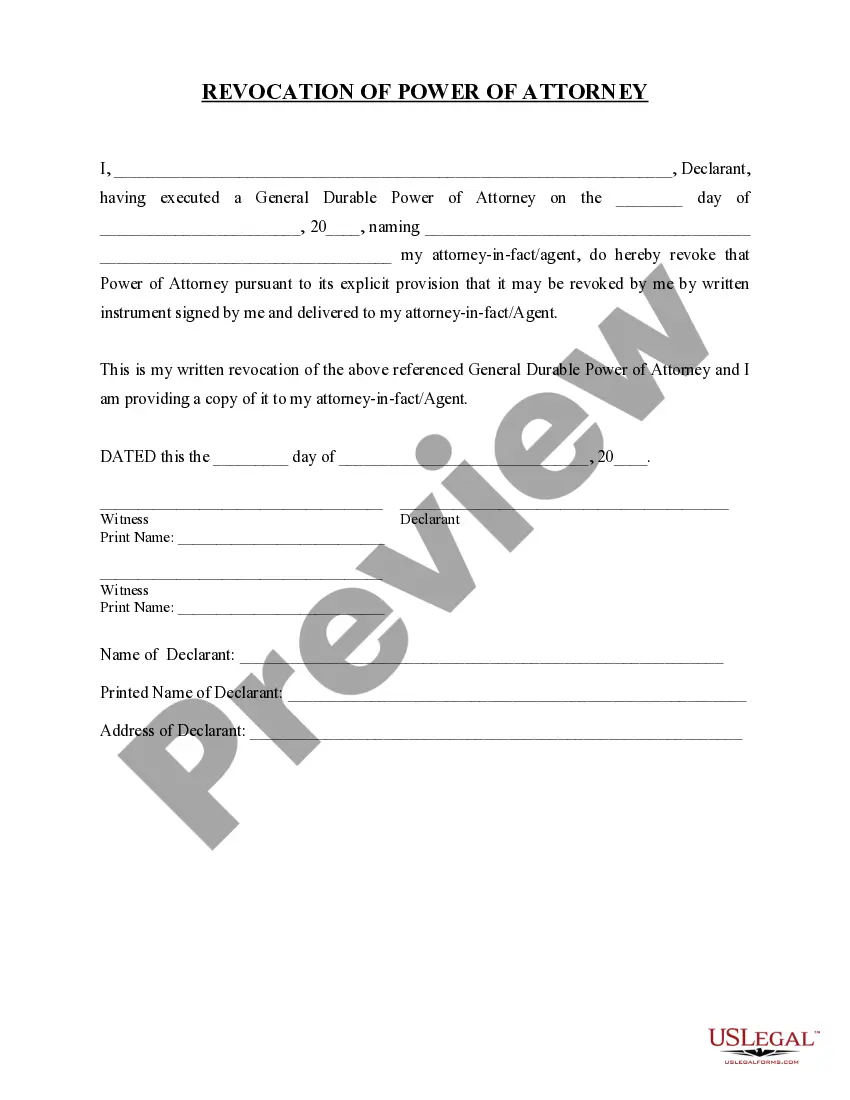

- Step 2. Use the Review option to examine the contents of the form. Don’t forget to check the summary.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

To claim farm equipment on your taxes, you typically need to report it as a business expense on your tax return. This includes deducting costs associated with purchasing, maintaining, and operating the equipment. The Alabama Agreement to Perform Farmhand Services including Operating Farm Machinery and Maintenance of Farm Equipment can play a crucial role in documenting these expenses. Consider using uslegalforms to streamline the process and ensure your claims are accurate and valid.

In Alabama, the definition of a farm for tax purposes often includes properties with a minimum of five acres. This requirement allows you to qualify for certain agricultural tax exemptions. When utilizing the Alabama Agreement to Perform Farmhand Services including Operating Farm Machinery and Maintenance of Farm Equipment, understanding these regulations can help you maximize your benefits. It's advisable to consult local tax guidelines to ensure compliance.

The Right to Farm Law in Alabama protects farmers from nuisance lawsuits, allowing them to continue agricultural practices without undue interference. This law acknowledges the importance of farming to local economies and communities. When engaging in agreements such as the Alabama Agreement to Perform Farmhand Services including Operating Farm Machinery and Maintenance of Farm Equipment, understanding this law can help safeguard your rights as a farmer and promote sustainable farming practices.

Yes, machinery is generally regarded as personal property. This classification allows you to include your machinery when calculating business assets and expenses. According to the Alabama Agreement to Perform Farmhand Services including Operating Farm Machinery and Maintenance of Farm Equipment, keeping accurate records of your machinery can help in maintenance, insurance, and tax deductions.

The IRS considers personal property as assets that are not real estate. This category includes goods like machinery, vehicles, and equipment, which are typically used in business operations. If you operate under the Alabama Agreement to Perform Farmhand Services including Operating Farm Machinery and Maintenance of Farm Equipment, understanding how the IRS defines personal property can help you manage your tax obligations effectively.

Yes, farm equipment is typically classified as personal property. This type of property includes machines, tools, and vehicles used on the farm. Under the Alabama Agreement to Perform Farmhand Services including Operating Farm Machinery and Maintenance of Farm Equipment, recognizing the classification of your equipment is important for maintenance and legal agreements. Personal property laws may also affect insurance coverage and taxes.

In Alabama, the size of a farm can vary significantly. A farm must generally consist of at least 10 acres to be recognized as such, although smaller farms also exist. When you consider the Alabama Agreement to Perform Farmhand Services including Operating Farm Machinery and Maintenance of Farm Equipment, understanding the land size is essential. This ensures you plan adequately for managing equipment and labor needs.

Farm equipment does not inherently have the right-of-way. Operators must follow specific traffic laws and guidelines to ensure safe maneuvering on public roads. Engaging with the Alabama Agreement to Perform Farmhand Services including Operating Farm Machinery and Maintenance of Farm Equipment will provide insights into navigating these requirements effectively. Proper understanding helps both farmhands and drivers maintain safety on the road.

Farm maintenance plays a vital role in ensuring the efficiency and longevity of farm operations. Regular maintenance includes inspecting and repairing equipment, which enhances productivity, reduces downtime, and ensures safety. When enrolling in the Alabama Agreement to Perform Farmhand Services including Operating Farm Machinery and Maintenance of Farm Equipment, you will learn best practices for maintaining your machinery and equipment. This knowledge is essential for any successful farmhand.

Farm equipment and machinery typically qualify as personal property rather than real property in Alabama. However, specific circumstances, such as how the equipment is used or its permanency on the farm, can influence its classification. Understanding these distinctions is crucial, especially when drafting the Alabama Agreement to Perform Farmhand Services including Operating Farm Machinery and Maintenance of Farm Equipment. A clear agreement can help clarify ownership and rights concerning farm assets.